{{item.title}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

Alberta - February 27, 2020

Alberta - February 27, 2020

Manitoba - March 19, 2020

Manitoba - March 19, 2020

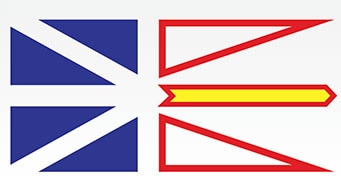

Newfoundland and Labrador - September 30, 2020

Newfoundland and Labrador - September 30, 2020

Nova Scotia - February 25, 2020

Nova Scotia - February 25, 2020

> Read more

Ontario - November 5, 2020

Ontario - November 5, 2020

> Read more

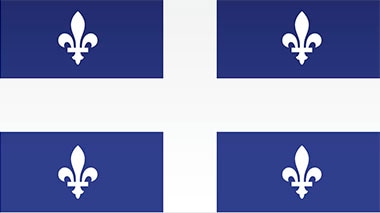

Quebec - March 10, 2020

Quebec - March 10, 2020

> Read more

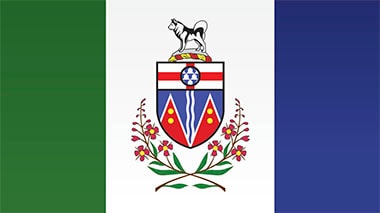

Yukon - March 5, 2020

Yukon - March 5, 2020

British Columbia -

British Columbia -

February 18, 2020 > Read more

New Brunswick - March 10, 2020

New Brunswick - March 10, 2020

Northwest Territories - February 25, 2020

Northwest Territories - February 25, 2020

Nunavut - February 19, 2020

Nunavut - February 19, 2020

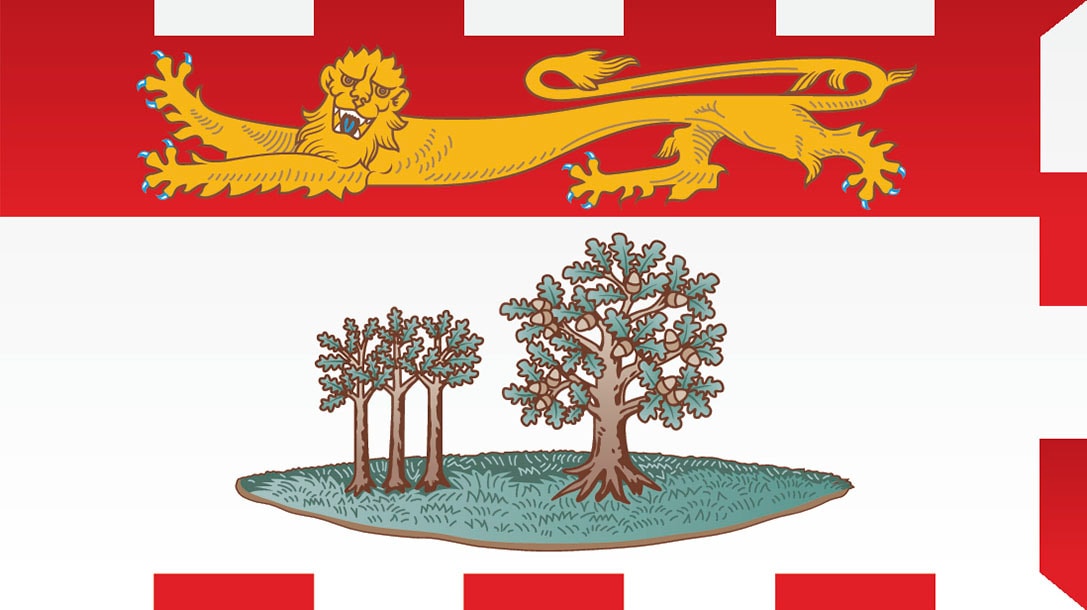

Prince Edward Island - June 17, 2020

Prince Edward Island - June 17, 2020

Saskatchewan - June 15, 2020

Saskatchewan - June 15, 2020

{{item.text}}

{{item.text}}