Tax Insights: Canada introduces first package of hybrid mismatch rules

May 09, 2022

Issue 2022-18

In brief

On April 29, 2022, the Department of Finance (Finance) released draft legislative proposals (the proposals) to address hybrid mismatch arrangements, which are cross‑border arrangements that are characterized differently under the tax laws of different countries. These proposals are the first of two separate legislative packages to implement into the Income Tax Act (the Act)1 the recommendations of the Organisation for Economic Co‑operation and Development (OECD) BEPS Action Plan (Action 2 Report)2 to eliminate the tax benefits arising from hybrid mismatch arrangements.

This first package deals with "deduction/non‑inclusion" mismatches relating to hybrid financial instruments (including mismatches involving hybrid transfers of financial instruments and substitute payments relating to these instruments). Generally, these hybrid mismatches involve situations in which a payment relating to a financial instrument is deductible by the payer and is not included in the ordinary income of the recipient. The second package, which will implement the remaining recommendations of the Action 2 Report (to the extent relevant in the Canadian context), will be released for stakeholder comment at a later date and will apply no earlier than 2023.

The proposed rules are intended to align with the recommendations of the Action 2 Report and to be interpreted based on that report (except where the context otherwise requires). However, this first package of legislation contains notable deviations from the Action 2 Report, including:

- treating interest payments that are non-deductible under these rules as deemed dividends for withholding tax purposes

- applying the rules to arrangements involving notional interest deductions (when no interest is actually paid)

The proposed rules will apply to payments arising after June 30, 2022 (for these purposes, this can include amounts paid or accruing after June 30, 2022). Finance has requested that interested parties provide comments in response to the proposals by June 30, 2022.

In detail

Scope of the rules

The main rules in the proposals (in proposed section 18.4 of the Act) apply to payments arising under “hybrid mismatch arrangements.” This first legislative package is generally limited to hybrid mismatch arrangements which produce a deduction/non-inclusion mismatch (D/NI mismatch).

Deduction/non-inclusion mismatch

A D/NI mismatch is an essential component of the proposals; it generally refers to a scenario where either:

- a payment is deductible in Canada, but is not included in ordinary income in a foreign country (or in Canada)

- a payment is deductible in a foreign country, but is not included in ordinary income in Canada (or in a foreign country)

A D/NI mismatch can also arise when a payment does produce an inclusion in ordinary income, but this income inclusion is smaller than the deduction. In that case, the D/NI mismatch is the amount by which the deduction exceeds the income inclusion (however, the income inclusion is ignored if it is 10% or less of the deduction).

The terms “Canadian ordinary income” and “foreign ordinary income” are used to determine whether an amount is included in income for the D/NI mismatch test. Broadly, these terms refer to amounts that are included in income for tax purposes, without any offsetting deduction, credit or exemption relating to the payment. Notably, Canadian ordinary income excludes intercorporate dividends that are deductible under sections 112 (for domestic dividends) or 113 (for certain dividends received from foreign affiliates).

The term “deductible” is defined broadly, to include equivalent foreign tax relief (e.g. provided through exemptions or credits). In addition, an amount is considered deductible for purposes of the D/NI mismatch test even if a deduction is actually restricted by the thin capitalization rules, the draft excessive interest and financing expenses limitation (EIFEL) rules3 or equivalent foreign tax rules.4

Timing is also important when applying the D/NI mismatch test: an income inclusion must occur in a taxation year that begins within 12 months of the end of the year in which the amount was deductible. A longer timing mismatch will produce a D/NI mismatch (although relief may be available when the mismatch resolves, as discussed below).

Hybrid mismatch arrangements

This first package of proposed legislation deals with three types of hybrid mismatch arrangements:

- Hybrid financial instrument arrangements – These are arrangements involving financial instruments (i.e. debt, shares or economically equivalent instruments) that are treated differently under the tax laws of different countries. For example, a financial instrument might be treated as debt in one country and equity in another country.

- Hybrid transfer arrangements – These are arrangements involving the transfer of a financial instrument, which are treated differently under different tax laws. For example, one country might treat an arrangement as a sale of the transferred instrument, while another country treats it as a loan that is secured by the transferred instrument. This concept also includes arrangements in which different tax treatments apply to compensation payments that are made for distributions received on the transferred instrument.

- Substitute payment arrangements – These are certain arrangements involving the transfer of a financial instrument, in which payments are made that substitute for returns on the transferred instrument.

Each type of arrangement is defined through a complex test. These tests generally have the following common requirements:

- Connected parties or structured arrangement – The parties to the arrangement must be connected in a certain way (either not dealing at arm’s length, or sharing at least 25% common ownership). If the parties are not sufficiently connected, the proposed rules can still apply if the arrangement is a “structured arrangement.” This term refers to an arrangement that is designed to produce a D/NI mismatch, or is priced to reflect the economic benefit of the mismatch. An exception prevents the rules from applying to certain parties to a structured arrangement who could not reasonably be aware of the D/NI mismatch and do not share in the value of this mismatch.

- D/NI mismatch – The arrangement must include a payment that produces a D/NI mismatch. “Payment” is defined broadly in these rules, to include both current and future obligations to make payments, as well as contingent obligations (this is intended to capture the different circumstances in which an amount may be deductible under foreign tax systems).

- Connection to hybrid treatment – The D/NI mismatch must reasonably be considered to arise because of the hybrid tax treatment of the arrangement (i.e. the different tax treatment of the arrangement in different countries, as described above). The substitute payments rule is somewhat different, as it does not require a D/NI mismatch arising from the hybrid tax treatment. This rule generally applies to transfer arrangements that produce certain types of D/NI mismatches involving substitute payments, which could otherwise undermine the integrity of the other hybrid mismatch rules.

The proposed rules also apply to notional interest deductions, which are allowed in some foreign tax systems on interest‑free (or low-interest) loans. These loans are essentially treated as hybrid financial instruments.

Where there is a hybrid mismatch arrangement, the D/NI mismatch that results from the hybrid tax treatment (as described above) is called the “hybrid mismatch amount” and is subject to the operative rules discussed below.

PwC observes

The hybrid mismatch rules are complex; taxpayers must work through a series of tests to determine whether the rules will apply to particular arrangements. There are many defined terms, some of which significantly expand the ordinary meaning of these terms.

The D/NI mismatch test is broad and can apply to many tax results that are unrelated to hybrid mismatch arrangements. The connection tests in the hybrid financial instrument, hybrid transfer and substitute payment rules are therefore very important in limiting the scope of the rules to genuine hybrid mismatches.

When determining the amount of a D/NI mismatch, a smaller income inclusion (equal to 10% or less of the deduction) is ignored. This exclusion seems unfair, as it could create a D/NI mismatch that exceeds the actual economic mismatch – for example, if a payment produces a $100 deduction and a $9 income inclusion, the D/NI mismatch is $100, whereas only $91 is actually not subject to tax.

The proposed rules deviate from the Action 2 Report by treating debts with notional interest deductions as hybrid mismatch arrangements (although this treatment appears consistent with the US anti-hybrid rules). Taxpayers who have related entities in jurisdictions that provide notional interest deductions should review their intercompany loans, to determine whether they could trigger the application of the proposed rules.

Operative rules

The operative rules (described below) aim to neutralize the D/NI mismatch arising from a hybrid mismatch arrangement.

Primary rule

The primary operative rule (in proposed subsections 18.4(3) and (4)) generally applies to “inbound” arrangements – i.e. a payment by a Canadian taxpayer to a foreign entity under a hybrid mismatch arrangement. This rule denies a deduction for the payment to the extent of the hybrid mismatch amount.

This primary rule takes precedence over any foreign hybrid mismatch rules, which might otherwise include the payment in foreign income. The primary rule also applies in priority to the Canadian thin capitalization rules and proposed EIFEL rules (and should therefore be considered before applying those other rules).

If a deduction for a payment is denied under the primary rule, an adjustment mechanism (in proposed paragraph 20(1)(yy)) allows a deduction to be claimed in the future, to the extent the taxpayer can demonstrate that an amount in respect of the payment is included in foreign ordinary income. This rule provides relief for hybrid mismatch amounts that involve timing differences, rather than permanent mismatches.

When an interest deduction is denied under the primary rule, the non-deductible interest is deemed to be a dividend for non-resident withholding tax purposes.

Secondary rule

The secondary operative rule (in proposed subsections 12.7(2) and (3)) generally applies to “outbound” arrangements – i.e. a payment received by a Canadian taxpayer from a foreign entity under a hybrid mismatch arrangement. This rule includes an amount in the taxpayer’s income, equal to the hybrid mismatch amount for the payment.

The secondary rule does not apply to a payment that is non-deductible in the foreign country due to a foreign hybrid mismatch rule (as there is no D/NI mismatch in those circumstances). The primary foreign hybrid mismatch rule therefore takes precedence over the secondary Canadian rule.

PwC observes

The proposed rules deviate significantly from the Action 2 Report, by treating non-deductible interest as a dividend for withholding tax purposes (although this is consistent with the treatment of non-deductible interest under the thin capitalization rules). This means that the primary rule can deny interest deductions, but also immediately increase cash withholding taxes (where dividends are subject to a higher withholding tax rate than interest under a relevant tax treaty, such as Canada’s tax treaty with the United States).

The primary rule also demonstrates the importance of coordinating Canada’s hybrid rules with other countries’ rules. The primary rule denies a deduction in Canada, operating on the assumption that foreign hybrid rules will not be applied in these circumstances. This ordering is consistent with the Action 2 Report, but taxpayers must ensure that relevant hybrid mismatch rules in foreign jurisdictions actually provide relief in these circumstances.

The ordering of the primary rule ahead of the Canadian thin capitalization rules and EIFEL rules is also important. The primary rule generally denies an expense deduction to the extent it exceeds certain income inclusions (under the D/NI mismatch test), whereas those other rules simply deny a portion of the expense (without netting that expense against any income). The total deduction denied under all of these rules may therefore be larger than it would be if the ordering were reversed. For example, assume a taxpayer has $100 of interest expense that produces a $80 D/NI mismatch (due to a $20 foreign income inclusion), and 50% of the taxpayer’s interest expenses are non-deductible under the thin capitalization rules. The primary hybrid mismatch rule would deny $80 of the interest deduction and $10 of the remaining deduction would be denied under the thin capitalization rules (i.e. $90 total denied interest). If the ordering were reversed, $50 of the interest deduction would be denied under the thin capitalization rules, resulting in only a $30 D/NI mismatch to be caught by the primary rule (i.e. $80 total denied interest). It might be more appropriate to remove a debt from the debt-to-equity ratio used in the thin capitalization rules, to the extent interest on the debt is non-deductible under the hybrid mismatch rules.

Unlike the primary rule, the secondary rule does not appear to have an adjustment mechanism that provides relief for an income inclusion resulting from a long-term timing mismatch once that mismatch resolves.

Denial of foreign affiliate dividend deductions

In addition to the main operative rules outlined above, the proposals include a new restriction on the deductions provided in section 113 of the Act for certain dividends received from foreign affiliates. The new rule (proposed subsection 113(5) of the Act) denies access to a section 113 deduction for a foreign affiliate dividend, to the extent the dividend is deductible for foreign tax purposes by the dividend payer (or by certain other entities that pick-up the dividend payer’s income for foreign tax purposes). Unlike the main operative rules, the application of proposed subsection 113(5) does not require a hybrid mismatch arrangement.

Proposed subsection 113(5) applies even if the foreign tax deduction for the dividend would be denied by foreign hybrid mismatch rules, or by foreign equivalents of the thin capitalization or EIFEL rules. This rule can also take priority over the main Canadian hybrid rules (because if a taxpayer receives a foreign affiliate dividend and cannot claim a section 113 deduction, this can eliminate the D/NI mismatch required by the main rules).

When this rule denies the section 113 deduction for a dividend, the dividend still reduces the foreign affiliate surplus balances of the dividend payer. It also appears that no foreign tax credit would be available for any withholding tax paid on the dividend, due to the existing restriction in the foreign tax credit rules for taxes paid on income from foreign affiliate shares (which is not amended by the proposals).

PwC observes

The application of proposed subsection 113(5) could lead to problematic results, particularly in scenarios where a foreign country’s deduction for dividends paid by a corporation reflects a policy choice to instead impose equivalent tax at the shareholder level. For example, US REITs (which may be structured as corporations) must generally distribute almost all of their income; those distributions are deducted by the REITs and are instead taxed in the hands of their investors (including significant withholding tax for non-US investors). A Canadian corporation that invests in a US REIT could face significant double taxation under the proposed rules; this result may be unintended. The government should consider providing access to foreign tax credits for withholding tax on foreign affiliate dividends, when section 113 deductions for those dividends are denied by proposed subsection 113(5).

As noted above, coordination with foreign hybrid rules will also be important. Proposed subsection 113(5) takes priority over foreign hybrid rules that would deny the deduction for a dividend payment, on the basis that other countries should not apply their hybrid rules when subsection 113(5) applies. This ordering is consistent with the Action 2 Report, but taxpayers should monitor their investments in countries that provide dividend deductions, to ensure that their foreign hybrid rules are actually applied in this manner.

Anti-avoidance rule

A targeted anti-avoidance rule addresses certain arrangements that produce outcomes substantially similar to those caught by the proposed rules, but which do not satisfy the technical requirements of those rules. This anti‑avoidance rule generally applies to a payment if one of the main purposes of a transaction (or series of transactions) that includes the payment is to avoid or limit the application of the proposed rules, and one of the following conditions is satisfied:

- the payment is a dividend which produces a deduction for foreign tax purposes

- a D/NI mismatch (or substantially similar outcome) arises because of a different treatment of the terms or conditions of the transactions under the tax laws of different countries

When this rule applies, it redetermines the tax consequences to deny the tax benefit arising from the D/NI mismatch (or substantially similar outcome).

Examples of arrangements affected by the hybrid mismatch rules

The following examples illustrate the application of the proposed rules to certain hybrid arrangements (these are largely based on examples in the explanatory notes accompanying the proposals). It is important to note that, although the explanatory notes consider how the proposed rules would apply to these arrangements, they do not rule out the possibility that these arrangements could also be challenged under existing tax rules.

Loan and forward subscription arrangement

The first example involves an inbound investment into Canada:

- USco 1 and USco 2 are US companies; USco 2 is a wholly-owned subsidiary of USco 1 and is fiscally transparent for US tax purposes.

- Canco is a Canadian company.

- USco 1 makes an interest-bearing loan (Loan) to Canco.

- USco 2 and Canco enter into a forward subscription agreement (FSA), under which USco 2 agrees to subscribe for a specified number of common shares of Canco at specified future dates (which match the interest payment dates and the maturity date on the Loan).

- USco 1 and USco 2 enter into a capital support agreement (CSA), under which USco 1 agrees to contribute capital to USco 2 to provide it with the funds required to meet the obligations under the FSA.

- USco 1 enters into a guarantee agreement with Canco to guarantee USco 2’s obligations under the FSA.

- On each interest payment date (and on the maturity of the Loan):

- USco 1 contributes cash to USco 2 as a capital contribution (pursuant to the CSA)

- USco 2 uses the cash to subscribe for common shares of Canco (pursuant to the FSA), and

- Canco uses the cash to pay interest to USco 1 under the Loan (or to pay the principal amount of the Loan on maturity)

For the purposes of this example, the Loan is assumed to be treated as debt for Canadian tax purposes, and the interest payments to USco 1 are deductible. For US tax purposes, the arrangement is essentially viewed as an equity investment by USco 1 in Canco and the interest payments are treated as stock dividends, which are not included in USco 1’s taxable income.

This arrangement is a “hybrid financial instrument arrangement” under the proposed rules, as it meets the following conditions:

- the Loan is a “financial instrument” and interest on the Loan is a “payment” arising under this financial instrument

- the payer and recipient of the interest (Canco and USco 1) do not deal at arm’s length

- the interest payment gives rise to a D/NI mismatch, as it produces a deduction for Canadian tax purposes, without any inclusion in the foreign ordinary income of USco 1, and

- the D/NI mismatch arises because the arrangement is treated differently under the tax laws of Canada and the US (i.e. Canada treats the Loan as debt that is separate from the FSA, whereas the US treats these instruments as an integrated equity investment); this difference in treatment is attributable to the terms and conditions of the Loan, the CSA, the FSA and the guarantee agreement

The interest payment is therefore considered a “hybrid mismatch amount” and Canco’s deduction of this amount is denied by the primary operative rule (proposed subsection 18.4(4)). The payment is also deemed to be a dividend (rather than interest) for withholding tax purposes.

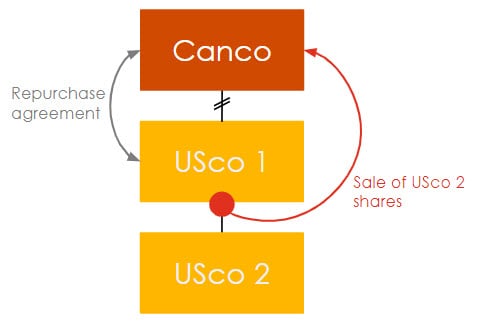

Sale and repurchase of shares (Repo)

The second example involves an outbound investment from Canada:

- Canco is a Canadian company.

- USco 1 and USco 2 are US companies, which are foreign affiliates of Canco.

- USco 1 sells shares of USco 2 to Canco for $100 million and also enters into a repurchase agreement to repurchase those shares in one year’s time for $110 million. Canco retains any dividends paid on the USco 2 shares during this period and the repurchase price is reduced by the amount of these dividends.

- During the one year period in which Canco owns the USco 2 shares, USco 2 pays a $10 million dividend.

Under Canadian income tax law, the dividend paid by USco 2 to Canco is included in Canco’s income under subsection 90(1), and an equal amount is deducted from taxable income under paragraph 113(1)(a) (assuming that the dividend is paid from USco 2’s exempt surplus). Under US tax law, the arrangement is treated as a loan from Canco to USco 1 (which is secured by the USco 2 shares); USco 1 is treated as having a $10 million deductible interest expense in respect of this loan (for illustrative purposes, we assume that the US hybrid mismatch rules do not apply to deny the deduction).

Proposed subsection 113(5) does not apply to the dividend, as the dividend is not deductible by USco 2 (although USco 1 has a deduction in this arrangement, this deduction arises because it is considered a borrower for US tax purposes, not because it has an ownership interest in the dividend payer).

This arrangement is a “hybrid transfer arrangement” as it meets the following conditions:

- the arrangement involves the transfer of a financial instrument (the USco 2 shares), and the dividend paid by USco 2 is a payment arising on the transferred financial instrument

- the payer and recipient of the dividend (USco 2 and Canco) do not deal at arm’s length

- in the explanatory notes, Finance states that the dividend payment gives rise to a D/NI mismatch, as USco 1’s interest deduction arises “in respect of” the dividend, and the dividend is not included in Canco’s Canadian ordinary income (because of the offsetting section 113 deduction), and

- the D/NI mismatch arises because the transfer arrangement is treated differently under the tax laws of Canada and the US (i.e. the US treats the arrangement as a borrowing, whereas Canada does not)

The dividend payment is therefore a “hybrid mismatch amount;” Canco must include an amount equal to the dividend in its income under the secondary operative rule (proposed subsection 12.7(3)). As noted above, this example assumes that the US hybrid mismatch rules do not apply to deny USco 1’s interest deduction. If those rules did apply, the Canadian hybrid mismatch rules would not apply, as there would be no D/NI mismatch.

Future legislation

As noted above, this first package of proposed legislation addresses only some of the hybrid mismatches discussed in the Action 2 Report. The second package will address other types of hybrid mismatches discussed in that report, which may include the following:

- Hybrid entity mismatches – Hybrid entities are entities that are treated as fiscally transparent in one country and opaque in another country. Arrangements involving these entities can produce D/NI mismatches, as well as double deduction mismatches (when a payment produces a deduction in Canada and in another country).

- Branch mismatches – Mismatches resulting from differences in the tax laws of different countries, involving the allocation of income or expenditures to a branch.

- Imported mismatches – Certain arrangements in which a payment is deductible by an entity in one country and included in the ordinary income of an entity in a second country, but that income inclusion is offset by a deduction under a hybrid mismatch arrangement with an entity in a third country.

The takeaway

The hybrid mismatch rules are a complex addition to the Canadian tax system, with many broad terms and complicated tests. Taxpayers should carefully review these rules to determine whether they apply to their existing financing arrangements. In some cases, taxpayers may need to refer to the explanatory notes and the Action 2 Report for additional guidance. Any interactions with the existing “foreign tax credit generator” rules (a narrower regime that denies foreign tax credits or deductions relating to certain hybrid arrangements) should also be considered. Taxpayers should also note that the proposed rules apply to some arrangements that are not covered in the Action 2 Report (i.e. notional interest deductions claimed on interest-free loans).

The rules will require a coordinated global approach on a number of levels. Taxpayers must have a sound understanding of the foreign tax treatment of their arrangements when applying the proposed rules to those arrangements. The Canadian hybrid mismatch rules also rely on coordination with foreign hybrid mismatch rules, to prevent double taxation in cases where Canada denies a deduction.

Since the proposed rules are scheduled to take effect on July 1, 2022, taxpayers must act quickly to assess the impact of these rules on their financing arrangements and consider any appropriate response.

1. Unless otherwise noted, all statutory references refer to the provisions of the Act.

2. See OECD/G20 Base Erosion and Profit Shifting Project, Neutralising the Effects of Hybrid Mismatch ArrangementsOpens in a new window and Neutralising the Effects of Branch Mismatch ArrangementsOpens in a new window.

3. See our Tax Insights “Excessive interest and financing expenses limitation (EIFEL) regimeOpens in a new window”.

4. The D/NI mismatch test also ignores deduction restrictions that implement the OECD’s Pillar Two rules (i.e. an “undertaxed profits rule”).

Contact us

Contact us