Tax Insights: Excessive interest and financing expenses limitation (EIFEL) regime

February 15, 2022

Issue 2022-06

In brief

On February 4, 2022, the Department of Finance (Finance) released draft legislative proposals (the proposals), which include detailed explanatory notes (the Notes), to implement numerous 2021 federal budget and other measures. The proposals include the 2021 federal budget proposal to limit the amount of net interest and financing expenses that certain taxpayers may deduct in computing their taxable income, based on a fixed percentage of earnings before interest, taxes, depreciation and amortization (EBITDA). The proposals would limit the net interest and financing deductions to:

30% of adjusted taxable income, known as the “fixed ratio” (40% for taxation years beginning after December 31, 2022 and before January 1, 2024), or

by election, a higher percentage of adjusted taxable income based on the group/entity’s net third-party interest expense to EBITDA ratio, known as the “group ratio”

The proposed new rules are referred to as the excessive interest and financing expenses limitation (EIFEL) regime and are expected to take effect for taxation years beginning after December 31, 2022. With the introduction of the EIFEL regime, Canada follows other jurisdictions in implementing a regime that is consistent with the recommendations in the Action 4 report of the Organisation for Economic Co-operation and Development (OECD) BEPS Action Plan.

This Tax Insights discusses the new EIFEL regime, for which the federal government has launched public consultations, with comments to be submitted to Finance by May 5, 2022.

In detail

Who will the rules apply to?

The EIFEL regime will apply to any taxpayer, defined as a corporation or trust, that is not considered to be an “excluded entity.” Excluded entities are generally:

Canadian-controlled private corporations (CCPCs) that, together with any associated corporations, have taxable capital employed in Canada of less than $15 million

groups of corporations and trusts whose aggregate net interest expense among their Canadian members is $250,000 or less

- certain standalone Canadian-resident corporations and trusts, and groups consisting exclusively of Canadian‑resident corporations and trusts, that carry on substantially all of their business in Canada, provided that:

- no non-resident is a foreign affiliate of, or holds a significant interest in, any group member, and

- no group member has any significant amount of interest and financing expenses payable to a “tax‑indifferent investor” (which is defined in subsection 248(1) of the Income Tax Act (the Act) and includes persons exempt from tax and non-residents)

Similar to how the thin capitalization rules apply to debts of partnerships, the EIFEL rules (as currently drafted) indirectly apply to partnerships, because the interest and financing expenses and income of a partnership are attributed to members of the partnership (including “ultimate'' members in a tiered structure) that are corporations or trusts to the extent of their share. Where a taxpayer that is a partner of a partnership is determined to have excess interest and financing expenses as determined under the EIFEL rules, the taxpayer would include an amount in income in respect of its share of the partnership’s interest and financing expenses (instead of the partnership being denied a deduction for such interest and financing expenses).

PwC observes

Finance appears to have intentionally adopted a lower “de minimis” threshold for the purpose of determining which entities will be impacted by the limitation. For other countries, which have adopted EBITDA-based interest limitation rules, the threshold at which the rules apply is generally higher (e.g. the United Kingdom adopted a £2m net interest expense “de minimis” threshold and Germany adopted an even higher threshold of €3m net interest expense). As a result, groups may need to pay closer attention to their Canadian net interest position as compared to other jurisdictions, which have already implemented interest limitation measures influenced by BEPS Action 4.

The proposals and the Notes do not clearly indicate whether the EIFEL rules should be applied when computing the income of a foreign affiliate. A foreign affiliate is generally deemed to be a Canadian resident for the purposes of computing its foreign accrual property income (FAPI), except to the extent that the context otherwise requires. In this case, the context may indicate that the foreign affiliate is not considered a Canadian resident for the purposes of the EIFEL rules (and would therefore not be subject to these rules). On the other hand, certain Canadian tax rules (i.e. the thin capitalization rules) are expressly excluded from the computation of a foriegn affiliate’s income; as currently drafted, there appears to be no such exclusion for the EIFEL rules. It is possible that subsequent versions of the proposals will clarify this issue. If a foreign affiliate was subject to the EIFEL rules, this could cause significant practical difficulties, such as conflicts between the EIFEL rules and the interest limitation rules of foreign jurisdictions.

Fixed ratio

The proposals provide for a fixed “ratio of permissible expenses,” which would limit the deduction of net interest and financing expenses to a rate of 30% of “adjusted taxable income.”

During a transition period, the ratio would be fixed at 40% for taxation years beginning after December 31, 2022 and before January 1, 2024; it will then be reduced to 30% thereafter. The transitional rules include anti-avoidance measures that would deny the benefit of the higher 40% ratio if the taxpayer has undertaken a transaction to extend the period for which the 40% ratio would otherwise apply.

PwC observes

The rules provide for a helpful transitional rate of 40% for taxation years beginning after December 31, 2022 and before January 1, 2024. However, the anti-avoidance rule associated with possibly denying the higher 40% ratio should be considered when contemplating any changes in year end, including a change that occurs because of a corporate reorganization.

A fixed ratio of 30% is generally consistent with similar measures adopted by other jurisdictions; it is at the upper end of the OECD BEPS recommended range of 10% to 30%.1

Adjusted taxable income

The fixed ratio is applied to “adjusted taxable income” (ATI) of the taxpayer to determine what portion of the taxpayer’s net interest and financing expense is deductible under the EIFEL rules. The ATI of a taxpayer is determined by reference to taxable income (or for non-resident taxpayers, taxable income earned in Canada) as computed under Part I of the Act, subject to certain adjustments. Specifically, ATI is determined by the formula:

A + B - C

Item A in the formula is the positive or negative number determined as:

the taxpayer’s taxable income for the year, or in the case of a non-resident taxpayer, its taxable income earned in Canada for the year (in both cases without regard to any restriction under the EIFEL rules), less

the total of the taxpayer’s non-capital loss and net capital loss for the year

Item B in the formula is the total of various amounts, including:

the taxpayer’s otherwise deductible interest and financing expenses for the year (including the taxpayer’s pro-rata share of interest and financing expenses of a partnership, taking into account possible at-risk rule limitations), and its deduction of restricted interest and finance expenses from previous years

deductions in respect of Part VI.1 tax

capital cost allowance (CCA) deductions (including the taxpayer’s pro-rata share of CCA deductions by a partnership, to the extent that it is not limited by the at-risk rules)

the portion of the taxpayer’s non-capital loss for another year deducted under section 111 of the Act to the extent that this loss can reasonably be considered to relate to the taxpayer’s net interest and financing expense deducted in that other year

Item C in the formula is the total of various amounts, including:

the taxpayer’s interest and financing revenues for the year

the taxpayer’s foreign source income for the year to the extent it is sheltered from Canadian tax by foreign tax credits

the taxpayer’s share of income and taxable gains allocated to it from a trust

amounts included in income of the taxpayer relating to the excess portion of interest and financing expense of a partnership

any amount of taxable income of the taxpayer not subject to tax under Part I

Since the starting point for ATI is taxable income, ATI would automatically include deductions for dividends received from other Canadian corporations (section 112 of the Act) and from foreign affiliates (section 113 of the Act).

PwC observes

As currently drafted, item A in the ATI formula starts with the taxpayer’s taxable income and then deducts the current year’s non-capital loss and net capital loss. If these current year’s losses are applied in a future taxation year to reduce the taxpayer’s taxable income for that year, the proposals do not provide for a subsequent adjustment to the ATI calculation in the subsequent period for the use of these losses (except for the partial addback of the portion of a non-capital loss that reasonably relates to the net interest and financing expense of the taxpayer). This results in these losses reducing ATI twice (once in the year incurred, and once in the year applied). We hope that this was a drafting oversight, which Finance will correct in subsequent versions of the proposals.

Interest and financing expenses and revenues

The EIFEL legislation extensively defines what is meant by interest and financing expenses and interest and financing revenues.

Interest and financing expenses

The definition of interest and financing expenses is broad and, among the specifically defined amounts included in the definition, includes a catch-all provision for amounts “paid in, or payable in or in respect of, a year as, on account of, in lieu of payment of or in satisfaction of, interest (other than excluded interest)” which are otherwise deductible under the Act.

In addition, interest and financing expenses include:

financing expenses incurred, which would be deductible under subparagraphs 20(1)(e)(ii) to (ii.2) and paragraphs 20(1)(e.1), (e.2) and (f) of the Act

- the portion of the taxpayer’s CCA claim or resource expenses that reasonably relates to interest and financing expenses, which otherwise would have been included in the taxpayer’s interest and financing expenses for a year but instead had been capitalized

- certain amounts that are paid, or payable, by the taxpayer; or that is a loss, or capital loss, of the taxpayer; that can reasonably be considered to be economically equivalent to interest, or otherwise part of the cost of funding of the taxpayer (or a non-arm’s length party), which would:

- be deductible in computing the taxpayer’s income for the year, or

- in the case of a capital loss, reduce the taxpayer’s taxable capital gain or be deductible in computing the taxpayer’s taxable income for the year, and

- amounts that are fees or expenses relating to such funding of the taxpayer

the implicit financing component of lease expenditures (other than those relating to excluded leases), which would otherwise be deductible by the taxpayer in computing its income for the year

all of the above expense items, which are included in the calculation of income for a partnership, as pro-rated based on the taxpayer’s share of partnership income (adjusted for amounts restricted as a deduction, or deducted in a subsequent year, due to the at-risk rules)

Interest and financing revenues

Similarly, the definition of interest and financing revenues is drafted broadly to capture an array of interest revenue and financing-related revenue streams. In particular, it includes:

amounts receivable, on account of, in lieu of payment or in satisfaction of interest (other than excluded interest) that are included in taxable income for the year

guarantee fees or similar fees for the repayment of a debt obligation owing by another person or partnership that is included in computing the taxpayer’s income for the year

- amounts that can be reasonably considered to increase the taxpayer’s return with respect to debt obligations owing to the taxpayer less:

- any amounts paid or payable by the taxpayer, or

- a loss or a capital loss of the taxpayer for the year,

as a result of such arrangements

the implicit financing component of lease income (other than amounts relating to excluded leases) included in the taxpayer’s income for the year

all of the above income items, which are included in the calculation of income for a partnership, as pro-rated based on the taxpayer’s share of partnership income

In addition, the proposals include specific anti-avoidance rules that prevent certain items from being included in interest and financing revenues (or excluded from interest and financing expenses).

PwC observes

The definitions of interest and financing expenses and revenues are broadly drafted to include a wide range of items. Some items included are relatively subjective – for example, items that could be “reasonably considered” to be part of the “cost of funding.” The Notes explore this further by stating that this can include “any amount that can reasonably be considered compensation for the time value of money” and provides an example in respect of derivative contracts. The Notes also refer to the accounting treatment under generally accepted accounting principles (GAAP) for providing guidance as to whether amounts should be included in “interest and financing expenses,” although it notes that GAAP does not provide a definitive conclusion. For taxpayers with hedging arrangements and derivative contracts, further consideration may therefore be required to determine which amounts should be included within the definition.

Proposed subsection 18.2(3) of the Act deems amounts of previously capitalized interest that are otherwise deductible as CCA or resource pools, but have been denied as a deduction under subsection 18.2(2), to have been deducted in computing a taxpayer’s total depreciation allowed, or the balance of its undeducted resource expenses. The Notes explain that this is to prevent taxpayers from obtaining a “double benefit” of having a higher undepreciated capital cost or undeducted resource expense pool, which could be deductible in a future year, while at the same time having a restricted interest expense carryforward for a future deduction. However, this deemed deduction also has the effect of increasing recapture to the taxpayer on a future disposal of the asset, while the restricted interest expense could remain non-deductible due to the EIFEL limitations. This observation is particularly relevant to taxpayers in industries with significant amounts of capitalized interest.

Proposed subsection 18.2(12) applies an exclusion from interest and financing revenues for amounts received from a person or partnership with whom the taxpayer does not deal at arm’s length, except to the extent that they are included in the computation of interest and financing expenses of a taxable Canadian corporation or a trust that is resident in Canada and subject to tax under Part I of the Act. As currently drafted, this rule appears to be overly restrictive in respect of loans to foreign affiliates or other non-arm’s length non-residents from Canadian taxpayers, particularly when these loans are funded by the Canadian taxpayer’s borrowings. In this case, the loans to non-arm’s length non-residents could give rise to an EIFEL interest disallowance notwithstanding that the taxpayer may economically be in a net interest income position.

Excluded interest

When certain conditions are met, entities can elect to exclude certain interest payments from the interest and financing expenses of the payer (and the interest and financing revenues of the payee).

The conditions required to be met are:

the interest is paid or payable by a corporation (payer corporation) to another corporation (payee corporation) in respect of a debt that is, throughout the period during which the interest accrued, owed by the payer corporation to the payee corporation

both the payer and payee corporations are taxable Canadian corporations, and

the payee corporation is an eligible group corporation in respect of the payer corporation (essentially, being related or affiliated, taking into account only de jure control, for tax purposes)

To exclude interest, the election must be jointly filed by the payer and the payee corporations, and must specify the amount of interest and debt to which the election applies. The election is required to be made on or before the earlier of the filing-due date for the taxation year in which the amount of interest was paid or became payable, of either:

the payer corporation’s taxation year, or

the payee corporation’s taxation year

According to the Notes, this exclusion is intended to prevent the EIFEL rules from having a negative impact on transactions that are commonly undertaken in Canadian corporate groups to allow the losses of one group member to be offset against the income of another group member.

PwC observes

The application of the “excluded interest” election is broad and only requires two eligible group corporations, which are taxable Canadian corporations, to make the election. The exclusion does not appear to apply an industry-specific restriction, as seen in other areas of the proposals (e.g. where certain restrictions are placed on relevant financial institutions), and therefore should be available to all Canadian taxpayers that meet the conditions. However, the requirement to file an election for the “excluded interest” exemption is different from the 2021 federal budget proposals (which stated that interest income and expense between Canadian members of a corporate group would be generally excluded) and adds further administrative complexity to the EIFEL regime. In addition, the “excluded interest” exemption election is not available to trusts or partnerships.

Determination of allowable interest and financing expenses in a taxation year

The mechanism to disallow interest and financing expenses within the EIFEL rules works by:

denying a deduction for the “excessive” amount of interest and financing expenses, or

including in the income of a partner their share of the “excessive” amount of interest and financing expenses of the partnership

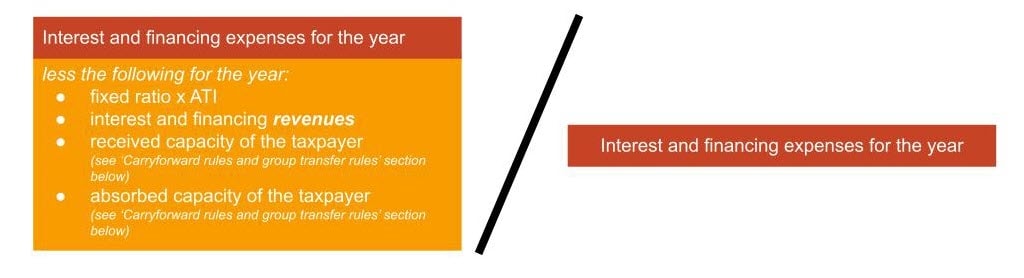

The proportion of total interest and financing expenses, which is determined as excessive, is calculated under subsection 18.2(2) as follows:

The above fraction therefore determines the portion of interest and financing expenses that would be non‑deductible in a taxation year, with the remainder deductible under the existing rules as set out in the Act.

Group ratio rules

As mentioned above, the Canadian members of a group of corporations and/or trusts may jointly elect to have the group ratio rules apply (certain standalone entities that are not part of a group can also elect to have the group ratio rules apply), which would allow a taxpayer to deduct interest and financing expenses that exceed the amount otherwise deductible by applying the fixed ratio. The purpose of the group ratio rule is to benefit taxpayers that have net third-party interest expense to book EBITDA that is higher than the permissible fixed ratio (30%) – i.e. to enable taxpayers to access a higher fixed percentage where the group as a whole is bearing higher interest and financing expenses as a result of its external debt.

To apply the group ratio rules, group members will be required to jointly elect into the regime with respect to the relevant taxation year. The election is required to be filed on or before the earliest filing due date of a Canadian group member for the year and must include an allocation of the group ratio amount to each Canadian group member (see below for further details on this allocation).

Consolidated group

The EIFEL rules rely on accounting definitions to determine a “consolidated group” for the purposes of the group ratio rule. As a result, a “consolidated group” is the ultimate parent entity and all the entities that are fully consolidated in the parent’s consolidated financial statements, or that would be if the group were required to prepare such financial statements under International Financial Reporting Standards (IFRS).

The ultimate parent entity is defined as the top entity in the group’s organizational structure in respect of which the consolidated financial statements of the group are prepared, such that no other entity holds (directly or indirectly) an interest in the entity which requires this entity to consolidate its results.

The EIFEL rules then consider these audited consolidated financial statements for the purpose of determining the group net interest expense and group adjusted net book income, which are used to calculate the group ratio.

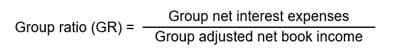

Group ratio calculation

The group ratio is generally calculated as follows:

Adjustments to arrive at group net interest expense and group adjusted net book income are similar in concept to those applied in arriving at net interest and financing expense and adjusted taxable income; however, the adjustments are based on amounts in the group’s audited consolidated financial statements.

The use of consolidated financial statements to determine the above measures relies on the consolidated financial statements being prepared under “acceptable accounting standards.” This has been defined to include IFRS, but also GAAP in Canada, Australia, the People’s Republic of China, Hong Kong, the Republic of India, Japan, the Republic of Korea, New Zealand, Singapore and the United States.

The group net interest expense is determined from the consolidated group’s net third-party interest expense. The amount is calculated as the group’s specified interest expense less the specified interest income for the period (these terms include certain other financing payments, such as guarantee fees) and adjusts for amounts paid to, or received from, specified non-members (generally speaking, these are entities which are not members of the consolidated group, but do not deal at arm’s length with a group member, hold a significant interest in a group member, or in which a group member holds a significant interest).

The group adjusted net book income is determined from the consolidated group’s book EBITDA, determined by combining the following items from the consolidated financial statements:

Add |

Deduct |

|---|---|

Net income |

Net loss |

Income tax expense |

Income tax recoverable |

Specified interest expense (excluding capitalized interest amounts) |

Specified interest income |

Depreciation / amortization / impairments / write-offs / losses on disposals and other expenses with respect to assets |

Gains on disposals of assets which have been amortized (only to the extent that proceeds ≤ original cost) |

Consolidated group’s share of income tax expense, or depreciation / amortization / impairments / write-offs / loss on disposals and other expenses with respect to assets, for an equity-accounted entity |

Consolidated group’s share of income tax recoverable, or gains on the disposal of assets, for an equity-accounted entity |

Sum to group adjusted net book income |

|

Restrictions to the group ratio

If the group ratio formula would otherwise exceed 40%, adjustment rules apply to restrict the group ratio, so that the full benefit is not necessarily obtained from the ratio. Specifically, the group ratio is adjusted as follows:

Group ratio calculated |

Allowable group |

Effective group ratio |

|---|---|---|

< 40% |

GR |

0% to 40%* |

40% to 60% |

40% + 50% x (GR - 40%) |

40% to 50% |

> 60% |

Lesser of:

|

50% to 100% |

* It is unlikely that there would be a benefit to accessing the group ratio in situations where the ratio is less than 30% (i.e. below the ordinary fixed ratio). |

||

As well as limiting the group ratio to 100%, these adjustment formulae are meant to account for situations where some group members may have negative book EBITDA, which may lead to unreasonably high results for the initial group ratio calculation. Where the group as a whole has nil or negative book EBITDA, the group ratio is deemed to be nil.

Allocation of group ratio amounts

Under the group ratio rule, the maximum amount of interest and financing expense that Canadian consolidated group members can collectively deduct is equal to the total of each group member’s adjusted taxable income multiplied by the group ratio. When a group ratio election is made for a taxation year, the election must specify how this deductible amount is allocated to each Canadian group member. This “allocated group ratio amount” (AGRA) replaces the fixed ratio amount in the interest limitation calculation, so that the group ratio allocation overrides the permissible deduction calculated under the fixed ratio. This manual allocation of the group ratio amount to each group taxpayer, which is required in the election, inherently allows current year excess capacity transfers within the corporate group (excess capacity for group members is further discussed below).

The total amount allocated to all group members under this election generally cannot exceed the least of:

- the total amount produced when the adjusted taxable income of each Canadian group member is multiplied by the group ratio

- the consolidated group’s net third-party interest expense, and

- the net adjusted taxable income of the Canadian group members

PwC observes

The group ratio calculation is designed to utilize amounts included in the consolidated financial statements, however, the calculation is still not straightforward and requires combining many different items from a group’s consolidated accounts. Notable adjustments to the amounts within the consolidated financial statements include:

- limitations for including interest expenses and income, which are associated with specified non-members, and

- inclusions for interest-related amounts for equity-accounted entities

This may require data that is more detailed than amounts included within the consolidated financial statements in order to calculate these adjustments.

For groups that do not ordinarily report their consolidated financial statements under IFRS (or one of the other accepted accounting principles), the group ratio rules would require separate audited consolidated financial statements to be prepared to allow for the group ratio to apply. The list of acceptable GAAP has been determined by Finance based upon those which should not generate material competitive advantages or disadvantages based on the use of these accounting standards versus IFRS. However, the list notably excludes any local European GAAP and therefore the group ratio calculations could be unavailable for European-headed groups that do not consolidate using IFRS.

The rules adjusting the group ratio mean that an initial group ratio of 260% or more would produce an applicable group ratio of 100%, and no further benefit can be obtained when the initial group ratio calculation is more than 260%. The capping of the group ratio at 100% is in line with the OECD BEPS Action 4 recommendations with respect to the group ratio rule.

The group ratio regime requires an election and will therefore require consideration by businesses each taxation year to determine whether their current borrowing and EBITDA profile means that a group ratio election could be beneficial. Whether the group ratio regime is beneficial to a particular group can change over time and may need to be considered following significant commercial or economic changes. In addition, the group ratio regime requires information that may not easily be available to the Canadian group members, particularly in large conglomerate or private equity structures.

Carryforward rules and group transfer rules

The EIFEL rules allow taxpayers to carry forward certain amounts from a taxation year to later taxation years. Specifically, taxpayers can carry forward:

- excess capacity to deduct interest, and

- restricted interest and financing expenses

In addition, the rules provide flexibility for one eligible group corporation to transfer excess capacity to other group corporations. The carryforward and group transfer provisions are subject to certain restrictions, which are summarized below.

Excess capacity and cumulative unused excess capacity

A taxpayer’s “excess capacity” for a taxation year generally refers to the amount by which the maximum amount that it is permitted to deduct in respect of interest and financing expenses for that taxation year (under the proposed subsection 18.2(2) formula) exceeds the actual interest and financing expenses for the year. A taxpayer’s “cumulative unused excess capacity” for a particular year is its unused excess capacity for the year plus the three immediately preceding years, less:

- amounts of “absorbed capacity” that are used by the taxpayer in the current or preceding years, and

- amounts of “transferred capacity” that are transferred to other group members in the preceding years (as discussed below)

In a year in which the taxpayer uses the group ratio, all taxpayers in the group will be treated as having an excess capacity of nil for the purposes of determining their cumulative unused excess capacity (i.e. the group ratio rules cannot be used to create excess capacity, although they do provide flexibility when allocating the group ratio amount within the group, as described above).

The unused excess capacity for a particular year can be carried forward for three years. A taxpayer must use its cumulative unused excess capacity to reduce the amount of its own interest and financing expenses that would otherwise be denied by the EIFEL rules in a taxation year. This amount which is used in a later taxation year is referred to as the “absorbed capacity.” Absorbed capacity reduces the taxpayer’s cumulative unused excess capacity in the year that it is used.

If a taxpayer has cumulative unused excess capacity for a year (after any reduction for absorbed capacity), an election may be available to transfer this excess capacity to other Canadian group members. The transfer of capacity requires a joint election by the transferee and transferor entity and can only be made between eligible group corporations. The transferred amount is referred to as “transferred capacity” of the transferor and “received capacity” of the transferee. The received capacity is first used to allow the transferee a deduction in computing taxable income for restricted interest and financing expenses of prior years (as further discussed below). Any remaining received capacity reduces the amount of the interest and financing expenses deduction limitation that the transferee would otherwise have for the year under the formula in subsection 18.2(2).

Note that a restriction prevents “relevant financial institutions” from transferring their cumulative unused excess capacity to other group members. According to the Notes, this restriction is included because these institutions would often be expected to have excess capacity due to the nature of their businesses (i.e. receiving interest income that exceeds their interest expense). In addition, a group that includes a relevant financial institution cannot elect into the group ratio rules described above.

The transitional rules for the new EIFEL regime also allow taxpayers to jointly elect with each other eligible group corporation to determine their excess capacity for each of the three taxation years (defined as the “pre-regime years”) immediately preceding the first taxation year to which the EIFEL rules apply. Without these rules, taxpayers would not have excess capacity for the pre-regime years in which the EIFEL rules have not historically applied.

PwC observes

The ability to transfer unused excess capacity requires a joint election and is therefore not automatic. In addition, proposed paragraph 18.2(4)(e) deems all transfers to be invalid if the total amount transferred as per the elections filed is greater than the excess unused capacity that is available for transfer, with the ability to amend an election only when there is a reduction in the determination of cumulative unused excess capacity as a result of a reassessment. There are also other conditions relating to the ability to transfer excess capacity, one of which is that the entities must have the same tax reporting currency.

The ordering rules mean that a group member must first use its excess capacity carryforwards against its own denied interest and financing expenses, before being able to transfer any remaining capacity to other group members. The ordering rules may also result in a taxpayer not being able to use non-capital losses, which may be expiring in upcoming taxation years, to the extent it has current year excess capacity that results in a deduction of prior year restricted interest and financing expense that itself may not be expiring.

In addition, for the purpose of calculating a taxpayer’s cumulative unused excess capacity available for the taxation year beginning after December 31, 2022 and before January 1, 2024, the 40% fixed ratio is to be applied to the three preceding taxation years. For all other taxation years, the 30% fixed ratio is to be applied. Therefore, taxpayers electing into the transitional rules relating to excess capacity for pre-regime years will be required to perform two calculations of their cumulative unused excess capacity as a result of the transition year.

The restrictions preventing relevant financial institutions from transferring excess capacity, and from making the group ratio election, go beyond what was discussed in the 2021 federal budget (which referred only to banks and life insurance companies transferring capacity to group members who were not regulated banks or life insurance companies). These restrictions could cause significant difficulties for Canadian financial services groups, which are often required to perform certain functions in different entities. For example, regulatory restrictions often limit a regulated financial institution’s ability to incur third party debt, leading other group members to incur such debt. Preventing financial services groups from sharing their excess capacity could impair their ability to effectively conduct their business operations.

Restricted interest and financing expense

The amount of interest and financing expense denied under the new EIFEL rules in a taxation year (the “restricted interest and financing expense”) can be carried forward and deducted in computing the taxable income for any of the next 20 taxation years (a time limit which is modeled on the existing Canadian tax rules for the carry forward of non-capital losses) provided the taxpayer has excess capacity, or has received capacity from other group members, in the subsequent taxation year.

Loss restriction events

The EIFEL regime would also amend the existing loss restriction event rules under section 111 of the Act to provide the following restrictions for EIFEL tax attributes following a loss restriction event:

- Restricted interest and financing expenses may only be deducted following a loss restriction event to the extent that they can be reasonably regarded as the taxpayer’s expenses incurred “in the course of carrying on a business” in a taxation year before the loss restriction event and that taxpayer continues to carry on that business in the later taxation year; and these expenses may be deducted only to the extent of the taxpayer’s income in the later year from that business or a similar business (i.e. applying similar requirements which currently apply to non-capital losses after a loss restriction event).

- Cumulative unused excess capacity would expire following a loss restriction event, such that the absorbed capacity, excess capacity or transferred capacity for any taxation year that ended before the loss restriction event is disregarded for any taxation year that ends after the loss restriction event.

PwC observes

Loss restriction events will need to be carefully considered for any future transactions. In particular, it is not clear why, based on the drafting of the legislation, loss restriction events should result in the expiry of all cumulative unused excess capacity, regardless of the fact that the debt profile and borrowing of the Canadian companies may not have changed as a result of the event. If there are specific policy concerns with cumulative unused excess capacity being available after a loss restriction event, a more targeted rule to limit the use of the cumulative unused excess capacity, perhaps modeled after paragraph 111(5)(b), would seem to be more appropriate.

The tax attributes associated with the EIFEL regime will also impact a group’s deferred tax asset calculations and groups will need to consider these new tax attributes and whether valuation allowances are required in line with relevant accounting standards.

Interaction with existing rules

Canada has existing legislation to restrict the deductibility of interest payments for taxpayers that are thinly capitalized. Although the EIFEL rules conceptually overlap with these rules, the proposed EIFEL legislation confirms that the thin capitalization rules will remain in place and will apply in priority to the EIFEL rules. Thus, amounts for which a deduction is denied because of the thin capitalization limitations will be excluded from a taxpayer’s interest and financing expenses for the purposes of considering the EIFEL limitation.

PwC observes

It will be important to consider how the EIFEL rules will interact with proposed rules that are anticipated to be released shortly – for example, how will the EIFEL rules interact with the proposed anti-hybrid rules, which were also outlined in the 2021 federal budget. It is also worth considering whether the EIFEL rules will eliminate the need for, or lead to changes in, the existing thin capitalization rules in subsection 18(4).

Next steps

The Finance consultation period for the EIFEL proposals is from February 4, 2022 until May 5, 2022. Following the consultation, there will be a process to finalize the draft legislation to enact the EIFEL rules. However, the rules are expected to be in force for taxation years beginning after December 31, 2022.

PwC observes

Businesses should consider how the EIFEL rules will impact them and begin modeling the impact on their taxable income for taxation years starting from January 1, 2023 onwards. Actions required to minimize the impact of these rules should be implemented before their taxation years beginning after December 31, 2022. Taxpayers should also be aware that there is an anti-avoidance rule that could apply if they enter into transactions with a view to delaying the application of the EIFEL regime.

The takeaway

The EIFEL rules will be a complex addition to the Act and will require additional compliance and tax considerations for a large number of Canadian taxpayers, given the low de minimis threshold for taxpayers to be exempt from the rules.

As shown, the rules are fairly mechanical and formula-driven; however, groups have some important informed choices to consider because of the various elections set out in the legislation, including:

- applying the group ratio

- excluding interest from the definition of interest and financing expenses, and

- transferring unused excess capacity between group members

As the rules will come into force for taxation years beginning after December 31, 2022, taxpayers should start considering the impact of the rules on their tax filings and tax accounting for the upcoming periods. From a tax accounting perspective, the rules provide for additional tax attributes with respect to restricted interest and financing expenses and cumulative unused excess capacity, which may need to be considered for deferred tax calculations.

The consultation period on the rules is open until May 5, 2022. Taxpayers that have particular concerns on the current drafting of the rules should consider addressing their concerns to Finance as part of this consultation process.

1. OECD/G20 Base Erosion and Profit Shifting Project, Limiting Base Erosion Involving Interest Deductions and Other Financial Payments, Action 4 - 2016 Update (December 22, 2016) at www.oecd-ilibrary.org/books.

Contact us

National Growth Priorities Markets Leader, Partner International Tax, PwC Canada

Contact us