This year marks the 25th anniversary of PwC’s Annual Global CEO Survey. As it has in years past, the report offers a revelatory look at how leaders are navigating the most pressing issues of the day. In 1998, during the dot-com bubble, we talked to chief executives about technology, from their personal use of the internet to the future of e-commerce; in 2003, we tracked the rise of corporate governance and enterprise risk management in the wake of financial scandal; and in 2008, we gauged CEOs’ response to the collapse of the global financial system.

Similarly, this year’s survey, taken by 4,446 CEOs from 89 countries and territories, including 1,618 CEOs in Asia Pacific, amid a lingering pandemic and in the wake of social upheaval, documents a moment of extraordinary change. As executives grapple with a convergence of environmental, financial, and social pressures, they find themselves having to calculate an entirely new equation for success. Hence the title of this year’s report: ‘Reimagining the outcomes that matter - Global & Asia Pacific results.’

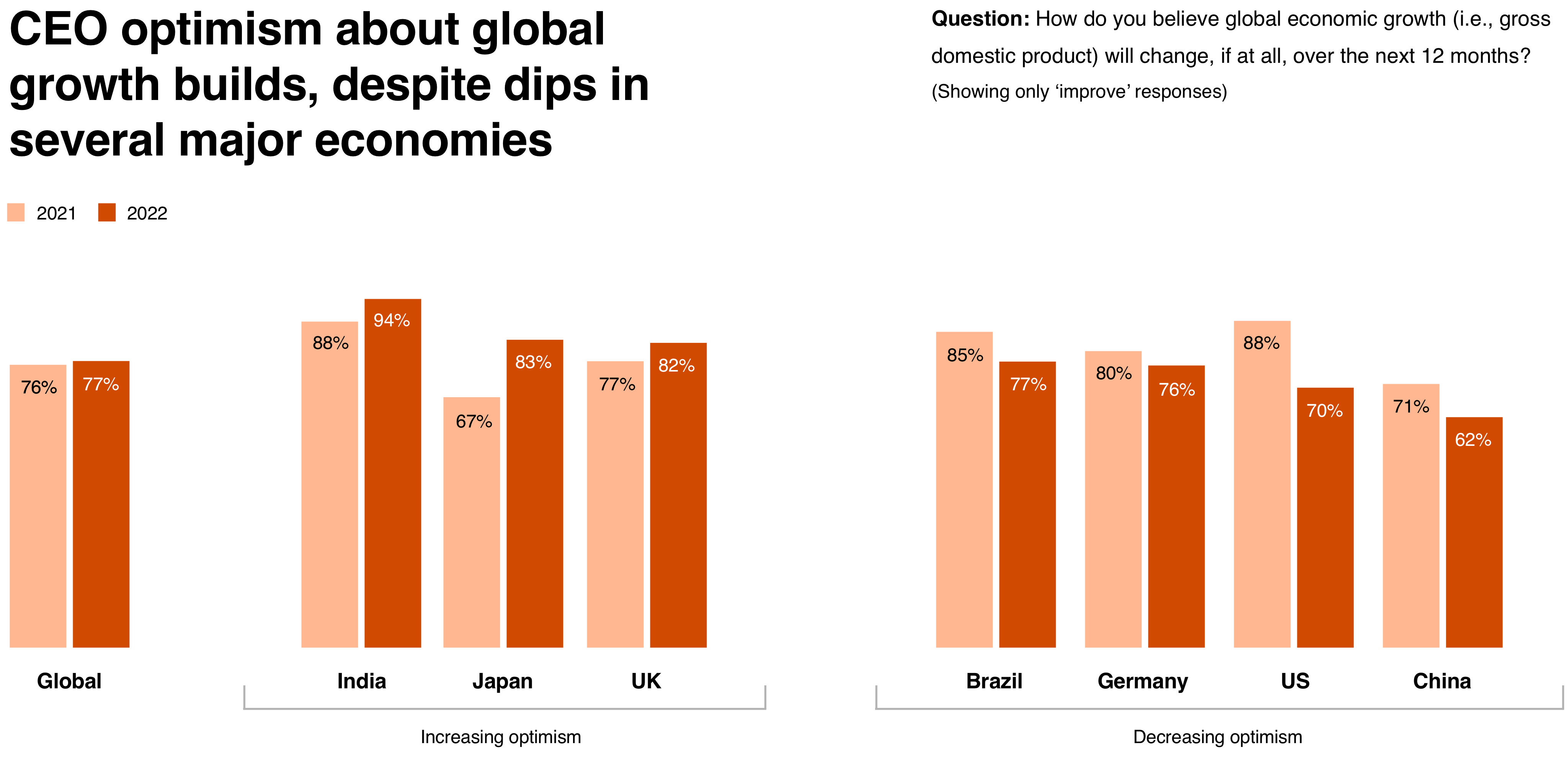

Near-term optimism

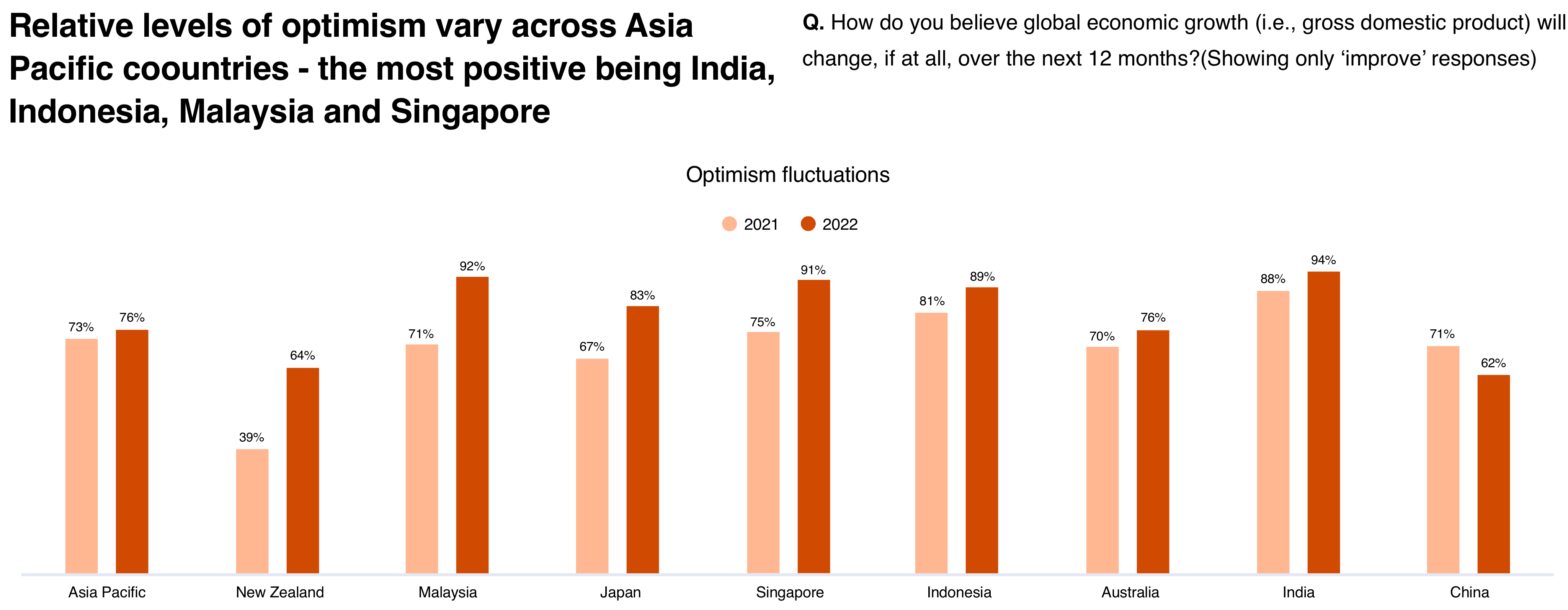

When we surveyed global chief executives in October and November of 2021, 77% said they expect global economic growth to improve during the year ahead, a one percentage point uptick from our previous survey (conducted in January and February of 2021) and the highest figure on record since 2012, when we began asking CEOs how they felt about the economy’s potential. Asia Pacific CEOs (76%) also share near-term optimism. Most countries in the region highlight significant improvement in confidence from the previous year with some countries reporting 15%-25% increases. India, Indonesia, Malaysia and Singapore reported a ~90+% level of optimism. China reported a decrease to 62%. This highlights clear differences in perception of global risks and opportunities.

Threats to the top line

Similar to last year, global CEOs are most concerned about cyber risks (49%) and the global health situation (48%) as the pandemic lingers. To understand what lies behind these views, we asked CEOs how they think each threat could inhibit their ability to achieve various business outcomes over the next 12 months. With the exception of social inequality, CEOs were most concerned about the potential of each threat to disrupt revenue. Slightly different from the global average results, Asia Pacific CEOs perceive health as the most material risk to growth: 58% of Asia Pacific CEOs identify this as the number one threat, 10% higher than their global counterparts. This may be driven by variable vaccination rates, public health directives and access to local talent in critical areas. Cyber and macroeconomic volatility are the second and third most material threats. In contrast, global CEOs see cyber risks (49%) as the most pressing concern.

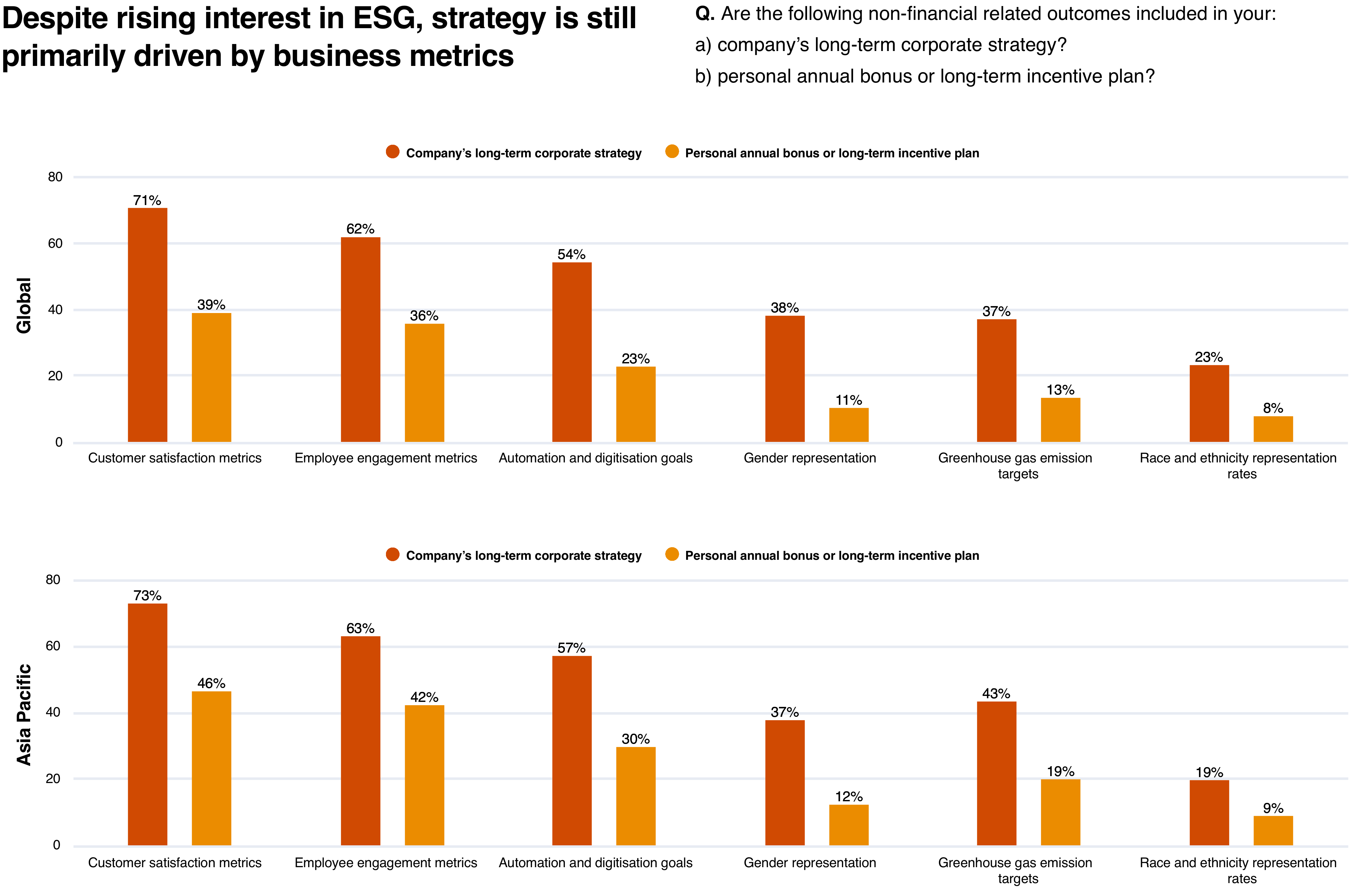

Shifting goals and incentives

Despite rising interest in ESG, most CEOs report only having non-financial outcomes closely related to business performance (e.g., customer satisfaction, employee engagement, and automation or digitization) included in their long-term strategy. Much less well-represented, in strategies and compensation, are targets related to GHG emissions and gender representation or racial and ethnic diversity: For example, 13% or fewer of CEOs have such targets in their annual bonus or long-term incentive plan. Consistent with global CEOs, business outcomes (i.e. customer/employee satisfaction and automation/digitisation goals) continue to be the main focus of strategy and incentives for Asia Pacific CEOs. This signals an opportunity for CEOs to look beyond traditional commercial elements - not only climate, but also gender, and race and ethnicity representation rates.

The long path to net-zero

Just 22% of global CEOs have made a net-zero commitment. The top three reasons global CEOs cited for why their firm had not made a carbon neutral or net-zero commitment: 1) they don’t think their companies produce a meaningful amount of GHG emissions (57%); 2) their company does not have the capabilities to measure its GHG emissions (55%); and 3) their sector does not have an established decarbonisation approach (52%). Asia Pacific CEOs are ahead of their global peers in net-zero and carbon-neutral commitments: 60-69% of companies in the region have made, or are progressing towards, a net-zero and/or carbon-neutral commitment, 9-13% ahead of global peers. In addition to those CEOs that have made net-zero commitments, 11% more Asia Pacific CEOs (77% vs. 66% global CEOs) have had their approach independently assessed and validated. A higher proportion of Asia Pacific CEOs have also embedded these emissions targets into their strategy (43% vs. 37% global CEOs).

Contact us