{{item.title}}

{{item.text}}

{{item.text}}

Access to capital to fund expansion and operations is critical to a company’s ability to meet its short- and long-term objectives. Traditionally, aside from simple bank financing, capital was raised through the following transactions

In a post-pandemic world, some of the major drivers of capital markets volatility include the likelihood of a global recession over a soft landing, geopolitical instability, human capital issues and emerging ESG considerations. Against this backdrop, the consequences of an improperly executed capital raising transaction have increased dramatically. Careful thought, preparation and planning are therefore crucial.

At PwC Indonesia, our capital markets specialists leverage deep knowledge of both the Indonesian and global exchanges and regulatory processes to help clients effectively address the new challenges of the current economic environment. Find out how we can guide you through each step of the readiness assessment process and beyond.

Going public is a monumental decision for any company. It is a transformational event that forever changes how a company goes about doing business. While going public often provides access to liquidity and wide range sources of capital, a public company also faces greater public scrutiny and regulation. How do you navigate the complexities to get there? And how do you know if it is the right path for your company?

Going public is, in every sense, a transformational event. You need to be confident it’s the right strategy for funding the next stage in your organisation’s development. You will need to consider whether your organisation is prepared to accept the additional disciplines that come with being a public company.

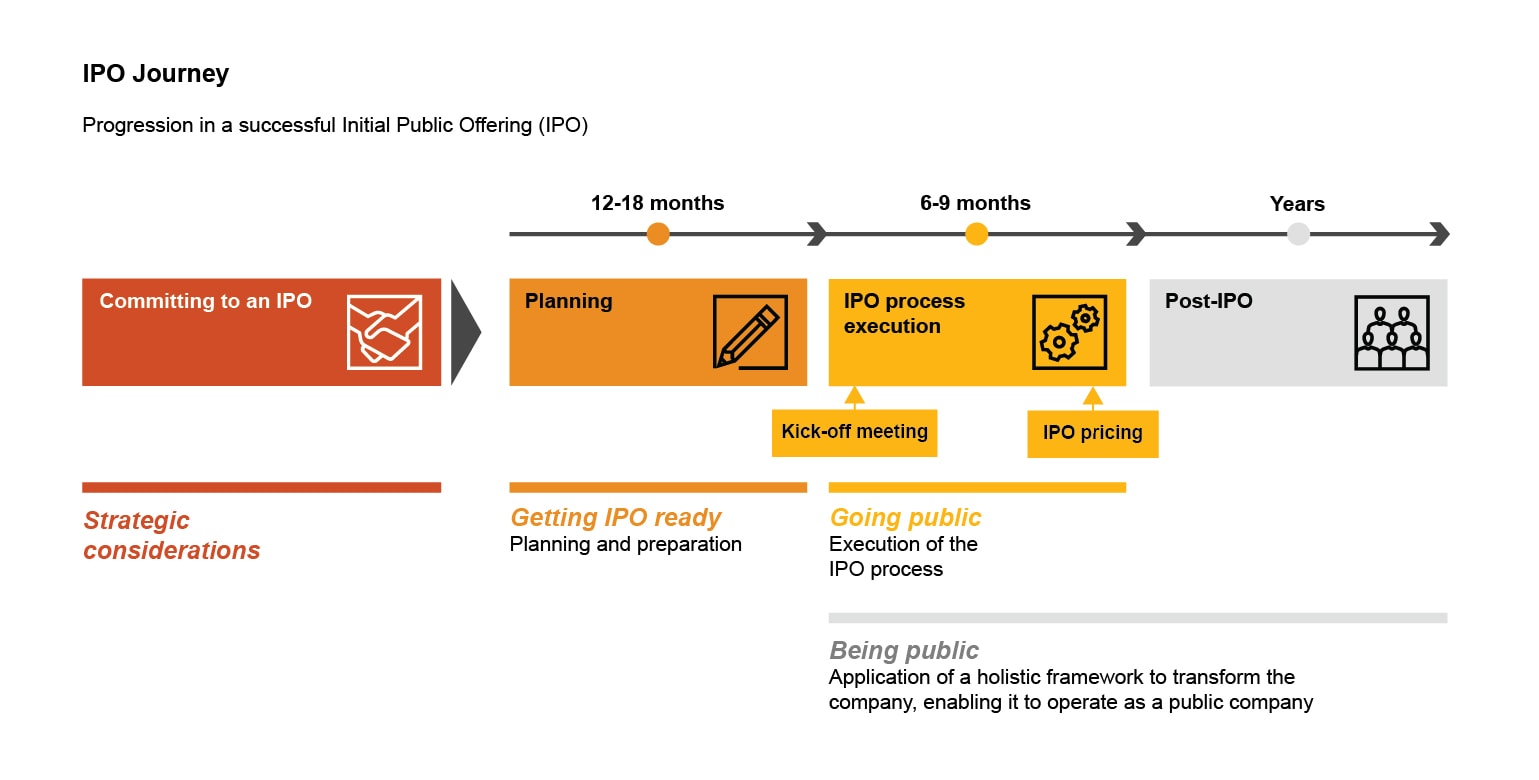

This publication is a comprehensive guide to assist your organisation in the IPO journey. Our aim is to help companies make informed decisions by addressing several factors such as the advantages, disadvantages, costs, timing and alternatives to going public. It outlines the process for going public and discusses the registration process and ongoing reporting requirements of a public company in Indonesia.

Further, this guide summarises the most significant accounting and financial reporting matters, commercial, legal, tax, and broader readiness considerations of becoming a public company.

{{item.text}}

{{item.text}}