In the short-term (12 months), Indonesia-based CEOs expect global economic growth to decrease. Global CEOs believe their companies will be economically viable within a decade if they continue on their current path whilst Asia Pacific and Indonesia hold a different perspective.

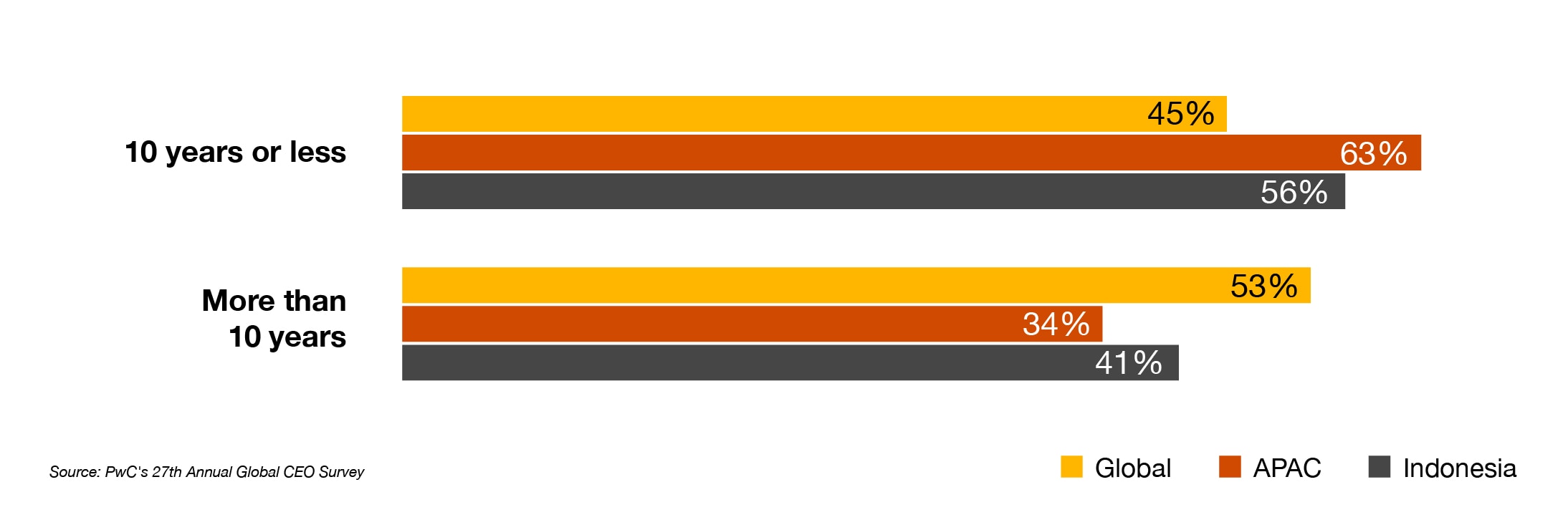

93% of surveyed CEOs based in Indonesia have taken steps to change how they create, deliver, and achieve value over the past five years. During that period, 69% took at least one action that significantly impacted their company’s business model. 56% believe their companies will not be economically viable in the next decade if they continue on their current path. This is lower than the Asia Pacific average (63%). While, when compared to global results, more than half of CEOs (53%) believe their companies will not be economically viable in the next decade, if they continue their current path.

Q. If your company continues running on its current path, how long do you think your business will be economically viable?

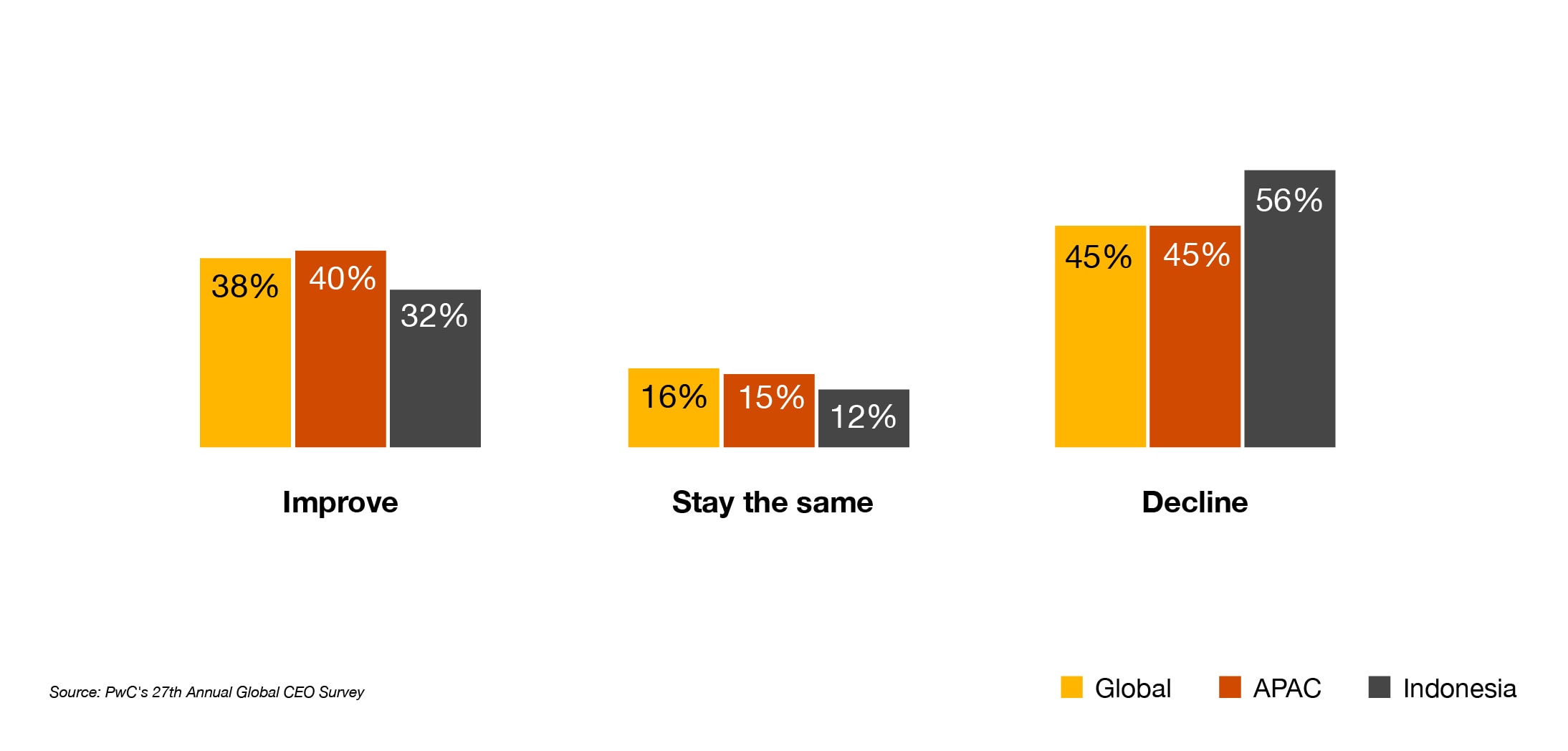

The intensification of concern about corporate viability was reflected in the near-term economic concerns where CEOs are less likely to expect global economic growth than a year ago. 56% of Indonesia-based CEOs expect global economic growth to decrease. Although Global and Asia Pacific exhibit similar results, Indonesia-based CEOs are more pessimistic than both aggregates.

Q. How do you foresee economic growth (i.e., gross domestic product) changin, if at all, over the next 12 months in the global economy?

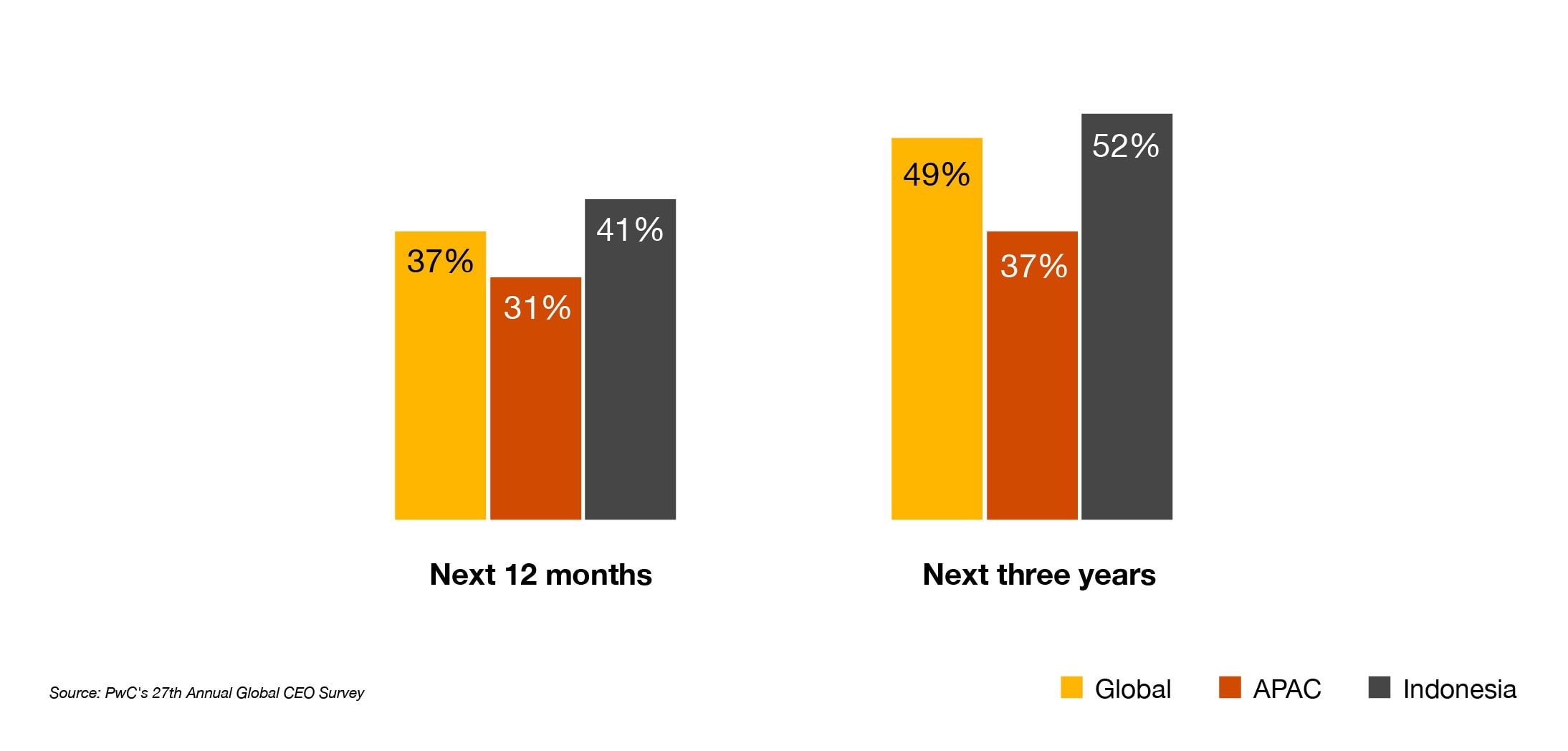

Nevertheless, Indonesia-based CEOs (41%) are confident when it comes to their company’s prospects for revenue growth in the next 12 months. They are more confident compared to Global and Asia Pacific on average (37% vs. 31%). Furthermore, the CEOs confidence level is higher over the medium term (52%).

Q. How confident are you about your company’s prospects for revenue growth over the next 12 months/next three years?

(Showing only ‘very confident’ and ‘extremely confident’ responses)

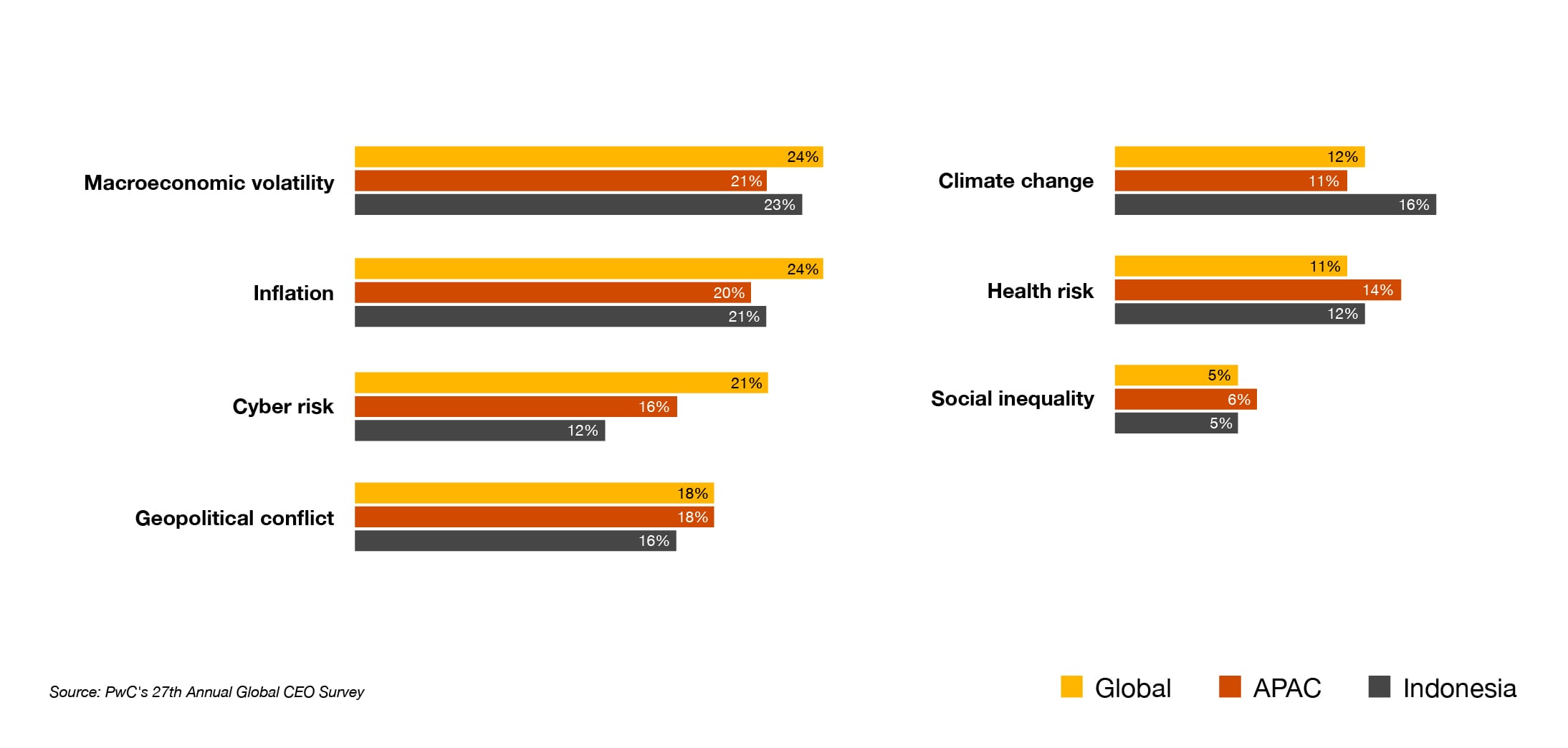

CEOs identify macroeconomic volatility as their primary threat.

Q.How exposed do you believe your company will be to the following key threats in the next 12 months?

(Showing sum of ‘highly exposed’ and ‘extremely exposed’ responses)

The top threats in the next 12 months for Indonesia-based CEOs are macroeconomic volatility (23%), inflation (21%), and geopolitical conflict (16%), aligning with the sentiments of Global and Asia Pacific counterparts. Indonesia-based CEOs also consider climate change, while Global CEOs prioritise cyber risk as another top threat.

This level of future uncertainty has been compounded by a year of persistent economic challenges, high inflation and geopolitical conflicts re-defining risk and limiting growth. CEOs are also confronting generational crises and opportunities in climate and generative artificial intelligence (GenAI). All things considered, there’s a compelling argument for accelerating business reinvention.

The reinvention imperative

Customer preferences was the top reinvention driver, both in the last five years and the next three years.

Q. Please indicate the extent to which the following factors have driven/will drive the way your company creates, delivers and achieves value in the last five years.

(Showing only ‘to a large extent’ and ‘to a very large extent’ responses)

Q. Please indicate the extent to which the following factors have driven/will drive the way your company creates, delivers and achieves value in the next three years

(Showing only ‘to a large extent’ and ‘to a very large extent’ responses)

Compared to the last five years, Indonesia-based CEOs expect changes associated with customer preferences (57%), while Global and and Asia Pacific choose technological changes (46% vs. 45%) to have a far larger impact on the way they create, deliver and capture value over the next three years.

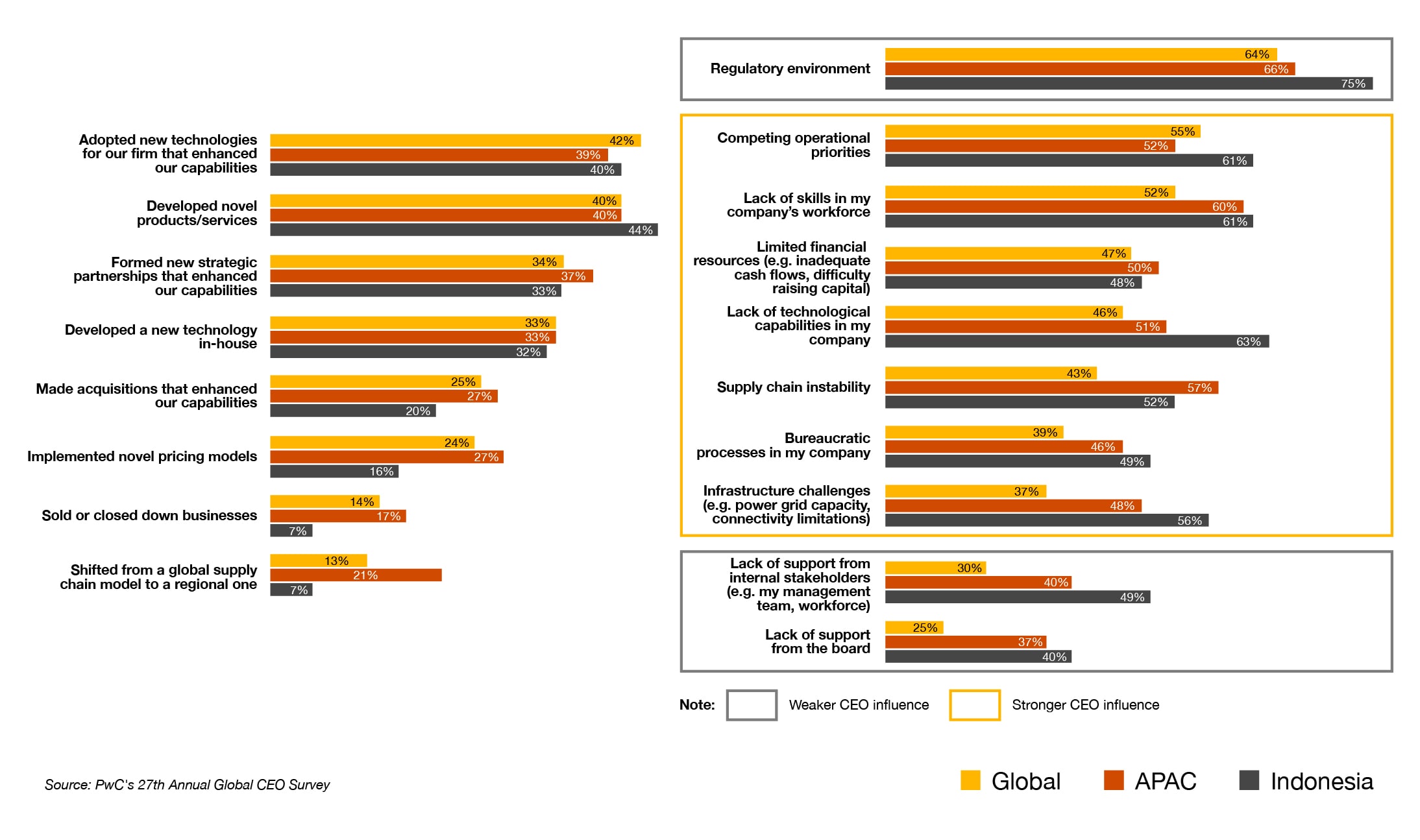

Due to the factors above, companies have taken steps towards reinvention in the last five years. Primary changes for Indonesia-based CEOs include adopting new technologies (40%), developing novel products (44%) and forming new strategic partnership (33%), in line with Global and Asia Pacific results. However, CEOs also specify their barrier to reinvention. In line with Global and Asia Pacific, the top #1 barrier for Indonesia-based CEOs is regulatory environment (75%) which CEOs have less control over. On average, Indonesia-based CEOs felt more pressured from the factors below compared to Global and Asia Pacific.

Q. To what extent have the following actions impacted the way your company creates, delivers and achieves value over the last five years?

(Showing only ‘to a large extent’ and ‘to a very large extent’ responses)

Q. To what extent, if at all, are the following factors inhibiting your company from changing the way it creates, delivers and achieves value?

(Showing only ‘to a moderate extent’, “to a large extent’ and ‘to a very large extent’ responses)

Generative AI (GenAI)

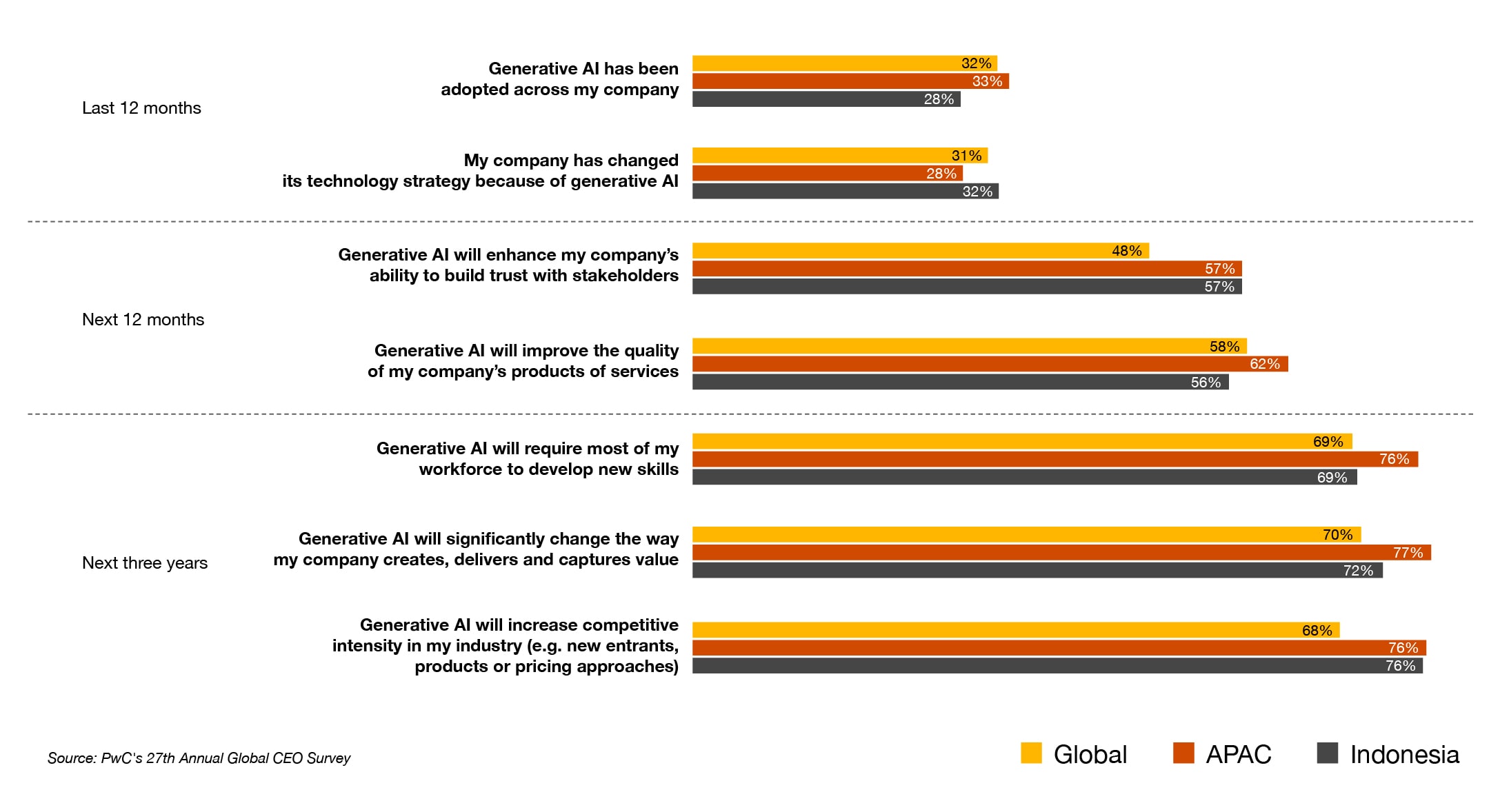

While most companies have not adopted GenAI in the past year, there is an expectation that they will enhance and improve by using GenAI in the next one to three years.

Q. To what extent do you agree or disagree with the following statements about generative AI?

(Showing only ‘Agree’ responses)

The majority of CEOs see GenAI as a catalyst for reinvention that will power efficiency, innovation and transformational change. More than two-thirds of CEOs based in Indonesia foresee a substantial impact from GenAI on their companies, workforce, and markets within the next three years. However, 53% of CEOs admit to not having adopted GenAI in their companiey in the past 12 months, compared to 41% in the Asia Pacific region.

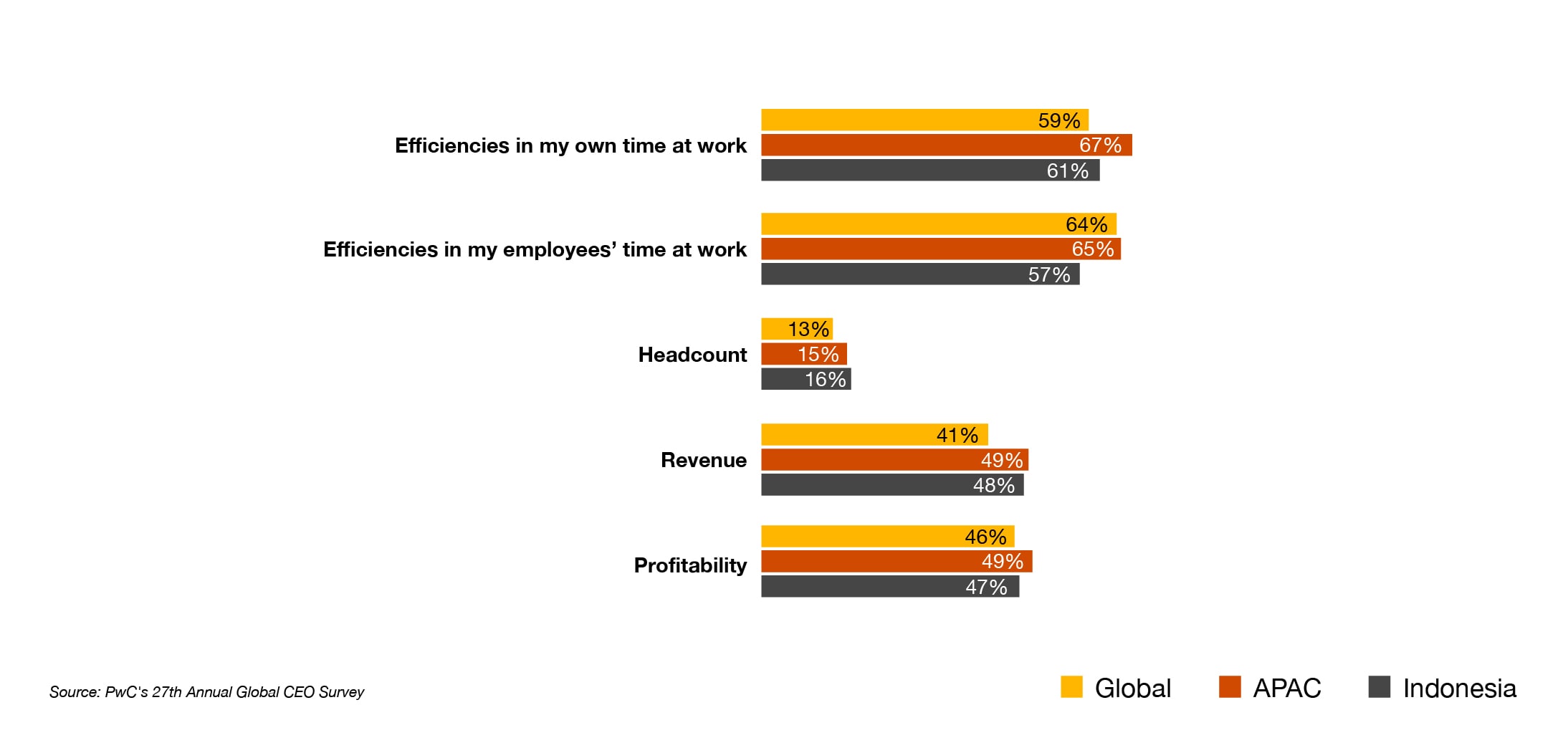

More than 57% of Indonesia-based CEOs believe GenAI will enhance efficiency for themselves and their employees (versus at least 59% globally and 65% in Asia Pacific). Additionally, at least 47% of Indonesia-based CEOs foresee GenAI contributing to increased revenue and profitability (versus at least 41% globally and 49% in Asia Pacific). However, only 16% of Indonesia-based CEOs (compared to 13% globally and 15% in Asia Pacific) anticipate a rise in headcount due to GenAI, with a higher number expecting a reduction.

Q. To what extent will GenAI increase or decrease the following in your company in the next 12 months?

(Showing only ‘Increase’ responses)

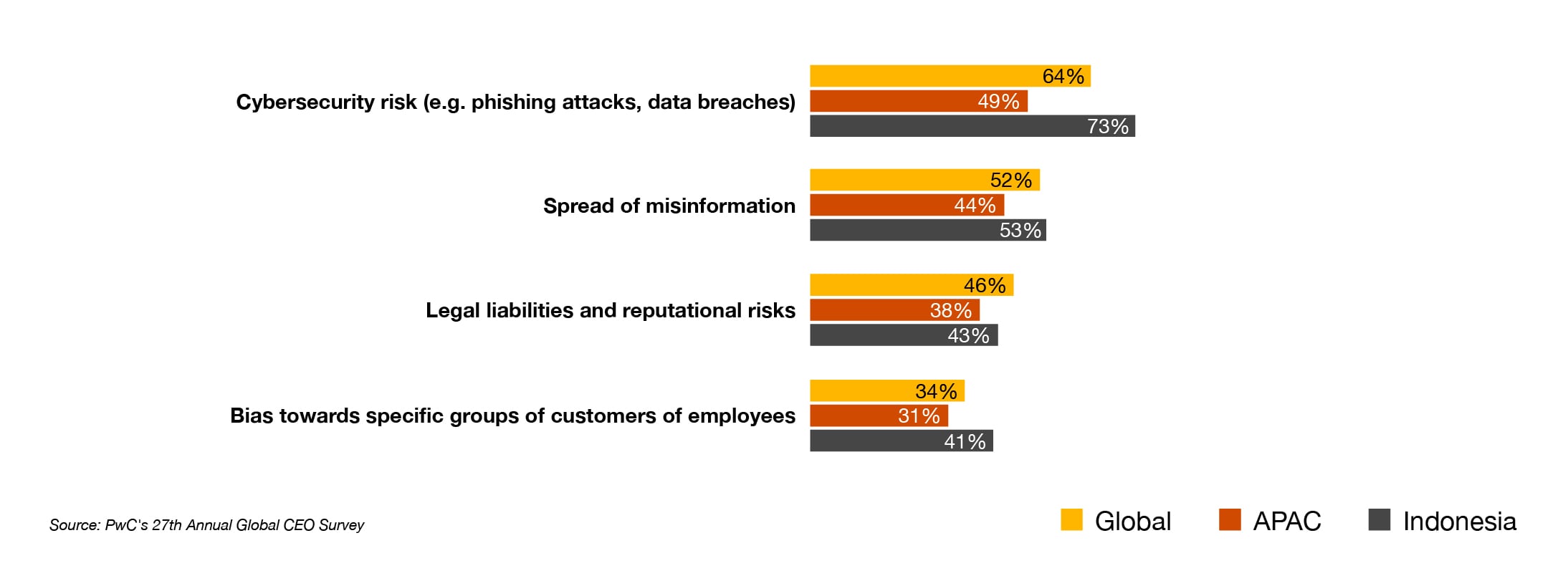

When asked about consequences of GenAI, Indonesia-based CEOs demonstrate results similar to those in the Global and Asia Pacific regions. 73% of Indonesia-based CEOs choose cybersecurity as the top #1 unintended consequence caused by companies from using GenAI, followed by the spreading of misinformation risk (53%) and legal liabilities and reputational risks (43%). Furthermore, 41% of Indonesia-based CEOs expect GenAI to increase bias towards specific groups of employees or customers in the next 12 months.

Q. To what extent do you agree or disagree that generative AI is likely to increase the following in your company in the next 12 months?

(Showing only ‘Agree’ responses)

Climate friendly products and services

Over than half of CEOs based in Indonesia said they are developing innovative climate-friendly products and services, in line with Global results but surpasses progress in the Asia Pacific region.

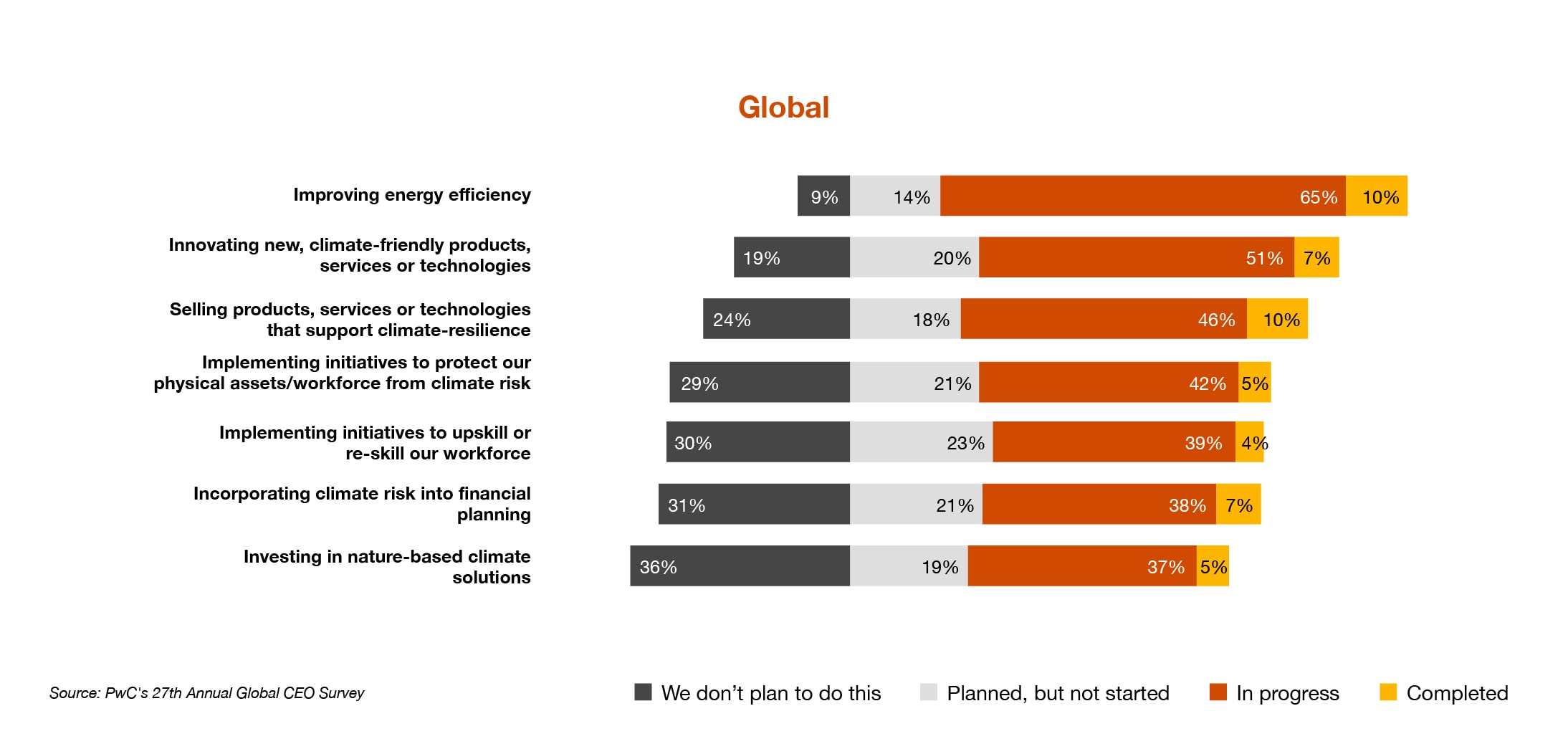

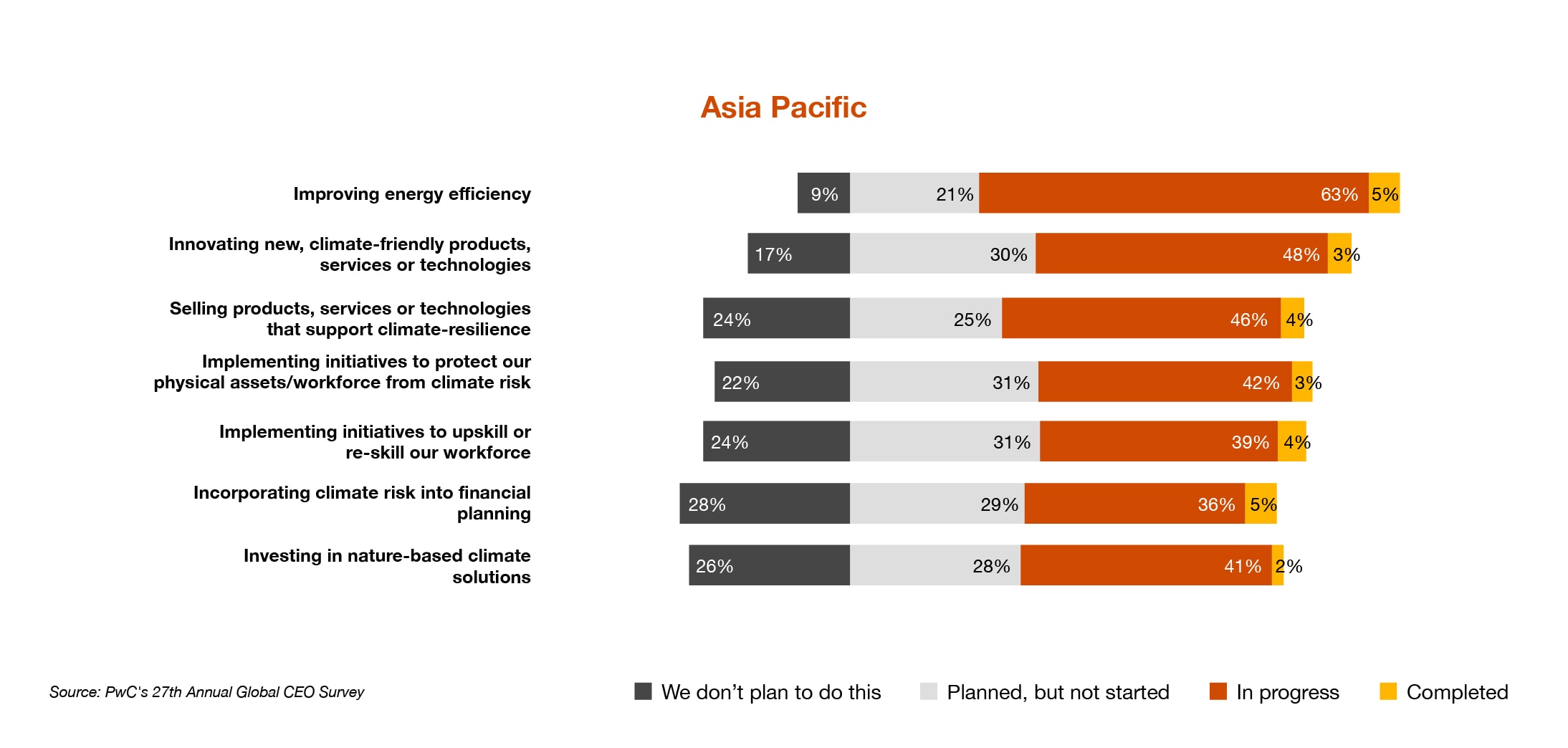

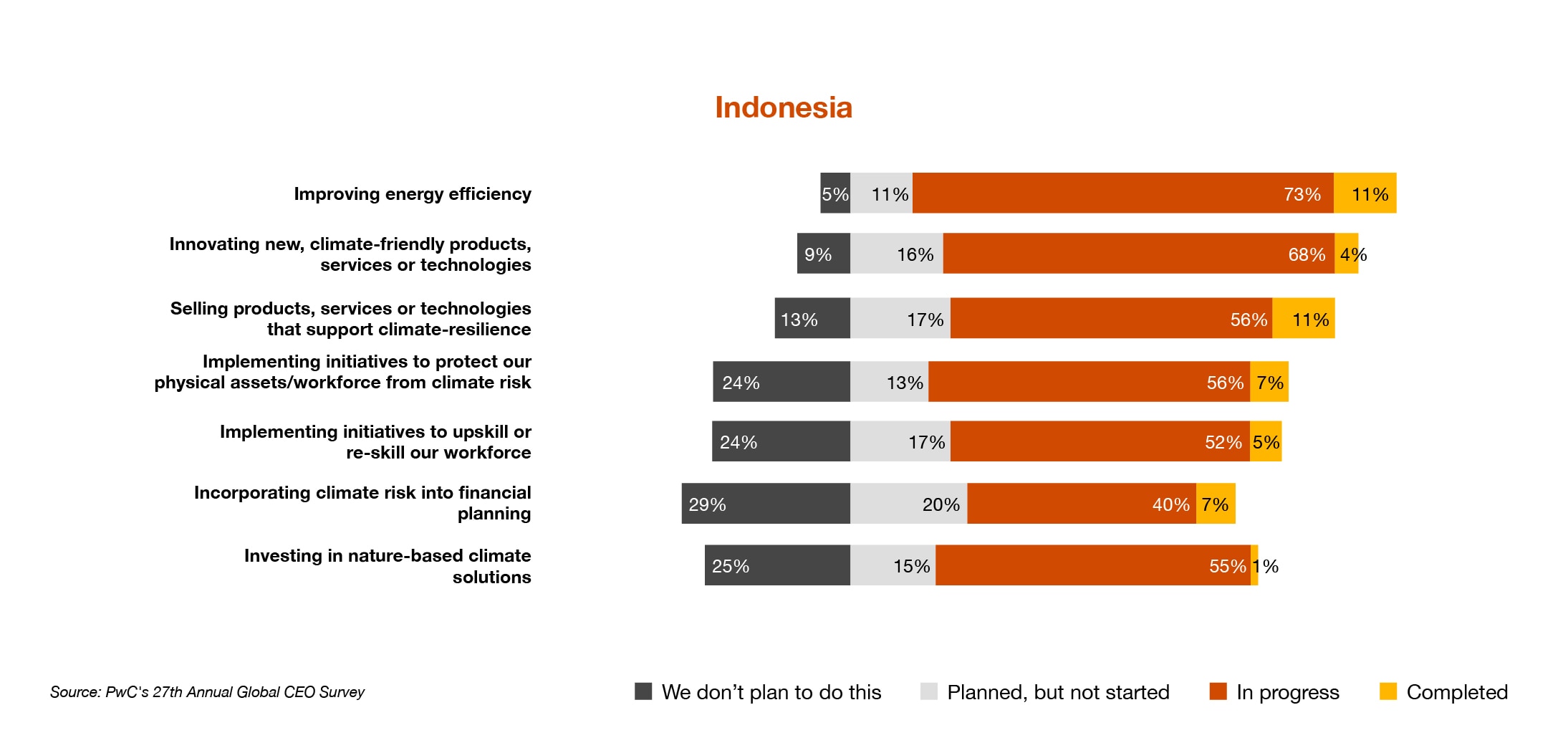

Q. Below is a list of actions companies may undertake related to climate change. Please describe your company’s progress on each of these actions.

Indonesia companies has taken actions regarding climate change, among others are improving energy efficiency (73%) and innovating new, climate-friendly products, services or technologies (68%). While Global, Asia Pacific, and Indonesia all prioritise the same top three actions in progress, interestingly on average more Indonesia-based companies have taken action compared to Global and Asia Pacific. However, a quarter of CEOs have no plan to incorporate climate risk into financial planning, implementing initiatives to upskill or re-skill our workforce and investing in nature-based climate solutions.

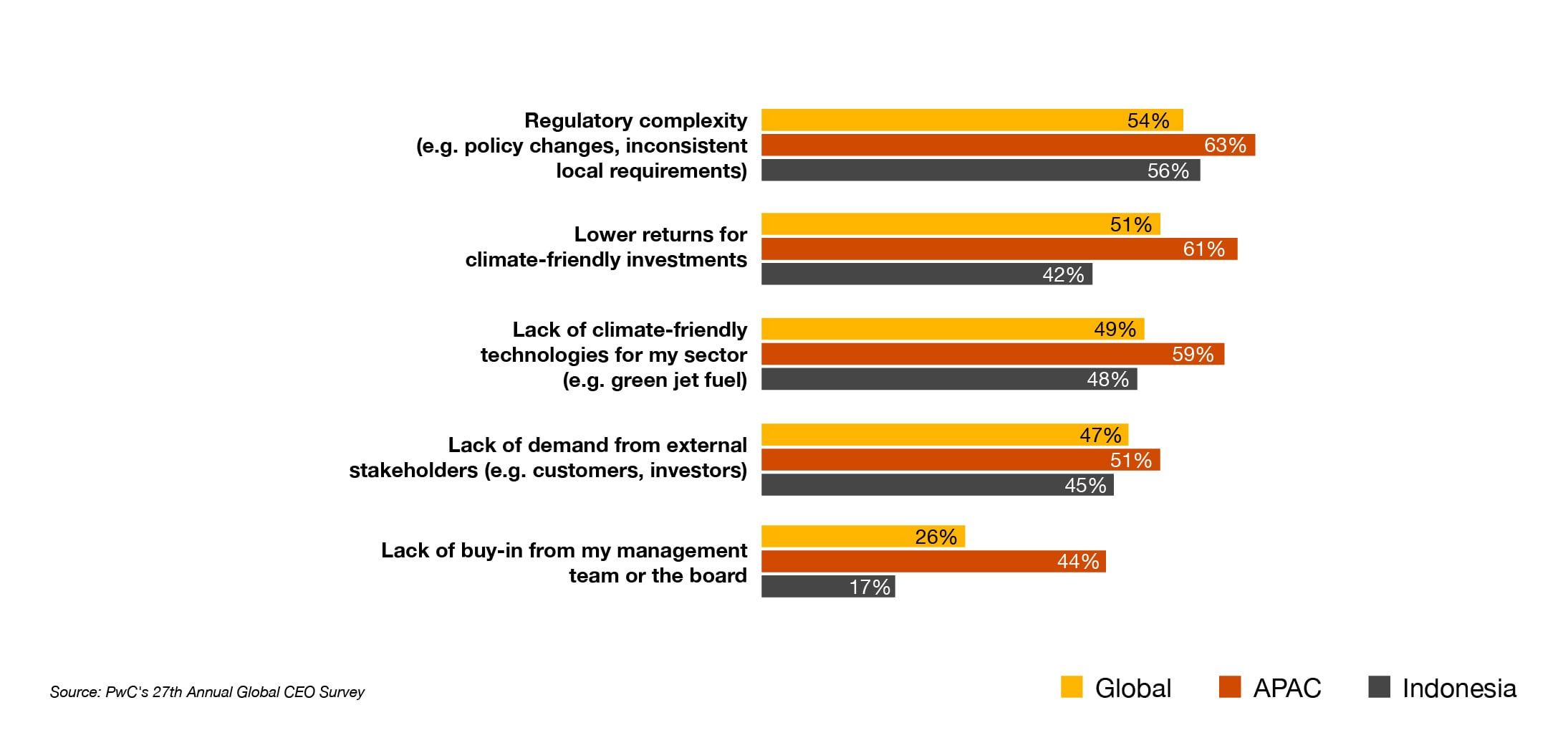

Concerning decarbonisation efforts, over half of Indonesian CEOs chose regulatory complexity as the primary constraint (56%). This is in line with Global and Asia Pacific. CEOs based in Indonesia also chose a lack of climate-friendly technologies (48%) and insufficient demand from external stakeholders (45%), while Global and Asia Pacific CEOs also choose lower returns for climate-friendly investments (51% vs 61%) and a lack of climate-friendly technologies (49% vs 59%) as their another top barrier. On average, Asia Pacific CEOs felt more pressure than Global and Indonesia.

Q. To what extent, if at all, are the following factors inhibiting your company’s ability to decarbonise its business model?

(Showing only ‘to a moderate extent’, “to a large extent’ and ‘to a very large extent’ responses)

27th Annual Global CEO Survey - Asia Pacific

Leading through accelerated reinvention

PwC's 27th Annual Global CEO Survey

Thriving in an age of continuous reinvention

Contact us