The global EV market is growing due to environmental concerns, government incentives, and technological advancements. Leading markets like China, Europe, and the US have strong policies supporting the shift to electric mobility, with many countries aiming to phase out internal combustion engines by 2030. Over 60% of consumers plan to buy an EV within the next five years, with high interest in regions like China, India, Indonesia, Latin America, the Middle East, and Africa, but lower interest in Japan. In the Asia Pacific, China leads with significant investments in EV infrastructure and manufacturing.

Indonesian EV landscape

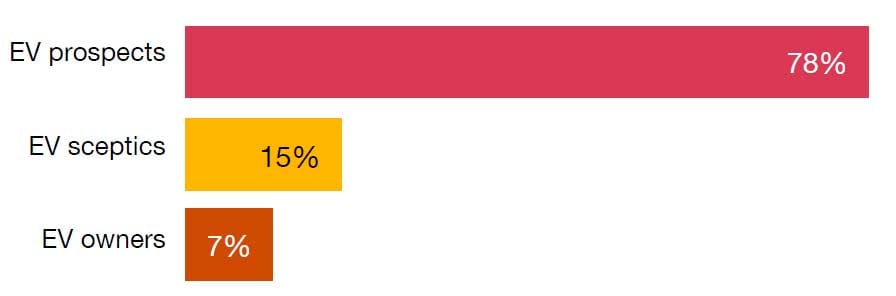

Electric vehicles (EVs) have moved beyond a niche market and are now embraced globally. In Indonesia, they are driven by fuel cost savings, environmental impact, and home charging technology. Indonesia, with its high middle class population and urbanisation, is becoming one of key players in the Asia Pacific region’s EV market. According to PwC’s eReadiness Indonesia study 2024, the respondents can be categorised into three segments: EV owners (7%), EV prospects (78%), and EV sceptics (15%). This highlights the significant untapped potential in Indonesia, which, if leveraged effectively, could position the country as a regional leader in electric mobility.

Indonesian EV consumer profile and demographic

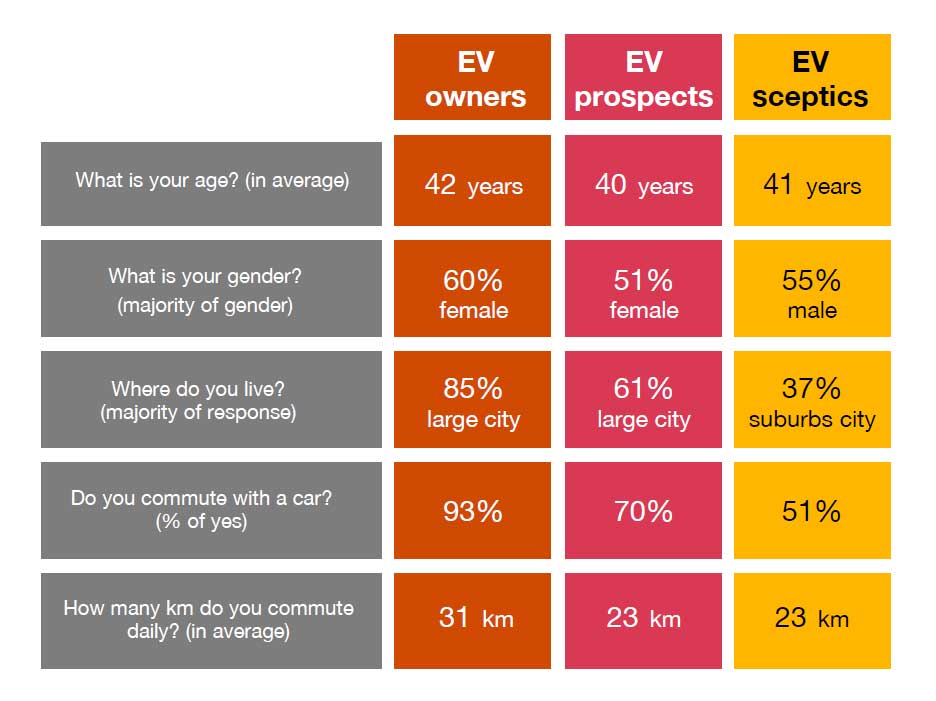

Our report classifies Indonesian respondents into three distinct categories with their own unique characteristics, motivations and barriers:

The role of technology and digital services

The technological ecosystem around electric vehicles (EVs) plays a crucial role in consumer choices, with many expecting seamless digital integration. EV owners often use car apps for various functions: 90% schedule and monitor service appointments, 55% access the vehicle feature guide, 50% purchase enhanced features, 45% track their vehicle’s location, and 40% lock or unlock their car remotely. Other features include remote start with preheating or precooling, live chat support, battery health monitoring, and remote parking assist. Prospective buyers are drawn to the convenience of integrating personal devices with their cars, seeing car apps as vital tools for managing the vehicle’s lifecycle, scheduling services, and tracking their EV’s location.

Government policies and incentives

The Indonesian government has introduced various policies and incentives to promote the adoption of electric vehicles (EVs), including incentives for vehicle purchases and ownerships, as well as home charging stations. The incentive removes the Luxury Goods Sales Tax (PPnBM) on EV for 2024, waives import tax until 2025 (subject to possible extension) and reduces value-added tax rate from 11% to 1%. Additionally, the government is expanding the EV charging network and working to electrify public transportation. At the regional level, the Jakarta Provincial Government supports EV adoption through policies like an exemption on odd-even plate number traffic restriction and annual car ownership tax exemption, aiming to reduce ownership costs, lower air pollution, and accelerate the transition to sustainable transportation.