Mining in Indonesia

Investment and Taxation Guide 2019 – 11th Edition

We welcome you to the 11th edition of the PwC Indonesia "Mining in Indonesia: Investment and Taxation Guide" released in June 2019, which highlights the key regulatory and taxation considerations for investors in the Indonesian mining sector - a sector which continues to be a key contributor to Indonesian economic growth.

Indonesia continues to be a significant player in the global mining industry, with significant production of coal, copper, gold, tin, bauxite, and nickel. Indonesia also continues to be one of the world’s largest exporters of thermal coal. However, since the Law on Mineral and Coal Mining No. 4 of 2009 (the “Mining Law”) was promulgated, various implementing regulations, including a number of amendments, have been issued by the Government in pursuing the goals of the Mining Law.

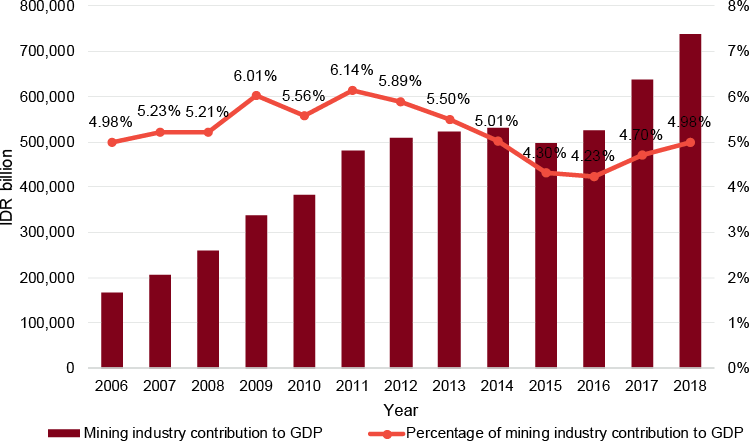

The Mining Industry’s Contribution to the Indonesian Economy Improved in 2018

The mining sector has been one of the key sectors contributing to Indonesia's economic growth over many decades. The sector makes a significant contribution to the Indonesian Gross Domestic Product ("GDP"), its exports, Government revenue, employment, and perhaps, most importantly, to the development of the many remote regions of Indonesia.

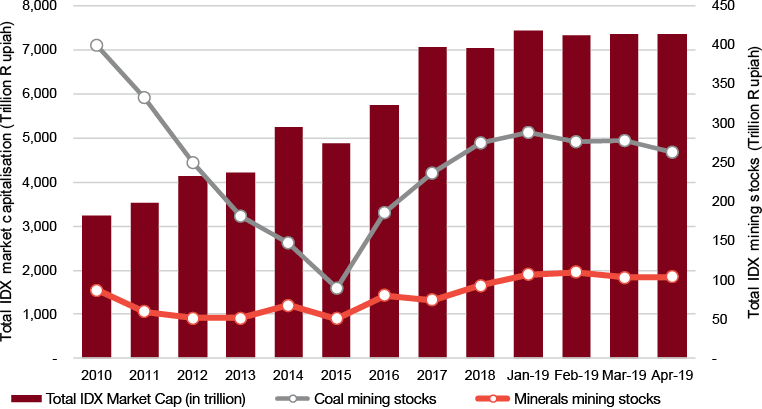

The Strong Price Environment Drove a Further Increase in the Market Capitalisation of Indonesian Mining Stocks in 2018

The movements in the market capitalisation of listed coal and mineral mining companies on the IDX generally follow the fluctuations in commodity prices, hence the further reduction in market capitalisation of coal stocks up to April 2019.