Over the past three years, the COVID-19 pandemic and geopolitical instability from the Russia-Ukraine conflict, energy supply disruption and price volatility resulted in an unpredictable macroeconomic situation. The uncertainty has highlighted the "energy trilemma", with the competing interests of energy supply, affordability and environmental sustainability causing energy companies and governments across the world to re-think their net zero strategies. Amid the uncertainty, the investment climate for oil and gas is even more important, as countries strive to satisfy energy demand in a sustainable manner. In Indonesia, as we await the long-planned revision to the 2001 Oil & Gas Law, debate around balancing the need to increase oil and gas production to satisfy the growing economy with Indonesia's 2060 net zero target, has led to discussions on carbon capture and storage (CCS), hydrogen and other new technologies. These will be the next set of challenges to development of new, large-scale oil and gas developments in the country.

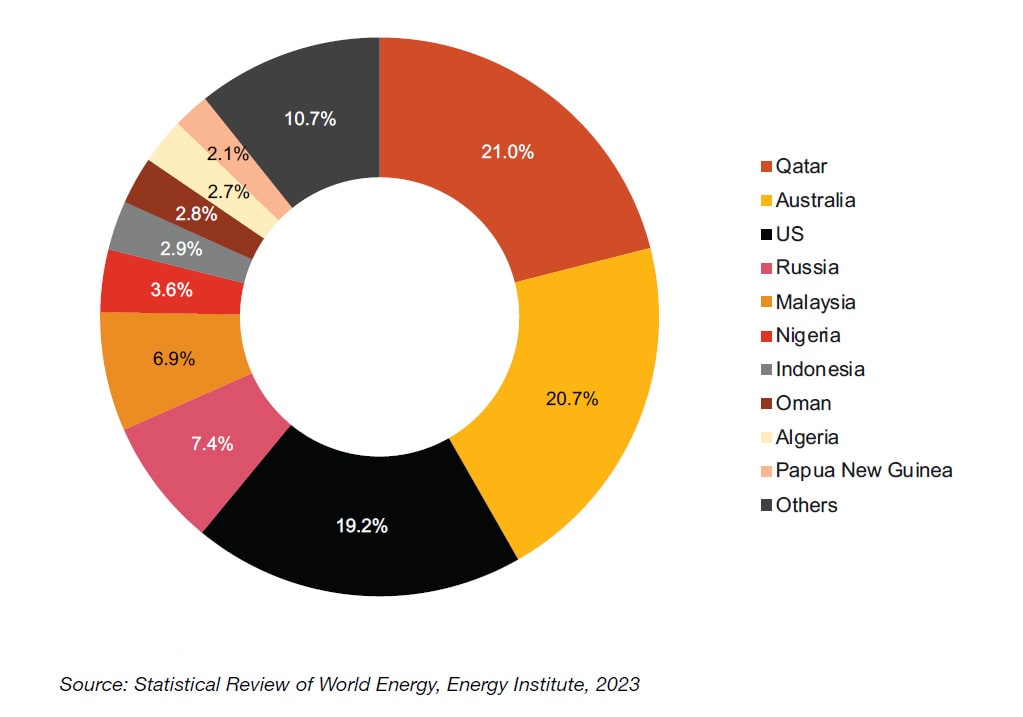

World's Top LNG Exporters 2022

Indonesia’s gas industry is being pressured by tough competition in LNG markets and increasing domestic gas “obligation”. Indonesia’s natural gas production market share has actually decreased in recent years. Along with Indonesia's effort to realign natural gas to domestic needs (in line with its 2006 policy), Indonesia still maintains its position as the seventh largest exporter of LNG in 2021 and 2022, behind Qatar, Australia, US, Russia, Malaysia and Nigeria. As Indonesia seeks to leverage higher global oil and gas prices, while reducing the need for imports, the production target for natural gas in 2022 has been set higher.

Oil and gas production has a long history in Indonesia, with Indonesia being an international pioneer in many areas, developing the Production Sharing Contract model and the commercialisation of Liquefied Natural Gas.

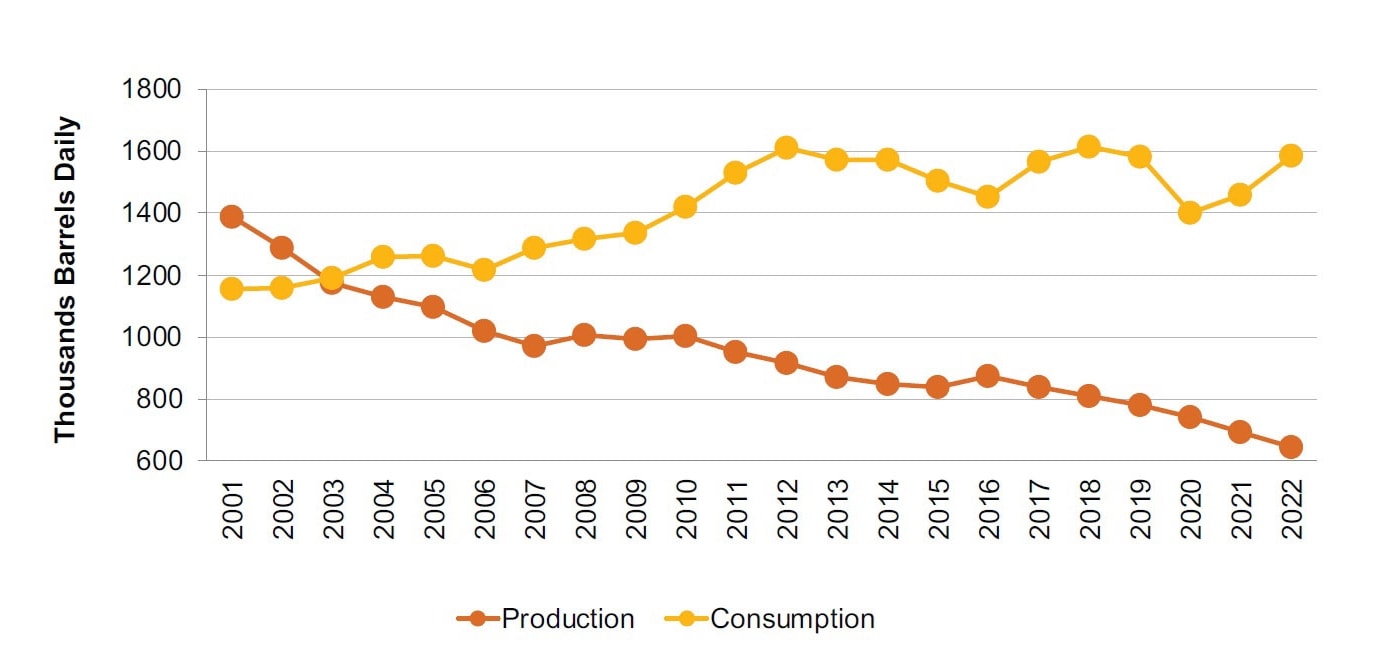

Indonesian Oil Production and Consumption

The performance of oil production in Indonesia cannot cover the consumption rate of crude oil that has continued to increase from 1,400 MBOPD in 2020 to 1,585 MBOPD in 2022. So, to meet the consumption demand, crude oil must be imported, according to Directorate General of Oil and Gas's 2022 Performance Report.

Energy Transition

Energy is a crucial input to all economic activity, and a secure and affordable energy supply has been a key enabling factor for Indonesian economic growth that has lifted millions out of poverty. Over the period from 2000 to 2020, Indonesia’s per capita gross domestic product (GDP) has doubled from approx. USD 1,868 to approx. USD 3,757 and Indonesia has become a trillion-dollar economy.

However, income inequality has worsened over this period reflected in the Gini coefficient increasing from 24.1 to 37.6. Population growth and continuing implementation of the development agenda by the Government of Indonesia is expected to drive economic growth, resulting in rising incomes, and stabilisation and decline in income inequality in line with global experience. Both have implications for energy demand on an aggregate and per capita basis.

Oil and Gas in Indonesia: Investment and Taxation Guide 2023

Indonesian Oil & Gas Concessions and Major Infrastructure Map

Related content

Oil and Gas in Indonesia: Investment and Taxation Guide 2020 - 11th edition

This edition outlines the latest tax and regulatory changes that have occurred in the oil and gas industry over recent years.

Oil and Gas in Indonesia: Investment and Taxation Guide 2019 - 10th edition

This edition outlines the latest tax and regulatory changes that have occurred in the oil and gas industry over recent years, including our views on recent regulatory developments surrounding the new “Gross Split” PSCs, introduced in 2017.