Indonesia has had tremendous success in meeting its growing energy demand, and in shifting to modern, commercial energy sources. However, a significant proportion of the expansion in energy supply has been from coal, reflecting domestic resource abundance and national development policy that emphasised exploitation of national resources for economic growth. Together with the expansion in supply from oil and natural gas to meet demand growth from population and economic growth, Indonesia’s greenhouse gas (“GHG”) emissions from energy use have increased steadily from 318 million tonnes of carbon dioxide equivalent (“mtCO2e”) in 2000 to 639 mtCO2e in 2019.

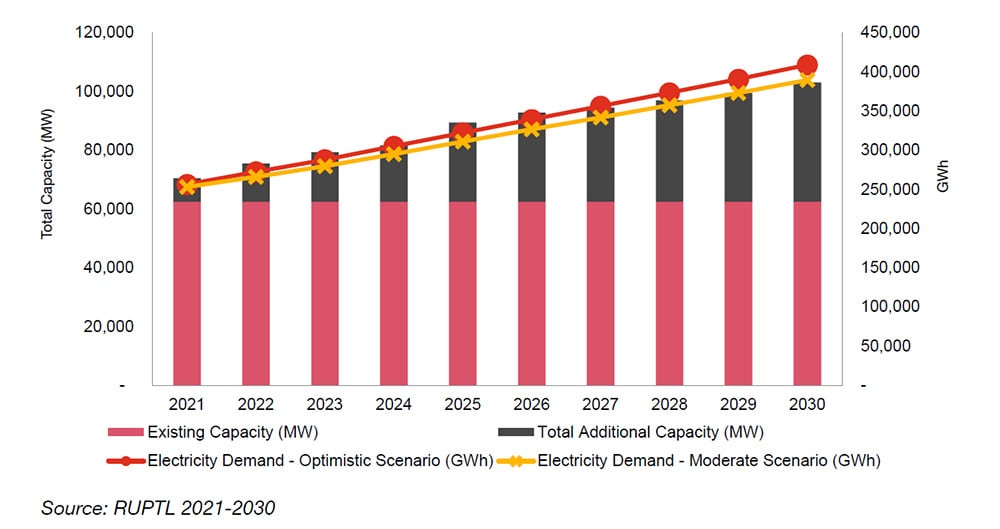

Electricity capacity (MW) and demand (GWh) 2021-2030

Indonesia’s rising income per capita and growing middle class, accompanied by a structurally lower electrification ratio, should have spurred significant growth in electricity demand. However, in light of current events, PLN provides two scenarios (moderate and optimistic) for electricity production based on different economic recovery assumptions. Under both scenarios, PLN has revised its target for electricity downwards; under the RUPTL 2021-2030’s moderate scenario, it is revised to 34.5 GW by 2028 from 56.4 GW by 2028 in the 2019 RUPTL. Despite this, renewable power plants will play a major role which is consistent with PLN’s Net Zero Ambition of 20.92 GW by 2030. In terms of the electricity demand, PLN has predicted a lower growth rate, around 4.41% (moderate scenario) to 4.67% (optimistic scenario) average per annum by 2030 in the RUPTL 2021-2030 as compared to 6.42% in the 2019 RUPTL, thereby reducing the estimated total electricity demand from 433 Terawatt hours (“TWh”) to 357 TWh (a 17.6% decrease) in 2028.

Based on the Ministry of Energy and Mineral Resources data, at the end of 2022 Indonesia’s installed power capacity had amounted to a total of 83.8 GW with the island of Java having 66% share of the total installed capacity.

Power in Indonesia: Investment and Taxation Guide 2023

Map of Indonesia's Major Power Plants and Transmission Lines -2023

Related content

Power in Indonesia: Investment and Taxation Guide 2018 - 6th edition

This edition outlines the latest tax and regulatory changes that have occurred in the power industry over recent years with a greater focus on the tracking of actual transactions and project implementation, particularly in light of the wave of Power Purchase Agreements (“PPAs”) signed in 2017.

Alternating Currents: Indonesian Power Industry Survey 2018

The survey covers Electricity planning; Investor confidence; Investor returns; Regulations; Energy policy and market design; and, many other trends and issues. This year, the survey identified a sharp deterioration in investor confidence given regulatory uncertainty around power tariffs and Power Purchase Agreement risk allocation. But, there is still intent to invest in the Indonesian power sector, and the survey highlights a number of potential solutions to further accelerate investment.