{{item.title}}

{{item.text}}

{{item.text}}

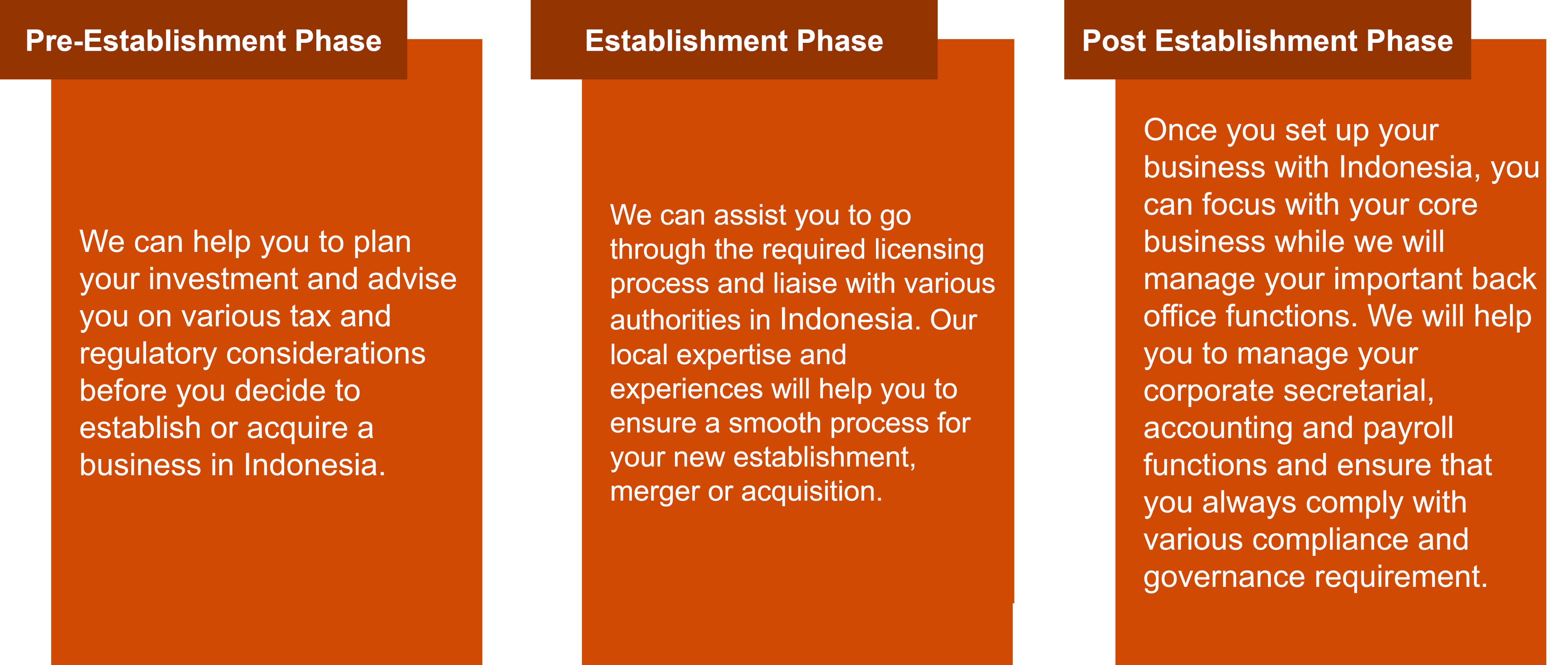

Indonesia is considered as a country with complex regulatory environment. It does not matter in what business you are, in what phase you are or whether you will enter the Indonesian market through new establishment, merger or acquisition, with our extensive knowledge, expertise and experiences, we can assist you to always comply with various regulatory and compliance requirements.

Once you enter the market, we can also help you managing your non-core functions including bookkeeping, payroll and corporate secretarial so that you can always focus on your core business as an important factor to your success.

Good corporate governance is key aspect for foreign investment in Indonesia. We will assist you to manage governance to various requirements under the Indonesian Company Law.

Payroll Administration

Our payroll administration services will ensure that you can manage accuracy, security and confidentiality as key aspects of your payroll as well as to get access to our technology and expertise in employment compliance matters

Payroll Related Advisory

We can advise in employment compliance related aspects which includes :

Employee Termination and Resignation

We can assist you with employment termination/resignation process which can include:

Monthly Accounting

We will maintain your transactions and bookkeeping and produce financial statements in accordance to the Indonesian Accounting Standards as well as manage your non-tax compliance/reporting requirement. This will ensure you to produce proper and timely records and reports.

Compliance Administration

We can advise and assist in various non-tax compliance requirements which include:

We will provide you with advisory work which can include:

We can assist you with various procedures and liaison with government authorities which can include:

We can assist you to make and submit a proper planning and application for obtaining investment facilities which can include:

{{item.text}}

{{item.text}}