2022 was marked by uncertainty from geopolitical tensions, a global energy crisis, continued supply chain disruption and financial market volatility. Any hopes that the inflationary spike observed towards the end of 2021 would be short lived, were quickly dashed as food and energy prices soared.

While these issues were not caused entirely by the war in Ukraine, they have been greatly exacerbated by it. According to the International Monetary Fund (IMF), global inflation increased from 4.7% in 2021 to 8.8% in 2022, which led to a rapid unwinding of easy monetary policy, with the US Federal Reserve leading the way by implementing four successive rate hikes in 2022.

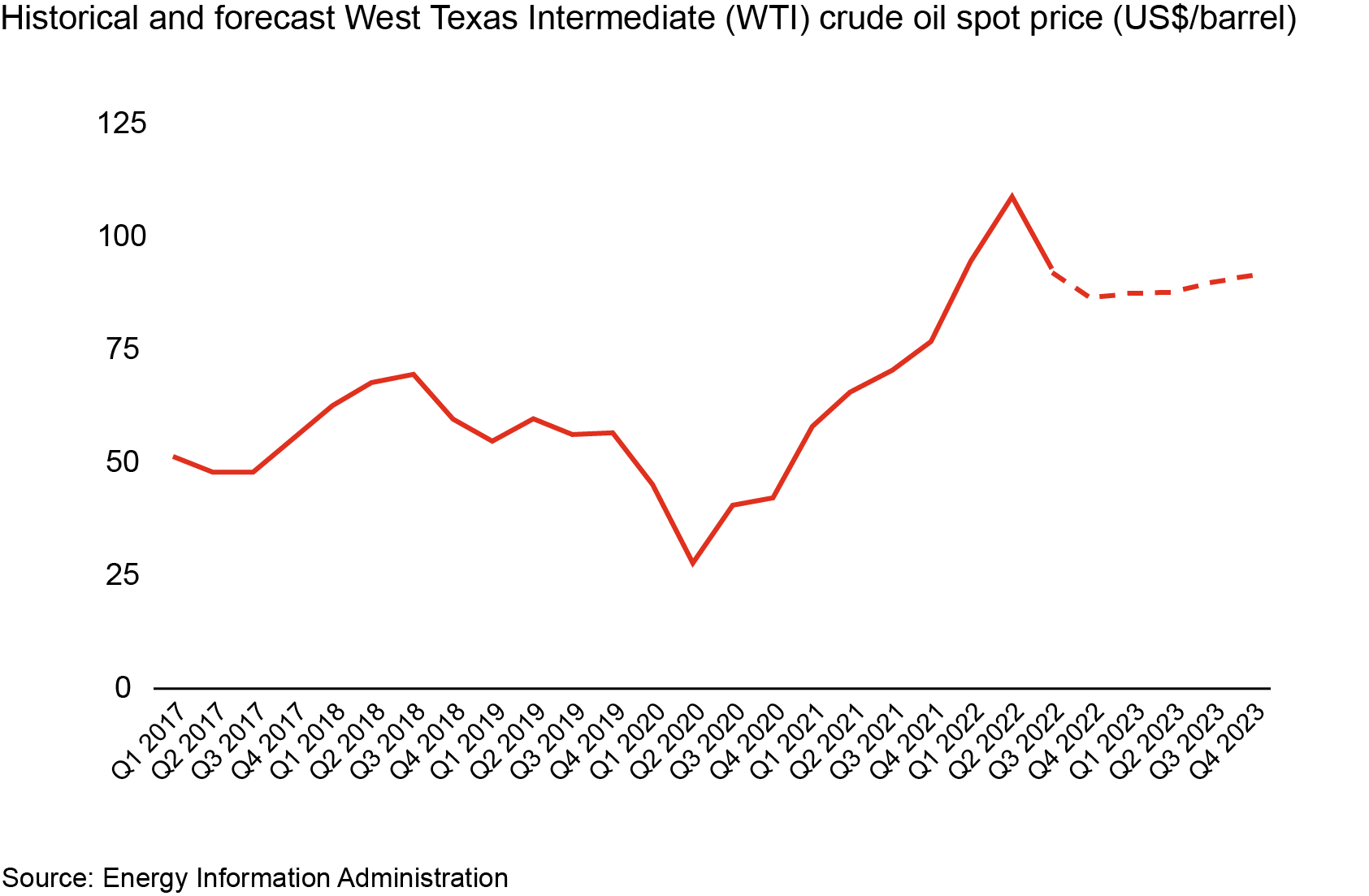

The IMF also predicts global growth to slow to 3.2% in 2022, down from 6.0% in 2021. Conversely, the gloomy global picture is somewhat offset by stronger performance in the oil-exporting Gulf Cooperation Council (GCC) countries. The region has been buoyed by high oil prices that have averaged above US$80 per barrel, reflecting new supply-demand dynamics as policymakers focus on securing energy supplies. Forecasters are expecting the region to deliver its strongest growth in a decade – with GDP predicted to expand by 6.5% in 2022.1

Against this backdrop, what trends and themes will shape the GCC economies in 2023?

1. The GCC will escape the global slowdown

Risks to the downside mean that global GDP growth could lose momentum going into 2023, reaching 2.7% - the weakest global growth profile since 2001 (barring the global financial crisis and the extreme phase of the COVID-19 pandemic).2

In contrast, forecasts for the GCC in 2023 are more upbeat, with 3.6% GDP growth expected this year. Although the region will not be completely immune to a global slowdown, there are a number of reasons to be optimistic:

Oil prices are likely to sustain US$75-95 per barrel levels in the coming year.3 While oil demand growth could be impacted by worsening global economic conditions, the ban on the seaborne import of crude oil and petroleum products from Russia, along with a gradual - albeit bumpy - recovery in China as it reverses its zero COVID policy stance, is likely to boost energy demand.

High oil prices also enable GCC governments to support the economy. The GCC region is expected to register strong ‘twin’ surpluses in 2022 and beyond. The regional fiscal balance is projected to register a surplus of 5.3% of GDP in 2022 —the first surplus since 2014 — while the external balance surplus is expected to reach 17.2% of GDP. This provides fiscal headroom for governments to sustain aggregate demand through spending.

While global inflationary risks remain, inflation in the region is likely to subside due to higher interest rates, and slowing global growth. Inflation is expected to average about 2.7% in 2023 across the GCC.

The GCC region will also benefit from its relative stability, in contrast to uncertainty elsewhere. While tourist arrivals are yet to recover to pre-pandemic levels, the United Arab Emirates (UAE) successfully tripled its share of global tourist arrivals, from 1% in 2019 to 3% in 2021, as it opened its borders relatively early on to international tourists keen to travel as soon as restrictions started to lift.4

2. The resurgence of the non-oil economy

While 2022 was the ‘year of oil’, the recovery of the non-oil economy was one of the good news stories of the year. While non-oil activity as a share of the overall economy has remained stable, this belies significant growth that was masked by high oil prices. Purchasing Managers’ Indices (PMIs) for the non-oil sector remained well in expansion territory for most of the year. In fact, the Post-COVID recovery in the GCC region has been led by the non-oil private sector.

We expect the momentum for the non-oil economy to continue in 2023. And while economies in the region still have a long way to go to decisively decouple growth from oil prices, governments appear determined to stay the current course, for example:

National economic and development strategies signal commitments to diversify the economy through concerted policy interventions and investments. Qatar’s third National Development Strategy, currently under development, will likely redouble diversification efforts. The ‘We the UAE 2031’ Vision, launched in November 2022, sets a target to increase non-oil exports to AED 800 billion ($217 billion) from current levels (c.AED 350 billion).

Advanced and industrial manufacturing form a core part of these strategies. ‘Operation 300 billion’ - the UAE’s industrial strategy - aims to more than double the industrial sector’s contribution to the GDP from AED 133 billion to AED 300 billion by 2031.

Similarly, tourism features prominently in most development plans. Huge investments are underway in the Kingdom of Saudi Arabia (KSA) to grow non-religious tourism as the Kingdom aims to increase the economic contribution of this sector from 3% to 10% of GDP by 2030.5 Meanwhile, the UAE Tourism Strategy 2031 aims to raise the tourism sector's contribution to the GDP to AED 450 billion by attracting 40 million hotel guests. And one of the key pillars of Oman’s 2040 Economic Vision is to increase tourism revenues to US$22.5 billion a year by 2040 from US$2.5 billion in 2019.

3. The liquidity squeeze will ease

The outlook in the Gulf is relatively upbeat but there are some risks, especially as countries adjust to a tighter monetary policy environment.

The unprecedented speed of increase in the Federal Reserve rate, which has been largely mirrored in the GCC countries that maintain pegged exchange rates, has put significant pressure on market liquidity, particularly in KSA. The sudden and sharp increase in interest rates, particularly after a prolonged period of low rates, has resulted in a rapid rise in lending that has not been matched by deposit growth, which is unusual for a period of high oil prices. As a consequence, liquidity conditions, as indicated by the Saudi Arabian Interbank Offered Rate (SAIBOR) rate which measures the cost of interbank lending, are the tightest on record.

We expect the liquidity squeeze to eventually ease with corrective action. The Saudi Arabian Monetary Authority’s (SAMA) open market operations have provided additional temporary liquidity, firstly in June 2022 when it placed SAR 50 billion as deposits with commercial lenders at a discount to SAIBOR, followed by another round of support in October 2022. Future gaps are likely to be addressed by swift intervention, but banks are likely to increase the share of long-term funding sources, which may also have the benefit of catalysing local capital markets as banks start to issue more long-term debt.

4. Continuing efforts to green the economy

All eyes are now on the UAE as the host of COP28 later this year. This year's focus will be on the Global Stocktake, which aims to assess countries’ collective progress towards achieving the goals of the Paris Agreement that came into force in 2016. Most GCC states have stated net zero commitments and one way of measuring progress towards achieving these targets is looking at the evolution in an economy’s carbon intensity, which is a measure of how much CO2 is produced to generate a dollar of GDP. On this measure, it is clear that the GCC countries still have a long way to go (see chart below).

That said, GCC member nations are getting serious about efforts to green the economy, and the scrutiny on the region provides impetus for further reforms:

Accelerated investment in renewable energy – Saudi Arabia has ambitious plans to develop 58.7GW of renewable power capacity by 2030. With around only 10GW under construction or tendered, we expect a significant ramp up in investments in renewable projects in 2023 to close the gap.6

Reduction in energy consumption, particularly from households, to bring down energy intensity levels. We expect further reforms to energy tariffs and subsidies to incentivise lower energy usage in the region. The UAE 2050 Strategy aims to increase the contribution of clean energy in the total energy mix to 50% by 2050, thereby cutting down on the use of oil. The aim is also to increase consumption efficiency of individuals and corporations by 40%.7

- Sustainable finance is an important enabler of the energy transition. The UAE has designs to become the region’s hub for sustainable finance: Abu Dhabi Global Market (ADGM) is the first ‘carbon neutral’ international financial centre in the world. In partnership with AirCarbon Exchange - a Singapore-based global carbon exchange using distributed ledger technology on a traditional trading architecture - ADGM also plans to launch the world’s first fully regulated carbon trading exchange and clearing house.8

5. The war for local talent intensifies

Greater emphasis is likely to be given to the localisation of the private sector workforce in tandem with the increase in labour force participation amongst nationals. Under Saudi Arabia’s Nitaqat programme, 2022 saw further increases in Saudisation requirements across a number of sectors and professions, including in healthcare, sales and marketing, as well as an increase in the number of jobs now restricted to Saudi nationals, including secretarial, translation, retail / store keeping, and data entry roles. In the UAE, both incentives as well as penalties have been introduced to encourage compliance with Emiratisation requirements.9

With the need to create at least 1 million more private sector jobs for Saudi nationals by 2030,10 we expect Saudisation requirements to increase and be introduced in more sectors and professions such as in marketing, consulting, engineering, project management, procurement, and the food and drug sector, as already signalled by the government. In the UAE, mainland companies with 50 or more employees must also increase their UAE workforce by 2% every year starting from 2023, reaching 10% in 2026 for skilled jobs.

Labour markets, particularly for nationals, already show signs of tightness - the unemployment rate for Saudi nationals has since declined to below 10% from its previous low of 11.8% in 2020 Q1.11 This pressure will only increase as the war for local talent intensifies, resulting in increased wages for locals, particularly in sectors with high demand and localisation requirements.

Employers will have to keep pace with these changes by adapting their recruitment strategies and heavily investing in training and development for local recruits. However, policymakers also need to closely monitor the impact of these policies on business and the impact on labour market dynamics. The right balance must be struck between the need for local job creation and the ability of businesses to attract the right talent and foreign investment needed to grow and stay globally competitive.

Looking ahead

The 2023 outlook for the GCC region appears more upbeat in comparison to the rest of the world, supported by relatively high oil prices and growth in the non-oil economy, as well as moderating inflation. With central banks across the region keeping a close eye on financial market volatility following a tighter monetary policy environment, liquidity conditions are expected to ease with the support of corrective action and as economies adjust to the new rate environment. With expected focus on the region and UAE as hosts of COP28, we are bound to see further investments and further policy action to green GCC economies. Finally, we expect major efforts on the part of employers to invest in skills development among the national workforce to adapt to localisation requirements.

For more, keep an eye out for our upcoming Middle East Economy Watch where we examine the latest economic developments across the region.

References:

1) IMF World Economic Outlook, October 2022.

2) IMF World Economic Outlook, October 2022. The IMF has also signalled in January that these projections may be further revised down.

3) Energy Information Administration, Short-Term Energy Outlook, December 2022

4) UNWTO data

5) Kingdom of Saudi Arabia, Vision 2030

6) GlobalData analysis

7) UAE 2050 Strategy

8) Khaleej Times, How ADGM is developing a sustainable finance industry in the UAE, October 2022.

9) United Arab Emirates' Government portal, Emiratis' employment in the private sector, accessed Jan 1st, 2023.

10) Based on the UN’s World Population Prospects’ population projections for Saudi Arabia’s working age population (15+), an increase in Saudi female labour force participation from 36% to 40% by 2030, and an increase in the share of public sector employment from around 70% to 80% by 2030.

11) General Authority for Statistics, Labour Force Survey Q3 2022.