Gulf countries’ sovereign credit ratings update

Credit rating agencies have begun to reassess the risks that exist in the region given the global economic slowdown, loosening of austerity measures, geopolitical risks, and the lower-for-longer oil prices.

What are sovereign credit ratings?

Sovereign credit ratings are measures of the perceived risk associated with a country’s ability to pay back a public debt. To access the international bond markets, governments are usually expected to have recent credit ratings from two of the three largest rating agencies: Standard & Poor’s (S&P), Moody’s, and Fitch1. Sovereign credit ratings are updated either on a periodic basis (for countries with routine and regular bond issuances) or when a country is looking to issue a publicly traded eurobond (a bond not denominated in the local/domestic currency).

The rating agencies use a different methodology to determine a credit rating, but they tend to evaluate similar dimensions, as follows.

- Institutional responsiveness: are government institutions and policy makers adequately able to assess and act on economic and fiscal pressures/constraints/risks? This also includes ability to respond to economic or political shocks, the level of government transparency, historical repayment ability, and geopolitical risks.

- Structure and growth of economy: is the economy adequately diversified and growing at a reasonable level to support repayment of debts? GDP per capita and the ability to raise government revenues are also considered.

- External liquidity: Does the government have adequate reserves or access to capital to repay the debt?

- Fiscal performance (debt & contingent liability): Does the government’s current fiscal position limit its ability to repay now or in the future?

- Monetary flexibility (money supply, interest rates, controls on credit): Does the country have stable monetary policy while also having adequate ability adjust when needed? Countries with fixed/pegged currencies often have less flexibility to use monetary policy to support the economy in times of sugglish growth.

Each rating agency perceives risks under these dimensions differently based on their assessment methodologies. Recent movements on Saudi Arabia’s credit rating illustrate this: whereas Moody’s (A1; stable) and S&P (A-; stable) largely affirmed their credit ratings, Fitch downgraded the Kingdom to A with a stable outlook2 (bringing it in-line with Moody’s and S&P) in September 2019 citing geopolitical risks.

Who uses sovereign credit ratings?

Credit ratings are issued for public consumption, but are mostly used by institutional investors who buy sovereign bonds. Institutional investors include pension and health care funds, bond funds, sovereign wealth funds, money managers for wealthy clients, and even other governments. The credit rating letter scores offer an easy “rule-of-thumb” to help filter investment opportunities and allocate investments across assets with different risk profiles (i.e. different ratings).

Why do sovereign credit ratings matter?

Sovereign credit ratings are updated either on a periodic basis (for countries with routine and regular bond issuances) or when a country is looking to issue a publicly traded eurobond (a bond not denominated in the local/domestic currency). A credit rating matters for three main reasons:

- It determines the ability of the sovereign to access the international capital markets. As most bond investments are carried out by institutional investors, many have guidelines as to what they are able to invest in. Most pension funds, for instance, may only invest in investment grade bonds (see ratings table above).

- It helps guide on expected interest rates. The lower the rating, the higher the interest rate and the higher the cost of borrowing for the government seeking funding.

- It determines the type of issuance options available. Higher rated sovereigns can often issue multiple tranches of debt and longer maturities in multiple markets (i.e. European and American markets for instance) because more parties are willing to buy the bonds.

There are also impacts a sovereign credit rating can have on the broader domestic economy:

- Within a geographic region, countries with higher sovereign credit ratings tend to attract more foreign direct investment (FDI) than their lower rated neighbors3. Similarly, following a credit downgrade, countries can experience FDI outflows.

- Sovereign credit rating downgrades also tend to translate to short-term sell-offs in the domestic stock market for emerging market economies.4

- Companies closely linked to the government - such as financial services, utilities, and government owned enterprises (GREs) - can also see their credit ratings changed or their cost of borrowing costs change. Oman’s experience in May 2017 serves as an example: S&P downgraded the sovereign to BB+ (the first rater to list Oman as non-investment grade). Following this downgrade, several state-owned entities (Oman Power and Water Procurement Co., OmanTel, and Oman Electricity Transmission Company) and private financial services players (among them Bank Muscat and Oman United Insurance Co.) also saw either their credit rating downgraded or their credit outlook adjusted to negative.

What’s happening in the Gulf?

Many Gulf countries re-entered the international debt markets after long absences following the 2014/2015 oil downturn. The countries with weaker financial reserves and limited appetite for fiscal reform were downgraded early in the credit cycle as credit rating agencies took note of the risk. However, given lower oil prices seem here to stay and several Gulf countries appear on track for medium term fiscal deficits, the rating agencies are primed to revisit the sovereign ratings. Below you can find some visuals on what sovereign credit ratings look like for Gulf countries and how that compares to the fiscal deficits expected in the medium term.

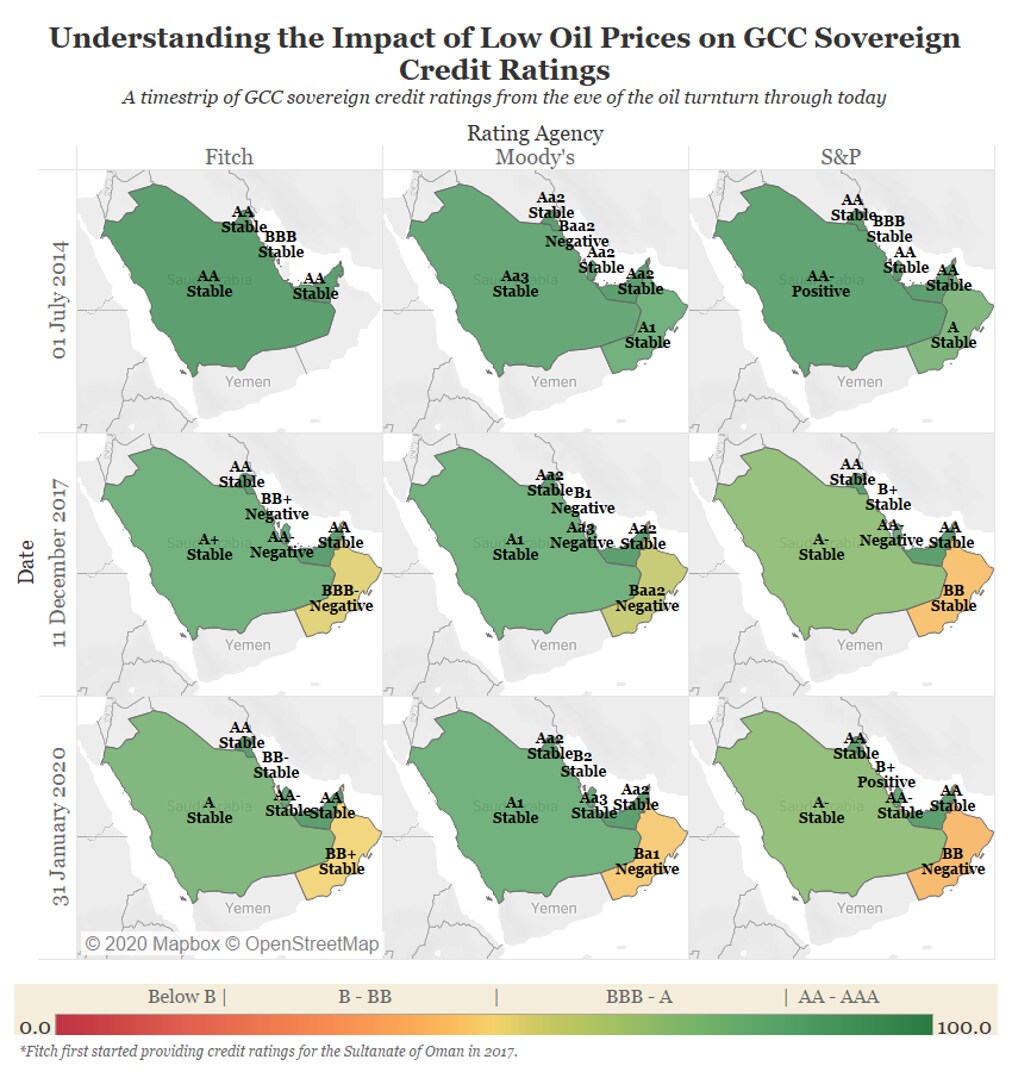

On the eve of the oil downturn, all GCC countries were rated investment grade by the three rating agencies. The first set of downgrades accorded over 2016 and 2017: Bahrain flew to non-investment grade while Oman and Saudi Arabia were downgraded due to increases in debt and reserve draw-downs. Over 2018 and 2019, the rating changes slowed: Saudi Arabia largely stabilized, Bahrain and Qatar strengthened their positions, while Oman continued to see downgrades.

*Generated using Tableau

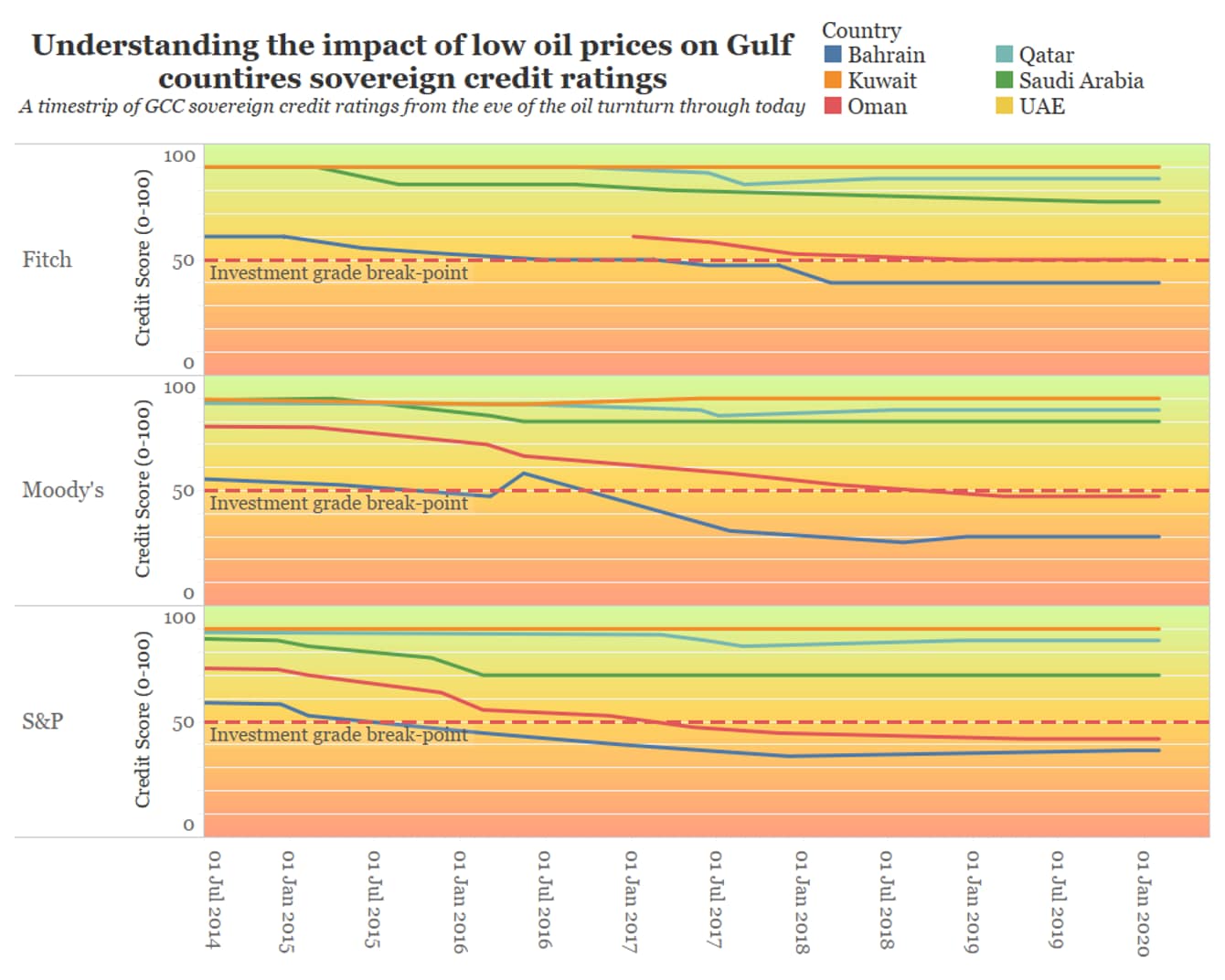

In the below visualisation, the credit ratings ratings have been translated into a familiar 0-100 scale from 1 July 2014 to 31 Jan 2020 to visualize the ratings change over time.

*Generated using Tableau; Note: Kuwait and UAE have maintained the same rating, so their lines overlap with each other.

Appendix 1:Current credit rating for Gulf countries (as of 31 January 2020)

Country |

S&P |

Moody’s |

Fitch |

Last action date |

Consensus |

Bahrain |

B+; Positive |

B2; stable |

BB-; stable |

Moody’s; Nov. 2019 outlook moved to positive from stable |

Non-investment grade; highly speculative |

Kuwait* |

AA; stable |

Aa2; stable |

AA; stable |

Moody’s; May 2017 outlook moved to stable from negative |

High-grade investment |

Oman |

BB; negative |

Ba1; negative |

BB+; stable |

S&P; April 2019 outlook moved to negative from stable |

Non-investment grade speculative |

Qatar |

AA-; stable |

Aa3; stable |

AA-; stable |

S&P; Dec. 2018 outlook moved to stable from negative |

High-grade investment |

Saudi Arabia |

A-; stable |

A1; stable |

A; stable |

Fitch; Sept. 2019 downgraded from A+ to A |

Medium-grade investment |

UAE (Abu Dhabi) |

AA; stable |

Aa2; stable |

AA; stable |

Moody’s; May 2017 outlook moved to stable from negative |

High-grade investment |

Appendix 2: Sovereign credit ratings grading scale

Moody's |

S&P |

Fitch |

Rating Description |

Category |

Long-term |

Long-term |

Long-term |

||

Aaa |

AAA |

AAA |

Prime |

Investment-grade |

Aa1 |

AA+ |

AA+ |

High grade |

|

Aa2 |

AA |

AA |

||

Aa3 |

AA− |

AA− |

||

A1 |

A+ |

A+ |

Medium grade |

|

A2 |

A |

A |

||

A3 |

A− |

A− |

||

Baa1 |

BBB+ |

BBB+ |

Lower medium grade |

|

Baa2 |

BBB |

BBB |

||

Baa3 |

BBB− |

BBB− |

||

Ba1 |

BB+ |

BB+ |

Non-investment grade speculative | Non-investment grade / high-yield bonds

|

Ba2 |

BB |

BB |

||

Ba3 |

BB− |

BB− |

||

Single B Ratings |

Single B Ratings |

Single B Ratings |

Highly speculative |

|

C and D Ratings |

C and D Ratings |

C and D Ratings |

Near/In Default |

(1) Each of the big three have developed a letter grade credit rating system (see table below). The letter grade is partnered with a “credit outlook” (usually positive, stable, or negative) to help forecast potential upcoming upgrades/downgrades in the credit rating in the next six-to-twelve months. A table is provided at the end to summarize this.

(2) Fitch, “Fitch Downgrades Saudi Arabia to 'A'; Outlook Stable,” 30 Septmeber 2019.

(3) Cai, P., Kim, S., & Gan, Q., “The Effects of Sovereign Credit Rating on Foreign Direct Investment,” The University of Sydney Business School.

(4) Martell, Rodolfo, “The Effect of Sovereign Credit Rating Changes on Emerging Stock Markets,” Purdue University. 12 March 2015.