28th CEO Survey: Saudi Arabia findings

Listen to the audio version of this content

CEO-Survey28-KSA-Eng video

"As Saudi Arabia advances its Vision 2030 economic diversification agenda, businesses are accelerating AI and GenAI adoption, forging strategic partnerships and strengthening their commitment to environmental and social sustainability. In 2024, the Kingdom achieved key milestones on major projects, while CEOs adeptly navigated the region’s geopolitical and economic shifts, balancing challenges with opportunities. Leaders in the Kingdom have also embraced a data-driven decision-making to secure the viability and resilience of their organisations."

Guided by its ambitious Vision 2030 agenda, the Kingdom of Saudi Arabia is embracing reinvention as it transforms its economy and society at pace. In alignment with the leadership’s goals to expand the private sector, build new industries, create thousands of jobs and promote green initiatives, CEOs in Saudi Arabia are steering their organisations to fulfil the nation’s bold commitments for a sustainable and future-ready economy.

CEOs in Saudi Arabia are particularly confident about domestic economic growth, with a significant 77% expecting growth in their territory over the next 12 months - higher than their regional and global peers. The country also stands as the top investment destination for other regional CEOs outside their own territories. In terms of sustainability, 72% of CEOs in the Kingdom have initiated climate-friendly investments over the past year, higher than their counterparts in the six countries surveyed, demonstrating a proactive approach to balancing growth with environmental responsibility. Business leaders in the country are faced with a packed agenda for the year ahead, as they navigate the significant market opportunities and risks of today while reinventing their businesses for tomorrow.

A resilient economy: CEOs in Saudi Arabia confident of growth

CEOs in Saudi Arabia are confident of domestic economic growth, with 77% of business leaders expecting growth in their country market in the coming 12 months, higher than the 71% of their GCC peers, the 64% in the Middle East, and the 57% of CEOs globally reflecting on their own territories. This high confidence in Saudi’s economic growth is also shared right across the region, with the Kingdom cited as the top country in the region that other country CEOs are looking to invest in, outside of their own territories.

The nation's growing leadership on the regional and international economic stage is further reflected in the International Monetary Fund’s strengthened positive outlook for the Saudi economy. In its April 2024 World Economic Outlook report, the IMF raised the expected growth rate for the Kingdom to 6%, up from the 5.5% projection issued in January 20241.

The country is now projected to be the second-fastest growing economy in 2025, trailing only India's anticipated growth rate of 6.5% - its strength is demonstrated in its success in diversifying its revenue streams, with non-oil revenue growing by 4.9% in the second half of 2024, its strongest growth so far2.

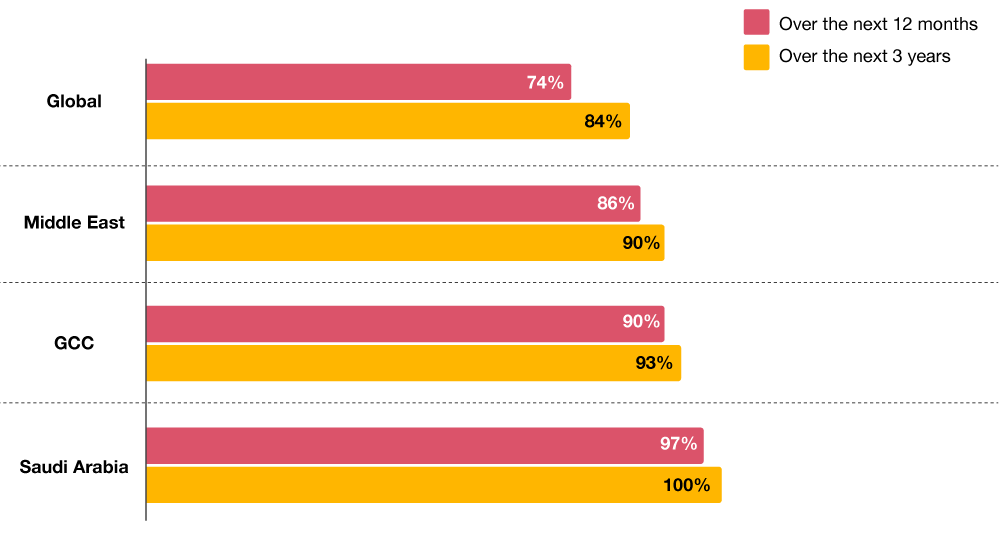

This optimism extends to the CEOs’ own organisations in Saudi Arabia, with 98% of CEOs confident in their company's revenue growth over the coming year, rising to 100% over the next three years.

Q. How confident are you about your company’s prospects for revenue growth?

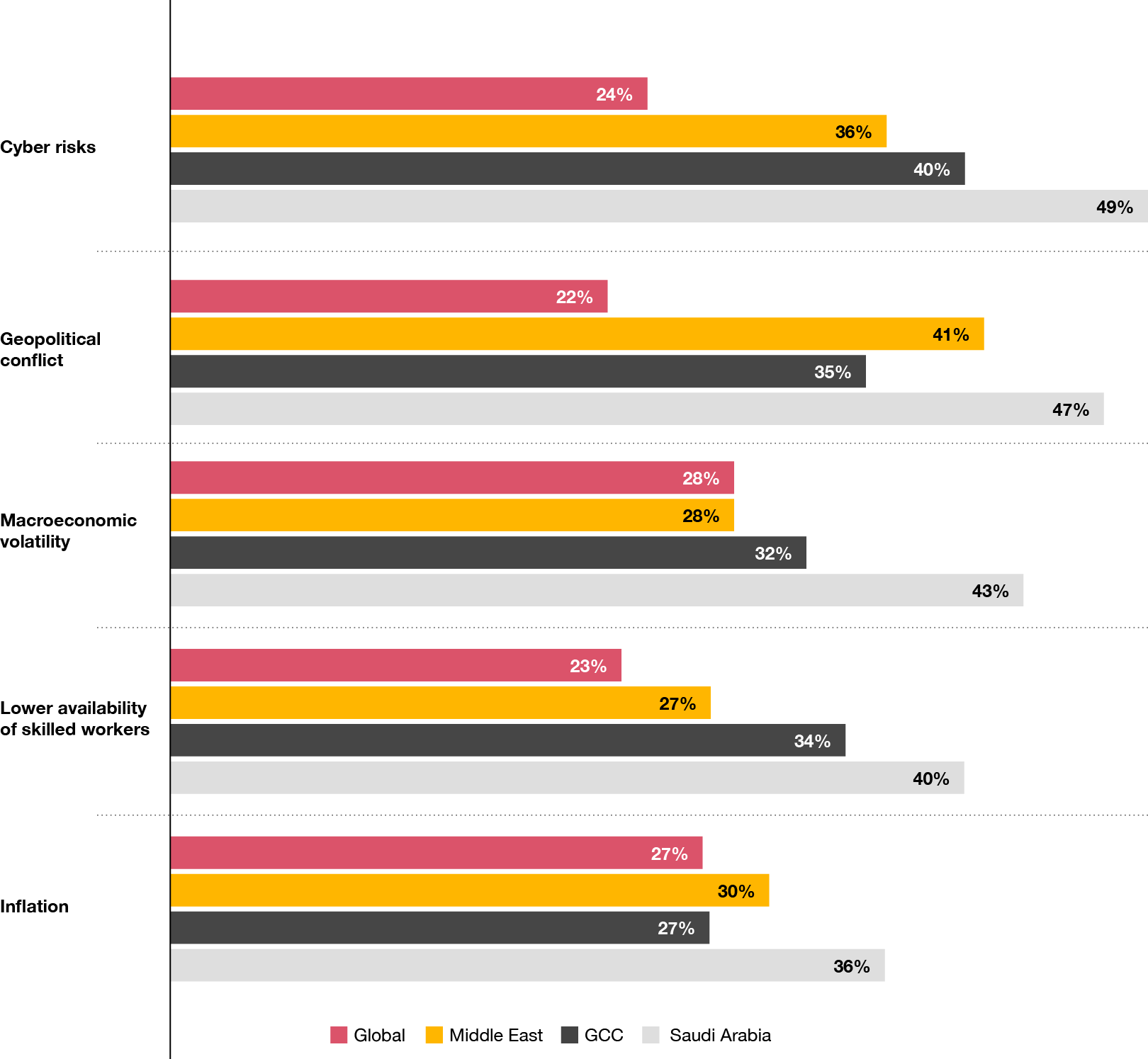

Inflation eases as cyber threats top the risk agenda

Inflation in Saudi Arabia peaked in January 2023 at 3.4% percent and by the end of 2024 was relatively stable at 2.0%.3 This has reflected in our survey, with only 36% of Saudi CEO’s identifying inflation as a key threat compared to 2024, when it was the top threat, with almost half (46%) saying their company was ‘highly’ or ‘extremely’ exposed to it. Instead, cyber risks have become a significant worry, with 49% of CEOs reporting their companies as highly or extremely exposed - more than doubling from 20% the previous year. Geopolitical conflict in the wider region, and globally, remains front of mind for business leaders in Saudi.

Q. How exposed do you believe your company will be to the following key threats in the next 12 months? (Showing sum of ‘highly exposed’ and ‘extremely exposed’ responses)

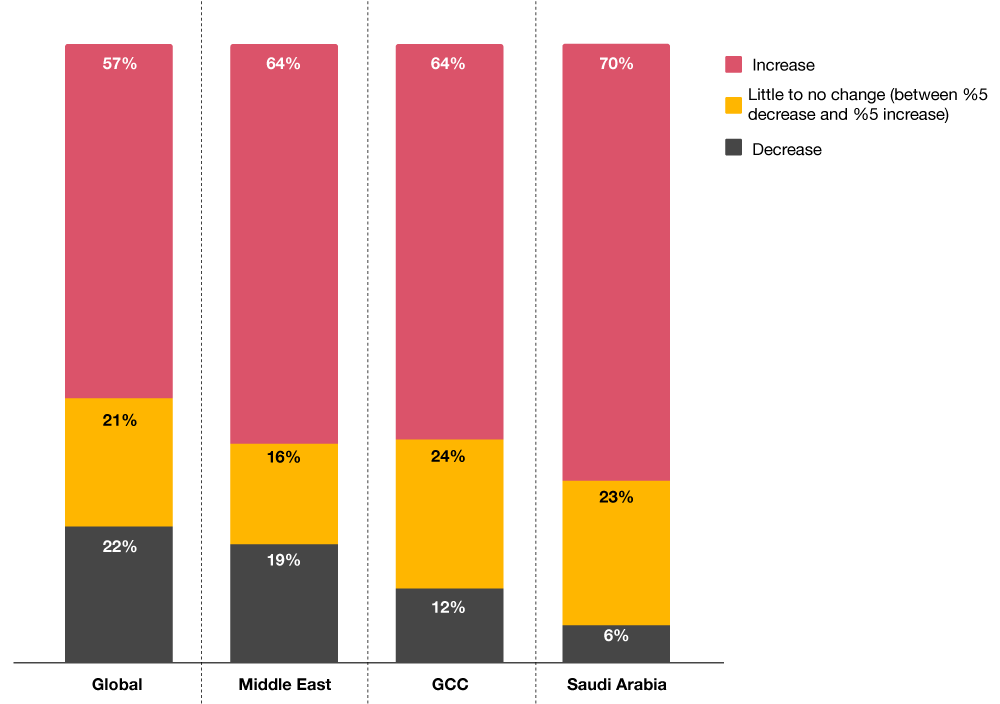

Buoyed by the confidence in the Saudi economy, business leaders in the Kingdom have ambitious plans to expand their workforce, with 70% indicating intentions to increase headcount - significantly higher than the 42% globally. This is driven in part by a combination of the growing private sector, incoming international firms, more women joining the workforce, Saudisation targets and emerging skills economies.

Saudi business leaders are also concerned about skill shortages, with 40% citing this as a concern. Under Vision 2030, the thriving economy pillar places emphasis on the education and upskilling opportunities to prepare citizens for a more diverse, future-ready economy4. Initiatives, such as the National Strategy for Data and Artificial Intelligence, focuses on training programmes for women, youth and entrepreneurs in the fields of data analysis, machine learning and other relevant skills, cultivating a generation of young experts who can lead advancements in science, technology, engineering and mathematics (STEM) fields.

Q. To what extent will your company increase or decrease headcount in the next 12 months?

**Percentages in charts may not add up to 100%—a result of rounding percentages; multi-selection answer options; and the decision in certain cases to exclude the display of certain responses, including ‘Other,’ ‘Not applicable’ and ‘Don’t know.’

Reinvention imperative stronger than ever, and more immediate

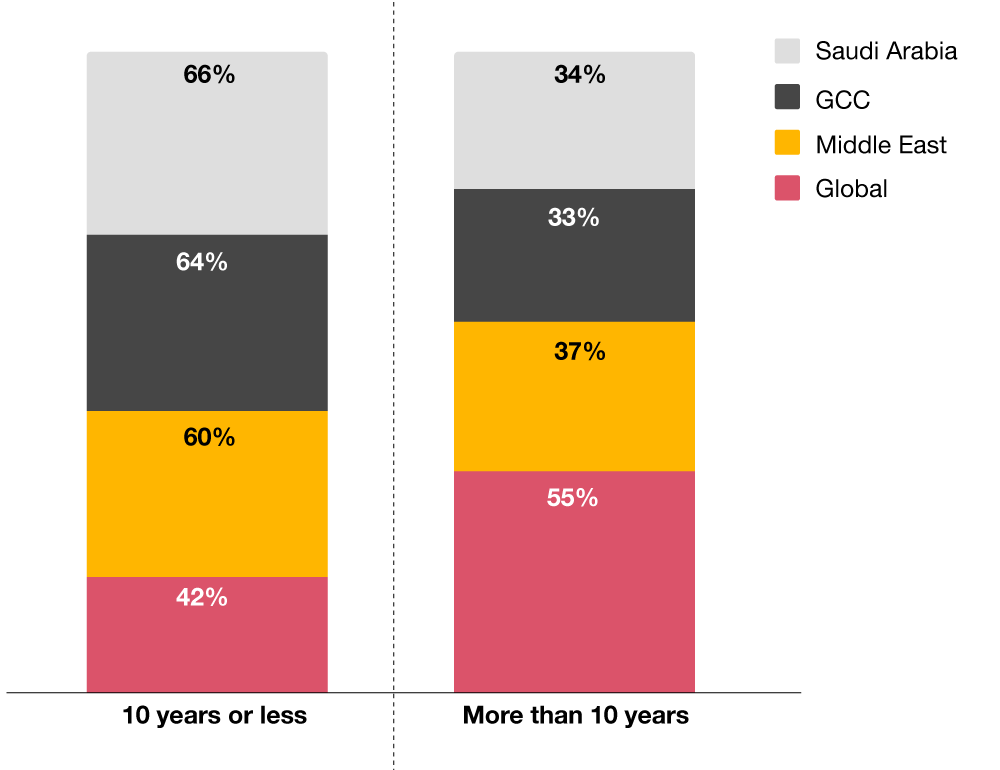

Given this confidence, CEOs in the Kingdom are ready to embrace reinvention, driven by transformative forces such as AI and climate change. Findings from our 28th Annual CEO Survey have revealed that notably, 66% of respondents - compared to 42% of CEOs globally and 64% in the GCC - believe they will need to adapt their businesses in 10 years or less to remain viable. This marks a significant increase from last year when 49% of CEOs in the Kingdom expressed the same concern.

Q. If your company continues running on its current path, for how long do you think your business will be economically viable?

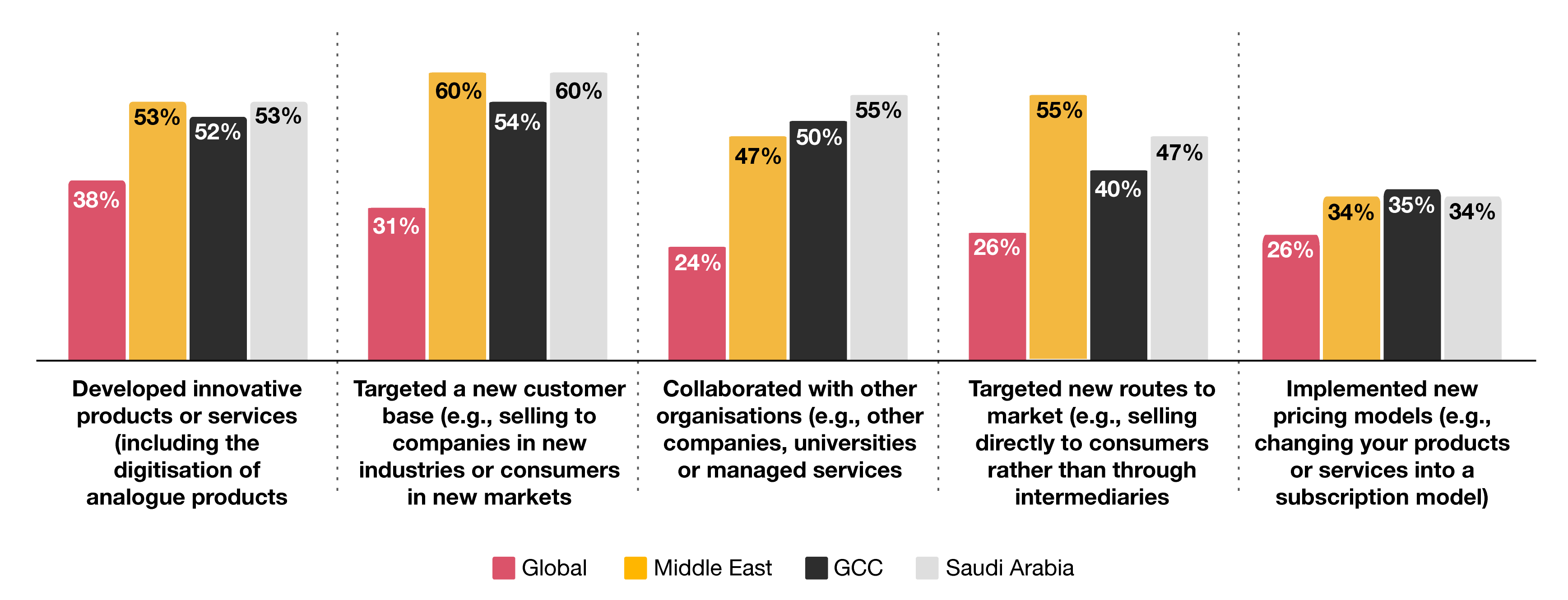

Recognising the need to evolve their business models, CEOs in Saudi Arabia have demonstrated agility over the past five years, driving change and creating value through strategic initiatives, such as targeting new customers, developing innovative products and collaborating with other organisations. A striking 60% of our survey respondents said they targeted a new customer base in the past five years, while 55% have collaborated with other organisations and targeted new routes to market. Similarly, 53% have developed innovative products, including the digitisation of analogue offerings, underscoring their commitment to innovation, meet changing customer expectations, and enhance efficiency - leading to new revenue streams.

Q. To what extent has your company taken the following actions in the last five years?

In line with their peers globally and across the wider region, CEOs in Saudi Arabia cited changes in regulatory environment as the strongest influence on economic viability for those needing to adapt within 10 years, followed by increasing products or service costs. Other key influences on business viability in Saudi include high levels of new entrants or strong competition from adjacent industries high levels of supply chain risk and disruptive technologies.

Artificial Intelligence: The megatrend powering future growth

Like their counterparts across the region, CEOs in Saudi Arabia recognise the transformative potential of disruptive technologies, such as AI and GenAI, to reshape enterprises and entire industries. Our survey data has reflected this enthusiasm among CEOs in the Kingdom in embracing AI and GenAI, with an impressive 81% indicating they have adopted GenAI in the past 12 months, aligning with global adoption trends. Trust in AI is notably high, with 57% of CEOs in the country saying they trust having the technology embedded in key processes to a large or very large extent – outpacing their regional peers (47%) and exceeding the global average of 33%.

This is yielding tangible results, with two-thirds of CEOs in Saudi Arabia reporting that GenAI has boosted profitability within their organisations over the past 12 months and an equal proportion reporting increased revenue - surpassing their peers across the region and globally in both metrics.

In 2024, the Kingdom rose to the 14th position in the Global AI Index5, fulfilling the Vision 2030 objective of becoming a top 15 country in AI by the end of the decade. Recently announced plans to invest US$100bn in data centres, infrastructure, startups and AI skills as part of Project Transcendence6 is a significant push by the Kingdom to build a robust AI ecosystem, positioning itself as a competitive global tech hub.

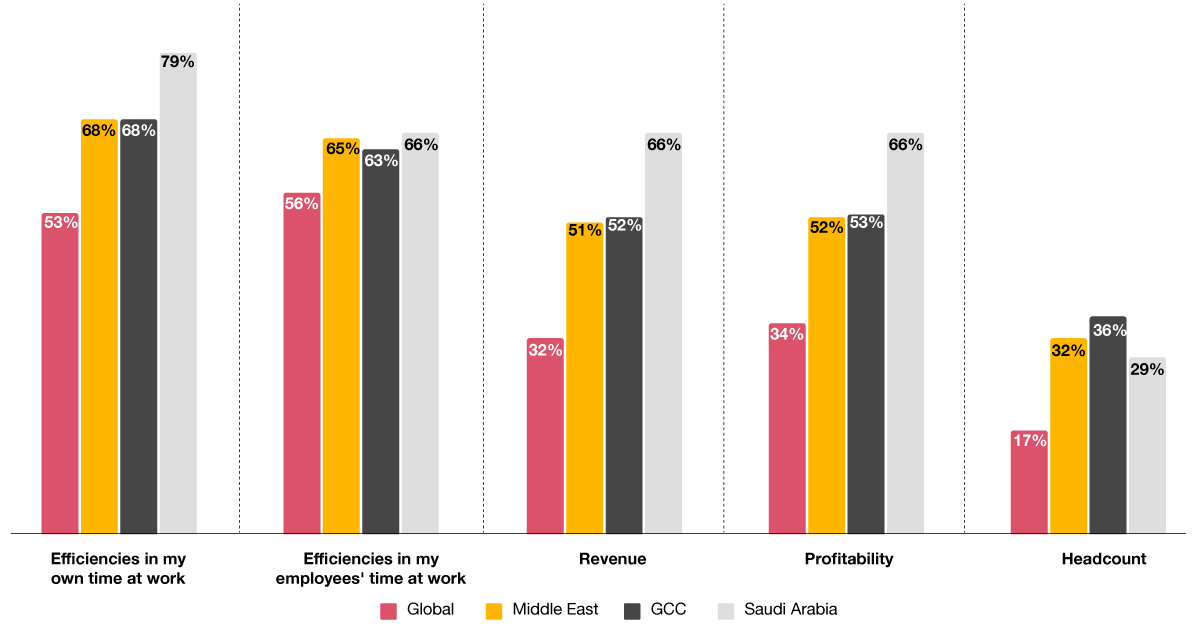

As more organisations are leveraging GenAI to enhance decision-making and operational efficiency, business leaders in the Kingdom have indicated that the automation has liberated them to focus on more strategic growth initiatives and cultivating client relationships.7 Time efficiencies were also cited by Saudi as a key benefit- with 79% agreeing that it has made their own time more efficient, much higher than 53% globally, and 66% have reported efficiencies in their employees' time at work, higher than 56% globally.

While accelerating the decline of clerical roles, technologies, such as AI and GenAI are also expected to become the biggest drivers of employment growth in the Kingdom. CEOs in Saudi Arabia are, therefore, positive about GenAI driving job creation, with 29% reporting an increase in headcount in the last 12 months, compared to only 17% globally, pointing to the possible rise in demand for technology and cybersecurity specialists in the country.

Q. To what extent did generative AI increase or decrease the following in your company in the last 12 months? (Increased)

Looking ahead, 71% of CEOs in Saudi Arabia have said that GenAI will further increase profitability in the next 12 months – once again outpacing the global average of 49%, and 67% of their Middle East peers.

A significant 92% of CEOs in Saudi Arabia - more than the global average of 78% - say that GenAI will be systematically integrated into their technology platforms within three years, while 86% (compared 76% globally) expect it to be integrated into business processes and workflows. A further 88% will embed it into core business strategy, 79% into new products/services development and 89% into workforce and skills development.

Unlocking business value amid the climate challenge

Large scale investments in renewable energy are a core driver of the Kingdom’s transformation. The Vision 2030 programme sets a target of 50% electricity generation from renewables by 2030, while the Kingdom was one of the first countries in the world to announce a formal net zero target, for 20608. Sustainability plans are due to accelerate in the second half of this decade, with the aim of creating hundreds of thousands of jobs in tourism, manufacturing and other non-oil sectors.

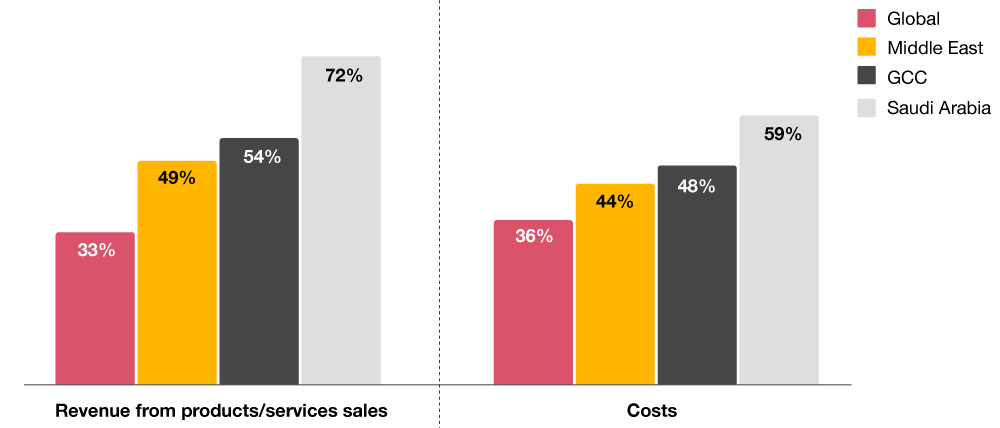

72% of CEOs in Saudi Arabia have made climate-friendly investments over the last 12 months, aligning with their peers globally and more than their Middle East and GCC peers. These include transitioning to energy-efficient operations, developing greener products and services and implementing emission-reducing technologies. In Saudi Arabia, in particular, these investments are paying off at a great pace.

While 59% of CEOs report that climate-friendly investments have caused an increase in costs, 72% have seen an increase in revenue – significantly higher than the 33% globally and 54% in the GCC.

Q. To what extent have climate-friendly investments initiated by your company in the last five years caused increases or decreases in the following? (NET Increase)

But despite the increases in revenue generated by climate-friendly investments, CEOs in Saudi were less likely to have accepted lower rates of return for climate-friendly investments than their global peers.

Lower returns for climate-friendly investments were also cited as the biggest barrier to decarbonisation at 59%, followed by lack of demand from external stakeholders and regulatory complexity. However, buy-in from the management team and board is comparably high, as CEOs in Saudi Arabia adopt innovative strategies that align with the Kingdom’s transformative Vision 2030 agenda and global sustainability goals, driving long-term value creation.

Industry convergence is aiding the reinvention agenda

As Saudi Arabia pushes forward with its diversification agenda, companies are seeking new domains of value, unlocking opportunities outside of their traditional industries and customer bases to boost business reinvention goals. Almost half (47%) of CEOs in the Kingdom say that in the past five years, they have begun to compete in sectors or industries that are new to them, compared to only 38% of their global counterparts.

The convergence of AI and 5G technology, for example, is transforming the digital landscape in Saudi, creating smarter systems that power industries, such as telecommunications, manufacturing and healthcare. Additionally, convergence is evident in the tech and sports sectors, with plans for digital stadiums9 already underway for the 2034 FIFA World Cup to transform fan engagement and elevate entertainment experiences. Furthermore, the intersection of technology and culture has revitalised Saudi Arabia’s heritage sites,10 ensuring that cultural assets are preserved for future generations.

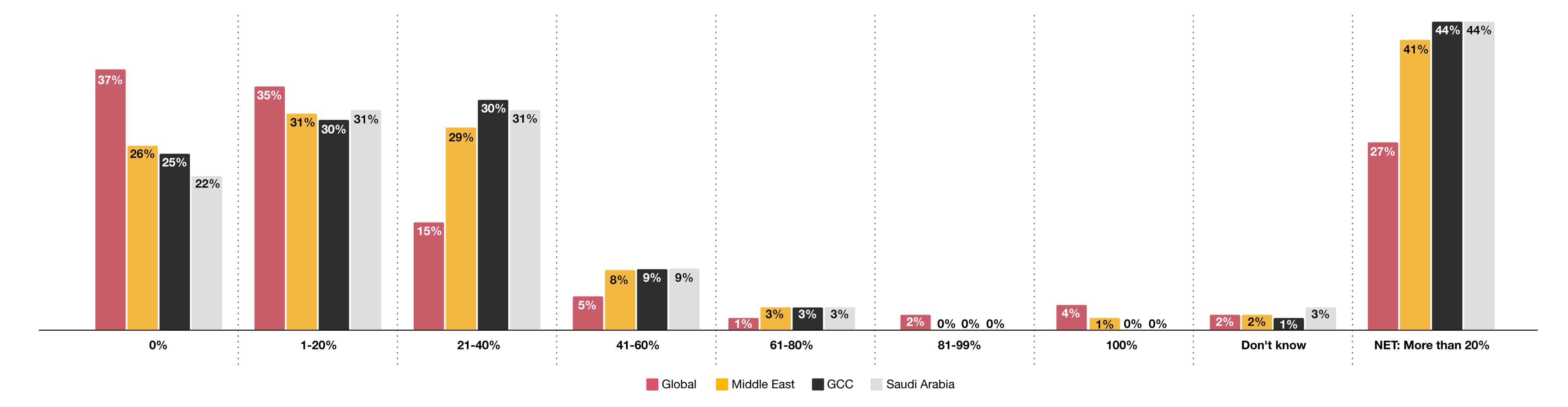

Industry convergence is also playing a pivotal role in enabling businesses to break traditional boundaries and explore new growth avenues. 28% of CEOs in Saudi Arabia have made a major acquisition (of more than 10% of assets) in the last three years, slightly ahead of their GCC peers at 25%. There is a keenness amongst 69% of business leaders in the Kingdom to make at least one acquisition within the next three years, with 75% of the expected deal value to come from industries other than their own.

Q. Of the acquisition(s) that your company is planning to make in the next three years, what proportion of the deal value do you expect will be from sectors or industries other than your own?

CEOs in Saudi Arabia can set reinvention plans on a course for success if they are able to:

Remain resilient and competitive on both regional and international stages. CEOs in Saudi Arabia must exercise fiscal prudence, strategically redirecting resources for greater impact, particularly in technology investments and workforce upskilling initiatives.

Empower the workforce to drive sustainable reinvention. Saudi leaders must upskill employees for future demands in high-growth sectors while attracting and retaining top talent to align with the Kingdom’s ambitious growth agenda.

Integrate climate-friendly investments into business strategies, even if it means accepting lower rates of return in the short term, as these will drive long-term value.

Establish robust governance frameworks for AI. Without proper governance, technologies that are designed to enhance efficiency and decision-making can create significant pitfalls, potentially undermining trust, compliance and ethical standards.

Diversify alliances and strengthen economic ties with partners in emerging economies as geopolitical fragmentation intensifies globally in 2025, with trade tensions between major trading blocs likely escalating11. Business leaders in the Kingdom should seize acquisition opportunities in emerging sectors, both domestically and internationally, to expand portfolios and accelerate diversification, positioning the Kingdom as a global economic powerhouse.

Leadership in focus: An exclusive interview with Faisal AlOmran, CEO, Saudi Investment Bank on vision, growth, and transformation

“We know that the future is unclear and the challenges we face may not be the same as before”