PwC Middle East’s recent collaboration with Salesforce combines AI and CRM, incorporating the unique business rules of financial services to deliver highly personalised offers to clients

Sales functions are the vital driver of growth in the highly competitive financial services sector, and sales leaders are being asked to do more in an extraordinarily competitive and challenging environment. Insights gleaned from data analysis can help financial services firms and their Customer Relationship Management (CRM) teams spot opportunities, but the sheer volume of data available can often be as much a hindrance as a help.

But what would be the impact if sales teams had real-time access to highly relevant and accurate customer information, which is personalised but compliant? What could sales teams achieve if they knew which customers were likely to be the most receptive to particular products, services, or offers? This is the difference between data analysis and actionable insight - analysis of data is only valuable if, ultimately, it leads to sales, increased revenues, and growth.

This principle has been behind PwC Middle East’s recent collaboration with Salesforce, where we have aimed to enhance white space analysis in financial services, using data cloud, CRM, and AI to provide CRM teams and sales functions with actionable, compliant insights that adhere to their organisation's rules.

Lost opportunities

Digital channels have transformed the banking sector, to the benefit of customers and institutions alike. Our PwC sentiment analysis of the banking sector in KSA found that clients and customers are generally accepting of digital interactions; in fact, digital channels outperformed traditional channels in terms of net sentiment scores by 27.3 percentage points. Even so, significant challenges remain as organisations attempt to win and retain customers and drive revenue growth through targeted cross-selling.

Investment by sales functions across the region in data, AI and analytics are helping them to drive growth in their organisation. But while data analysis provides CRM teams with better and more information, it is often the case that the contextual information available to them is neither comprehensive nor relevant. This results in lost selling opportunities and inefficient marketing; it is not unusual, for example, for a customer to be approached in a marketing drive for a product that, it turns out, they are not eligible for under the organisation’s own rules.

Intelligent, actionable insight

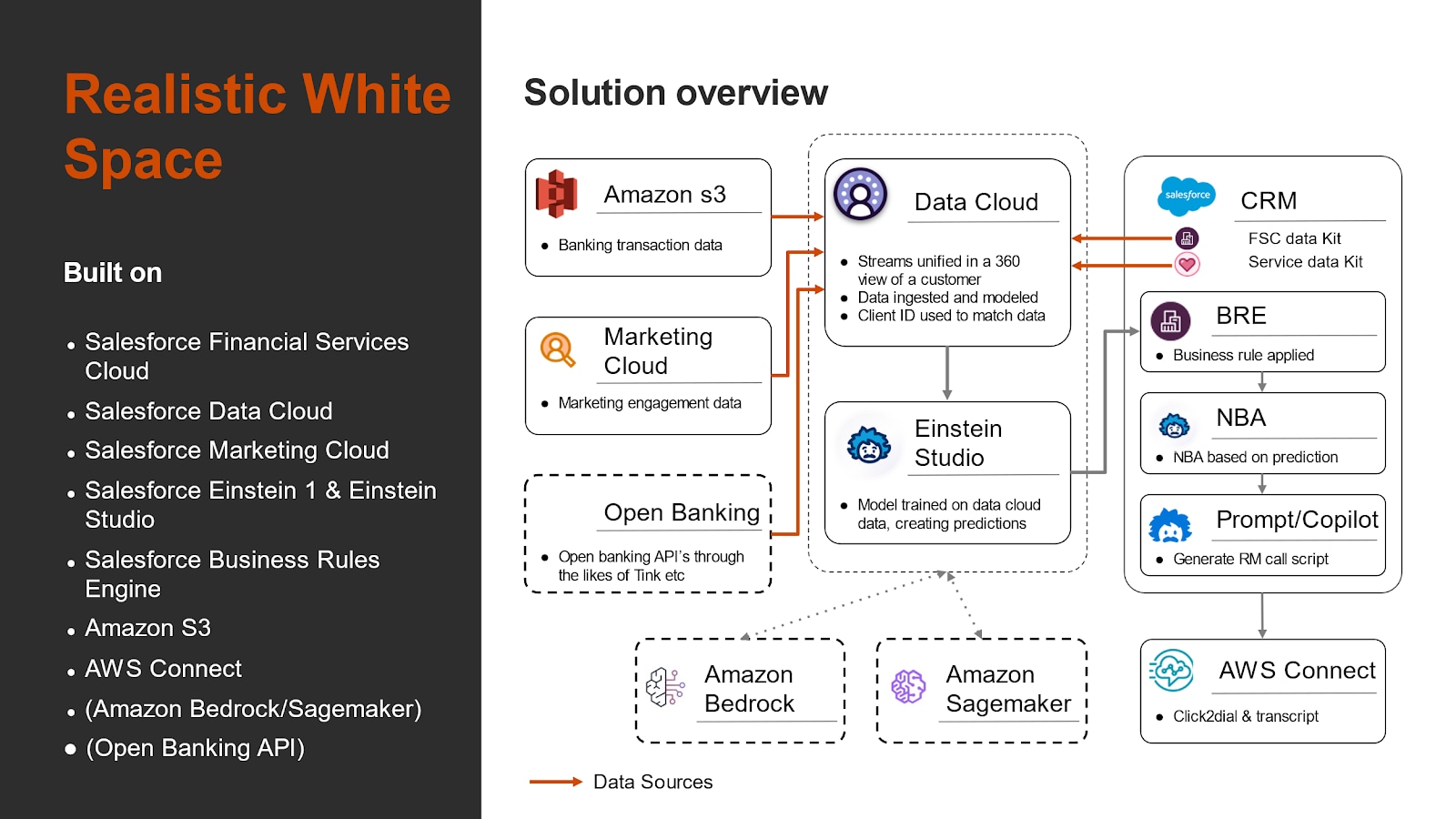

Our solution is created on the foundation that insights from data should be intelligent, relevant, and actionable. Using data analysis to target new and existing customers is an established practice, but comes with particular challenges in financial services because of strict regulatory and risk management requirements. Our solution is based around Salesforce Data Cloud, which combined with AI and CRM, incorporates the unique business rules of FS organisations, allowing them to put forward highly personalised offers to clients.

Figure 1

There are five key elements to the approach:

Gather data: The organisation’s own data – including financial transaction data (from Amazon S3) and marketing engagement data (from Salesforce Marketing Cloud) is supplemented with key data from Open Banking sources (with the customer’s consent) to provide as much contextual data as possible – is cleaned and collected into the Data Cloud.

Analyse: A machine learning model is trained on the Data Cloud, creating predictions for customers’ propensity to accept offers.

Create guard rails: The system ensures compliance with GDPR and other regulatory requirements by encrypting or hiding data that does not need to be seen by CRM teams.

Personalise to the organisation: The data is made visible to CRM teams according to the organisation’s own governance boundaries and business rules.

Continuous refinement: Known customer preferences following marketing drives and qualitative insight from sales teams should all be fed back into the propensity models and solutions, enabling the business to continue evolving.

This approach gives the CRM and sales team a 360-degree view of each customer and is much more than a data dashboard – it is an actionable plan based on intelligent analysis of all connected data. When a customer is identified for a marketing opportunity, it has already been established that they are eligible for the offer – and that they are inclined towards accepting it.

This means that relationship managers will have the right conversation with every client (the system will even generate a personalised sales script). A conversation which is personalised and carefully targeted, and supported by comprehensive, accurate and timely information. A conversation that is compliant, and which is aligned with the organisation’s objectives.

The result is better productivity, improved customer service, reputational enhancement, and lower risk. Salesforce’s own metrics suggest that a customer-centric, connected approach can result in a 40% increase in sales productivity, a 40% increase in customer retention rates, and a 21% reduction in the cost to acquire new customers.

Put your data to work

There are many benefits to this solution, including:

A truly customer-centric approach

Improved customer experience

Data-led decision-making, with business rules built in

Connecting the dots between different parts of a business, leading to improved cross-selling opportunities and consistently good CRM

Real-time notifications that help organisations better manage risk

A better uptake of offers through traditional marketing/in-app push

Financial institutions retain control over personalised and compliant offers

We have already seen its benefits in financial services institutions in the Middle East, including one large organisation that was able to address lost revenue attributed to unprofitable clients in its wholesale business.

In this data-rich digital age, it is vital that data analysis works hard for your organisation. That means creating actionable insights that can improve both customer service and productivity, and drive growth.

Tracy Murray