2024 Middle-East-Climate-Tech-report

ــــ

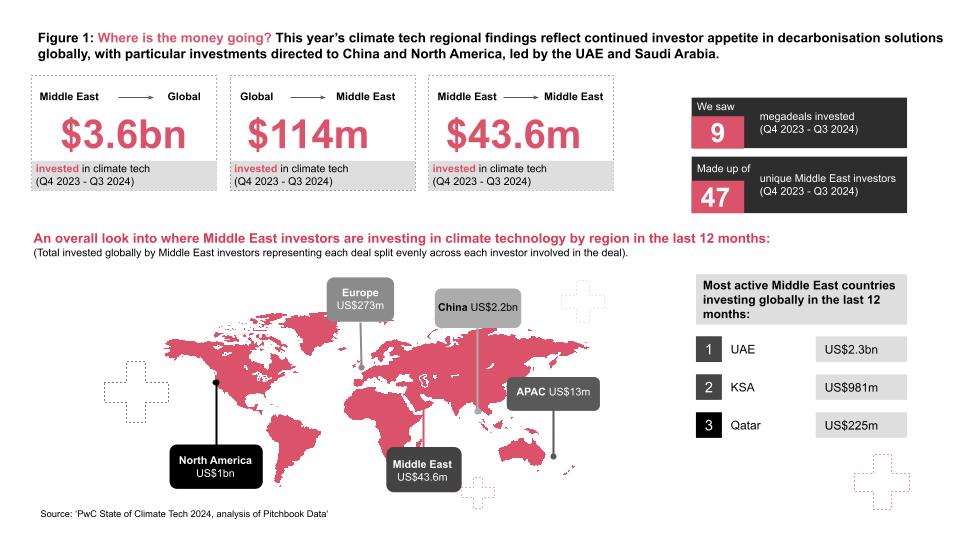

US$3.6bn

flows into global climate tech from Middle East investors, down 28% on last year

ــــ

US$13m

a record low investment in climate tech for energy, the Middle East’s highest-emitting sector - a drop from US$22m in 2023

ــــ

41%

drop in global investment to the region, falling from US$193m in 2023 to US$114m in 2024

ــــ

US$47.3m

in Middle East AI-related climate tech investments from global funding, compared to US$5.4m for AI innovators in 2023

ــــ

47

Middle East unique investors funded global climate tech over the past 12 months, down from 98 the previous year

Climate Tech conversations

"Aligning agendas across innovators, entrepreneurs, industries and governments is essential to creating an integrated impactful innovation ecosystem capable of delivering real-world solutions. Creating numerous programmatic linkages, organic and inorganic, is also vital to activate the ecosystem. In the case of deep tech ecosystems, a stronger pipeline of tech entrepreneurs is also needed to complement institutional R&D in taking a larger flow of tech innovations from lab-scale to market-ready solutions."

- Dr. Ammar Al Nahwi, Chief Executive Officer | Dhahran Techno Valley Holding Company

"When we examine the climate tech stack, it becomes clear that investments are not always aligned with the priorities needed to achieve net zero. Sectors like agriculture, construction and manufacturing remain significantly underfunded."

- Vijay Bains, Group Chief Sustainability Officer | Emirates NBD

"Access to funding remains a challenge - it has not been a great year for venture funding deployment and climate tech within that remains particularly difficult. VCs generally demand very fast returns, whereas climate tech often requires more patient funding, which remains a bottleneck."

- Dina el-Shenoufy, Chief Investment Officer | Flat6Labs

"A balanced mix of funding - grants, venture capital and private equity - is crucial for supporting both innovation and scalability in climate tech start-ups. These start-ups often need a combination of patient and strategic capital to develop prototypes, validate proof-of-concepts and execute pilot projects before transitioning to revenue generation."

- Noor Sweid, Founder and Managing Partner | Global Ventures

"We are seeing a lot of movement in the eMobility space. Key global players, such as Lucid Motors and Hyundai are central to Saudi Arabia’s EV manufacturing ambitions and the UAE is also making significant strides in early-stage manufacturing and green technology, with initiatives underway to develop EV assembly plants, solar-powered vehicle concepts and the region's first recycling plant for end-of-life EV batteries."

- Heiko Seitz, Partner and Global eMobility Leader | PwC Middle East

"The market for fundraising ranges from hard to extremely hard. Many investors are hesitant and smaller ticket sizes often fail to meet the extensive due diligence requirements of development finance institutions. We are also witnessing a significant decline in global venture capital activity, driven by rising interest rates and tighter budgets. Corporate investments, meanwhile, tend to prioritise long-term stability with established players over taking risks on emerging ventures."

- Nils Razmilovic, Founder and Chief Executive Officer | TAMU group

"Despite short-term setbacks due to the global energy crisis and other geopolitical pressures that have resulted in lower investment in climate tech, we believe that, in the long run, climate tech will play a major role on the road to net zero."

- Noel Aoun, Group Chief Strategy Officer | TAQA Group

"A key challenge for the climate innovation ecosystem regionally lies in corporate engagement, there is a need to align the growth pace and resources of start-ups with the needs of corporates and utility companies and solve the bottlenecks in procurement and implementation."

- Lola Fernandez, Principal | VentureSouq

"There exists a critical funding gap across the capital stack in the Middle East. While global investments from the region are concentrated around mobility and some areas of food and agriculture, other high-emission sectors such as industry, manufacturing, resource management, land use and the built environment still remain underfunded especially at the early stages."

- Sonia Weymuller, Co-Founder and General Partner | VentureSouq

Foreword

One year after COP28 in the UAE underscored the urgency of accelerating climate action, the climate tech investment landscape stands at a pivotal crossroads - entering a more challenging phase, both globally and regionally.

Findings from our latest State of the Climate Tech report reveal that globally, climate tech investment has contracted sharply, dropping 29% in the 12 months to September 2024 - falling below pre-2020 levels. This trend is now evident in the Middle East, where climate tech funding from regional investors to global markets declined from a peak of US$5 billion in 2023 to US$3.6 billion in 2024.

Despite this downturn, there are bright spots signalling the region’s enduring commitment to climate innovation. Investments in electric mobility are aligned with regional decarbonisation goals, while a pivot towards select megadeals (more than US$100m+) indicate a maturing market prioritising high-impact, value-driven opportunities.

AI-driven climate ventures have become a key growth area, recognised for their transformative potential to enhance productivity and bolster climate resilience. Middle Eastern investors have significantly increased their investments in global AI-related climate technologies, while within the region, AI-focused companies, particularly in the consumer and industrial sectors, have attracted considerable attention.

However, significant funding gaps remain. Critical sectors, such as industrial manufacturing, food, agriculture, land use (FALU) and the built environment are underfunded despite their outsized contributions to greenhouse gas emissions. Addressing this “carbon funding gap” is essential to scale solutions in hard-to-abate sectors, where substantial progress can be achieved.

What remains striking, however, is the disparity in finance patterns. While significant capital flows out of the region, investment by Middle East investors into scaling homegrown companies remains limited, with the levels of funding remaining within the region declining by 52% compared to 2023, making up just 1.2% of total climate tech investment made. This highlights the need to bolster support for local ventures to drive innovation and growth within the region.

This report tracks regional investment across three key directions: Middle East investors funding climate tech globally, global investors funding climate tech within the region and Middle East investors supporting homegrown climate tech locally. It delves into the critical trends, providing actionable insights into the shifting dynamics of climate tech investment and the transformative opportunities that lie ahead for players in the Middle East.

The stakes have never been higher. To keep the 1.5°C target within reach, we must work collectively to ensure efficient capital flows into the right areas, enabling innovators to achieve the greatest possible impact.

Dr. Yahya Anouti

Partner | Strategy&

PwC Middle East Sustainability Platform Leader

Jon Blackburn

Partner | Energy, Resources and Sustainability

PwC Middle East

Significant capital from the region powers global climate tech innovation

If investment and innovation are the twin pillars of the world’s response to climate change, climate tech innovators now face a tougher landscape as global investments continue to cool, marking a third consecutive year of decline. In the 12 months leading up to September 2024, investment levels fell below pre-2020 levels. Global climate tech financing dropped by 29%, from US$79 billion between Q4 2022 and Q3 2023 to US$56 billion in the following four quarters, signalling a sharp deviation from earlier growth trends. Despite this global cooling, Middle East investors directed US$3.6 billion into climate tech globally in 2024.

While this marks a decline (Figure 2) from the US$5 billion invested by September 2023, it remains a significant commitment during a period of tightening funds, likely driven by rising interest rates, inflation and geopolitical concerns. However, only US$43.6 million of this capital was directed toward regional climate tech companies, indicating a stark imbalance in funding priorities and missed opportunities to foster innovation within the region.

"Despite short-term setbacks due to the global energy crisis and other geopolitical pressures that have resulted in lower investment in climate tech, we believe that, in the long run, climate tech will play a major role on the road to net zero."

During this period, Middle Eastern investment in China surged significantly, rising from US$739 million in 2023 to US$2.2 billion in 2024. This may be attributed to China’s leadership in green technologies and EV production1, which aligns with the decarbonisation goals of Middle Eastern governments and their broader strategic intent to leverage China's technological expertise, scalability and cost efficiencies to drive innovation - particularly in electric vehicle manufacturing (Figure 3).

Regional investment into Europe also grew in 2024, especially in the energy sector, followed by GHG capture and storage, from US$217 million in 2023 to US$273 million in 2024. The GCC has been keen on partnerships with the EU to exchange knowledge and best practices highlighted by the launch of the EU-GCC Cooperation on Green Transition project at the World Future Energy Summit in Abu Dhabi, fostering collaboration between EU and Gulf green tech companies2.

Regional investment also holds the potential to create a broader impact by addressing climate challenges in the Global South. According to Stern at NYUAD’s Transition Investment Lab’s (TIL) third annual report, The Great Reallocation: Mobilising Capital for Transition Investment3 - developed in partnership with Mubadala - regional investors can channel transformative investments into underfunded sectors across not only the Middle East but also Africa and Southern Asia, where the most severe socioeconomic and environmental challenges persist. By strategically leveraging their capital, these investors can drive meaningful progress in other high-need areas beyond regional borders.

The UAE leads regional climate tech investment

Intra-regional investment trends reveal that the United Arab Emirates increased its climate tech investments globally by 138% between 2023 and 2024 (Figure 4). This surge is largely attributed to a strategic equity investment in Chinese electric vehicle (EV) manufacturer, Nio, by CYVN Holdings in Abu Dhabi, placing the UAE as the top regional investor over the past 12 months. In addition to Nio, the UAE also led a US$129 million megadeal in Zap Energy through the Government of Abu Dhabi during the same period.

Saudi Arabia and Qatar continue to rank among the top investors in climate tech within the region, with investments made in the energy, IMRM and mobility sectors, primarily in the United States, the United Kingdom and Belgium.

Electric mobility and AI-driven climate tech emerge as priority areas

Global investments are powering the Middle East’s EV ambitions, with substantial regional contributions to global electric mobility poised to deliver long-term benefits through innovation, knowledge transfer and economic growth. As Middle Eastern countries undergo environmental and economic transformation, strategic investments in EV technologies are bringing essential intellectual property, technological expertise and high-skilled jobs to the region - critical elements in building a robust EV ecosystem.

Our data shows that in the global electric mobility sector, Nio and American automotive company, Lucid Group, captured the majority of climate tech megadeals this year involving Middle East participation. In 2023, Saudi Arabia’s Public Investment Fund (PIF) and Ayar Third Investment Company invested US$2.55 billion and US$750 million in Lucid respectively, while Abu Dhabi’s CYVN Holdings committed US$738 million to Nio. By 2024, both Ayar and CYVN significantly increased their stakes, with Ayar adding US$750 million to Lucid and CYVN tripling its investment in Nio to US$2.2 billion.

This also reflects a maturing landscape, where Middle East investors prioritise high-value opportunities over volume (Figure 5). Despite a fall in the number and volume of megadeals - nine megadeals in 2024 amounting to a total value of US$4.8 billion - compared to 26 deals totaling US$11 billion in 2023, the average deal value rose by 25%. This is driven largely by the significant Nio investment, which alone accounted for over 62% of total regional outward climate tech investment in the last 12 months.

According to PwC Middle East’s eMobility Outlook 2024: KSA Edition, Saudi Arabia, for example, is dedicating US$39 billion to establishing a domestic EV manufacturing industry by 2030, supporting its ambitious net zero and economic diversification goals. With the goal of transitioning 30% of Riyadh’s vehicles to electric by 2030, the Kingdom is working with global leaders, such as Lucid Motors, to build a regional hub for EV production. This strategy not only aligns with Saudi Arabia’s environmental objectives but also aims to boost in-country value, attract foreign investment and create a strong domestic workforce, ultimately contributing to Vision 2030. Supported by the Saudi PIF, Lucid recently opened Saudi Arabia's first auto manufacturing facility in King Abdullah Economic City. With an initial capacity of 5,000 vehicles per annum, the complete facility is expected to have a future capacity of 155,000 EVs annually.

Like Saudi Arabia, the UAE is also prioritising EV adoption as a central pillar of its Energy Strategy 2050, which targets carbon neutrality by mid-century. With a goal of having 50% of vehicles on UAE roads be electric or hybrid by 2050, the country is incentivising EV adoption and investing in supporting infrastructure. CYVN Holdings’ recent US$2.2 billion investment in Nio goes beyond capital; it includes plans for a new research and development (R&D) centre in Abu Dhabi focused on autonomous driving and artificial intelligence.

With mobility accounting for 84% of the region's total global climate tech investment in 2024, it highlights the strategic focus on reimagining transportation to reduce carbon emissions. By directing investments toward established global electric mobility players, regional governments are laying the groundwork for a robust homegrown EV industry.

The Middle East has also accelerated investment into AI-related climate tech (Figure 6), given AI’s potential to drive energy efficiency, reduce emissions and improve environmental performance across sectors.

It has embraced the AI revolution with ambitious strategies and significant investments. In 2024, the region invested US$2.4 billion in global AI-related climate tech, nearly 2.5 times the US$969 million invested in 2023.

Autonomous vehicles dominated AI-related investments, accounting for US$2.3 billion (96%) of the total AI funding in 2024 - a significant rise from US$800 million (82%) in 2023. Notably, the region's US$2.2 billion investment in Nio in 2024 marks the largest contribution to autonomous vehicles within the AI-driven smart mobility segment. In the region, the UAE plans to establish a state-of-the-art research and development (R&D) centre in Abu Dhabi to focus on autonomous driving and artificial intelligence advancements and CYVN Holdings’ partnership with Nio underscores this regional agenda to achieve transformative goals in the smart mobility sector4.

Globally, AI-driven climate-tech organisations have also attracted substantial investment, accounting for 7.5% of all climate-tech investment in 20235, amounting to US$5 billion. In just the first three quarters of 2024, this went up to 14.6% of total climate-tech investments, worth US$6 billion.

Sovereigns lead the charge

In the Middle East, government grants and incentives have historically played a key role in catalysing innovation. In our earlier publication, the 2023 Middle East Climate Tech report, we had discussed that there is a significant opportunity in the region to develop innovative solutions that can contribute to global climate efforts - and that Sovereign Investment Funds (SIFs) have a huge potential to support local entrepreneurs and play a key role in driving this. In fact, the recent COP28 summit in the UAE saw the announcement of ALTÉRRA6, a US$30 billion climate focused fund, domiciled in the Abu Dhabi Global Market, receiving the support from the UAE government.

This year, the 2024 PwC Pitchbook analysis7 indicates an active participation of SIFs as unique investors in the global climate tech landscape, despite the number decreasing from 98 to 47 over the past 12 months. Funding from unique Middle East investors amounted to US$3.55 billion in 2024, down from US$5.02 billion in 2023.

In fact, the top three investors represent over 89% of the total investment value, which was similar to the 12-month period leading up to Q3 2023, with Abu Dhabi government-owned investor CYVN taking over the top position, Ayar Third Investment Company - a subsidiary of Saudi PIF - retaining its position as the second largest investor into climate tech. While Qatar Investment Authority strengthened its overall investment to move into the third position.

The largest number of deals were with US-based innovators (21 deals), followed by UAE-based climate tech companies (15 deals), indicating that Middle Eastern SIFs are playing a significant role globally.

Beyond SIFs, regional VCs are also contributing to the climate tech space. Notable investments include US$3.75 million by Oryx into Grubtech within the energy sector and US$2.67 million each by the Dubai Future District Fund and Global Ventures into iyris within the FALU sector.

Funding gaps in high-emission sectors remain

Middle East climate tech investments point to significant funding gaps globally and within the region, particularly in sectors critical for decarbonisation, such as industrial manufacturing, FALU and energy. These gaps reiterate the need for a more balanced and targeted approach to align investments with high-emission sectors that can drive impactful change.

Between 2023 and 2024, the majority of the regional funding was targeted towards the electric mobility sector, globally (Figure 7.1). Funding by Middle East investors into the region’s mobility sector, however, dropped sharply, from US$47 million to just US$2 million during the same period. This decline is striking, as mobility contributes 16% to the region's emissions. However, despite the reduced investment in homegrown mobility solutions, interest has remained globally in the mobility sector, with global investment trends suggesting that Middle East investors are exploring more proven technologies to bolster the capacity and technical skills in the EV industry within the region.

Middle Eastern investments in the energy sector globally grew significantly, increasing from US$173 million in 2023 to US$442 million in 2024. Despite this growth, energy funding still falls short relative to the sector’s contribution to 14% of global emissions. At the regional level, investment in energy by regional investors saw a decline from US$22 million in 2023 to US$13 million in 2024. Given that energy accounts for 45% of the Middle East's emissions (Figure 7.2), these levels are far from sufficient. This disparity suggests a critical underinvestment in one of the region’s most significant sources of emissions.

On a positive note, however, we see a renewed emphasis on energy deals by regional players, driven by strategic initiatives like the UAE’s Energy Strategy 2050. High-profile acquisitions, such as Masdar’s investments in the US, Spain and Greece, highlight the region’s commitment to strengthening its global energy leadership, as explored in our latest Transact Middle East Report - Mid year updates.

In the industry, manufacturing and resource management (IMRM) sector, global investment from the Middle East plummeted 74% from US$103 million in 2023 to US$27 million in 2024, while regional funding by Middle East investors increased modestly, from US$6 million to US$18 million. Although the regional growth is promising, it remains far below the sector’s share of 28% of the Middle East’s emissions. Globally, the steep decline in IMRM investment indicates a lack of focus on decarbonising this critical sector.

In FALU, global investments from the Middle East halved from US$400 million in 2023 to US$200 million in 2024, despite the sector contributing 22% to global emissions. Meanwhile, regional funding into local FALU climate tech companies by Middle Eastern investors showed modest growth, increasing from US$2 million to US$11 million. However, a pressing concern remains: the need for significantly greater investment in sustainable practices and the integrated management of water, land and food systems to ensure long-term food security for the region.

The built environment sector, which accounts for 16% of global emissions and 9% of regional emissions, has seen minimal investment both globally and regionally. Global funding remained flat at US$30 million in both 2023 and 2024, while regional investments by Middle East investors remain negligible. This indicates a critical gap in funding for sustainable urban development and energy-efficient infrastructure - areas essential for achieving decarbonisation targets.

Sonia Weymuller, Co-Founder and General Partner, VentureSouq, notes, “There exists a critical funding gap across the capital stack in the Middle East. While global investments from the region are concentrated around mobility and some areas of food and agriculture, other high-emission sectors such as industry, manufacturing, resource management, land use and the built environment still remain underfunded especially at the early stages."

Bridging these gaps in the region will require a strategic reallocation of capital to ensure that both global and regional investments align with the sectors that have the greatest potential for emissions reduction and long-term impact.

According to Vijay Bains, Group Chief Sustainability Officer, Emirates NBD, "When we examine the climate tech stack, it becomes clear that investments are not always aligned with the priorities needed to achieve net zero. Sectors like agriculture, construction and manufacturing remain significantly underfunded."

A cautious global engagement

When it comes to global investment into Middle East climate tech sectors, Pitchbook data analysis reveals a downward trend, as levels decrease by 41% from US$193 million in 2023 to US$114 million in 2024. This marks a sharp drop from the 2022 peak of US$895 million, primarily driven by decreased investment in the region's mobility and energy start-ups, despite mobility being a critical area of growth in the region. In the mobility sector, global investment plummeted by 77%, while the energy sector experienced a significant 75% decline between 2023 and 2024.

AI-related climate-tech companies in the Middle East attracted US$47.3 million in global investments in 2024, a significant increase from the US$5.4 million raised in 2023. However, this figure represents only a small fraction of the US$6 billion invested in AI start-ups globally, during 2024, highlighting the region's untapped potential in the sector.

Within the Middle East, the GCC is positioning itself as a global AI leader, driven by robust ICT infrastructure, making the region an attractive hub for top AI firms and talent, as explored in our latest Middle East Economy Watch. Key investments like Microsoft’s US$1.5 billion in G42 and Mubadala’s US$500 million stake in Anthropic, highlight a focused approach to AI innovation.

However, global investment in other high emitting regional sectors has shown growth, with funding for FALU increasing from US$2 million in 2023 to US$17 million in 2024 and funding in infrastructure, manufacturing and resource management (IMRM) rising from US$11 million in 2023 to US$50 million in 2024.

The total number of Middle East climate tech companies receiving global investment has also decreased, from 75 in 2023 to 49 in 2024 and dealmaking has been slower, with the number of deals declining from 95 in 2023 to 59 in 2024. Despite this, average funding per company invested in has risen, from US$2.6 million in the previous period to US$3.1 million in the current period, reflecting the broader trend of fewer but larger deals.

High-profile investments include US$30 million for Tenderd in the UAE’s IMRM sector, US$20 million for Immensa in Saudi Arabia’s IMRM sector, US$16 million for iyris in the UAE’s FALU sector and US$16 million for Wize in the UAE’s mobility sector.

Net Zero Future50 innovators: Driving innovation and impact

Last year, PwC Middle East’s Net Zero Future50 report identified 50 pioneering technology solutions, led by diverse founding teams, as key drivers of decarbonisation in the region and ripe for investment to scale. Over the past 12 months, several of these companies have secured new investment from global and regional sources and have their sights set on further growth in 2025:

Regional innovator, iyris (formerly RedSea Farms), has advanced sustainable agriculture in hot climates with cutting-edge technologies and go to market collaborations. Its innovative heat blocking products and resilient plant genetics are part of its ongoing commitment to empowering farmers to mitigate the impact of climate change and address food security concerns.

UAE-based Grubtech has optimised food industry operations to reduce waste and environmental impact, expanding globally with a new European headquarters.

Olive Gaea has enhanced its Zero platform to help financial institutions manage emissions and drive transition financing, solidifying its role as a key player in climate tech.

Oman’s Innotech has tripled its revenue, revolutionising construction with 3D printing technology that cuts carbon emissions.

The work of these trailblazers continues to highlight the transformative potential of regional innovation in addressing global climate challenges.

"Aligning agendas across innovators, entrepreneurs, industries and governments is essential to creating an integrated impactful innovation ecosystem capable of delivering real-world solutions. Creating numerous programmatic linkages, organic and inorganic, is also vital to activate the ecosystem. In the case of deep tech ecosystems, a stronger pipeline of tech entrepreneurs is also needed to complement institutional R&D in taking a larger flow of tech innovations from lab-scale to market-ready solutions."

Opportunities rise to support homegrown talent and accelerate local innovation

In the Middle East, the UAE, Saudi Arabia and Qatar together funneled US$3.49 billion into climate tech outside the region, while their combined investment at home was a mere US$35.67 million. This indicates a missed opportunity to nurture and scale homegrown climate tech innovation in the Middle East, leaving the region underfunded despite its vast potential.

To meet the escalating need for decarbonisation - which must now move 20 times faster to limit global warming to 1.5°C - targeted investments are essential.

How can we align ambition and scale impact?

By embracing these strategies, the Middle East can lead the charge in addressing regional and global challenges, establishing itself as a hub for climate innovation. Now is the time to more effectively mobilise capital, close funding gaps and use technology to transform climate ambition into meaningful action.

Contact us

Partner and Sustainability Leader, Strategy& Middle East

Jon Blackburn