In the first half of 2024, the consumer markets industry in the region experienced several challenges, including uneven inflation across the region, high interest rates and the on-going geopolitical instability, which affected consumer sentiment in the region. Despite these challenges, there is a growing appetite from international large corporations and private equities in the consumer market sector in the region with more deals in the pipeline. This is particularly driven by the momentum of digital shopping which continues to grow in the region with retailers in the GCC increasingly implementing omnichannel strategies to cater to the evolving needs of consumers.

Introduction

The Middle East began 2024 on an optimistic note, with expectations of resilience and growth in the mergers and acquisitions market. This sentiment has been driven by strong investor confidence in the region and a higher projected growth rate than the global average , according to the IMF. Despite a global slowdown in deals, uncertainty about interest rates and market volatility, the region’s dealmaking activity has managed to not only weather the storm but, in some cases, thrive amidst it. This highlights the Middle East's unique position in the global M&A landscape.

The region has remained resilient, strengthened by strategic government initiatives focused on economic diversification, green economy initiatives, tech advancements, and an emphasis on localisation and value creation. As private equity (PE) deals in the region increase steadily, sovereign wealth funds (SWFs) with ample reserves continue to drive deal volumes and foster growth in emerging sectors. Moreover, voluntary oil production cuts from OPEC+ countries in the last year raised oil prices, supporting diversification initiatives and enhancing market stability in the region, positioning the Middle East as an attractive hub for dealmaking.

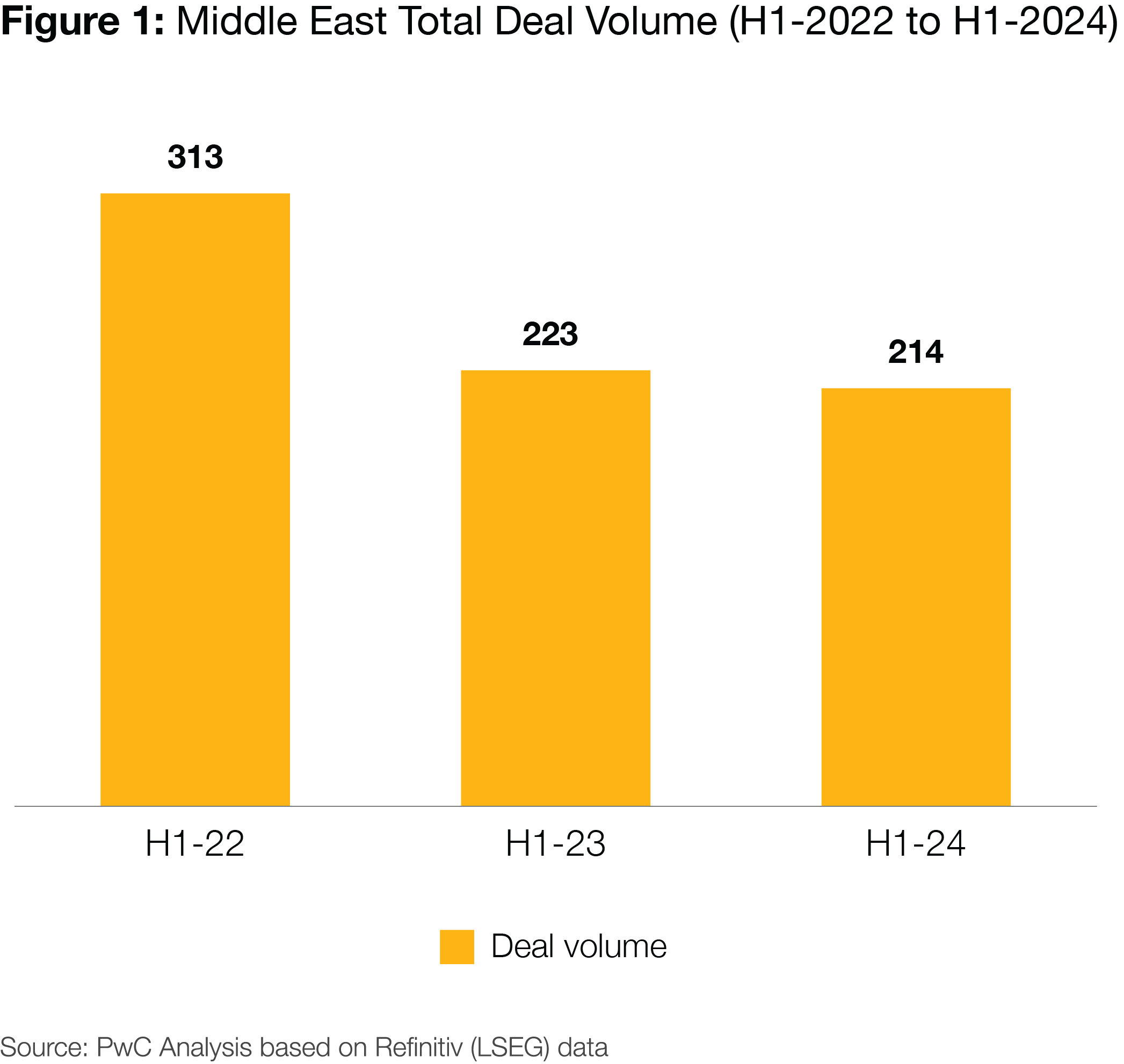

Overall, M&A deals in the region in H1-2024 stood at 214 - a 4% decline from H1-2023, compared to a 25% drop globally. This divergence from global levels underscores the Middle East's ongoing resilience, standing out against other regions despite shared macroeconomic challenges and complex geopolitical factors.

Country highlights

Our analysis reveals that in the first half of the year, the UAE, Saudi Arabia and Egypt continued to dominate deal activity in the Middle East, collectively accounting for 189 deals or 88% of total deal volume in the region (Figure 4). The UAE and Saudi Arabia, in particular, continue to be seen as key pillars for deal making in the region, supported by robust economic fundamentals and proactive government initiatives aimed at economic diversification and attracting private investment.

Also in a slight deviation from global trends, we see that the UAE and Saudi Arabia maintained very similar deal volumes compared to H1-2023, while Egypt noted a 21% increase in deals during the same interval, following a significant economic turnaround this year, driven by a US$35bn investment from the UAE, which enabled key reforms like currency liberalisation, helping to reduce inflation. The rest of the region, however, witnessed a 39% decline in deal volume - aligning more closely with global trends.

In the UAE, deal activity was robust across various sectors, such as industrial manufacturing, technology, consumer markets and financial services. The financial services sector recorded the largest deal in the region during the half-year period: a US$2.196 billion in-kind dividend distribution to shareholders by Agility Global PLC, representing 49% of its issued share capital.

Saudi Arabia also saw a similar trend across various sectors, including industrial manufacturing, consumer markets, financial services and energy. A key transaction was Qassim Cement Company’s US$378 million acquisition of Hail Cement Company via a share-swap, reflecting the ongoing construction boom ahead of the 2030 Expo and the 2034 FIFA World Cup bid. The Kingdom’s prominence within the region’s capital markets remains strong, with 10 out of the 13 GCC IPOs in Q2-2024 occurring on the Tadawul Main Market and Nomu Parallel.

Meanwhile, efforts by GCC countries to support Egypt’s economic recovery and foster further regional stability and growth continue to play out by way of extensive prospective foreign direct investments into the country, highlighting a potential for a further uptick in dealmaking in the country, particularly in the infrastructure and real estate, healthcare, tourism and financial services sectors.

Sector highlights

Looking ahead

The Middle East’s M&A landscape remains resilient as the region continues to attract investment, particularly in key sectors such as energy, financial services, and technology, underscoring its commitment to innovation, sustainability, and long-term growth.

As we progress through the year, improved global macroeconomic conditions could further help accelerate deal momentum, while in the region dealmakers need to adapt to evolving regional dynamics that could significantly impact M&A activities.

Key considerations for dealmakers include aligning M&A strategies with national economic plans like Saudi Vision 2030 and UAE Centennial 2071, and leveraging AI and GenAI technologies for more efficient deal execution. While geopolitical complexities remain, emerging sectors like AI, green energy, and healthcare offer significant growth potential, positioning the Middle East as a dynamic hub for international investment and strategic dealmaking.

2024 mid-year M&A insights

2024 TransAct Middle East Report - Mid year updates

Contact us

Imad Matar

Partner, Transaction Services Leader, PwC Middle East

Tel: +966 (11) 211 0400 (ext 1501)