Understanding carbon credits

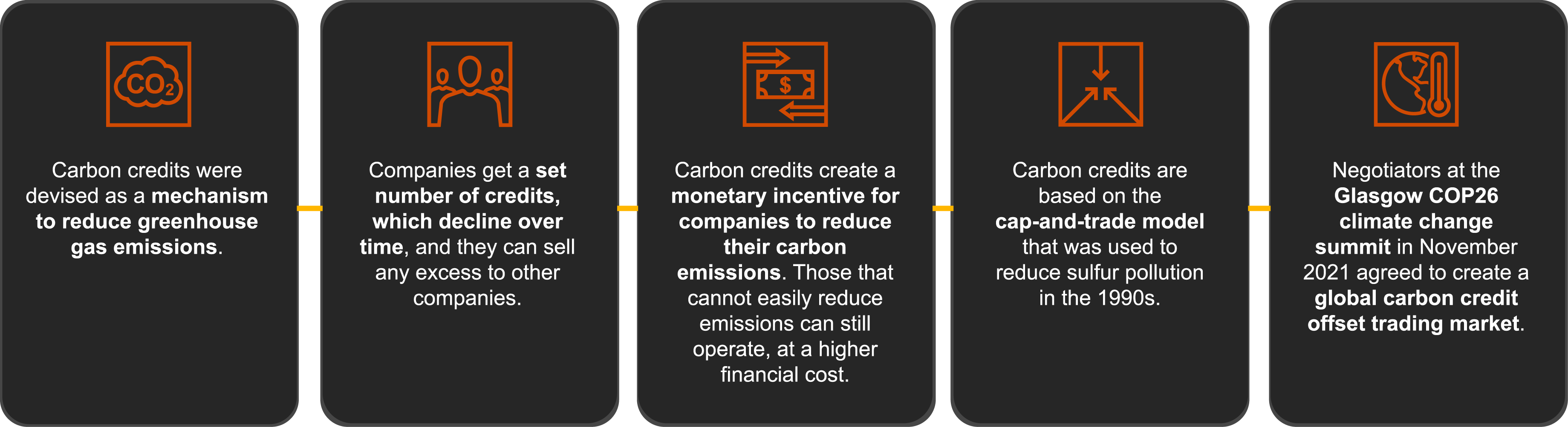

Carbon credits, also known as carbon offsets, are permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gases. The direct relationship between sustainability and human prosperity prompts us to reimagine possibilities to integrate sustainable considerations, preferences, and practices in our day-to-day life.

This chart illustrates the projected increase in demand for carbon credits over the coming decades, highlighting the urgency and potential for market growth.

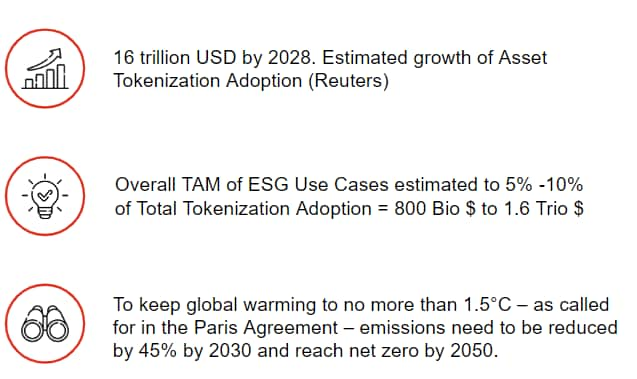

Carbon credits and tokenisation in numbers

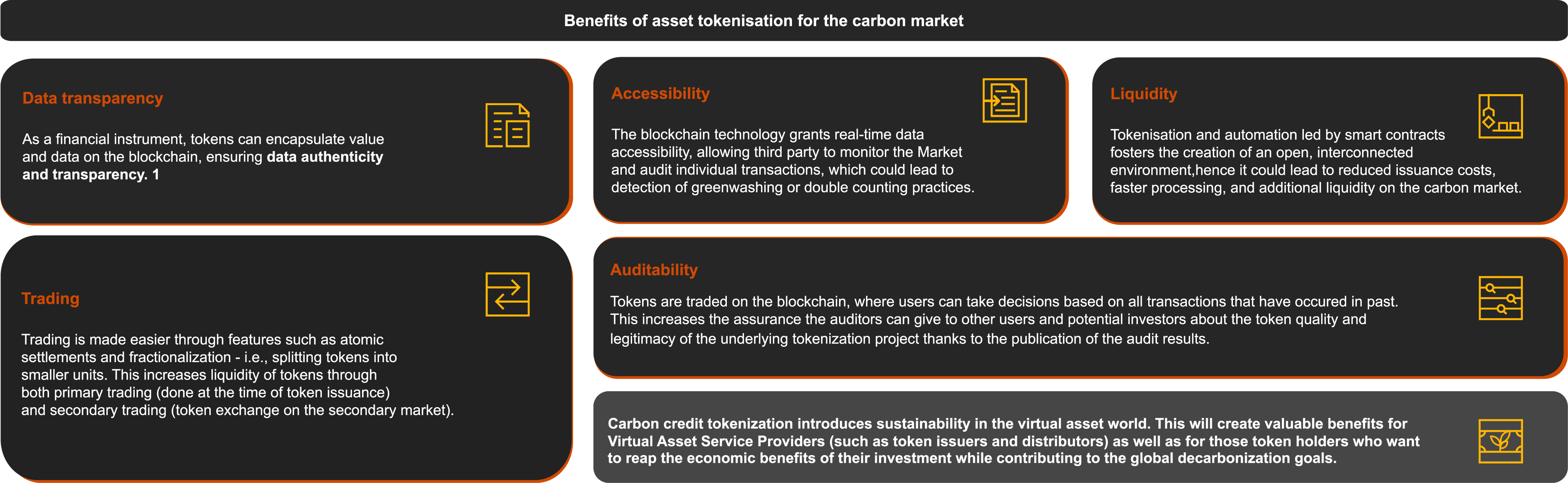

The Transformation through tokenisation

tokenisation increases data transparency and traceability, hence it may become a suitable way of reducing GHG emission double counting and greenwashing issues.

The Role of Banks in Carbon Credit tokenisation

Banks have a significant role to play in the emerging Carbon Credit tokenisation market, acting promptly can position them as game-changing players in the Virtual Assets space.

Opportunities for the Banks

The tokenisation of carbon credits opens a plethora of opportunities for banks, including the introduction of new financial products like tokenized securities, green bonds, and structured products linked to the tokenized carbon credits.

Ecosystem Creation

Banks have the opportunity to create an ecosystem offering their clients and partners wishing to offset their carbon exposure with an access to a secure and user-friendly marketplace. The marketplace would provide the capability to efficiently evaluate, buy, exchange and redeem carbon credits

Increase Trust

Banks act as a facilitator by sourcing trustworthy and quality carbon credits projects before tokenizing new tokens and listing them on the platform. Clients can trust the bank for performing due diligences on multiple projects which ultimately reduces the risk of greenwashing

Price Discovery

The OTC Bulletin Board and/or order books available for clients to trade on the primary and secondary market will improve access to liquidity and generate a better and more transparent price discovery mechanism

Fulfil ESG Commitments

Banks can capture ESG opportunities and remain aligned with the different commitments taken by their respective boards. They can also strengthen the relationships with their key clients who also need to reach their own ESG targets

Product Innovation

Carbon credit tokenisation offers the opportunity for banks to create hybrid financial products such as carbon baskets, tokenized structured products and green bonds. Powered by DLT and smart contracts, those new

products would be more accessible and offer a more seamless process for issuers as well as increased portfolio diversification to clients

Network Effect

Banks can create a network effect by building consortiums or partnerships with other banks as well as other companies wishing to be actively involved in the ESG space. The growth of the ecosystem would also further support the supply of quality projects

Carbon Credit tokenisation : Fils’ Use Cases

Fils' enterprise-grade digital infrastructure enables businesses of all sizes to embed sustainable and climate action into their business models and customer journeys across industries.

Case Studies

AirCarbon Exchange (ACX)

ACX has established the world's first regulated carbon exchange and clearinghouse, leveraging tokenisation to enhance efficiency and transparency in carbon trading.

Project Genesis 2.0

Led by the BIS Innovation Hub, Genesis 2.0 explores the integration of blockchain and smart contracts for digital carbon offsets with green bonds, enhancing transparency and accountability in green project financing.

Contact us

Serena Sebastiani

Virtual Assets Financial Services Consulting Lead, PwC Middle East

Oliver Sykes

Partner, Blockchain, Technology, Cybersecurity, PwC Middle East

Alexandre Tabbakh

Virtual Assets Specialist, PwC Middle East

Gianluca Masini

Virtual Assets Strategy & Ops, PwC Middle East