The velocity of business is accelerating, with competitive advantage being short-lived. Organisations can no longer simply rely on long term strategies to sustain competitive advantage. Businesses who sense and respond faster than the competition will be those that will gain strategic advantage. So the need for agility and scalability is key, which must translate to all the layers of the organisation including infrastructure provisioning, and operating.

Cloud computing offers on-demand (and virtually unlimited) IT resources that can be rapidly deployed at scale. With usage based pricing, cloud computing offers the flexibility to only pay for the specific duration resources are consumed for.

Therefore, cloud services come as an answer to the need for agility and scalability, looking to replace the rigidity of legacy systems and infrastructure, with modern abstracted on-demand environments and services to act as a catalyst for transformation and innovation.

Why is it important for specifically banks to adopt Cloud?

Our Cloud Business Survey reflected that 66% of Financial Services organisations are turning towards Cloud for growth and innovation. The various benefits and gains demonstrated in markets where Cloud services have been more readily available and the regulations actively support the use of Cloud have served as ambassadors globally.

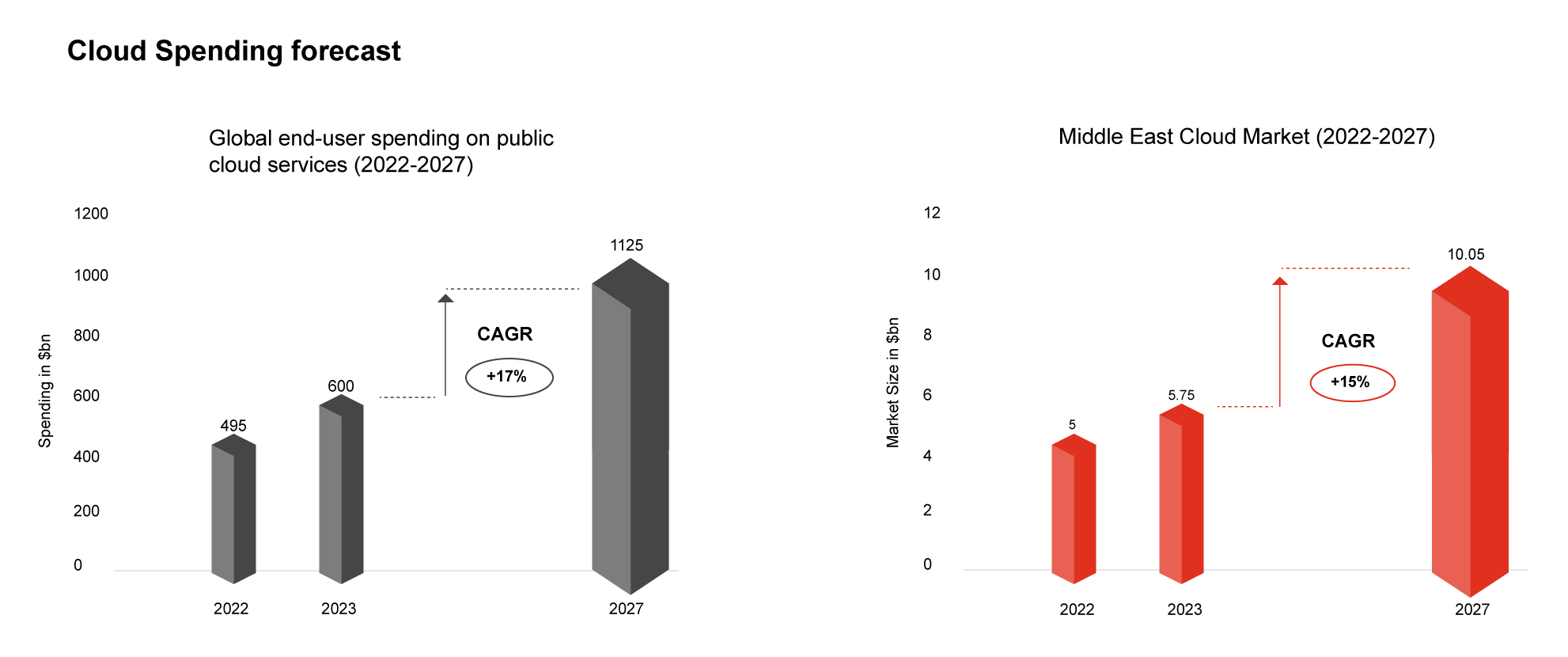

While the availability of services has been scarce in the GCC region, with hyper-scalers slowly launching their data centres, the ambition has been growing among financial services organisations, making it a difficult topic to ignore while progressing with the transformation agenda.

Even without a public cloud solution, a private cloud strategy can kickstart the journey and support the modernisation and readiness for the future move to the public Cloud, which is definitely coming.

Cloud provides access to an ever-growing variety of built-in features and services, such as data lakes and related analytics and AI capabilities. The organisation can pick and mix these as needed, to enable it to innovate quicker and like never before. Unlimited capacity, that organisations can scale up and down on quickly, as their needs change.

Cloud also reduces the foundational technical and operational complexity from organisations, so they can focus on their real job. With less dependency on internal IT, technology strategy can be more business-led and easier to achieve than ever before.

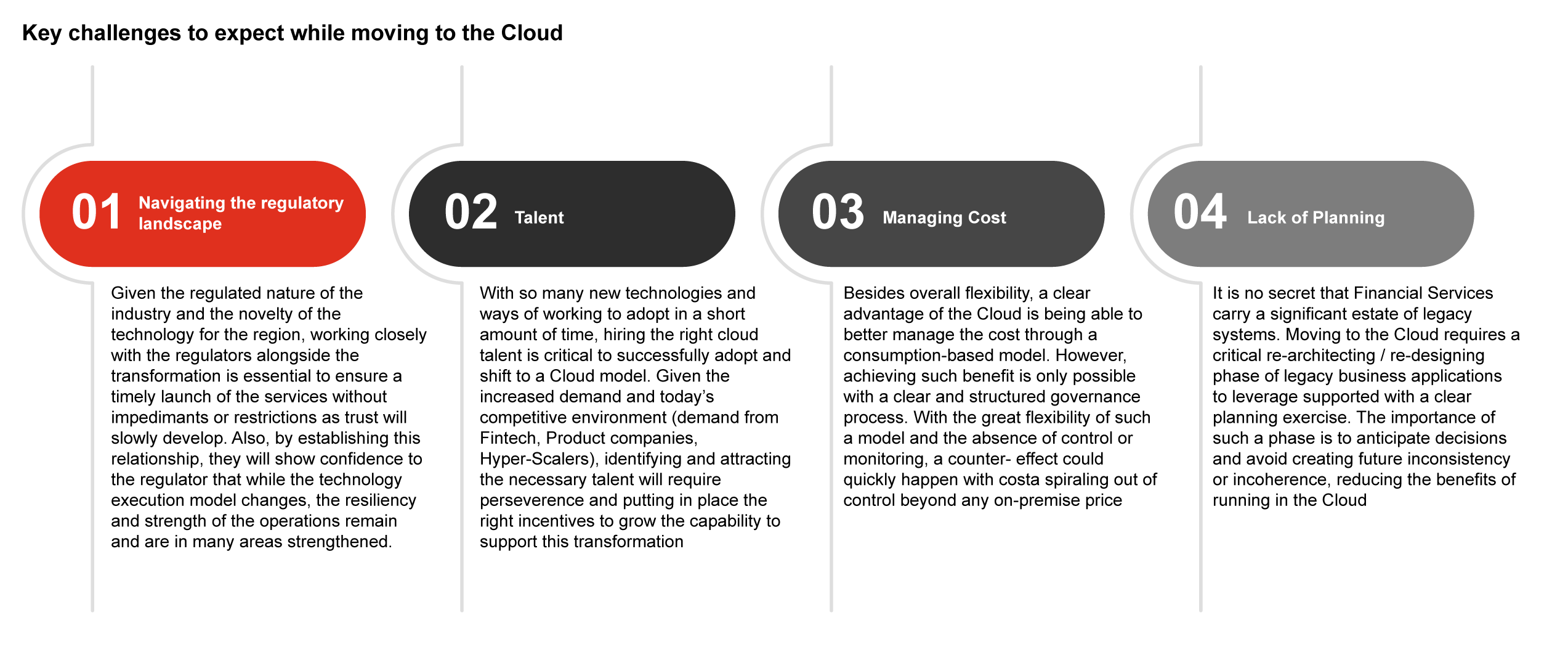

Cloud transformation within the Financial Services industry in the region is only getting started. With regulations continuously evolving and more providers arriving in the market, moving to Cloud services is becoming a reality. Still, many challenges pave the journey, and they will require careful consideration. Below are highlighted some of the key challenges that Financial Services institutions can expect:

Cloud is not only a technology play - moving to the Cloud implies core changes to the whole organisation from business to operation.

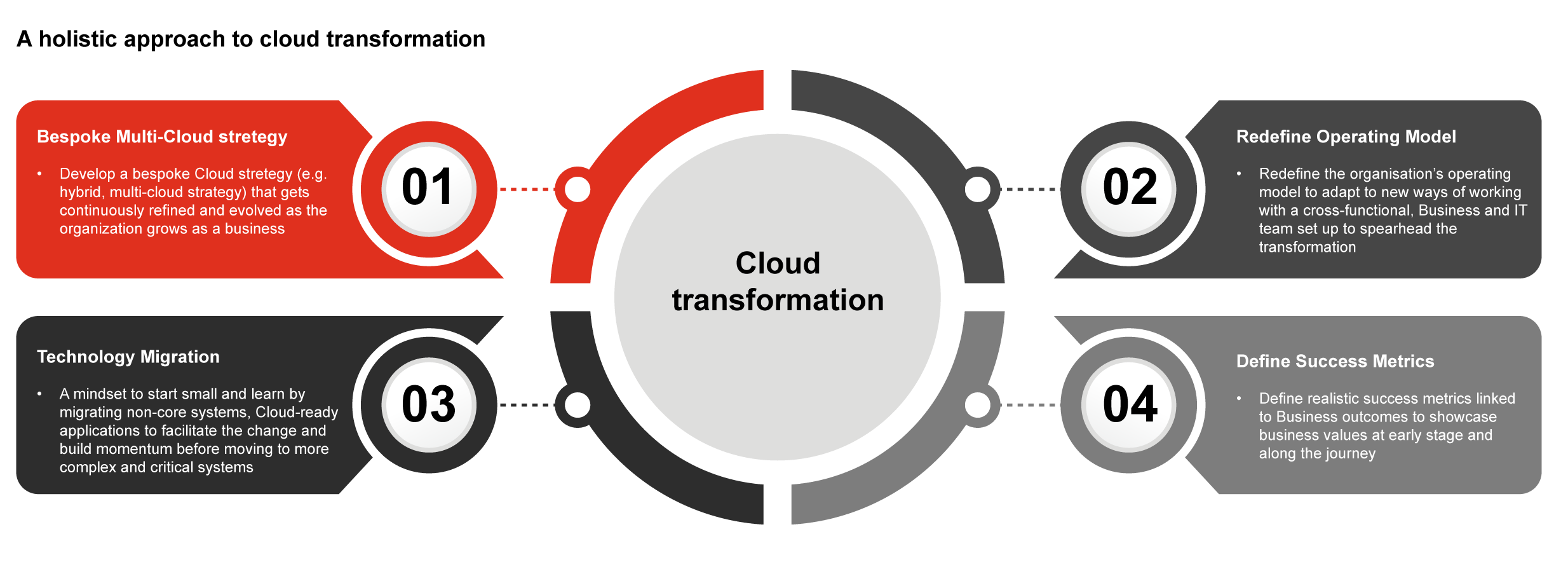

Financial institutions will need to take a holistic approach towards their transformation by looking at the following:

Most importantly, Cloud transformation should be viewed as an on-going journey and not a milestone.

For the Financial Services Industry embracing cloud has become foundational in providing digital-first, context appropriate experiences. The industry is being reshaped by FinTech and cloud is the underlying engine powering cutting edge innovations and scale.

The overall cloud adoption is expected to increase exponentially in the Middle East in the next five years driving strategic change and bringing disruptive innovation while unlocking new sources of value. Moving to the Cloud is a journey that requires a shift in the organisation’s DNA - business models, processes, ways of working and technology but can provide great returns.

How can PwC help?

We can help to accelerate business outcomes across the enterprise with our suite of cloud-powered solutions: