Electric vehicles have to be available in the mass market.

01 Executive summary

The UAE has identified the electrification of mobility (eMobility) as a priority policy area and is now seven years into an ambitious plan to decarbonise its infrastructure and energy production. Under the Energy Strategy 2050, the country is pursuing a combination of renewable and nuclear energy sources to achieve carbon neutrality by the middle of this century. The adoption of electric vehicles is a critical element in this transition to a low carbon economy, and is the focus of this report.

The UAE’s transition to eMobility

Public policy is a vital element in the UAE’s transition to eMobility. The country has already converted 20% of its federal government agency vehicles to EV powertrains and initially set a target for at least 30% of public sector vehicles and 10% of all vehicles on the road to be electric (EV or hybrid) by 2030. That was supported by government incentives such as free registration, free parking and reduced charging and toll fees for EVs.1

This target was updated in 2023 when the UAE Minister of Energy and Infrastructure announced during COP28 that the UAE aimed to have electric and hybrid vehicles accounting for 50% of all vehicles on its roads by 2050, alongside the tripling of power generation capacity from renewables.2

Dubai in particular already has a rapidly growing number of EVs on the road. According to the Dubai Water and Electricity Authority (DEWA), there were 25,929 electric vehicles (EVs) in Dubai by the end of December 2023, a sharp increase from the 15,100 EVs reported at the end of 20223. Creating a sustainable environment and infrastructure is one of the six UAE policy priorities originally set out in 2014, with the release of UAE Vision 2021.

This broad target has been developed into a series of detailed targets for 2030 and 2050, including the following targets on clean energy generation and electric vehicle adoption:

02 Achieving ambitious EV targets

The targets that the UAE has set for decarbonisation require a large-scale transition in the mobility economy that will reorient transportation away from internal combustion engine (ICE) vehicles and towards the adoption of EVs.

Across the UAE, PwC estimates that by 2030, EVs will have a market share of more than 15% (around 58,000 vehicles) of new passenger car and light commercial vehicle sales, while by 2035, the share will have increased to 25%, the equivalent of around 110,500 vehicles.

However, accelerating the share of new EV sales and achieving the targets outlined above will depend on several critical success factors:

Ensuring an ideal operating temperature to maximise the efficiency and range of electric vehicles (EVs).

EV charging infrastructure that can support the large-scale transition away from ICE vehicles must be developed.

The total cost of ownership (TCO) of EVs (a combined measure of purchase and operating costs) must be sufficiently attractive to encourage drivers to change.

The energy generation mix must shift to sustainable power generation, as EVs can only contribute to carbon emission reductions if the energy that powers them is also sustainable.

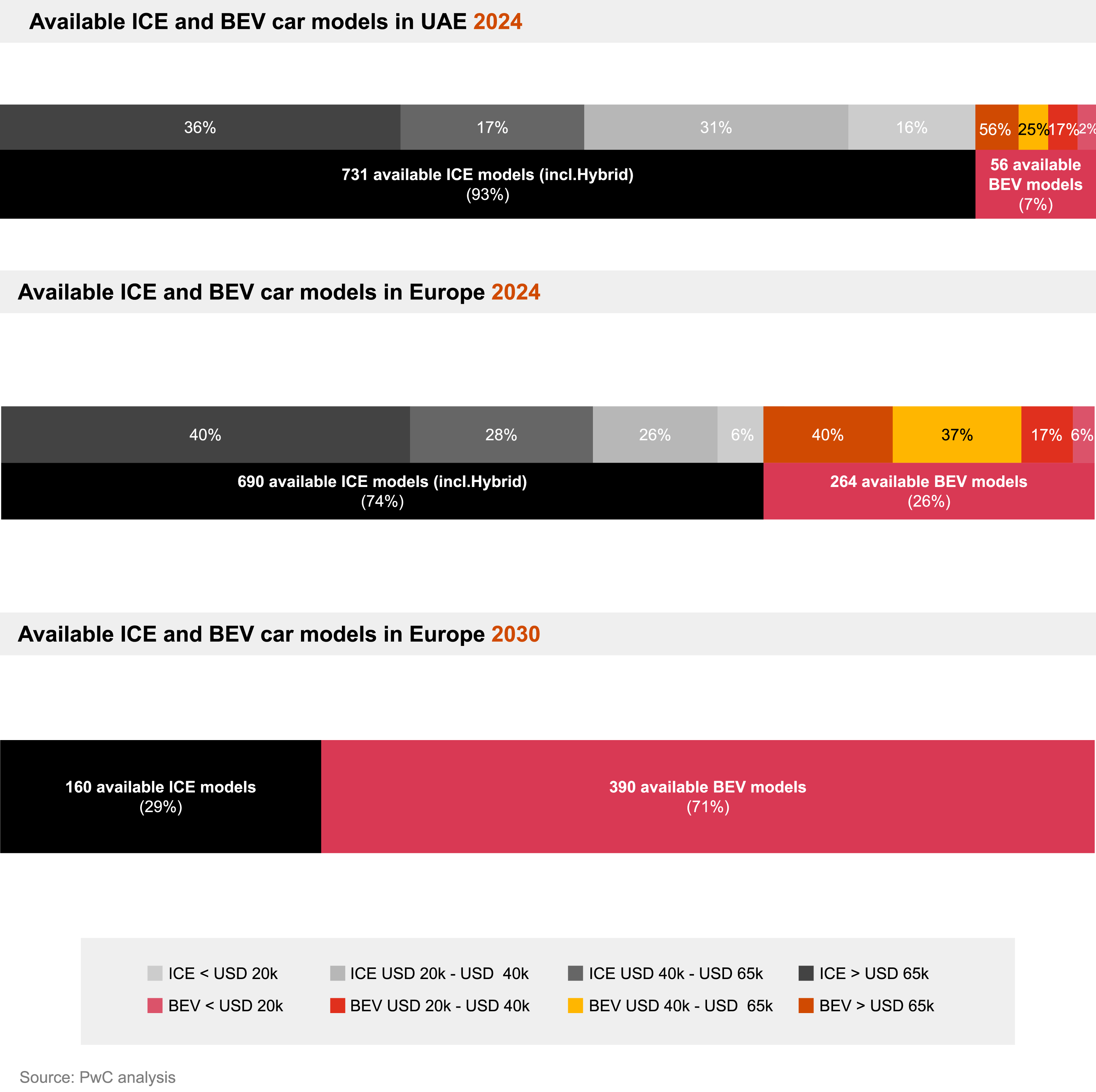

Availability

Only a small minority of the vehicle models currently offered by dealers in the UAE are EVs. More than 90% of all available models are ICE vehicles (including hybrids). By contrast in Europe, while ICE models still outnumber EVs, more than a quarter of all vehicles available are EVs and by 2030 it is forecast that more EVs than ICE vehicles will be available in the market. Auto analysts believe this rapid evolution of the European EV market is due to government electrification targets and emission reduction rules (EU regulators9 have set a target of zero emissions from passenger cars and light commercial vehicles by 2035).

Temperature

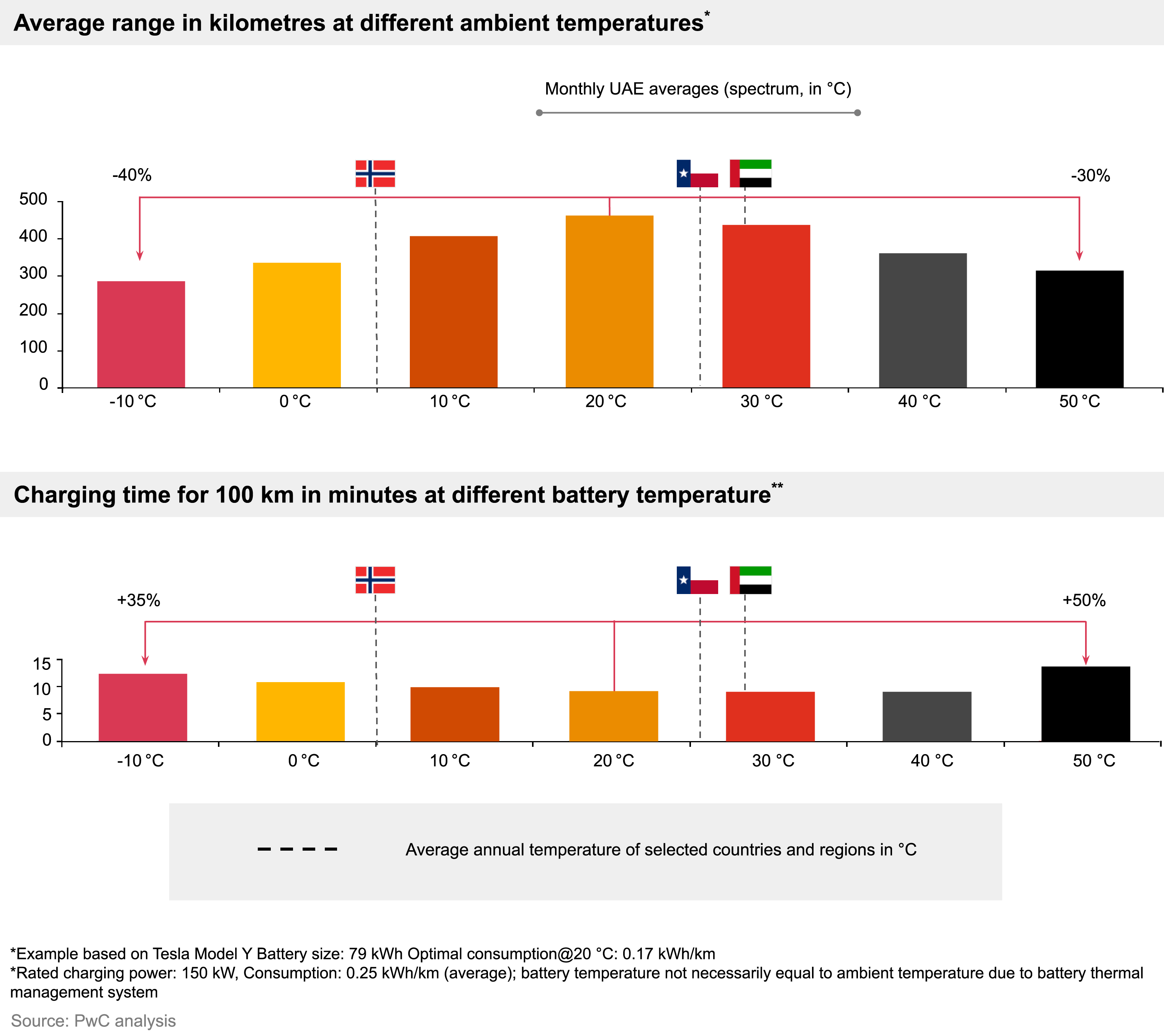

Electric vehicles are highly efficient but need an optimal operating temperature for maximum efficiency. Temperature fluctuations can significantly affect EV range and battery life: at high temperatures (which are common in the UAE summers), the electric vehicle will need to cool down its batteries for optimal performance which can impact its range and charging speed; similar at lower temperatures, EV will need to pre-heat the internals of the vehicle, such as battery, for delivering optimum performance. Therefore we need to ensure an ideal operating temperature to maximise the efficiency and range of EVs.

EVs perform best around 20°C, where minimal energy is needed for climate control. However, at higher temperatures, such as 40°C, the demand for cooling increases, and the total range of the vehicle decreases by almost 23%. For example, an EV that can typically travel 460 kilometers on a full battery at 20°C might see its range drop to 360 kilometers at 40°C due to the additional energy required for cooling, reflecting a nearly 23% reduction in total range.

Infrastructure

Public charging infrastructure is the most significant bottleneck for rapid EV adoption in the UAE. Although the UAE has been investing heavily in renewable energy projects with a target of becoming carbon neutral by 2050, as of 2023, there were only around 2,000 public charging points deployed in UAE, and more than 65% of those were slow chargers. The gap between the current roll-out speed of public charging infrastructure and demand is set to grow. Demand is forecast to reach 45,000 charging points by 2035 if the UAE’s National Electric Vehicles Policy target for the share of EVs on the road is to be met. However, at the current rate of rollout there will only be 10,000 charging points in the UAE by 2035.

Cost

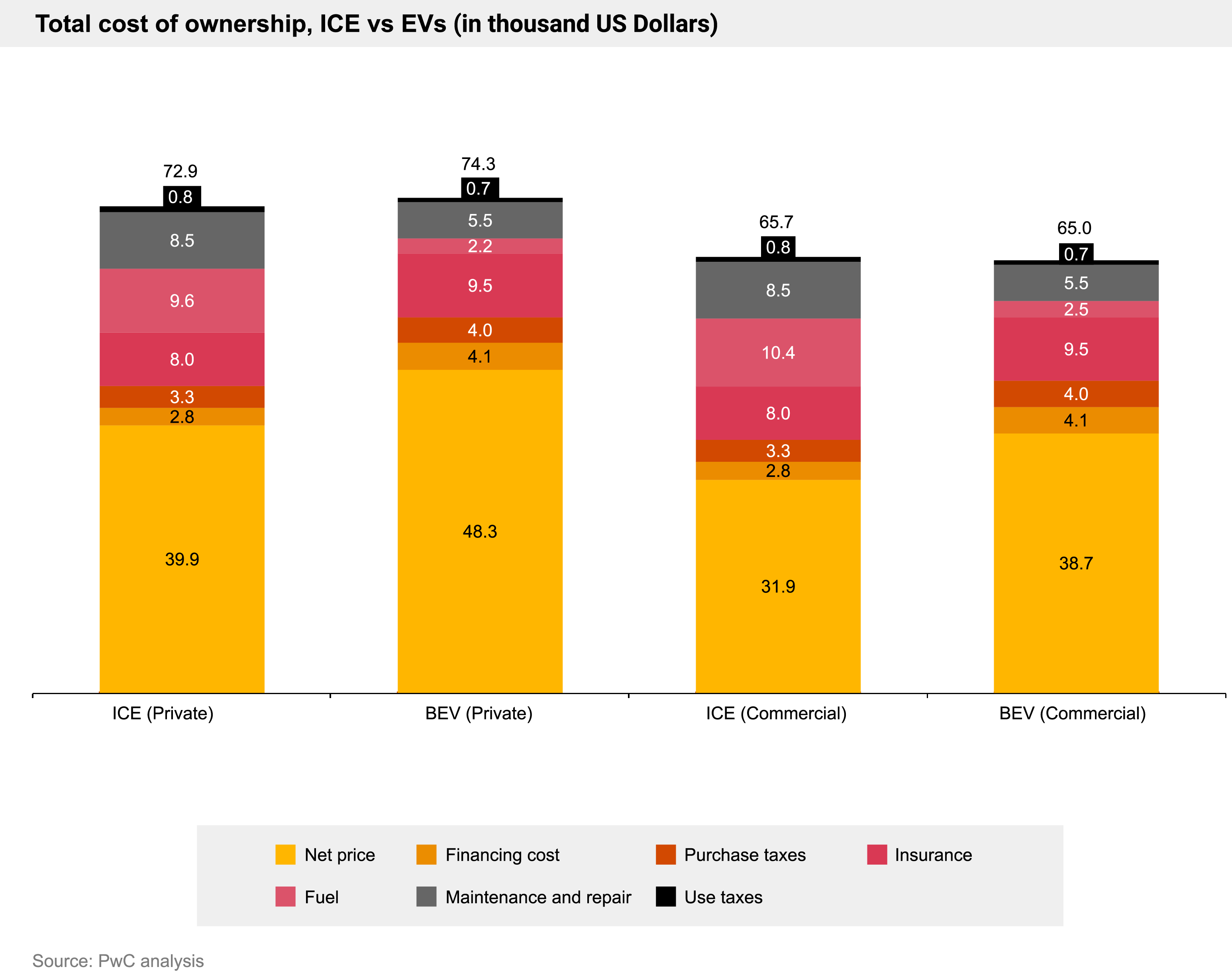

In the UAE, the total cost of ownership of privately owned EVs is marginally higher than the cost of ICE vehicles despite the lower cost of energy, primarily because the initial cost and the insurance cost is higher for EVs. However, for commercial buyers there is now a cost advantage in EVs, as vehicles are typically discounted, particularly for fleet customers who are regarded as pivotal clients and enjoy even greater discounts. The market is seeing a number of new entrants to the commercial EV market, intensifying price competition and increasing discounting as the new entrants specifically target major fleet operators.

Energy generation

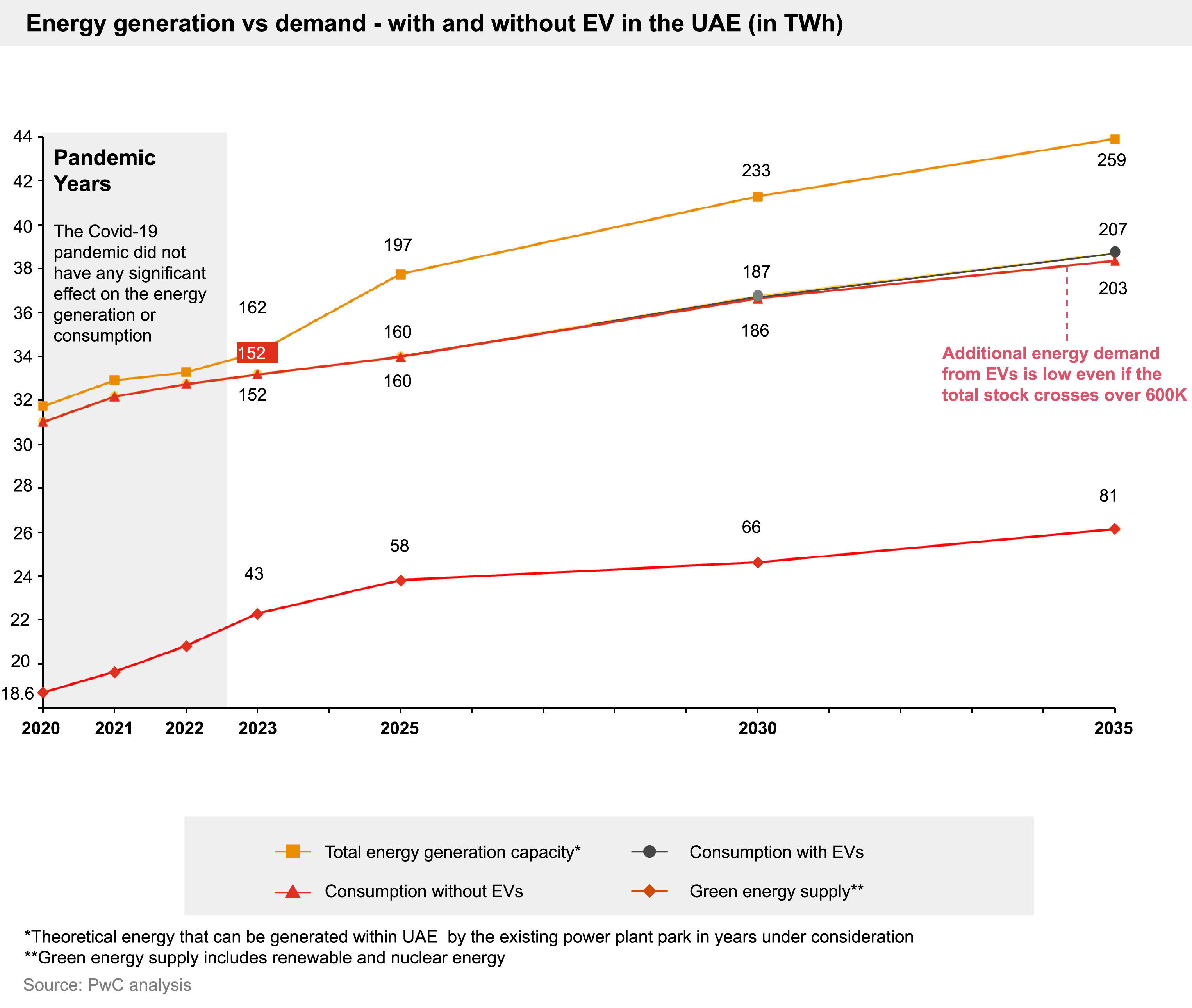

The UAE already has more than sufficient electricity generation capacity to meet demand from an increasing number of EVs on the road. It is estimated by PwC Middle East that if there were more than 600,000 EVs on the roads in the UAE by 2035 that would only add around 1.6% to overall electricity demand.

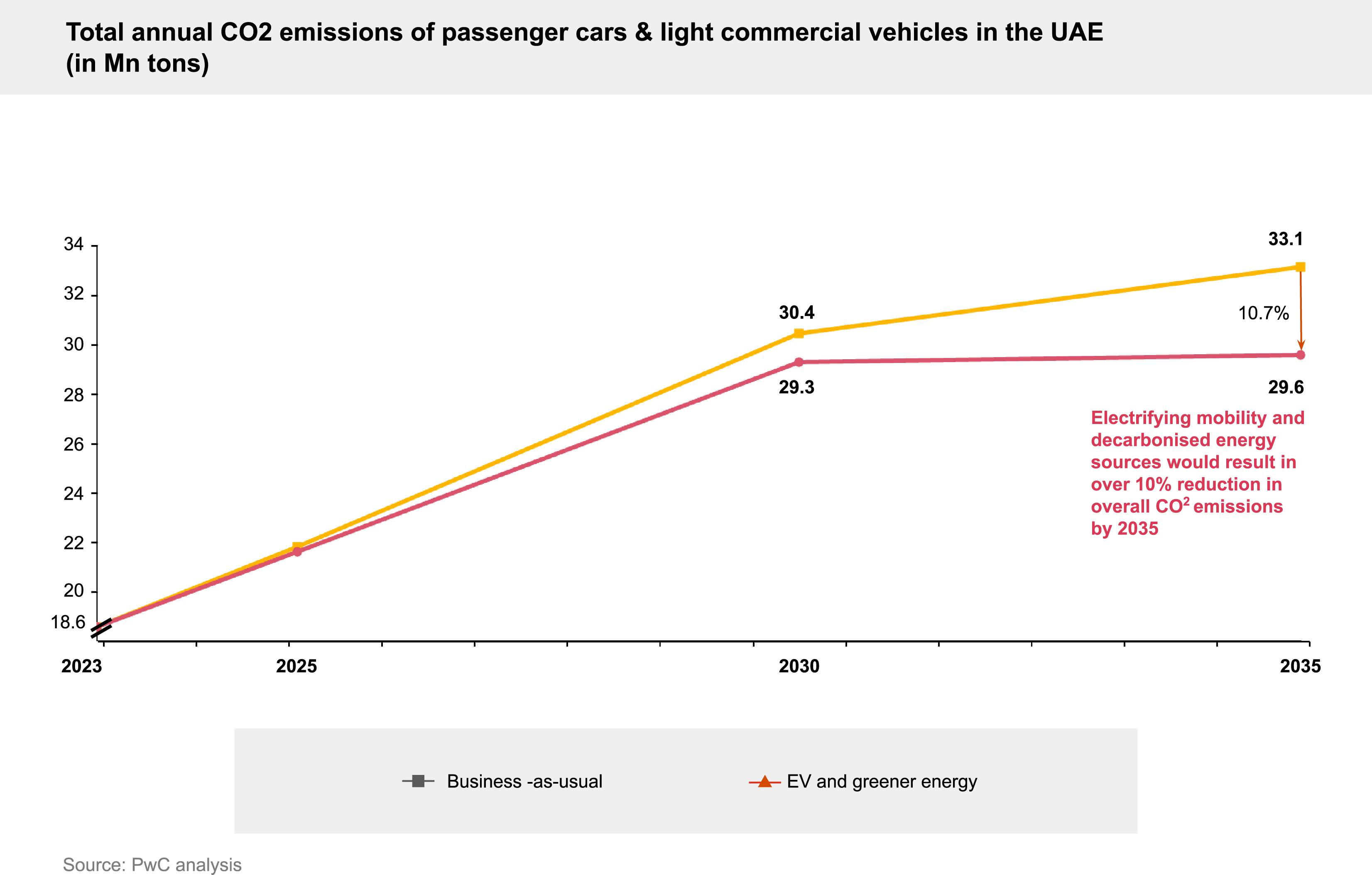

However, while forecast electricity generation is more than adequate to meet rising demand due to an increase in the proportion of EVs in the national vehicle fleet, the energy mix remains biased towards fossil fuels and as a result, the introduction of a greater proportion of EVs may not significantly reduce the country’s overall carbon emissions. To achieve significant emissions cuts the UAE will need to increase the share of green energy sources including renewables and nuclear power.

If the UAE’s EV targets for 2035 are achieved it is estimated that emissions will be almost 11% lower than if the national fleet was purely made up of ICE vehicles. Overall vehicle emissions in the country will still be higher than today however, indicating a higher proportion of EVs would be needed to bring down emissions levels.

03 Recommended key strategies

The introduction of zero tailpipe emission EVs in mobility markets represents an attractive solution to the challenge of decarbonisation - in principle. However in practice, EVs can only contribute to decarbonisation if they are widely available and attractive to buyers, if there is a charging infrastructure to support them, if the costs of ownership are competitive, and if the energy generation mix contains enough low emission power so that EVs do not merely end up creating emissions at the energy generation stage. Creating these conditions is a policy challenge for all governments.

In the UAE, we recommend following key strategies to support the increasing uptake of EVs and to ensure the supply of electricity meets the EV charging demand

The transition from fossil-fuel to electrified mobility is one of the biggest industrial and market changes of our time. As the eMobility market in the UAE matures, a combination of constructive policy and continued technology innovation to lower costs and increase efficiency has the potential to give electric vehicles a leading role in the race to meet full net zero targets by 2050.

Resources

1) https://www.trade.gov/country-commercial-guides/united-arab-emirates-smart-and-sustainable-mobility

2) https://gulfnews.com/uae/environment/50-electric-hybrid-cars-on-uae-roads-by-2050-minister-1.99661948

3) https://www.thenationalnews.com/business/energy/2024/02/04/dubai-ev-numbers-hit-nearly-26000-in-2023-amid-green-mobility-drive/#:~:text=The%20number%20of%20electric%20vehicles,Dewa%20statement%20reported%20last%20February

4) https://mediaoffice.ae/en/news/2023/July/09-07/Dubai-green-mobility

5) https://dubaievhub.ae/government-framework/regulations/

6) https://mediaoffice.ae/en/news/2023/July/09-07/Dubai-green-mobility

7) https://www.trade.gov/country-commercial-guides/united-arab-emirates-smart-and-sustainable-mobility

8) https://climate.ec.europa.eu/eu-action/transport/road-transport-reducing-co2-emissions-vehicles/co2-emission-performance-standards-cars-and-vans_en

9) https://www.agbi.com/manufacturing/2022/09/abu-dhabi-bids-to-become-electric-vehicle-manufacturing-hub/

10) https://www.agbi.com/sustainability/2023/01/uae-plans-to-build-its-first-electric-vehicle-battery-recycling-facility/

11) https://www.mdpi.com/2071-1050/16/2/770

Download the full report to discover more about :

eMobility Outlook 2024: UAE Edition

Contact us

Heiko Seitz

Global & Middle East eMobility Leader, PwC Middle East

Shikhar Gupta

Global eMobility Subject Matter Expert, PwC AC India

Dr. Jonas Wussow

eMobility Manager, PwC Middle East

Sushovan Bej

eMobility Manager, PwC Middle East

Contributors:

Pragati Mandal

Lalit Gholap

Vincent Pursian