Sustainability is emerging as a key differentiator in customer-facing sectors, including banking services. Banks have an opportunity to strengthen relationships with personal banking customers by prioritising sustainability in product innovation.

This report, in collaboration with Commercial Bank of Dubai (CBD), explores how this is transforming retail banking, driving innovation, and creating long-term value for customers.

With the rising frequency in climate catastrophes and a growing awareness around how to address climate change, we are entering a pivotal period where societal values and customer behaviours are being redefined.

We are backing our customers’ sustainability ambitions and evolving our product suite to align with these ambitions. The future is about empathising with customers on their hopes and fears to provide a more meaningful customer connection.

Mr Othman Bin Hendi

Chief Sustainability Officer

Commercial Bank of Dubai

Rising climate concerns and responsible consumption in the Middle East

Climate anxiety is rising as disasters become more frequent. People are increasingly aware of climate change's impact on their lives and future generations, leading to a consensus on the urgent need for action. This awareness is influencing consumer behaviour, with many aligning their purchases with environmental values.

PwC’s recent Voice of the climate-conscious consumer 2024 survey shows over half of regional consumers are buying more sustainable products to reduce their environmental footprint. 41% are more mindful of their consumption, and many advocate for green policies and leaders who prioritise environmental stewardship.

In the Middle East, climate concerns are driving a shift towards sustainable consumption:

- 83% of surveyed consumers noticed climate-related disruptions in the past year

- 85% are worried about climate change, with 26% feeling daily anxiety

Consumers prefer brands with lower carbon footprints and strong climate commitments, with 68% viewing this as crucial, above the global average of 52%. Sustainable consumption has become mainstream.

Eco-conscious consumers prioritise long-term planetary health over short-term convenience and financial gains, influencing their consumption, banking, and investment decisions.

Sustainability is set to disrupt the personal banking customer experience

Eco-conscious customers present a unique opportunity for banks as sustainability becomes a critical consideration for customers. Banks can establish deeper connections by addressing customers' values, especially regarding sustainability. Using digital technologies and data-driven insights, banks can develop innovative and values-aligned products and services for eco-conscious customers.

Integrating sustainability impact into products

Banks are increasingly offering value-aligned solutions in the shape of sustainable finance products from green mortgages and EV loans to green savings accounts, and carbon-tracking tools. These meet the demand from climate-concerned customers and demonstrate a bank's own commitment to international climate goals. Innovation should focus on sustainability impact to ensure new products and services resonate with customers and banks should meet the evolving needs of customers at various stages of their sustainability journey.

Sustainability maturity curve for banking

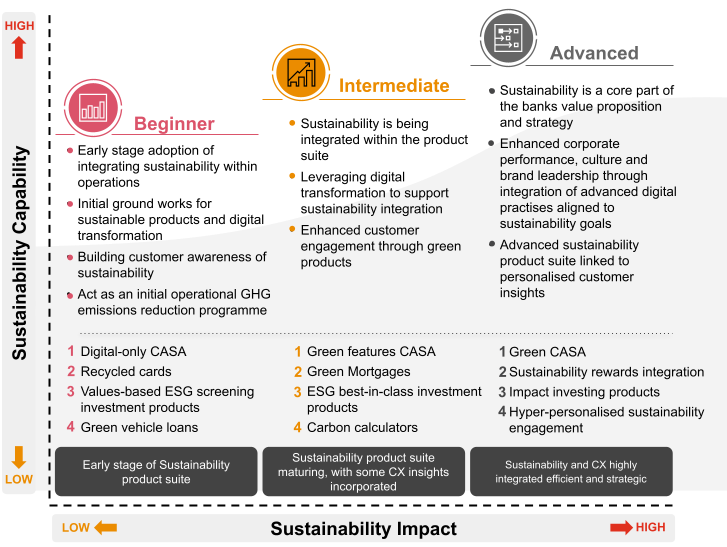

Our maturity curve illustrates how banks and fintechs, including those in the Middle East, are embedding sustainability into financial products, with differing degrees of sustainability impact depending on the sustainability maturity of internal capabilities and customers.

Creating a new customer equation

By differentiating through sustainability, banks can re-establish meaningful connections with their customers, create new revenue streams, and maintain their position as trusted advisors. In this context and considering the effort required to steer our economy towards Net Zero, banks have both an opportunity and a responsibility to CURATE a new customer equation.

To learn more about the CURATE model download our full report.

Spotlight: Commercial Bank of Dubai

Aligning banking choices with sustainability values

Commercial Bank of Dubai (CBD) has been on a sustainability transformation journey since 2022, supporting the UAE’s Net Zero 2050 Strategy. In 2023, CBD launched a US$500 million green bond and committed to carbon neutrality by 2030. CBD integrates sustainable finance into both corporate and personal banking, offering discounted loans for electric vehicles and solar panels, fully recycled debit and credit cards, and a “Green Growth Account” in partnership with Goumbook to plant mangrove trees. The challenge for CBD and other banks is to stay ahead of evolving customer expectations, particularly from Millennials and Gen Z, while maintaining relevance in a competitive financial landscape.

Contact us

Henna Sakia

FS Consulting ESG and Climate Risk, Manager, PwC Middle East