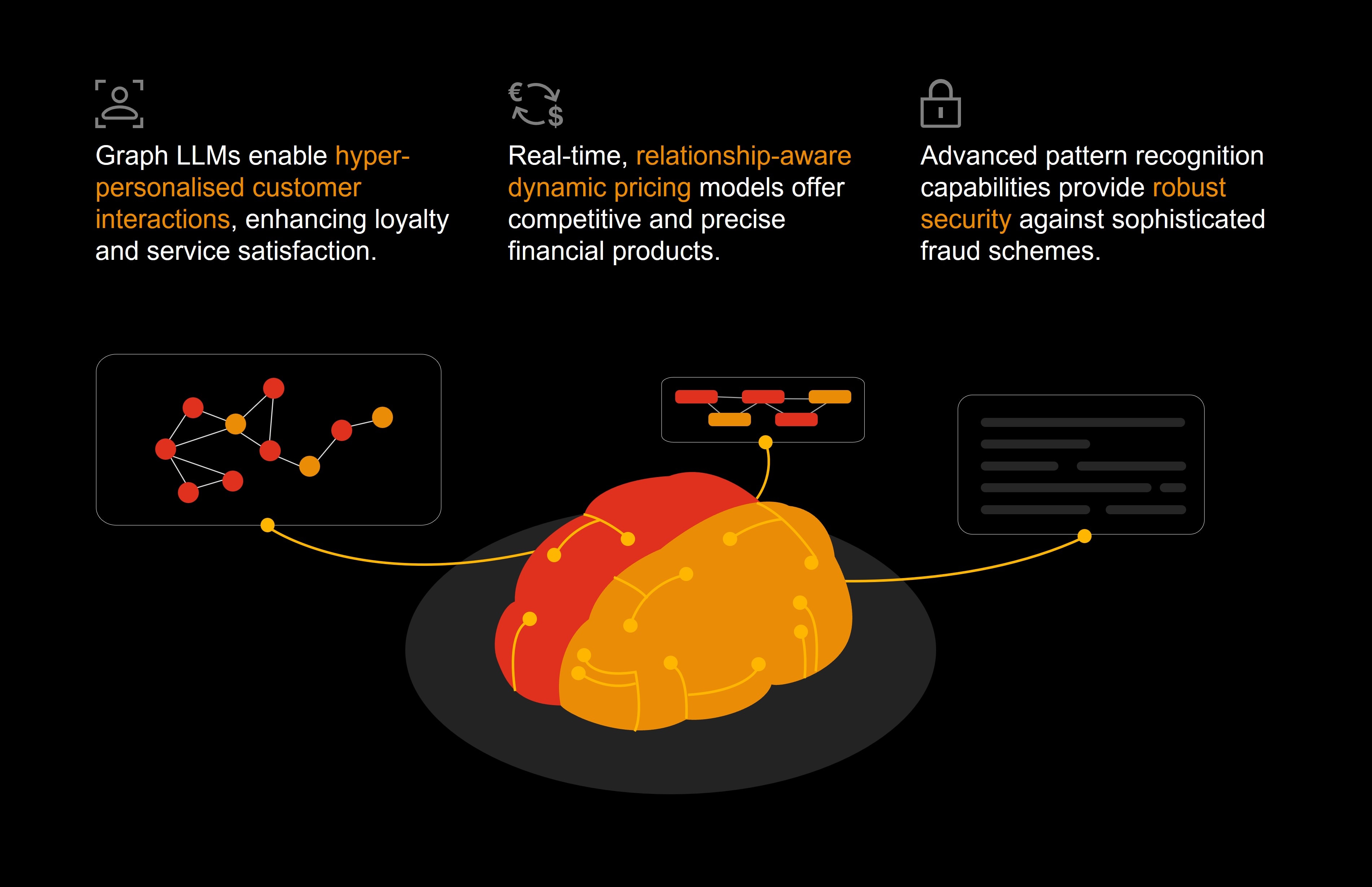

By harnessing the strengths of graph neural networks and large language models, financial institutions and insurers can hyper-personalise services, streamline operations, and discover unparalleled insights into complex data relationships.

In an interconnected and data-driven world, banks and insurers are at a tipping point. As data volumes surge and customer expectations shift, traditional approaches to data analysis are struggling to keep up. Graph Language Models (Graph LLMs) are emerging as a game-changer, helping financial institutions personalise services, streamline operations, and uncover deep insights within complex data relationships.

Currently, many financial services firms are exploring AI through limited, isolated applications, such as using machine learning for fraud detection or for enhancing basic customer insights. While these projects provide localised benefits, they often lack a cohesive approach that taps into AI’s full potential across the organisation.

Key Insights

For the banking and insurance sectors, graph LLMs are not just another technological advancement; they're a paradigm shift. They offer a rare trifecta: untapped operational efficiency, enhanced customer experience, and significant revenue growth. By understanding and leveraging the complex relationships inherent in financial data, organisations can unlock a new level of operational excellence and customer satisfaction. The impact of this technology goes beyond short-term gains; it establishes a foundation for long-term resilience and competitive strength in an increasingly data-centric industry.

The tools and technologies outlined in this report are not an exhaustive list or recommended by PwC Middle East. It’s important for companies to consider factors relevant to their own context before deciding to invest in graph LLMs.

Those who embrace graph LLMs have the potential to lead the industry, while those who don’t risk playing catch-up in a data-driven world.

In the high-stakes game of banking and insurance, Graph LLMs are the ace up your sleeve.

Download playbook here

Contact us