Introduction

Economic and fiscal policymakers have a critical role to play in the global green transition. A recent report from the Coalition of Finance Ministers for Climate Action, which hosted its 10th ministerial meeting in Marrakech in October, highlights many of the traditional levers that finance ministries can take to accelerate climate action. These include designing tax systems, controlling public spending, managing macroeconomic and fiscal risks, and supporting efforts to mobilise private climate finance.

Countries in the Middle East have already made commitments to address climate change and are setting direction with significant new initiatives, such as Saudi Arabia’s new carbon credit market and the UAE’s tax on single-use plastics. The UAE’s hosting of COP28 in Dubai last year was another big opportunity for the region to showcase its commitment and progress on climate action.

A successful green transition is particularly important in the Middle East, which is especially vulnerable to the impacts of climate change, such as rising temperatures, water scarcity and unpredictable weather. Building longer-term resilience to respond to these challenges is, therefore, critical for countries in the region.

The region is also heavily reliant on fossil fuels, and economic activity is typically concentrated in a small number of sectors. With uncertainty around oil prices and production volumes and the world starting to shift towards cleaner, renewable sources of energy, it is important that countries in the Middle East adapt to these changing trends in energy consumption in order to remain economically stable and competitive.

Despite the significant challenges brought about by climate change, there are also great opportunities for countries in the region to showcase their ambition by pioneering new technologies. The NEOM giga project in the Kingdom of Saudi Arabia is an ambitious and innovative example of how the region can become a leader in climate change and technological innovation.

Ambition and action do, however, come with significant costs, not only in terms of elevated public spending in the short term but also in the way future revenue and public finances are affected. It is essential that finance ministries and other institutions with economic and fiscal policy functions draw from and utilise all the levers at their disposal to drive effective, efficient and well-targeted public interventions for a successful and sustainable green transition.

What should the key climate priorities of finance ministries be?

Drawing on deep experience working with and within a number of finance ministries and other institutions across the world, and particularly in the Middle East, we have identified three key areas finance ministries in the region should be carefully considering now, if they are not already:

Strengthening finance ministry capabilities

Responding to the challenges of climate change will require a new set of skills beyond the traditional capabilities needed to shape and drive fiscal policy. Finance ministries in the region should invest in building internal skills and capabilities so that they can become key players in driving the climate change agenda.

In recent years, finance ministries across the world have taken on more responsibilities in this space - with some playing leading roles on behalf of their governments. For example, Denmark’s Ministry of Finance has committed to driving whole-economy climate action, and Rwanda’s Ministry of Finance and Economy leads on the country’s climate strategy. Others actively support lead ministries in this area. For example, in Singapore, where climate change policies are overseen by an inter-ministerial committee, the Ministry of Finance is responsible for ensuring fiscal sustainability, compatibility with economic priorities and long-term planning of measures.

Finance ministries have also been growing capabilities, deepening relevant expertise and revisiting internal and external governance arrangements to adapt to the challenge of climate change. In the UK, His Majesty’s Treasury has set up a team responsible for its net zero strategy and, over the last 10 years, increased the number of people working largely full-time on climate change issues from 20 to 120. Uruguay has also focused on building internal capabilities, and the Ministry of Finance there has set up a new environmental unit to drive climate strategy and coordination efforts within the Ministry. The Finnish Ministry of Finance has been taking stock of their internal climate-related skills and knowledge, and recently published a strategy outlining their commitment to drive efforts in the climate change space.

When it comes to the Middle East, finance ministries in the region need to first define their role in the country’s climate change agenda and how this complements the roles of other ministries. Alongside developing a clear strategy to guide their work in this space, finance ministries should also take stock of existing skills and capabilities with the aim of identifying where the key gaps are.

Once they have defined their role and identified their capability needs, they should set a clear implementation strategy with key milestones and actions. This should focus on a combination of short, medium and long-term actions, such as:

Governance changes and internal restructuring

Including appointing a senior responsible officer

Considering secondments

Between ministries and other external organisations, to build both skills and networks

Investing in developing existing staff

With a focus on learning and development, and tailored training

Partnering

Working with research and international institutions

Hiring new staff with particular expertise

Either on a permanent or temporary basis to fill key gaps while existing staff upskill

The exact course of action will vary from ministry to ministry, depending on their current organisational arrangements and capability needs and the roles of other ministries. Finance ministries may benefit from external support with some of these actions, such as:

Developing the finance ministry’s strategy for climate change

Formulating an implementation plan

Undertaking a gap assessment to identify skills and capability needs

Rolling out training programs to upskill existing staff

Embedding environmental concerns in spending and policy decisions

A number of governments in the Middle East have already laid out and started implementing ambitious economic growth and transformation strategies. These will, of course, have an impact on both the environment and the public finances.

Finance ministries have a responsibility to ensure that public money is spent effectively and efficiently.

This should especially be the case for climate change adaptation and mitigation, given the particular vulnerability of the Middle East to climate change and the potential cost of ambitious climate policies. In order to achieve value for money while building longer-term resilience, policymakers need to understand the impact of fiscal policies on the environment, but also the fiscal and economic impacts of environmental measures. Finance ministries can navigate this by:

In the short term, embedding environmental concerns into policy appraisal and investment evaluation frameworks for line ministries

In the medium- to long-term, adopting green budgeting practices

Finance ministries will need to set the strategic direction for incorporating climate change considerations into government policy impact assessment and investment appraisal processes. At the same time, they will need to cooperate with other ministries and public bodies to introduce requirements in a manner that is pragmatic and not too burdensome. For example, in the UK, HM Treasury’s central guidance on appraisal and evaluation has recently been updated with new guidance on valuing environmental and climate impacts, following consultations with other ministries.

As a first step, finance ministries should require that environmental impacts of significant spending decisions are evaluated before decisions are made. Steps like this have already been taken by some in the region. For example, Abu Dhabi has recently introduced requirements of environmental assessments for all development projects.

This can be extended to other areas of public finance like those outlined by the OECD Paris Collaborative for Green Budgeting. Countries, such as France, Italy and Ireland, have already started to incorporate green budgeting procedures in their annual budgeting process. This can increase accountability and strengthen the understanding of impacts of spending decisions. Significant expertise and resources will generally be required for green budgeting to be effective, so new practices should be introduced proportionately and balanced against other priorities.

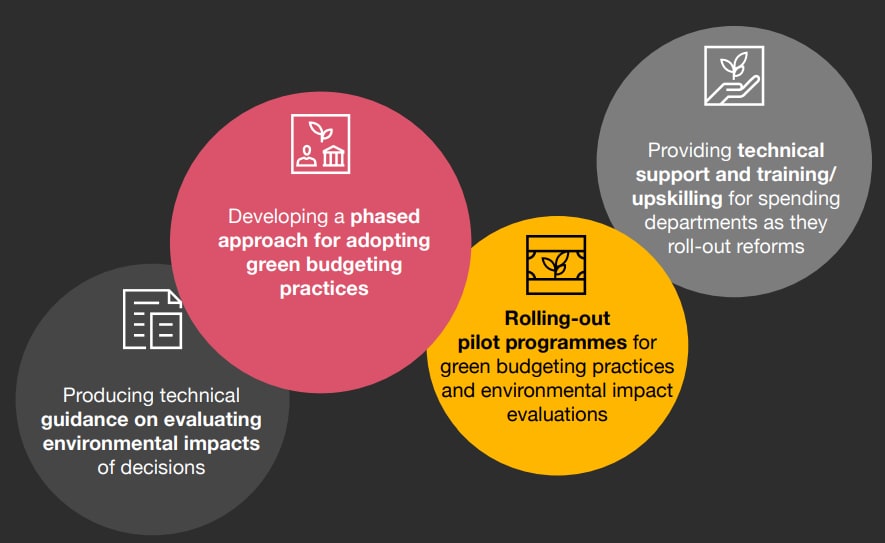

By incorporating simple environmental considerations into their existing procedures, finance ministries can develop a culture around understanding the true cost of spending decisions. This will lay the foundations for a more comprehensive reporting of environmental impacts through fuller green budgeting practices in the medium to long term. External support may be required for developing and implementing frameworks and strategies. This can include:

Using policy levers to drive change

While building capability and improving evidence and understanding of impacts are important foundations, effective and direct policy action is fundamental for a successful green transition. Finance ministries are in the unique position of holding policy levers that are critical for facilitating this transition - i.e direct financial incentives and the ability to reform taxes and control spending.

As is the case for many countries, the goal for countries in the Middle East should be to build on their comparative strengths to improve outcomes for societies, while recognising environmental costs and moving to more sustainable and diverse economies.

Finance ministries will need to start with a vision of how their country’s climate change objectives fit in with their wider economic and fiscal strategy. Once that is clear, coherent targets and policies can be developed for implementation over the short and medium-term.

In the short-term, policymakers should:

1.Set ambitious but realistic environmental targets and goals

2. Review existing taxes and policy incentives to ensure they are still effective

3. Consider changes to existing harmful subsidies and incentives

In the medium-term, they should:

1. Introduce new greener tax policy reforms to incentivise behavioural change

2. Introduce new incentives for attracting green investment

New incentives for green technologies can range from direct government subsidies and tax reliefs to helping unlock private finance and introducing pro-innovation regulation. While these incentives can be effective, ministries will need to keep in mind that large public investment in renewables will come with significant long-term fiscal costswhich could impact future generations. These costs may come in the form of elevated levels of debt or the opportunity cost of not spending on other priorities.

The COP28 global agreement has recognised the commitment of over 200 countries to transition away from fossil fuels in a 'just, orderly and equitable manner' and phase out 'inefficient fossil fuel subsidies that do not address energy poverty or just transitions’. When looking at their strategically important oil and gas industries, ministries in the Middle East need to approach reforms carefully. For example, subsidies could be made conditional on more sustainable practices or could be gradually decreased, rather than removed completely. Gradual removal of subsidies is generally recommended as winding these down too quickly can have adverse impacts on key industries, increase inflation, indirectly affect poorer segments of society and prove controversial in a way that undermines support for broader climate measures.

When it comes to industries with high carbon footprints, another option is to raise their effective price to better account for their true costs. This can be done through carbon floors, carbon pricing and emissions trading schemes. While these are becoming increasingly popular choices to effectively manage greenhouse gas emissions, careful analysis of options is needed to manage impacts on economic growth, investment and distributional outcomes.

Environmental taxes can also be used more widely to reinforce the “polluter pays principle” - a key principle in environmental policy. Such taxes can apply to both businesses and households and can range from small taxes or fees on waste disposal and single-use plastics to more wide-ranging excise duties on fuel and commercial exploitation of natural resources. While environmental taxes are often used to encourage more sustainable choices rather than raise significant revenue, they can also help strengthen the public finances - particularly in the immediate term until the targeted behaviour ideally shifts.

Looking ahead for finance ministries

Ultimately, there is no exact one-size-fits-all approach. Finance ministries in the Middle East should look closely at insights and lessons from other countries but apply these carefully to their own context. At the same time, the cost of inaction is too high to ignore, and governments in the region will need to respond before it is too late and irreversible thresholds are reached. Seeking external advice can help ministries understand best practices and adopt approaches tailored to the local landscape, and can cover areas like:

Supporting with the design and roll-out of tax policy reform and green incentives

Carrying out diagnostic reviews of existing taxes, subsidies and wider incentives

Conducting economic analysis to understand policy impacts

Most finance ministries around the world are grappling with these issues, and in many cases best practice is still emerging. Governments of all shapes and sizes are looking to each other to understand what works and what doesn’t, and how best to navigate climate change in the landscape of competing pressures placed on fiscal, economic and environmental policy.

Initiatives like the Coalition of Finance Ministers for Climate Action are an invaluable source of expertise and knowledge-sharing, while global forums like COP are crucial opportunities for countries to showcase their ambition and momentum on tackling climate change.

Our team of economists and policy and change management experts can help develop and implement tailored lasting reforms, leveraging years of experience and deep expertise working with and within international institutions, finance ministries, tax authorities, environment ministries and other key institutions in countries around the world.

How finance ministries in the Middle East can help drive the green transition

Contact us

Global Fiscal Policy, Senior Manager, PwC United Kingdom

Tel: +44 (0) 7841 468 574