Data and projections: May 2023

Chart of the quarter

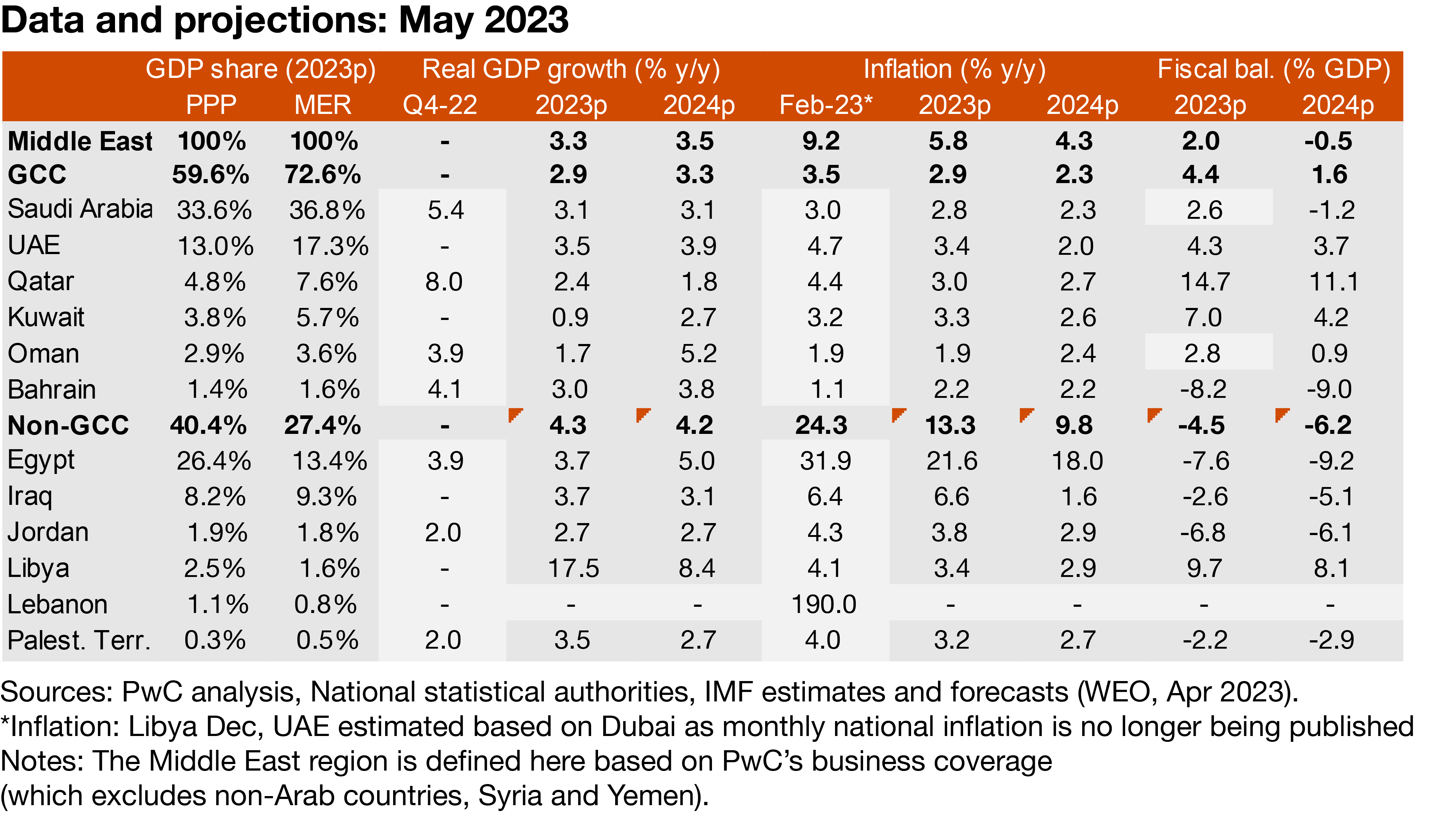

The decision on 3 April by various members of OPEC+ (including Saudi Arabia, UAE, Kuwait and Oman) to announce additional voluntary production cuts from May took the oil market by surprise. OPEC’s own forecasts of supply and demand had not indicated any glut in supply but amidst economic uncertainty, the producers decided to make a precautionary move by cutting output by a further -4.8% on top of a similar cut in November. This means that output from the GCC will be about -1.7m b/d lower in May than it was in October. Assuming that the latest cuts persist through the year, as is the currently stated intention, then most participating states will see output fall by about -4% y/y, after rising by 12% or more in 2022. The exception is Bahrain because it significantly underproduced its quota last year, due to onshore maintenance work, and did not pledge an additional voluntary cut. As a result, if its output does recover to its quota level then it could see an increase of around 10%. While the cuts will necessarily reduce real GDP in most countries, if the boost to the oil price from the cuts persist then it should more than offset the impact on export and fiscal revenue.

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100