Population trends

Expat numbers fell sharply in 2020-21

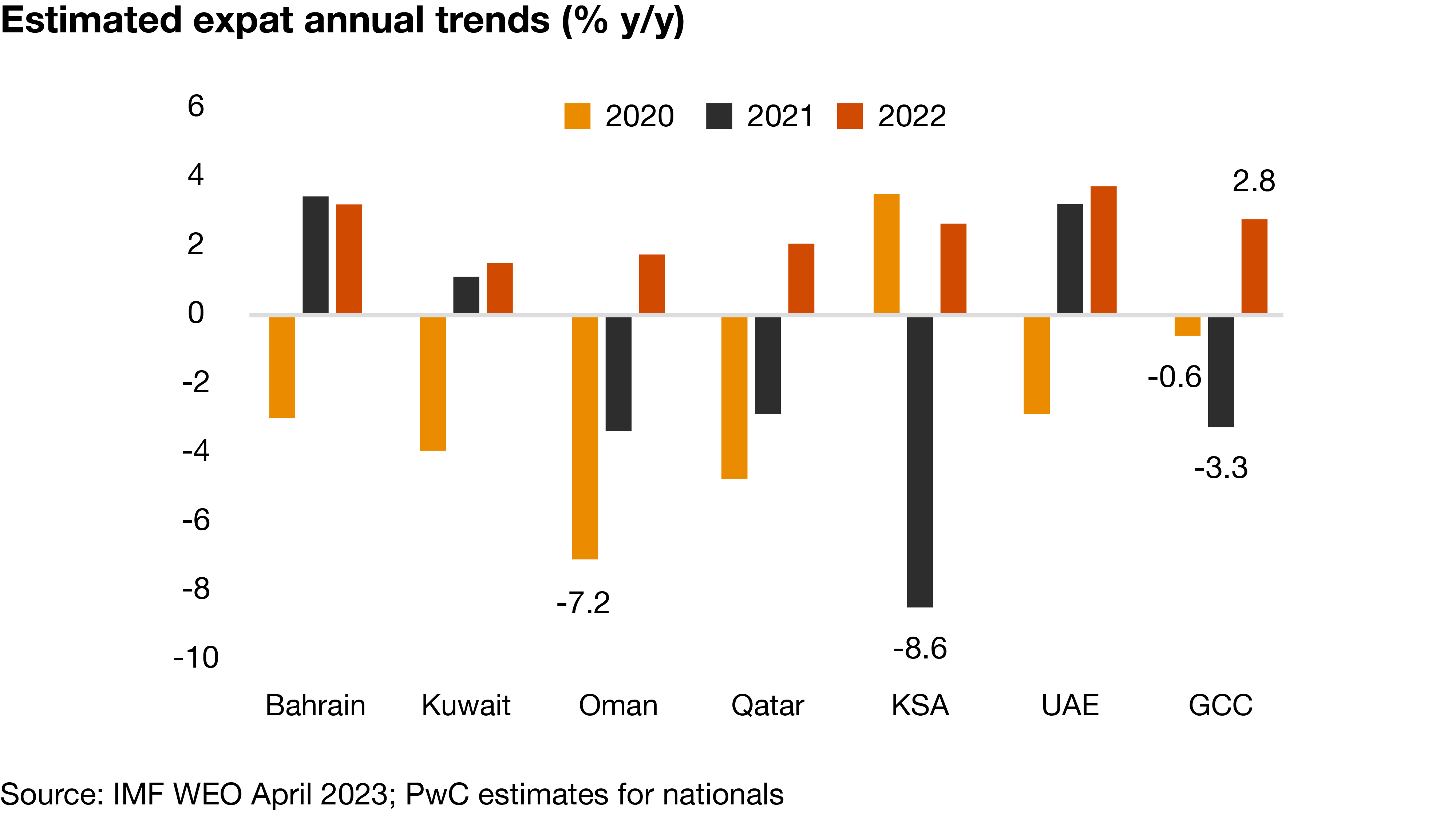

There are around 30 million expatriates in the GCC, half of the region’s total population. The pandemic had a significant impact on numbers for a variety of reasons, and while it is difficult to get a precise picture of the expat population, it is clear that the loss in the expat population had an impact on demand and was, therefore, one of the factors that caused weakness in a range of economic sectors, such as in healthcare and education.

Yet COVID-19 was not the only factor driving population trends. In Saudi Arabia, Saudization policies had been driving down the expat population until 2019 when the stimulus caused by Vision 2030 implementation caused a rebound just before the pandemic. In Qatar, World Cup preparations likely limited the scale of expat departures during the pandemic. In Oman and Bahrain, fiscal consolidation efforts were a factor driving reductions in expat numbers before and during the pandemic.

Looking at the region as a whole, the IMF estimates that population growth slowed from 2% in 2018-19 to 0.3% in 2020 and contracted by -0.8% in 2021. Combining the IMF data with official figures for the national population (drawing in part on data compiled by the Gulf Research Centre), we calculated that the region’s total expat population at end-2021 was about -4% less than in 2019.

The recovery in expat numbers

In Oman, Qatar, the KSA and Bahrain, where the population data is most readily available, there has been a strong rebound over the last 18 months. By end-2022, expat numbers were above pre-pandemic levels in Bahrain, Qatar, the KSA and Oman. In Oman and Bahrain this boost has largely been due to renewed hiring thanks to higher oil prices and other economic drivers, and elsewhere in the GCC recent initiatives such as new VISA legislation, alongside geo-political migration drivers from outside the region, will continue to attract more expatriates to the GCC.

Indeed, across the region as a whole expat numbers rebounded by 2.8% in 2022 and should surpass the 2019 level later this year.

Visions for expats vary

Looking ahead, the vision for expatriates in the GCC varies significantly by country. Dubai’s Urban Plan aims to double the population by 2040, and Saudi Arabia also has ambitious population plans including doubling the population of Riyadh and attracting nine million people to The Line by 2045. Many of the planned newcomers to both cities will be expatriates, facilitated by recent visa reforms. Saudi Arabia’s premium residency programme, which offers a range of benefits from the ability to own property and businesses and the right to work without the need for a sponsor, also aims to attract highly-skilled expats, investors and entrepreneurs that will hopefully create jobs and bring in investment. Major investments in infrastructure will be required to accommodate these rising populations. By contrast, Kuwait aims to reduce the population share of expats from 70% currently to 30%, which would require a three-quarter reduction to their numbers.

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100