Data and projections: September 2024

Chart of the quarter

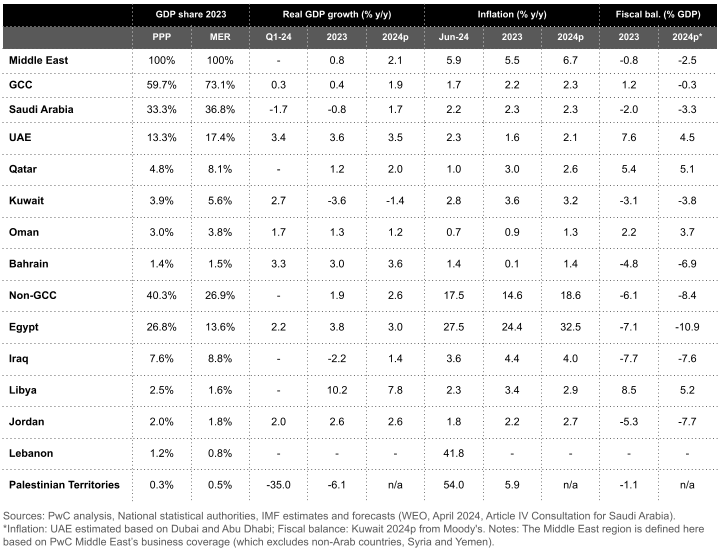

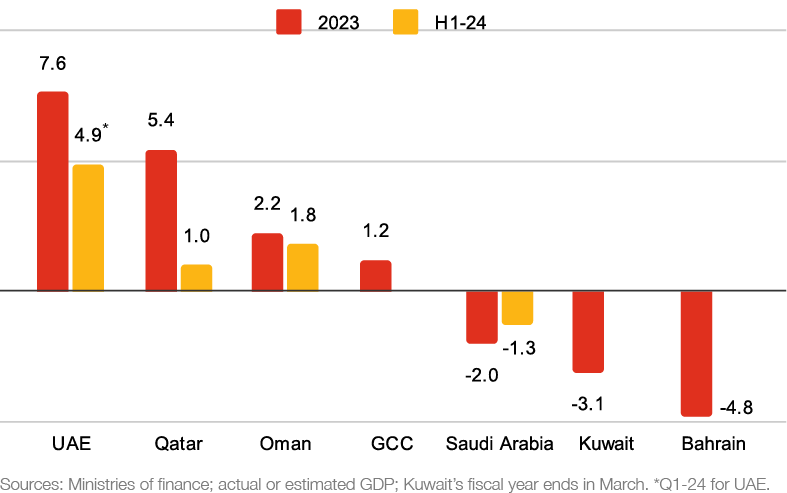

In 2023, the GCC achieved an aggregate fiscal surplus of 1.2% of regional GDP. This was down from the 5.8% achieved in 2022 but was still the second-strongest result since 2013. The narrowing is no surprise given that oil prices fell by about a fifth and OPEC+ also cut production. Hydrocarbon revenue overall declined by -15% and expenditure rose by 8%. More positively, non-oil revenue increased by 5%, led by Saudi Arabia at 11%.

Moving into 2024, Qatar’s surplus narrowed to about 1% of GDP in H1 and Oman’s dipped slightly to 1.8%. Conversely, Saudi Arabia’s deficit narrowed to -1.3% of GDP, supported by the Aramco performance dividend. In Q1, the UAE posted a strong surplus of nearly 5%. Spending growth was modest in most of these states, including just 2.1% y/y in Oman and 1.3% in Qatar, but Saudi Arabia’s continued to grow rapidly, up 12%. Given that oil prices have dipped towards $70 a barrel in September, and spending is usually skewed to the second half, full year balances are likely to be weaker than in H2, except perhaps for Qatar given timing lags in its LNG revenue relative to oil revenue in the region.

Fiscal balance (% GDP)

Middle East Economy Watch - September 2024

Download latest issue

Economy Matters

A blog by the economists behind PwC’s Middle East Economy Watch

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100