OPEC+ prepares to taper and non-oil growth remains robust

OPEC+ extends agreement through 2025

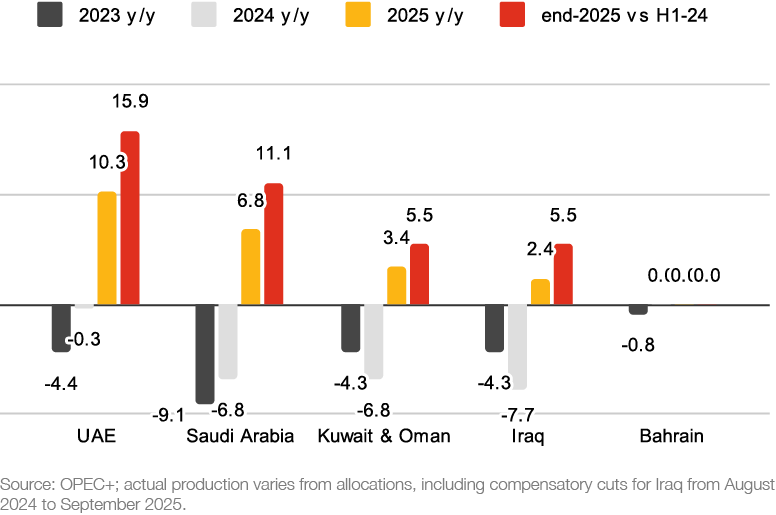

The OPEC+ ministerial meeting in Riyadh in June took place amid growing tensions within the alliance of 19 oil exporters because of persistent inequalities in quota levels and overproduction by some countries, such as Iraq and Kazakhstan. This has placed a disproportionate burden on a few countries, particularly the UAE and Saudi Arabia, and to a lesser extent Kuwait and Oman, despite the original purpose of OPEC+ being to foster collaboration among all member states to balance supply and demand.

The alliance agreed to extend their production quotas through 2025, maintaining the levels set in October 2022, with a few subsequent adjustments. Additionally, eight of the largest producers - including KSA, UAE, Kuwait, Oman and Iraq - committed to maintaining their voluntary cuts during Q3 2024, and then phase them out over another year. There were two initial adjustments to this plan: the UAE was allocated an additional 300,000 b/d in 2025 due to its rising capacity, while Iraq, Kazakhstan and Russia agreed to make additional cuts to compensate for their overproduction during the first half of the year.

Change in OPEC+ allocations (%)

The most important aspect of the agreement was the commitment to continue cooperation beyond 2024, which was far from assured. Moreover, independent assessments of capacity for each country, which had been due by the end of June, were postponed until late 2025 due to a combination of technical and political reasons. This in turn is a signal that some OPEC+ cuts could continue into 2026, which would mark a remarkable tenth consecutive year of producer action.

As always, OPEC+ plans can be quickly modified if oil market conditions materially change. This happened in September when, having averaged US$82 in the year until August, Brent crude dipped toward US$70, amidst concern about demand growth. In response, the plan to taper voluntary cuts was postponed for two months and will now start in December rather than October. This will have the impact of reducing oil supply in Q4 by about 450,000 b/d compared with the June plan. The current agreement means that overall OPEC+ oil production in December will increase for the first time in over two years, rising by 180,000 b/d, with similar tapering in subsequent months, equivalent to about a 0.45% m/m increase for the eight countries engaged in voluntary cuts. It is possible that further adjustments to this plan will be deemed necessary.

There is a broad consensus on the likely growth in supply from non-OPEC+ countries in the next few years, notably the US and Guyana, but there is a significant divergence in expectations for demand growth.

In August, OPEC’s monthly demand forecast was reduced for the first time in over a year, but it still sees demand in 2025 as 3.9m b/d higher than in 2023. This is twice as high as the International Energy Agency’s estimates, which were recently revised down to reflect tepid growth in demand from China.1 Conversely, there is an inherent risk that potential geopolitical flare ups could disrupt supply as has been seen recently in Libya.

Non-oil growth remains robust

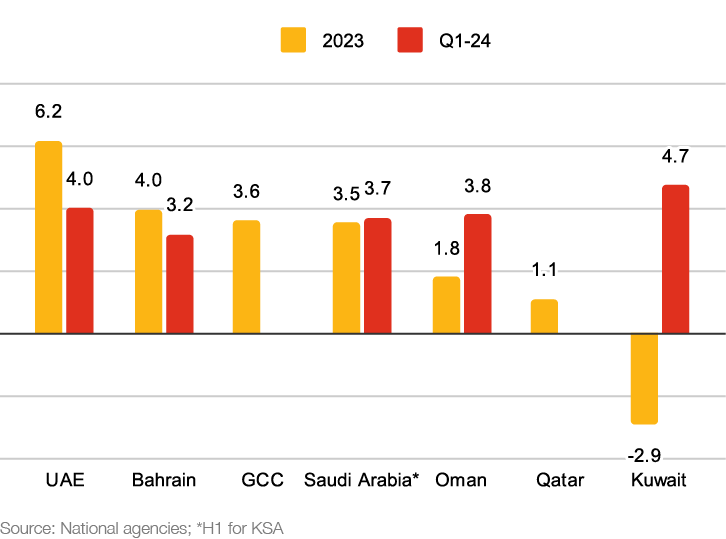

Real non-oil growth across the GCC averaged 3.6% in 2023, robust but down from over 5% in 2021-22. 2023 growth was led by the UAE on 6.2%, which was driven by Abu Dhabi’s spectacular 9.1% expansion.

The outturn so far for 2024 is broadly encouraging. Kuwait returned to non-oil growth at 4.7%, its strongest result in years. Other solid results including 4.0% in UAE and 3.8% in Oman, while Saudi Arabia achieved 3.7% in H1 (this is an estimate using the same methodology of non-upstream GDP as Gulf peers, its private sector non-oil GDP grew more strongly by 4.2%).

Real non-oil GDP growth (% y/y)

High-frequency indicators suggested that Q2 non-oil growth was also solid, with Saudi Arabia’s flash GDP indicating a modest acceleration. However, Purchasing Manager Indices (PMIs) softened in most countries. There was a further softening in July, with PMIs hitting multi-year lows in Saudi Arabia and the UAE, although they were still firmly in expansionary territory. Other leading indicators show a more positive story. Saudi Arabia’s manufacturing index showed 8.6% y/y expansion in Q2, and tourist numbers were up by 6% y/y in Dubai, 8% in Oman and 14% in Qatar.

The non-oil outlook in the GCC remains positive. The IMF’s most recent forecast from April sees non-oil GDP growth accelerating to 4.5% in 2025, which would be a three-year high and up from an expected 3.6% this year.2 This acceleration will be supported by looser monetary policy as US interest rates are reduced, enabling GCC states with pegged currencies to also lower their rates, improving access to credit to grow the non-oil economy. Meanwhile, rising oil production could strengthen the fiscal positions of hydrocarbon exporters, provided prices remain favourable.

References

1) iea.org Oil Market Report September 2024

2) IMF’s World Economic Outlook report, April 2024

Middle East Economy Watch - September 2024

Download latest issue

Economy Matters

A blog by the economists behind PwC’s Middle East Economy Watch

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100