Download the report

Why does working capital matter?

Businesses have continued to face a high level of disruption in the twelve months since our last Middle East Working Capital Study. The impact of the COVID-19 pandemic combined with continued oil price volatility, resurgent inflation, and continued regional fiscal reforms has made it an extremely challenging period for shareholders and executives to manage their business. These disruptions have come while longer term global megatrends have already been reshaping business.

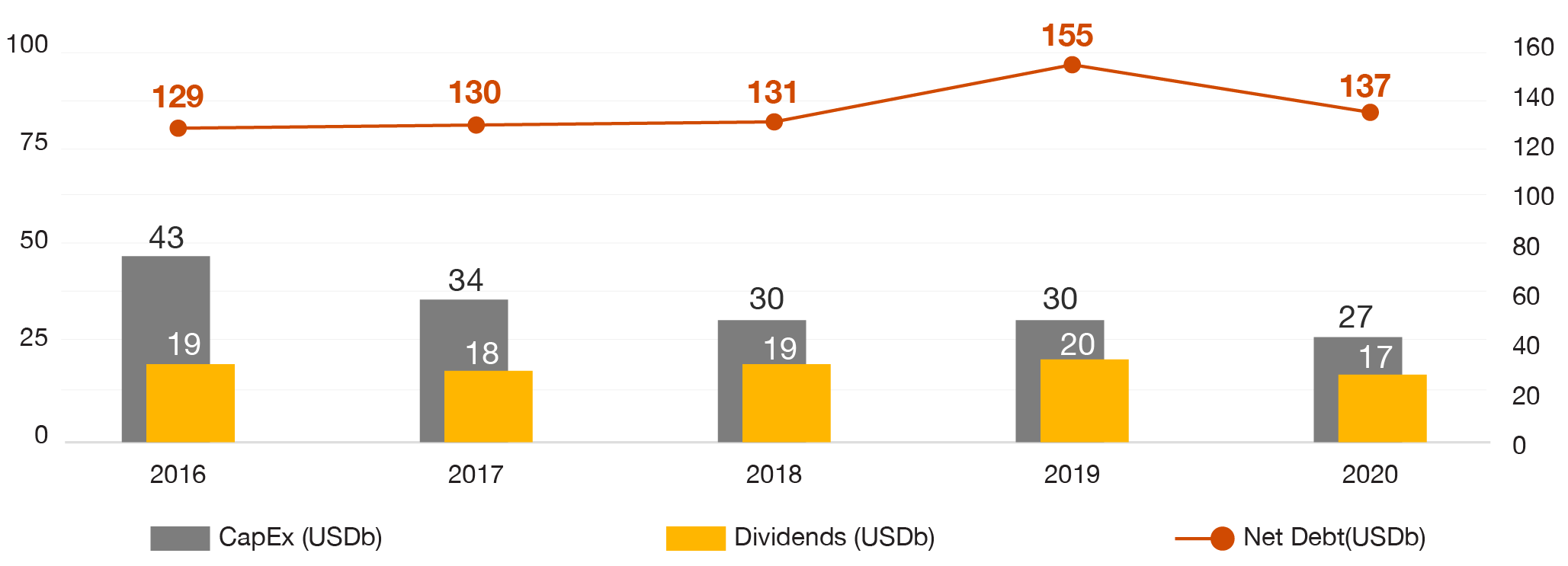

Against this background of rapid change, the importance of capital efficiency is rising. Increased competition, increased investor scrutiny and higher levels of indebtedness are all contributing to a rise in the opportunity cost of trapped capital within organisations.

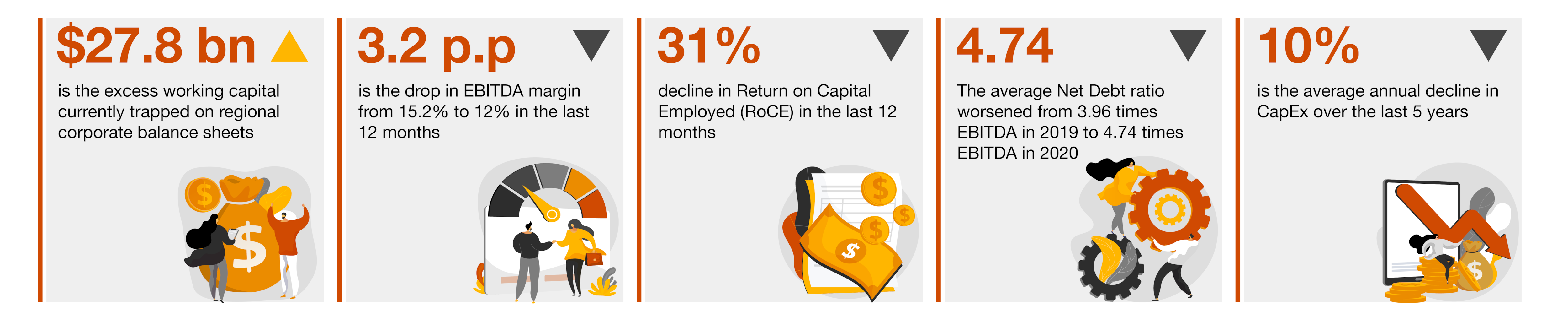

Working capital efficiency is a key metric of corporate competitiveness – and right now that metric is flashing red. Although the top line metric of Working Capital Days has stayed the same, Return on Capital Employed continued to deteriorate and the average debt leverage of companies in our survey increased. Overall, the financial efficiency of regional corporations is declining just at the moment when efficient cash management and capital efficiency is most needed.

In this study we outline how companies can act now to repair cash flows, improve competitiveness, and recover.

Latest working capital trends

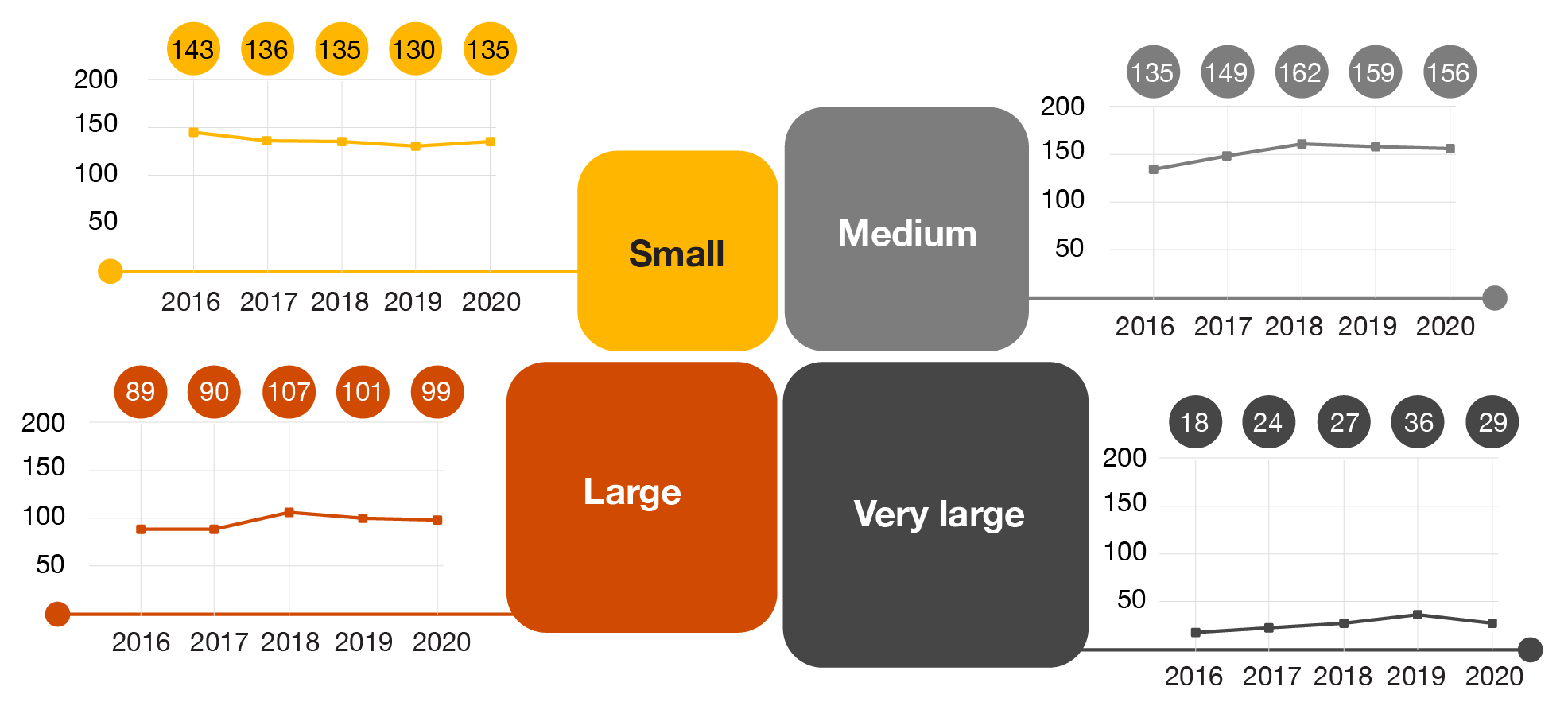

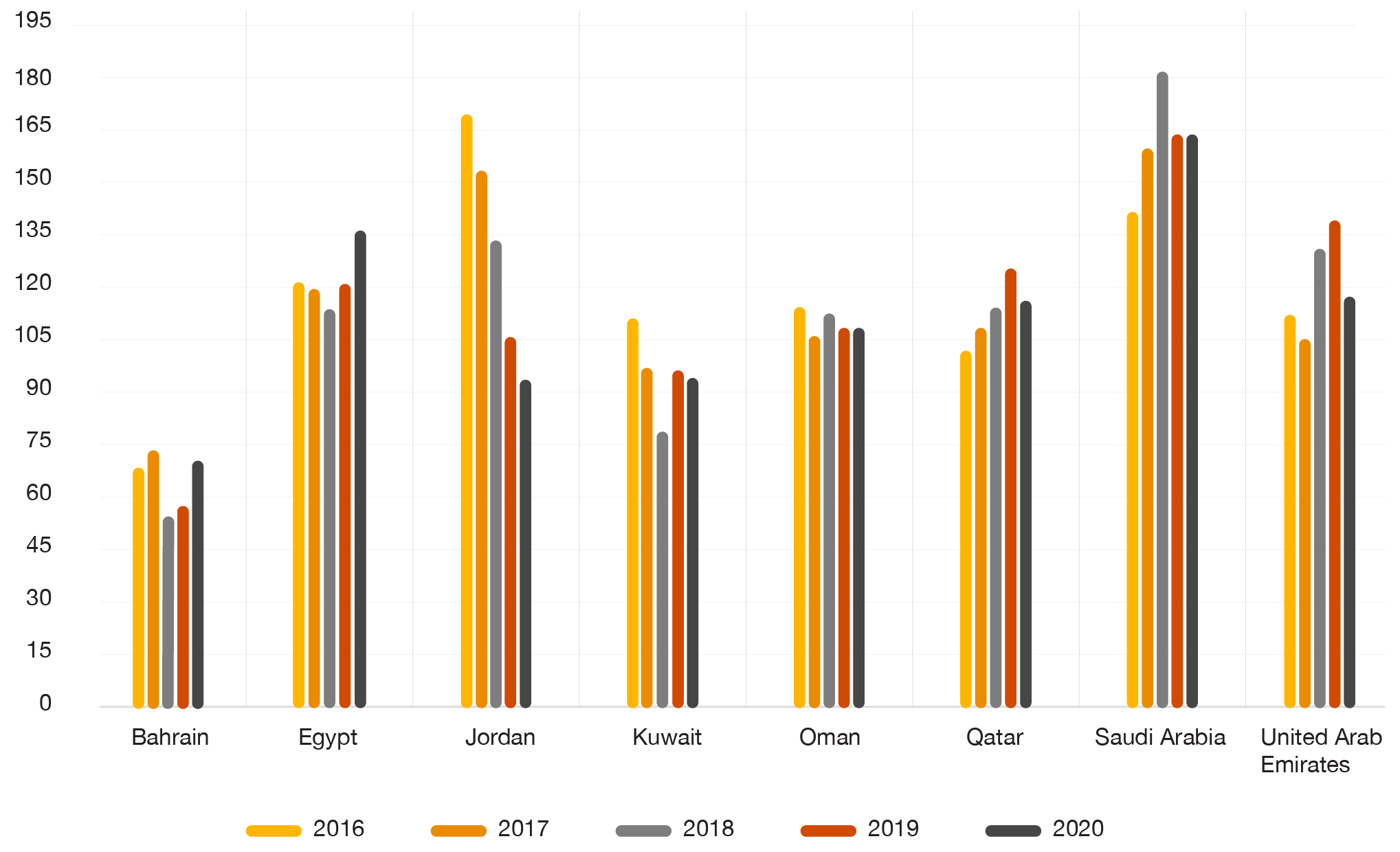

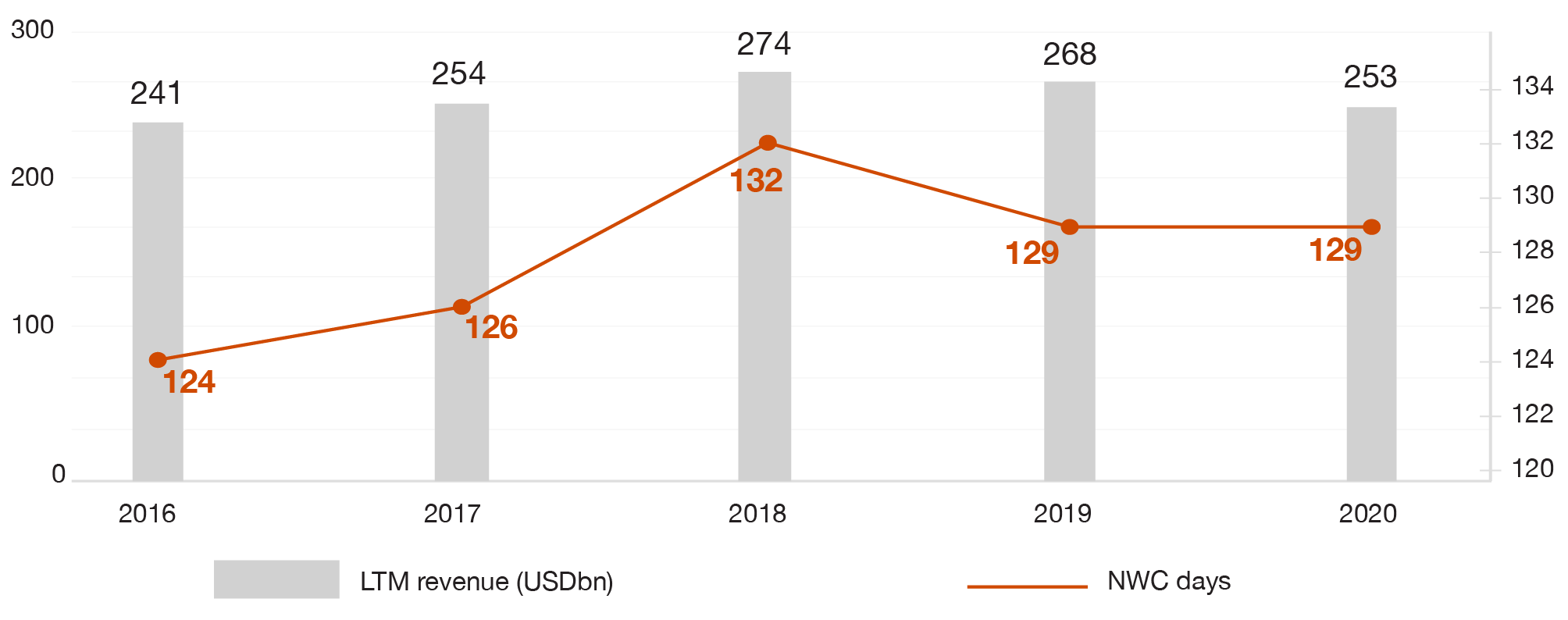

Working capital efficiency in the Middle East measured as average Net Working Capital days has remained largely stagnant in FY20.

Over the last five years, Net Working Capital days have been on a deteriorating trend, increasing by five days since 2016 (equivalent to an average 1.1% deterioration per annum) corresponding to around a cumulative $3.8 billion of additional cash tied up in the operations of companies in our study. This trend showed a mild reversal in 2019 but Net Working Capital days remained unchanged in 2020.

As activities resume to pre-COVID-19 levels, we expect to see reinvestment back into working capital and renewed short to medium term upward pressure on average working capital days. This means that those companies with a clear strategy for where to invest and how to govern their enterprise-wide working capital will be at a significant competitive advantage. Our study shows that companies that have better working capital metrics also show better performance across other KPIs.

Working capital trends

The 2021 Middle East Working Capital Study shows that working capital management should be seen as a strategic priority for boards and management teams. Better working capital performance is associated with better balance sheet metrics on revenue, debt and profitability, and generates broader non-financial benefits.

Contact us

Partner, Debt, Capital, Performance & Restructuring Advisory, PwC Middle East

Tel: +971 4 304 3228

Dan Georgescu

Director, Performance and Restructuring Services, PwC Middle East

Tel: +971 5 6418 9776