What’s the story?

Companies in the Middle East benefit from post-pandemic rebound – but little progress on working capital efficiency

Listed businesses in the region have experienced a strong rebound since our last Middle East Working Capital Study. Revenues have risen above pre-pandemic levels, due to the strong response by the region’s governments to COVID-19, combined with the regional boost provided by the increase in oil prices, the positive impact of EXPO 2020 (held in Dubai from October 2021 to March 2022) and the upcoming football World Cup hosted by Qatar.

However, Middle East businesses, like their counterparts around the world, have continued to experience disruption throughout 2021 and the first half of 2022 due to global macroeconomic and geopolitical events. For example, although inflation has been less severe in the Middle East than in other parts of the world, the region remains globally connected and companies are having to pay higher prices for many imported materials, finished goods and services. These higher costs are trickling through balance sheets, increasing the amount of working capital tied up in operations.

There have also been continued delays in receiving orders, resulting in products being out of stock and lost sales, or companies planning strategic buffer stocks to cover the gap, which also ties up working capital. Lastly, higher interest rates, which are likely to rise further in the short-term, are increasing the cost of working capital financing.

As a result, many businesses in the region are rethinking their overall strategy, as well as their end-to-end supply chains, in order to increase resilience. In this context, corporates need to align their working capital approach with their new strategic and operating model, and treat working capital as a strategic pillar that can strengthen their performance and resilience in turbulent market conditions

“The focus for many businesses is shifting from ‘stabilise and survive’ to recovery and growth. However, unstable supply chains are disrupting operations and heightening the pressure on working capital. There are still many ‘hidden treasures’ locked up on balance sheets of businesses which could be released to fuel growth and build resilience in the face of continuous global disruption.”

Mo Farzadi

Business Restructuring Services Leader, PwC Middle East

Liquidity and resilience trends

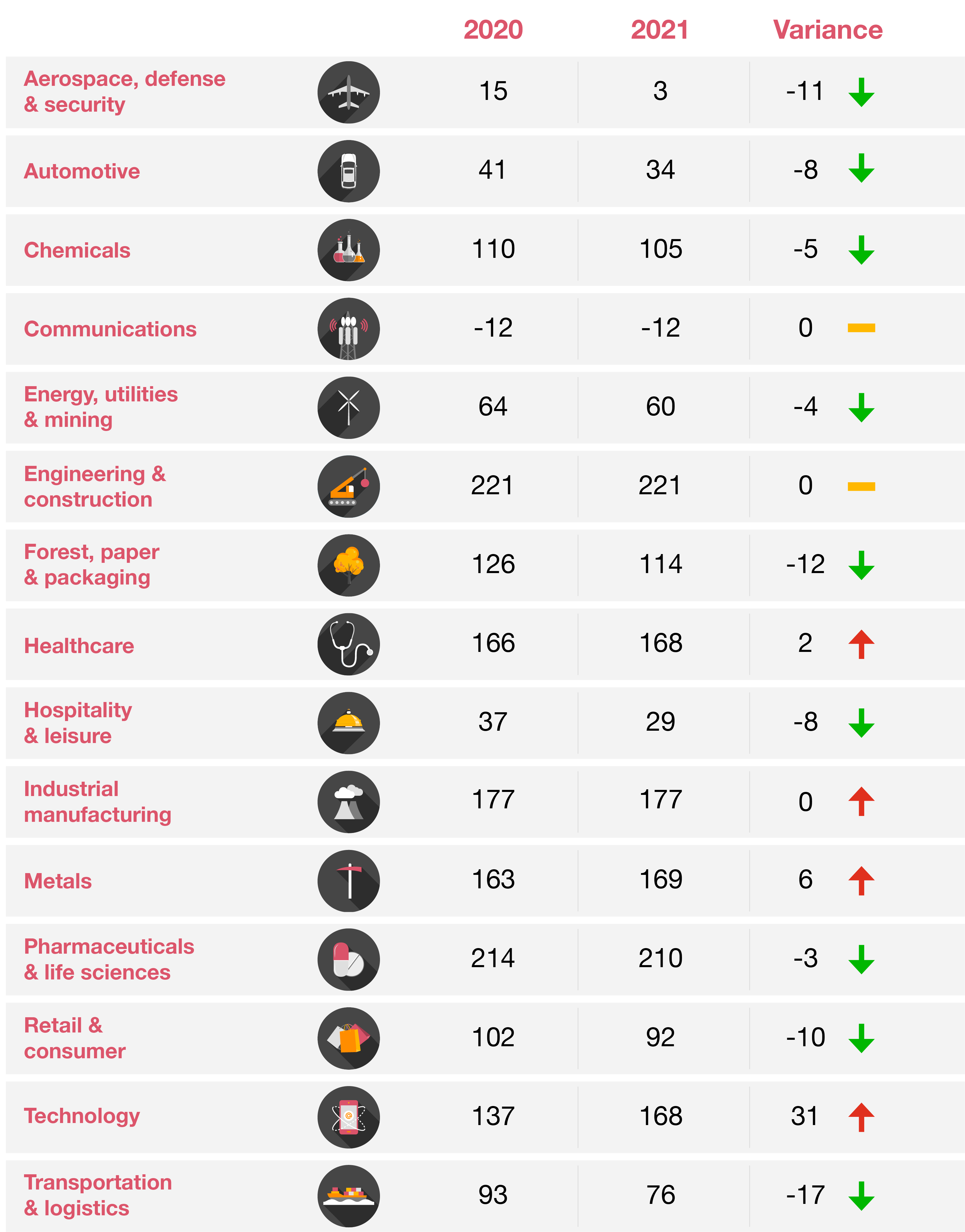

Working capital efficiency in the Middle East, measured as average net working capital days, slightly improved in 2021

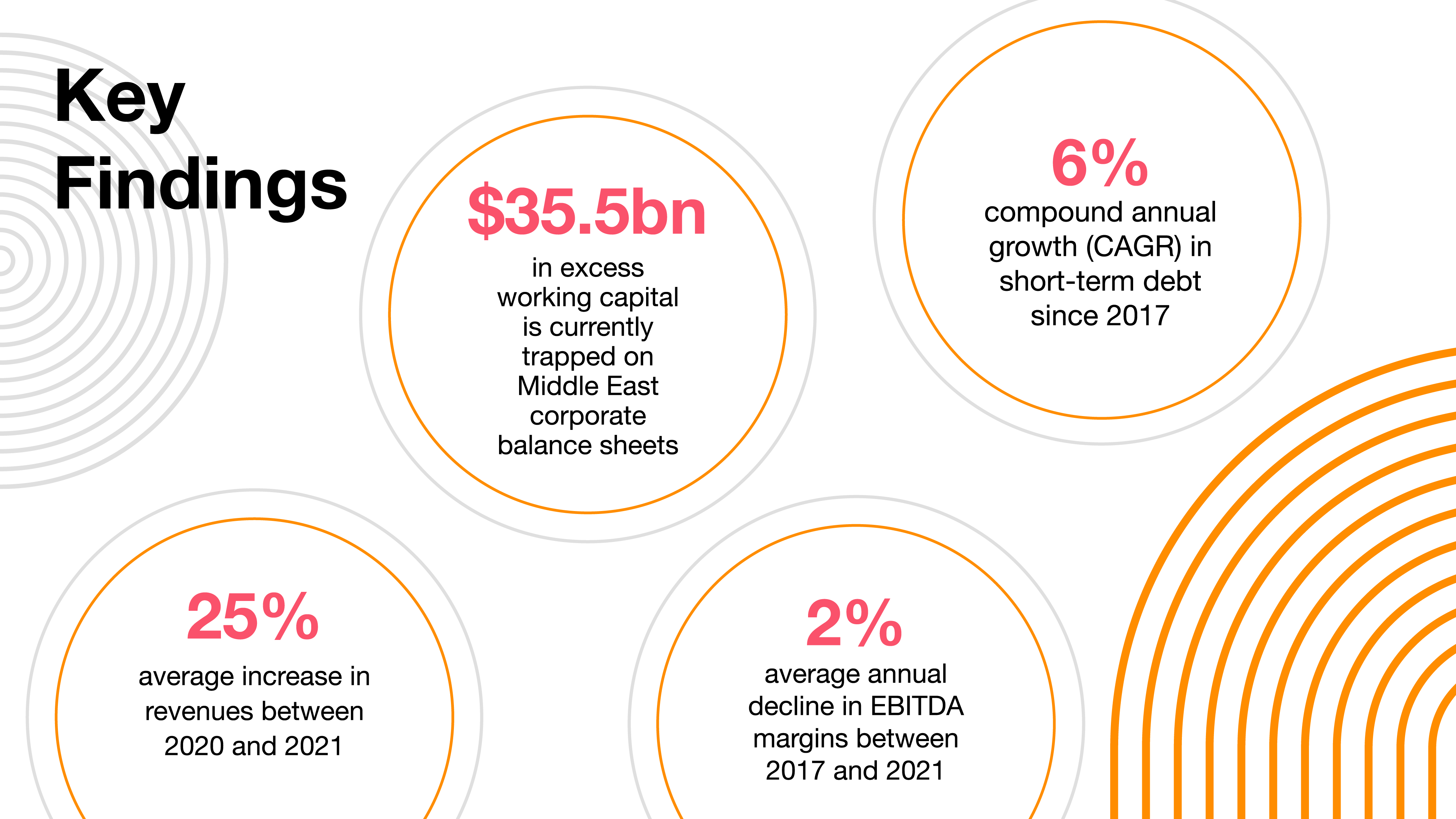

Net working capital (NWC) days - the number of days required to convert cash paid out into cash collected – is a critical measure of a company’s financial health. Between 2017 and 2021, NWC days increased on average by five days for listed Middle East companies. This increase corresponds to an additional $14.5bn tied up in working capital by the businesses in our study, which they could not invest elsewhere, compared with 2017. In this context, it is worth noting that the 3% improvement in NWC days between 2020 and 2021 is solely due to the increase in the average amount of time companies take to pay their creditors.

Alongside their deteriorating working capital performance, Middle East businesses have seen short-term debt steadily increasing since 2017 at an average annual rate of 6%, with the rate rising steeply by 10% between 2020 and 2021. This shows that companies have chosen to take on more debt to support their daily operations, rather than looking at sustainable ways to reduce the baseline of working capital required to run the business.

Working capital trends

Key steps to improve working capital performance

The findings in our 2022 Working Capital Study confirm that, while many Middle East companies are taking positive action to improve their performance, there is still far too much “hidden treasure” locked up on balance sheets which could be released to drive growth and build resilience in the face of continuous global disruption. We recommend that companies should take the following actions to ensure they manage their working capital as productively as possible:

Revisit your working capital operating model in light of changing market conditions and the latest corporate strategy

Embed a cash culture across all layers of the organisation to ensure a clear understanding of how each decision can impact cash flows

Define clear rules for trade-offs between cash and costs

- Review policies and procedures to ensure the business transformation has the right guidelines

- Leverage data analytics and internal information to improve the decision-making process

- Optimise internal processes to ensure companies can efficiently deliver on their defined working capital operating model

Contact us

Partner, Debt, Capital, Performance & Restructuring Advisory, PwC Middle East

Tel: +971 4 304 3228

Dan Georgescu

Director, Performance and Restructuring Services, PwC Middle East

Tel: +971 5 6418 9776