Executive summary

Businesses in the Middle East continued their strong bounce back in the wake of the global pandemic, with a robust year-on-year rise of 21% in the top line, in part driven by high oil prices, which peaked at US$116 per barrel during 2022. This boosted regional economies, coupled with a resurgence of the non-oil economies spearheaded by the 2030 and 2031 national visions and diversification agendas of the KSA and UAE.

Between 2018 and 2022, we have observed a strong Merger and Acquisition (M&A) activity and an increased number of listings on the local exchanges. In fact, by the end of 2022, a total of 632 M&A deals were recorded in the region, more than double the number of 2018, as revealed in our 2023 Transact Middle East mid-year report. High interest rates, concerns about an imminent recession, and inflationary pressures have resulted in an uncertain environment, further heightened by the sharp downturn in oil prices in Q1-2023. With interest rates rising and profitability under pressure, a robust working capital strategy that places a company in the strongest possible position for transformation, is more important now than ever.

Based on the latest results, our study highlights some key findings noticed across the 424 regional companies analysed.

“With macroeconomic uncertainties, including turbulent market conditions, businesses should focus on efficient working capital management that can help them continue to invest towards future growth. Organisations must act now, treating working capital as a strategic pillar, thereby, strengthening their corporate resilience. We expect working capital optimisation to be a key focus area for companies in the next few years as it offers a cost-effective funding source and also supports investments in other strategic priorities like digitisation, and sustainability.”

Mo Farzadi

Business Restructuring Services Leader,

PwC Middle East

Working capital trends

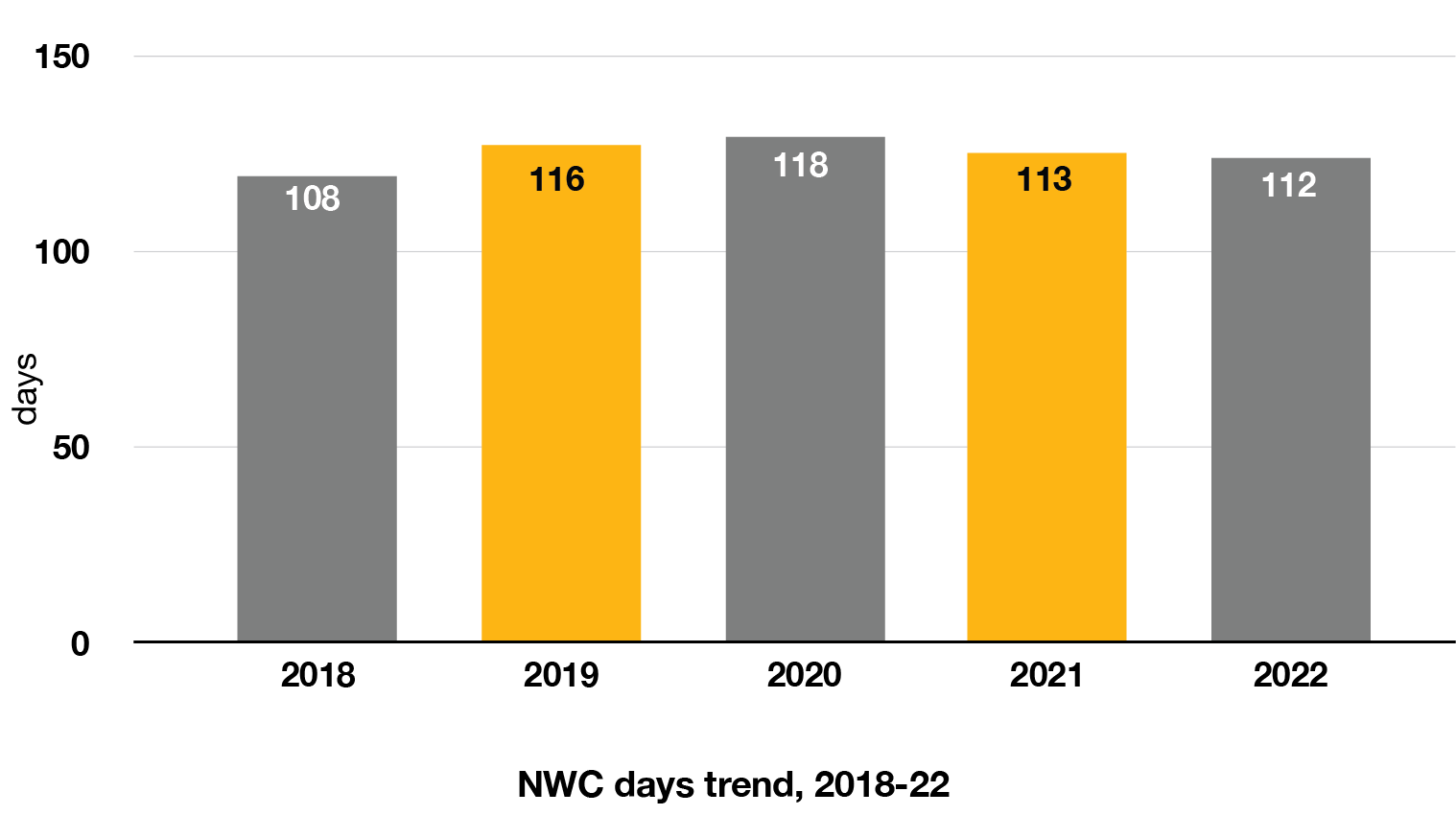

The working capital performance, measured as net working capital days, has improved since the COVID-19 pandemic from 118 days in 2020 to 112 days in 2022.

If companies close the gap to the 2018 performance, this would release approximately $5.6bn of liquidity, enabling them to fund their expansions or turnarounds, reduce the cost of financing, or provide further returns to shareholders.

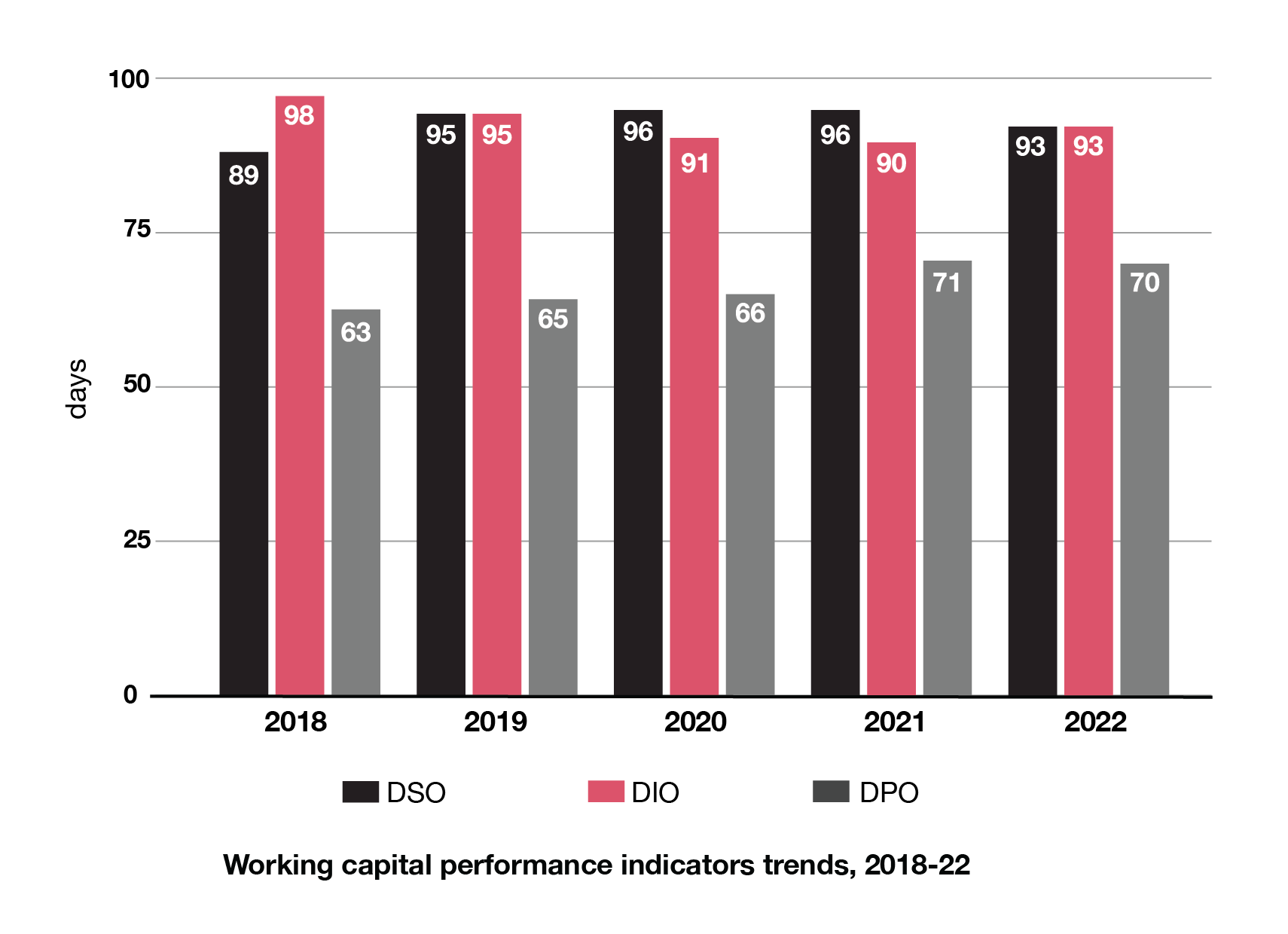

In 2022, we can see the DPO reducing by one day, and a focus on cash collections drives the overall working capital performance improvement. Furthermore, the inventory performance of regional companies has deteriorated as a result of global supply chain disruptions and an attempt by companies to focus on the purchasing costs to combat rising inflation and price volatility by purchasing larger quantities to keep sourcing costs under control.

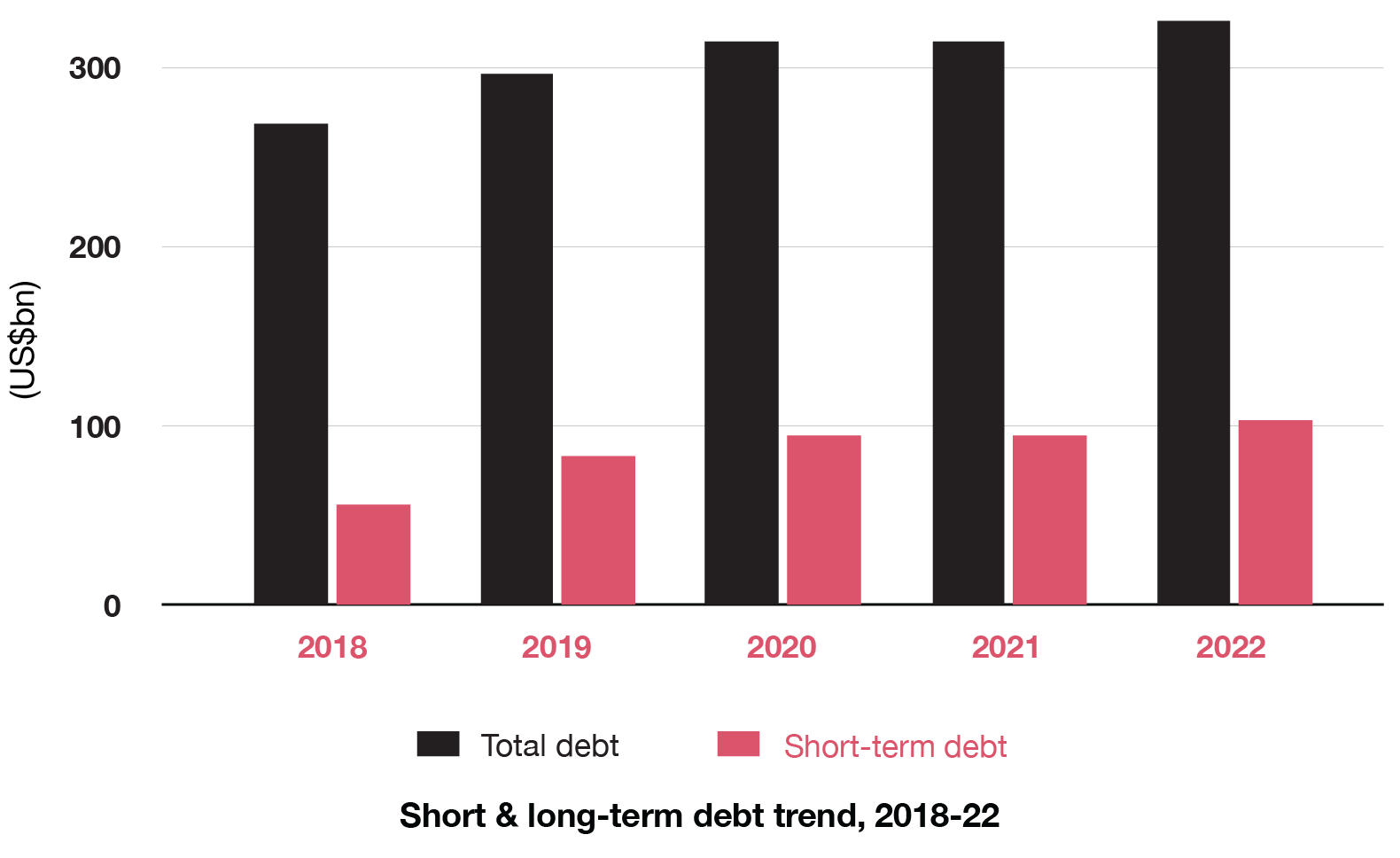

Despite working capital performance improving over the last two years, Middle East businesses have seen short-term debt increasing by 15% over the same period. If companies look at releasing working capital from operations through performance improvement, not only could the financing costs be eliminated for the cash released, but treasurers could use the cash to generate returns by investing it in fixed term deposits or other alternatives.

With their eyes set on top-line growth, businesses in the region witnessed yet another year of decline in EBITDA margins, reaching 17.9% in 2022 from 18.9% in 2021. Consequently, the region continues to experience a long-term deterioration in EBITDA margins, with a compound annual decline of 2.5% since 2018. This deterioration, combined with an increase in the capital employed, means that shareholders have continued to receive a lower return on capital employed (ROCE), which in 2022, was on average 8.4%. The ROCE experienced a compound annual decline rate of 4% since 2018, despite an isolated rebound in 2021, primarily driven by the recovery of profitability post the COVID pandemic.

Liquidity generated from operations has also reduced as the long-term declining EBITDA trend is further impacted by a declining conversion of EBITDA to operating cash flow, which has dropped from 105.9% in 2020 to 94.8% in 2022. The reduction in operating cash flows over the last year, coupled with a 3% increase in the total debt between 2021 and 2022, suggests that companies are looking for alternative sources of cash to fund their needs and plans.

The working capital performance improvement of companies in our study has been driven by a reduction in DSO, a measure of how long companies take to collect cash from customers. The DIO and DPO, which represent the average inventory time and average time to pay creditors respectively, have deteriorated in 2022.

During 2022, inventory performance has deteriorated by three days to 93 days at the end of 2022. Several disruptive events during 2022 have impacted global supply chains, starting with geopolitical tensions, logistics disruptions, production delays, commodities’ price volatility, and global inflation.

However, we are now seeing signs that businesses across the Middle East are increasingly focused on increasing their supply chain resilience and investing in technology to help manage inventories, forecast demand and manage their stock mix.

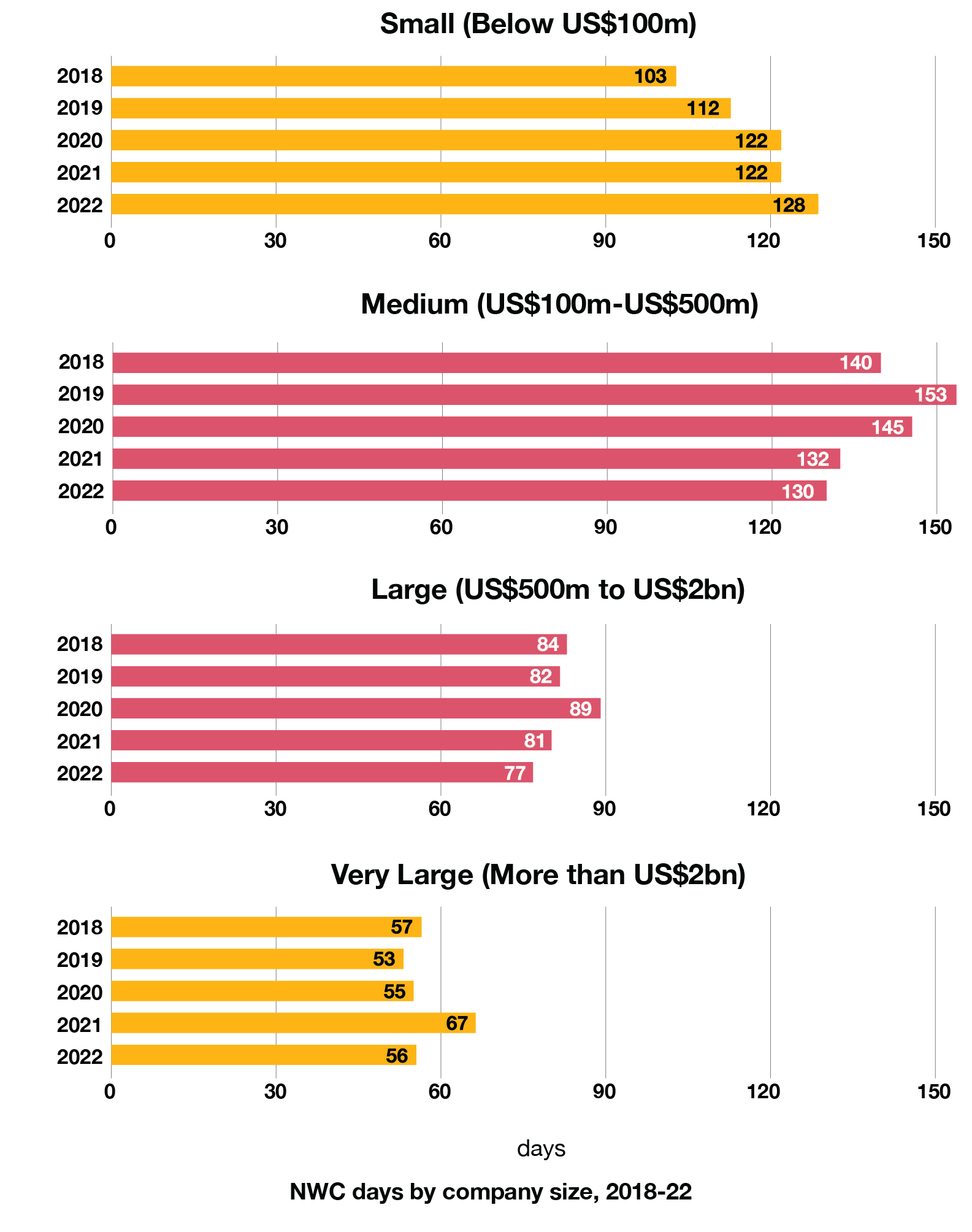

The results of this year’s study show a similar trend to previous years, where very large companies have a working capital cycle that turns cash over two times faster compared to their small and medium peers.

Smaller companies have been the only ones to experience a deteriorating working capital performance in 2022 despite a substantial increase in their DPO. These companies struggle to collect cash from customers, with their performance significantly deteriorating by 9% in 2022 alone, while inventory management remains challenging with a 5% deterioration from last year bringing the position to the worst in five years.

Small and medium companies have also seen their inventory management performance deteriorate with the average number of inventory days going up 5% and 7%, respectively, in 2022 alone. Inventory management remains the most complex element of working capital performance, and coupled with the increasing complexities and uncertainties that globally connected supply chains bring as well as the lower maturity of supply chains for smaller companies in the region, not only results in larger amounts of cash tied up in inventory but comes with significant stock imbalances leading to impacts on the top-line through lost sales. Our study has revealed that small companies had a 2% compounded annual growth in revenue over the last five years versus 11% for very large ones.

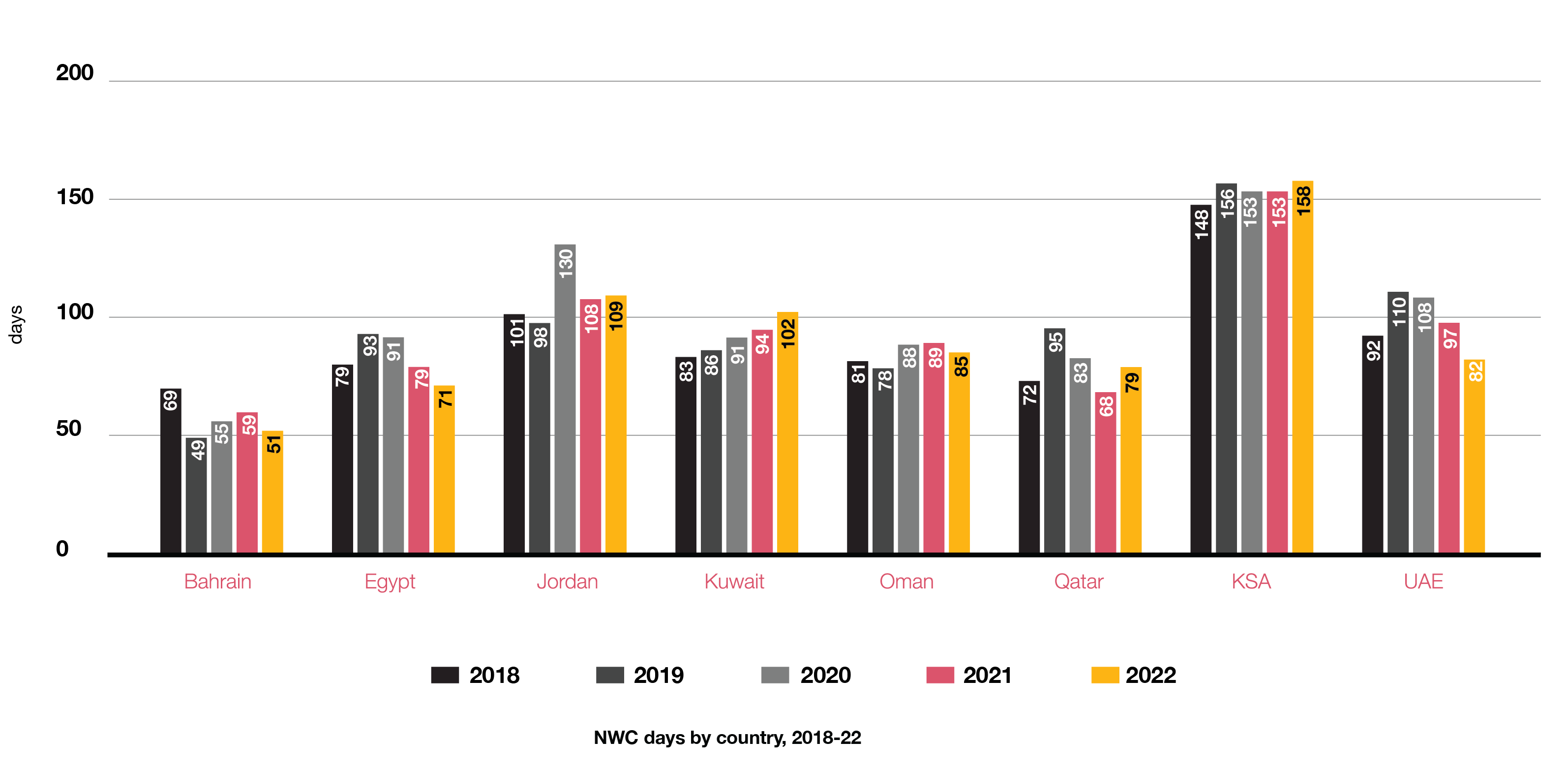

Only three countries across the Middle East, namely the KSA, Kuwait and Qatar, have experienced a deterioration in working capital performance during 2022. The performance at country-level across the Middle East continues to show a significant variation from companies in KSA operating with an average cycle of 158 days in 2022 to businesses in Bahrain where the working capital cycle averages 51 days only.

A total of 52% of the companies in our sample have improved their working capital performance. This highlights that regardless of size or sector, a clear focus on internal processes, policies, systems and people can yield significant benefits.

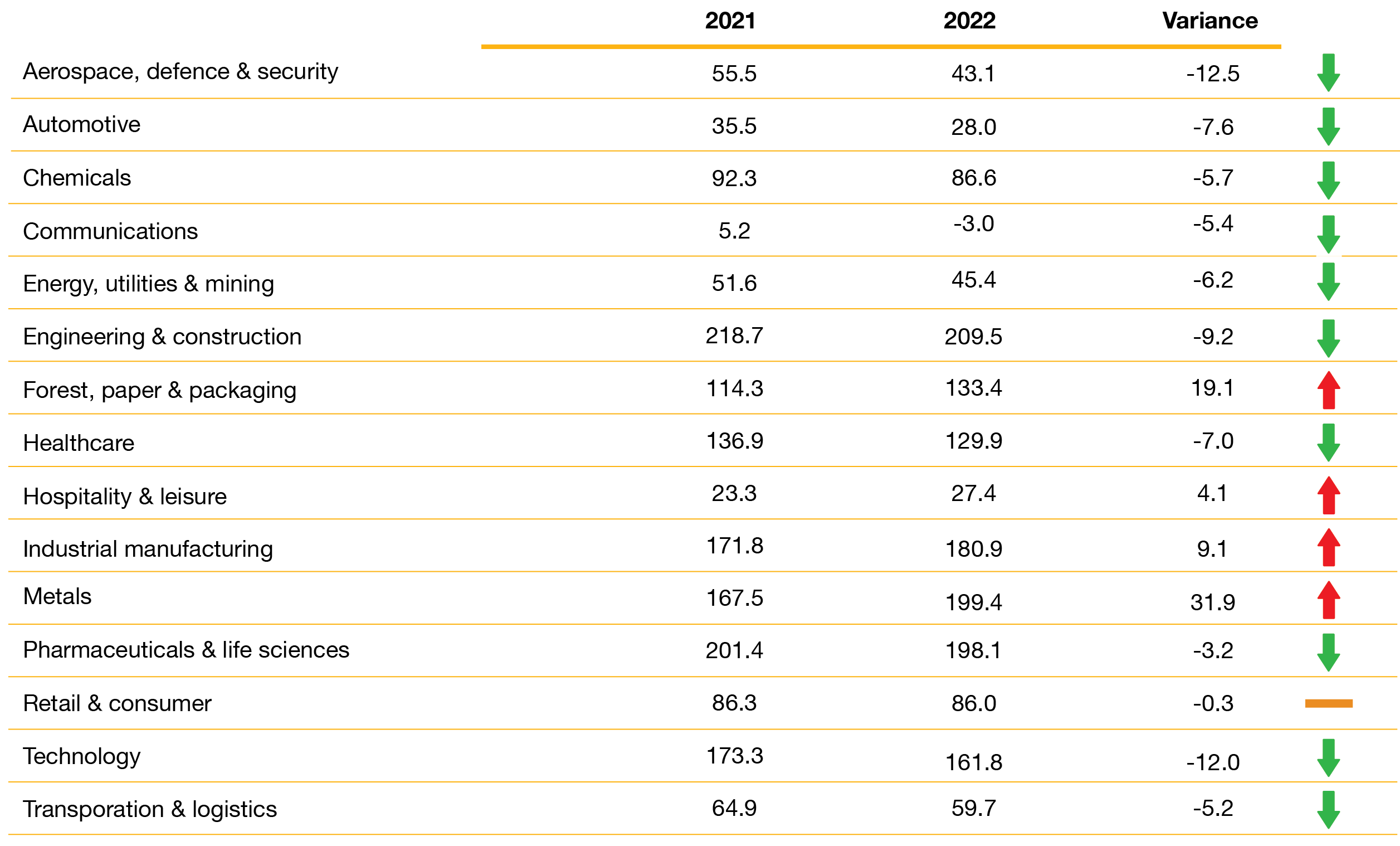

Most sectors across the Middle East have shown signs of improvement in working capital performance with a selected group of top-performing companies in each sector leading the charge.

Act now

Our study highlights that although companies in the Middle East have been improving their working capital performance over the last two years, it is primarily driven by the top-performing corporates that are increasing their gap to the medium and bottom quartiles.

The top-performing corporates have embedded a cash culture across their organisation and have working capital as a key strategic pillar, meaning that working capital practices are aligned to the strategy and operating model, increasing the business resilience by optimising the amount of cash required to run day to day operations and increasing their agility.

During 2023, the interest rates continued their growth and although we see an increasing number of companies attempting to improve working capital, there is far more that can be done to ease the burden for shareholders and accelerate cash generation.

The time to act is now, and in our experience working with all types of businesses across the region, the top four areas of focus for the coming 12 months should be:

Contact us

Partner, Debt, Capital, Performance & Restructuring Advisory, PwC Middle East

Tel: +971 4 304 3228

Anthony Manton

Partner, Business Restructuring Services, PwC Middle East

Tel: +971 04 304 3100

George Kakos

Partner, Debt & Capital Advisory, PwC Middle East

Tel: UAE: +971 56 682 0631 | KSA: +966 56 961 0097

Dan Georgescu

Director, Performance and Restructuring Services, PwC Middle East

Tel: +971 5 6418 9776