What a difference a year makes. In 2021 we described the tax challenges facing organisations in the Middle East as a ‘perfect storm’. The combination of the introduction of further local indirect taxes and well-funded, highly active tax authorities was placing increasing demands on multinational organisations in the region.

A year later, our second survey reveals that huge progress has been made. The responses of senior tax decision-makers operating in 12 jurisdictions across the Middle East reveal an increasing confidence in dealing with the demands of the evolving tax regime and a maturing relationship with tax authorities.

Our 2022 report charts this growth and the hurdles still to come - and pinpoints practical actions for businesses as we move into this next phase of change.

“It’s encouraging to see that organisations have worked hard to build trusted relationships with the tax authorities and have really invested in their tax functions in the face of enormous - and rapid - transformation.”

Explore the 3 key themes from the findings

Tax departments in the Middle East have made huge progress in a relatively short period of time, rising to meet the demands of a rapidly developing tax environment.

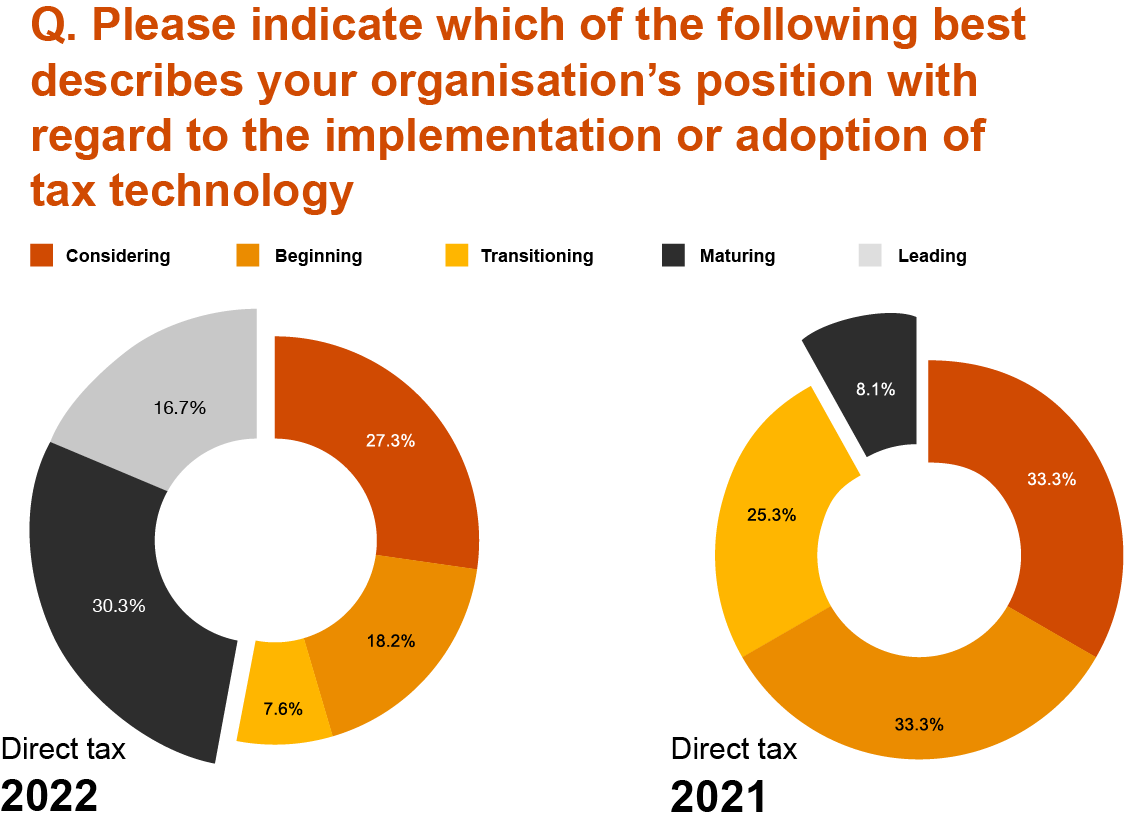

This year, 47% told us they now consider their approach to the adoption of tax technology as either maturing or leading. This is remarkable progress compared to 12 months ago, when just 8% of companies described themselves this way, with most only just starting o grasp the level of investment needed in tax technology in order to keep up with the expected continuation of transformation.

But this is just the beginning. 79% of tax leaders expect the regional tax landscape to continue to undergo extensive change in the next three to five years.

While young women are highly motivated and keen to make their mark in the workplace, their experiences of employers are falling short of expectations. Too often, the assurance that they will be treated the same as their male colleagues and given equal training, development and career opportunities, is not reflected in their actual experience

Almost all of the survey respondents (94%) say they value employers who help them to achieve

a work-life balance, while 80% feel it is important to play a leading role in looking after their families. This suggests that young women value their time outside of work, whether it is to maintain their own wellbeing, cultivate personal interests and their own development, or to fulfil their roles and responsibilities within their families.

However this does not mean that the women are not ambitious and want to progress their career - 84% of respondents aspire to become leaders in their field, 80% are confident about their ability to

lead others, and 86% believe they have the skills and experience to progress to the next level of their career.

“Good quality data is the oxygen that tax functions need to operate successfully – it ensures that compliance requirements are met, that risk is managed effectively, and generates meaningful insight for decision-makers.”

Three critical steps to building a strategic tax function

Get ahead in the race to recruit

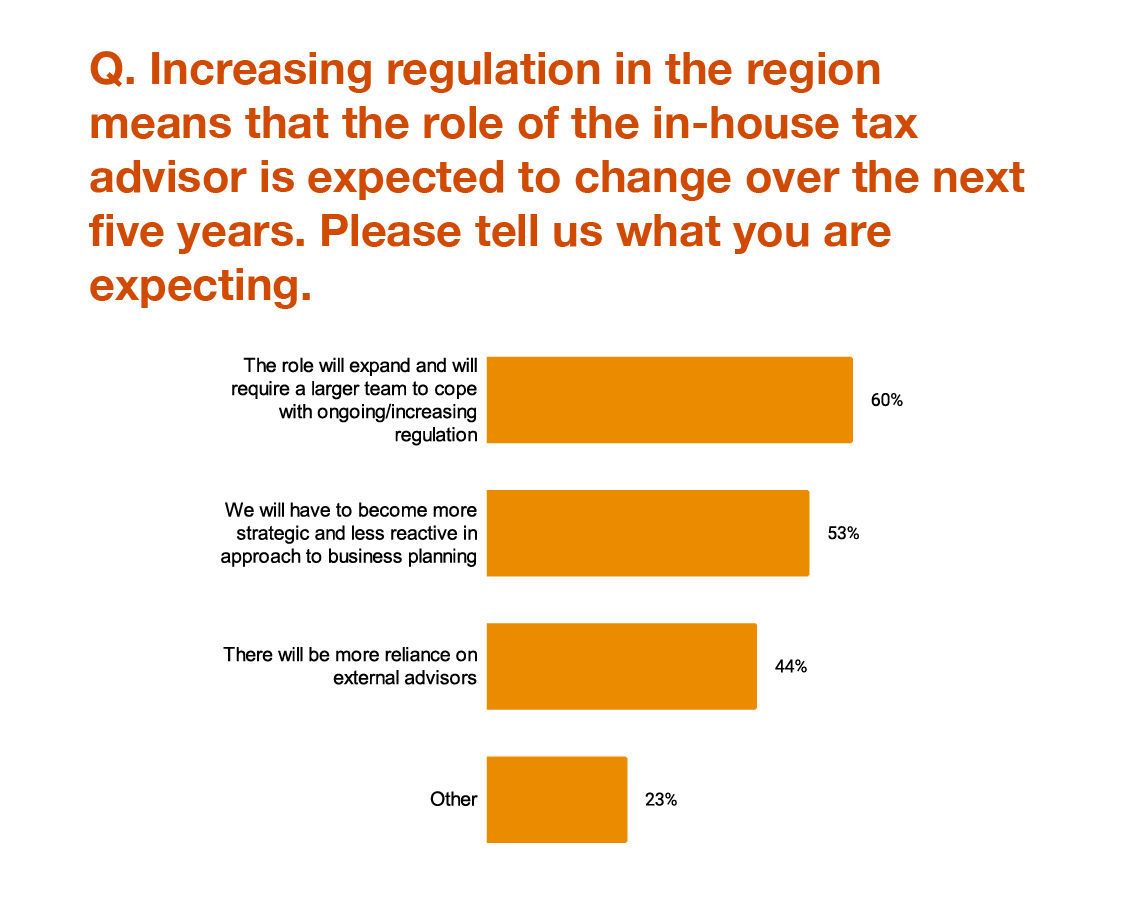

Tax professionals with strategic, technical skills are a scarce resource. Tax teams across the region are set to grow significantly in the coming years and will be competing with organisations across the world for the best talent.

Continue to leverage technology

Tax departments across the region have made huge advances in tech implementation over the past year. But while tax leaders understand the value of tax technology, continued investment is critical to keep pace.

Have a sharper strategic focus

Tax is rapidly becoming one of the most important elements of strategic decision-making. Tax teams will increasingly find themselves needing to be led by those with the right experience and technical expertise to understand and react to more complex tax transformation.

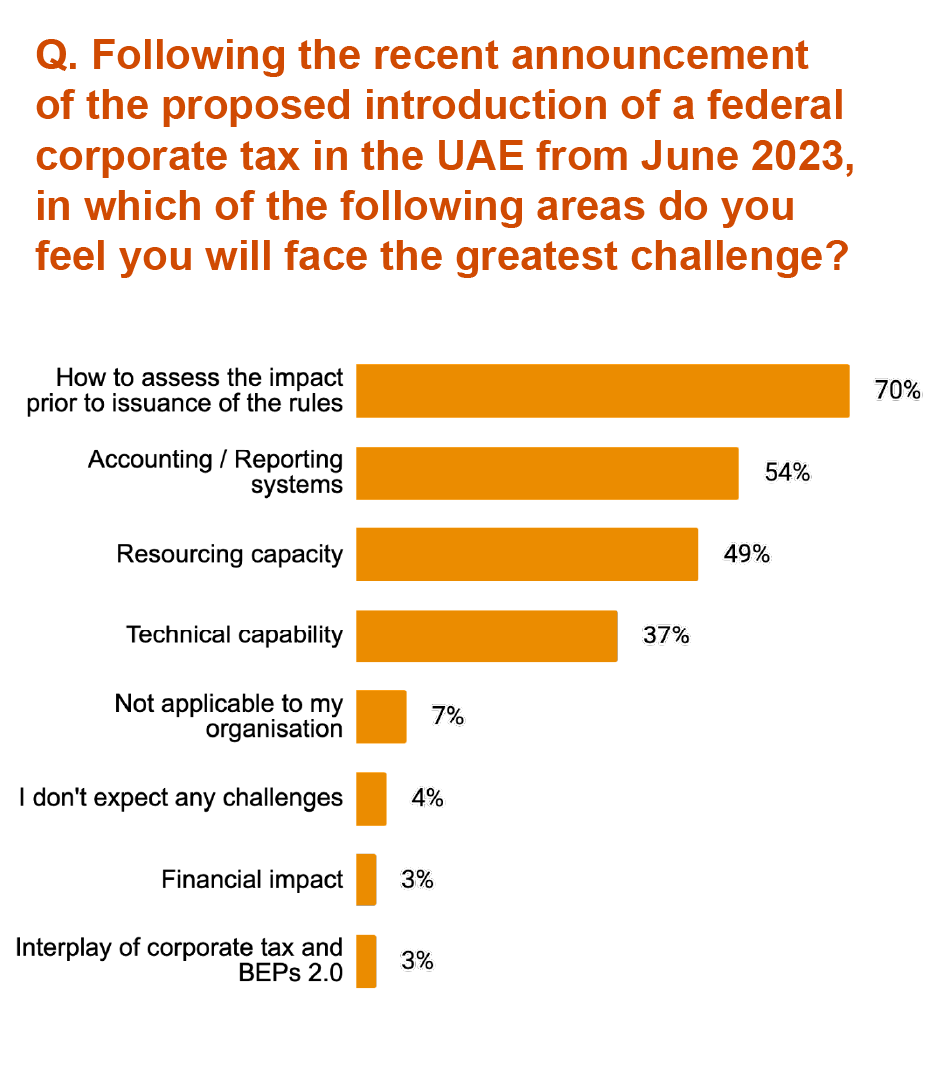

Reaction to the announcement of the introduction of Federal Corporate Tax in the UAE from June 2023:

With a little over a year to go before UAE CT becomes effective, organisations with operations in the UAE are still assessing what the new tax will mean for their business, and for the bottom line. The reality is that the introduction of CT has wide-ranging implications for the tax function and the wider business, and will require serious investment in upskilling and an expansion of capacity for many inhouse UAE tax teams.