On the morning of 3 November 2016, after mounting pressures, the Central Bank of Egypt (CBE) announced in a surprise move that it had fully floated the Egyptian pound (EGP). This came after a parallel market had slowly flourished and the market differential reached close to 100% by the end of October. The CBE also raised interest rates by 300 basis points on the same day. The decision to “liberate exchange rates” and move away from the long standing partially pegged EGP envisages to return foreign-currency trading to the formal banking sector. In fact, less than a month after floatation the banking sector had pulled in more than USD3bn, as reported by the CBE.

Timeline

This has sparked a series of news stories, as exactly eight days following the floatation, the IMF called for an early meeting to review the package being considered and approved its biggest ever Middle East loan amounting to a total of USD12bn for Egypt. The International Monetary Fund (IMF) already released the first tranche of USD2.7bn to be added to Egypt’s cash-strapped international reserves. Egypt is currently en route to receive the second tranche of the IMF loan.

A quick and strong sign of renewed confidence

Less than a week after the currency float decision, the Egyptian Exchange (EGX) hit a five-year high. Foreign investors and institutions, including Gulf-based investors, were on the buying side, merely locals and retail investors were sellers. This is a quick and strong sign of a renewed confidence that international and regional investors have in Egypt as an economy. It is apparent that undoubtedly large growth is expected over the long term, bolstered by a free economic system.

Undoubtedly, in the simplest terms, Egypt has become a more affordable destination than before - be it as a travel or investment destination. Both will lead to an inflow of foreign currency and Foreign Direct Investment (FDI) into the market and increased economic activities (reducing unemployment, increasing GDP, etc). There is a time lag, however, as investors will only start coming once they feel that the USD: EGP rate has reached stability and that the speculation/high volatility period is coming to an end.

The EGP is currently trading at close to EGP 16 to the dollar having appreciated 16% this month. Although further volatility is expected in the short term, it is expected to strengthen further and reach its fair value over the medium term. The IMF also expects inflation to drop in the second half of the year and push down interest rates to permit credit recovery.

Furthermore, the large devaluation of the EGP has resulted in a valuation gap due to the large decrease in business values compared to previously stated dollar terms. Valuation adjustments will therefore have to be made resulting in a delay before deals are sealed.

“Egypt exports rose 8.65% with tremendous opportunity to grow further given the recent devaluation in 2016”

Egypt is now well positioned to compete in global markets

On a more positive note, we expect that Egypt's exports should increase as it is now able to offer a more competitively priced product amidst global competition. Moreover, we believe there is tremendous potential for local manufacturers to seize the opportunity of the currently high cost of imports, by offering competitive, and more affordable locally produced products. Egypt occupies a geographically strategic location and offers an economical and relatively qualified labour force with an average labour cost of USD1.3 per hour in 2015 according to the Economist Intelligence Unit. The growing population complements a significant market in the region and the move towards a free economy has removed a barrier which has previously kept away many eager but cautious investors. We do expect some industries to face difficulty in passing through price increases that match the EGP devaluation impact on their businesses, which will ultimately lead to a temporary margin erosion, until the market stabilises and margins revert to normal levels again. For the average Egyptian as well, it is not going to be easy. Wage inflation is likely to fall behind price inflation in goods and services, which will put pressure on discretionary spending and may affect growth in certain industries.

On the other hand, companies can now benefit from the free float as forex losses will now be recognised by the tax authority. Previous foreign currency purchases from the parallel market created a burden of forex losses that was not supported by receipts and hence only a certain portion was allowed as an expense during tax investigation.

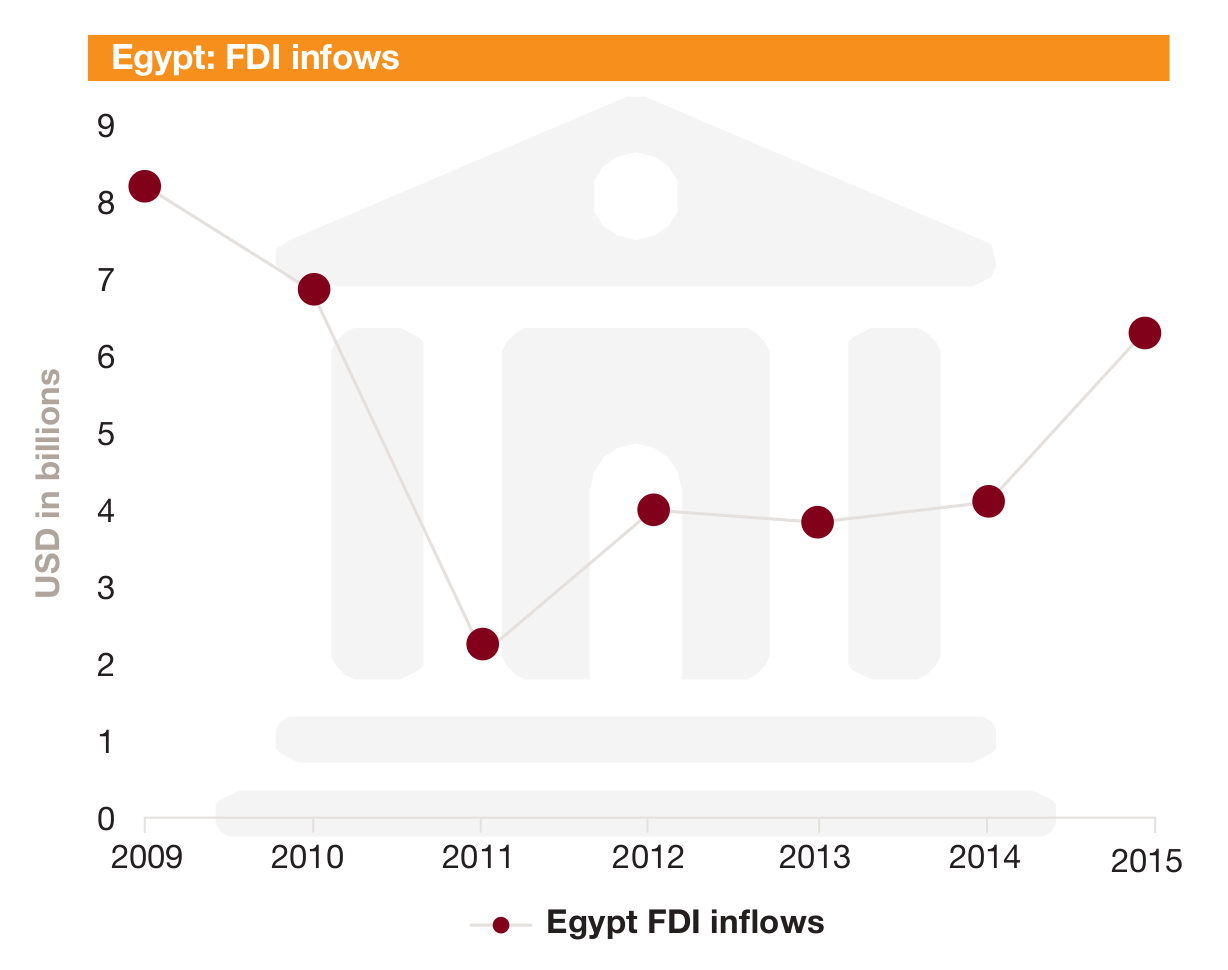

Although Egypt’s FDI decreased as a result of the global economic crisis and later the revolution of 2011, FDI resumed growth from USD4.1bn in 2014 to USD6.4bn in 2015. The last few months have also shown encouraging momentum, which should lend confidence to Egypt’s reform efforts. According to the CBE, Egypt’s FDI recorded USD2.8bn during Q3 in 2016, compared to USD1.4bn during the first quarter, and USD1.7bn in the second. Moreover, Egypt was one of the top five destinations for inbound FDI in Africa, receiving USD6.4bn in 2015, up by nearly 56% from 2014 as reported by United Nations Conference on Trade and Development. Russia’s Ministry of Trade announced in July last year that a number of Russian companies are planning to invest around USD4.6bn in a new industrial park in East Port Said, with construction scheduled to begin in 2018.

Source: Central Bank of Egypt

Beyond the flotation

The liberalisation of the EGP is only one of many steps being taken by the government as part of a wider economic reform program. Agreed reforms include increasing the government’s income from tax sources via the implementation of the Value Added Tax (VAT) and introducing a law aimed at speeding up the resolution of tax disputes and settlements, as well as considering a different structure of progressive salary tax rates.

Another key pillar of the economic reform program is bringing back FDI to its pre-2011 levels and beyond. The Ministry of Investment has expressed its desire to raise Egypt’s ranking in the Doing Business report to 90 from the current 122. A set of tax and non-tax incentives are currently under consideration to be offered to foreign investors, along with a clear roadmap for profit repatriation to avoid the mistakes of the past. The new investment act has received initial approval by the Cabinet and passed to the State Council for final review before being forwarded to the House of Representatives for debate. The government is planning to implement the new investment law by March 2017, which will streamline industrial licensing for all businesses other than those serving vital public interests.

The government is also proposing a new insolvency law, of which a draft has been issued, to be implemented by June 2017, according to the IMF. The law is aimed to simplify the time-consuming bankruptcy procedures and to legitimise insolvency.

Furthermore, a new milestone has been set by the CBE to attract FDI, as a consequence of the free float, which is the approval for commercial banks to sell USD to clients looking to repatriate profits. Whilst the effect of this decision on the stock market was bullish, businesses with M&A transactions in the pipeline have cheered even louder as foreign investors who were not willing to bring money into the country with no guarantee of getting their dividends out, are now more comfortable investing in Egypt.

The government is also restructuring the subsidy program. A five year energy subsidy reform program began in 2014 and further electricity price hikes were announced in August 2016. It also passed an increase in fuel prices on the day following the floatation of the EGP. Albeit, some do argue that the latter is merely a reflection of the new exchange rates rather than a reduction in the subsidy bill. From a macro perspective, the government is looking at moving into a cash-based subsidy system, where the less fortunate get their subsidies in cash, rather than subsidising food commodities and fuel for all. This will probably be a priority in the economic reform program, especially given that a percentage of Egypt’s population sadly moved below the poverty line overnight following the EGP floatation. This will also help reduce the government’s subsidy bill allowing it to focus its expenditure on other much needed areas such as required infrastructure.

In addition, an infrastructure intensive works policy has been launched i.e. construction of the third metro line, expansion of the port of Sokhna and improvement and renovation of the rail and road network, which offers numerous investment opportunities to foreign companies. Government policy for large-scale infrastructure projects is evolving and improving the appeal to foreign investors. This is an encouraging sign for foreign investment.

“The new Invesment law aims to boost investor confidence and reduce potential hurdles that incoming foreign investors may face”

According to the draft, investors can now incorporate a company online, recruit up to 20% expats in their projects, repatriate profits more freely and offer only a 2% unified custom tax on imported equipment and machinery.

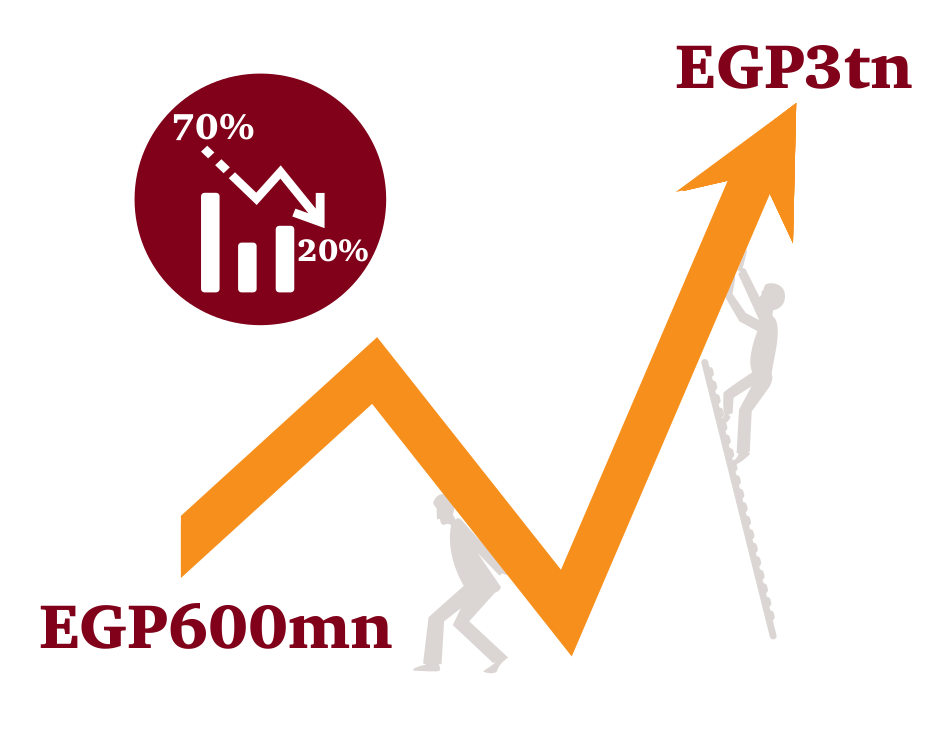

Current efforts also include enabling capital markets to become a catalyst for investment. Egypt’s capital market currently represents c.20% of GDP, down from 70% in 2007-08. Egypt’s finance minister sees that there is strong potential to bolster the market by attracting public markets investors through an ambitious program to IPO state-owned assets including public utility companies. The list includes Arab African International Bank and Banque du Caire, amongst a number of other government entities (mainly oil & gas such as AMOC and Enpi). This is estimated to trigger EGP3tn of capital market compared to a current aggregate market cap of around EGP600mn, as stated by the Minister of Finance.

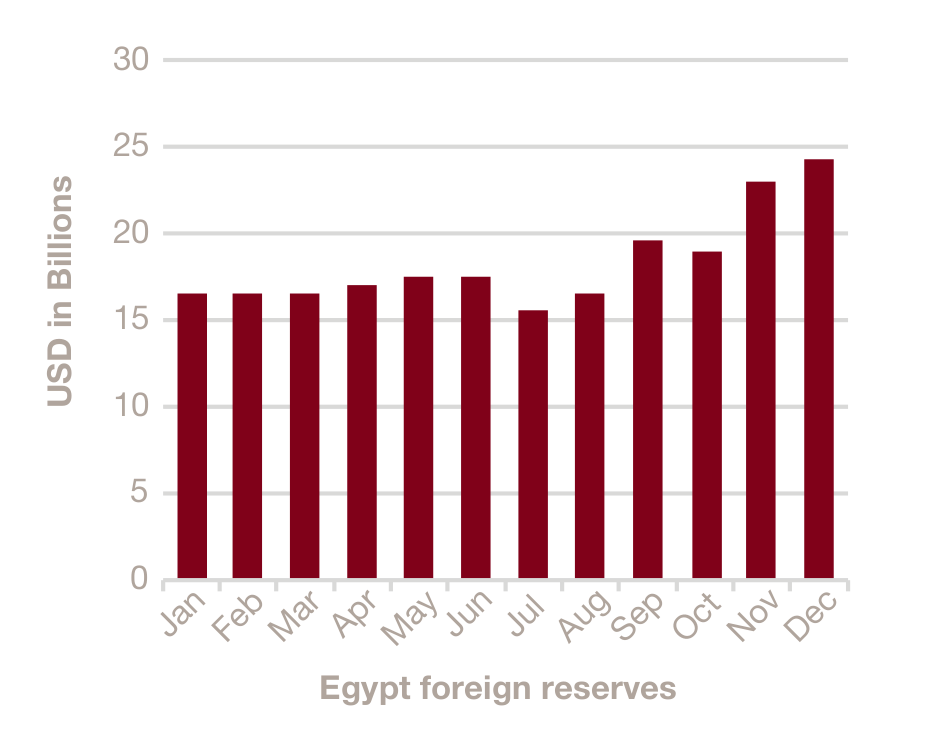

Source: Central Bank of Egypt

Furthermore, the government has been exerting efforts at international fronts to boost foreign reserves. A day before the IMF loan approval, CBE initiated a repurchase transaction with international banks that has a maturity of one year. The finance ministry announced it sold USD4bn in bonds on the Irish Stock Exchange for the benefit of the CBE and used part of it as collateral to execute the agreement. Hence, an additional USD2bn has been added to the foreign reserves. In addition, on 24 January 2017, following a well received and successful roadshow, Egypt sold USD4bn of Eurobonds in three tranches, raising twice as much as targeted and at lower yields than initially expected. The government is also considering issuing bonds in other international currencies i.e. yen and yuan as part of the government’s effort to raise USD21bn over three years to shore up reserves and end the hard currency shortage. It also recently finalised a USD2.7bn currency swap with China.

Key takeaways

Ultimately, Egypt has begun the road to a free and growing economy. The Egyptian economy has a strong demographic base and GDP growth has been very slow paced and arguably frozen for years, resulting in a huge opportunity of untapped potential. It is apparent that the roll out of reforms is driving Egypt towards a liberalised economy, especially as there appears to be a strong commitment to such reforms from Egyptian leadership. A move long awaited by a thirsty private sector and foreign investors.

Although a rapid revival of capital markets is expected there is still a cautious approach towards the Egyptian market pending the cementing of reform speculation in the short term, as investors do look forward to more transparency and clearer long-term plans.

We expect that the free float will result in an increased market confidence and a new wave of foreign investment. The devaluation of the EGP has made investments in Egypt both more affordable and more promising, particularly given the growth-friendly investment climate. It is allowing Egyptian goods and services to be more competitive at a global level and the yields on Egyptian assets to be more attractive. We also expect exports to pick up on exploration of new gas fields and competitive gains from the EGP devaluation. There is a strong opportunity to increase our exports to several fast-growing markets, especially given the various trade agreements already in place.

This is a good time for investors to explore new investment opportunities in Egypt, as the market is beginning to settle down and absorb the post devaluation impact. Investors will soon be able to get a clearer picture of how the float is evolving. This will also allow potential deal parties to get a stronger sense of the valuation adjustments due to the EGP devaluation.

The background

The 2011 revolution caused economic hardship in Egypt, resulting in foreign currency shortages as the country witnessed a flight of capital due to security issues as well as labour and social unrest. The consequent effects can largely be attributed to the already fragile Egyptian economy. Although it was growing at rates of 5% and 6% annually pre-revolution this growth was not strong enough to establish a sound economic base. Whilst on the brink of the revolution, the country was already suffering from 9% unemployment and the government footed a large subsidy bill ranging between 12.2% and 8.5% of GDP between 2008 and 2010, which mainly consisted of energy and food subsidies.

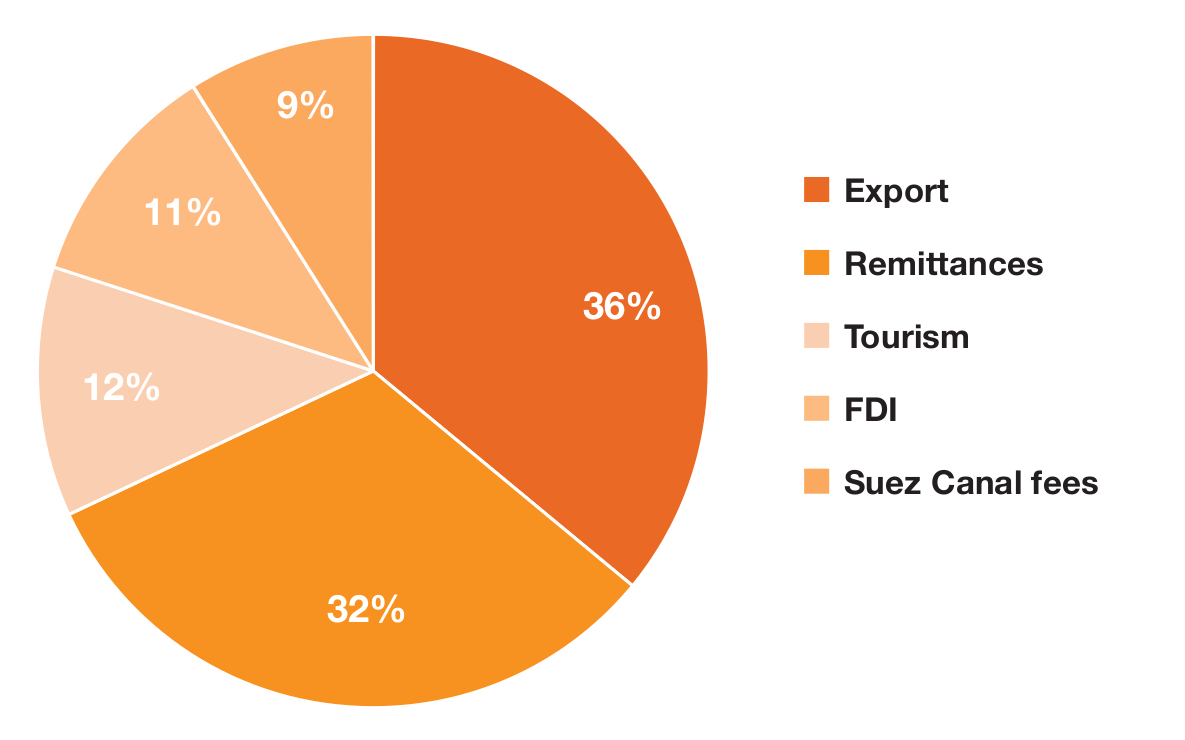

When Egypt faced a hiccup in foreign currency supply, it unfortunately led to a domino effect triggering a series of economic woes. Egypt’s main sources of foreign currency are: exports, remittances (including loans and grants), tourism, FDI and Suez Canal fees. All of these sources have suffered due to palpable uncertainty following the 2011 revolution. One of the largest affected sectors (and perhaps the first to cause the domino effect) was the tourism industry. Once a main source of foreign currency and a large contributor to GDP (accounting for more than 10% of GDP pre-2011), the industry suffered significantly amid security concerns due to the Arab spring. The situation was made worse when a Russian aircraft crashed whilst flying from Sharm-El Sheikh to St. Petersburg spurring a series of flight bans from several European countries. As a result, a foreign currency parallel market started to evolve; consequently remittances began funneling out of the formal banking sector as people used the parallel market to get more favorable exchange rates. Capital controls were also imposed, this limited money transfers out of the country making it near impossible for multi-nationals to repatriate profits, therefore causing a considerable decline in FDI.

This served to amplify the shortage of foreign currency. The dollar shortage incapacitated trade and made it hard for manufacturers to import raw materials and machines. This was further exacerbated by low oil prices, which negatively affected neighboring Arab countries’ readiness to offer financial support. The large decline in oil prices also resulted in shipping companies on the Europe-Asia route finding it more economical to circumnavigate the southern tip of Africa, than pay the transit fees for the Suez Canal. All these factors combined increased the country’s foreign currency shortage and as a result Egypt’s current account deficit leapt to an unprecedented 5.3% in July 2016.

“Whilst there are some challenges ahead, an inflow of USD12bn into Egyptian banks since the EGP free float shows confidence in the economy is returning”

Egypt: Sources of Foreign Currency 2014/2015

Source: Central Bank of Egypt