Introduction

Egypt, the region’s most populous country, with approximately 106 million people has a diverse consumer base and a skilled, educated workforce1. However, in the past few years, the country has faced significant economic challenges. With the recent investment from the UAE to develop the Ras El Hikma area and additional funding support from multilateral institutions, such as the IMF and World Bank, Egypt’s key economic indicators have shown marked improvement. The country has recorded stronger fiscal discipline, steadily declining inflation and foreign exchange reserves reaching record levels, despite the challenges of decreased revenue for the Suez Canal due to current geopolitical conflicts in the wider region. The evolving economic landscape and the rapid pace of tech advancements have not only reshaped consumer awareness but have also become the driving force behind shifts in behaviour. Our survey dives into the heart of these changes and looks at the factors that are influencing the mindset and actions of consumers across Egypt2.

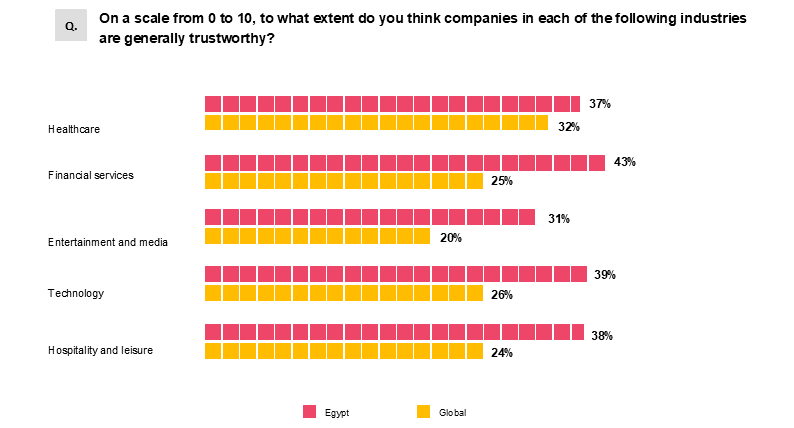

Most trusted sectors

Consumers in Egypt now place greater value on trust and reliability across industries. In our latest Voice of the Consumer 2024: Regional findings, insights from 320 consumers in Egypt reveal that financial services have been rated as the most trusted by 43% of consumers (vs 25% globally), scoring high between 9 to 10.

In Egypt, the financial services sector has also been historically strong, providing critical banking services and products that meet the needs of the economy. Despite challenging macroeconomic environments, Egypt has strengthened its digital financial services in the last few years to boost financial inclusion, with Payment Service Provider (PSP) applications providing a fast, secure, and convenient solution for money transfers across the country. Other trusted sectors in Egypt include technology (scoring a 7.7 out of 10) and hospitality and leisure (scoring 7.7 out of 10).

What builds consumer trust?

In Egypt, over 20% of surveyed consumers are open to trying new brands due to their innovative and high-quality products, positive reviews, strong reputations, and promotional offers. Meanwhile, the foundation of consumer trust remains centred on data protection and ability to offer high quality products and services. With many brands in Egypt marketing their products on social media platforms, a significant 89% of consumers surveyed in Egypt and 85% of their regional counterparts cite safeguarding customer data as the most crucial factor for earning trust in a company.

Inflation remains a top concern

With rising prices and current economic challenges, 67% of consumers surveyed in Egypt have identified inflation is their top concern. While inflation is also a primary concern regionally and globally, it holds particular significance for Egyptians due to recent macroeconomic trends, including the devaluation of the Egyptian pound. Egyptian consumers are also increasingly mindful of macroeconomic shifts, health considerations, and climate change, reflecting concerns seen across the wider region.

Climate and sustainability

Aware of the impacts of climate change, 37% of consumers surveyed in Egypt (compared to almost 30% regionally) reported having noticed climate-related disruption to their day-to-day lives to a great extent . As a result, 56% of consumers surveyed in Egypt are eager to buy more sustainable products to reduce their environmental footprint.

In terms of mobility, there is growing awareness of climate change and the region's broader agenda to reduce dependence on fossil fuels. With the additional pressure of increasing fuel costs, roughly 5% of surveyed consumers have already made the shift to electric vehicles. The transition to electric vehicles in Egypt is gaining momentum, with the government identifying EVs as one of the strategic industries to benefit from the tax exemptions. While the charging infrastructure is still developing, it presents a significant opportunity for growth and innovation in the country's EV market3.

In addition, 87% of survey respondents also indicated that they would be willing to use alternative transport if their area had better public transport infrastructure. Many upcoming public transport solutions, such as the Monorail, Light Rapid Transit (LRT), and Bus Rapid Transit (BRT), are set to be electric, reflecting a shift toward more sustainable urban mobility options.

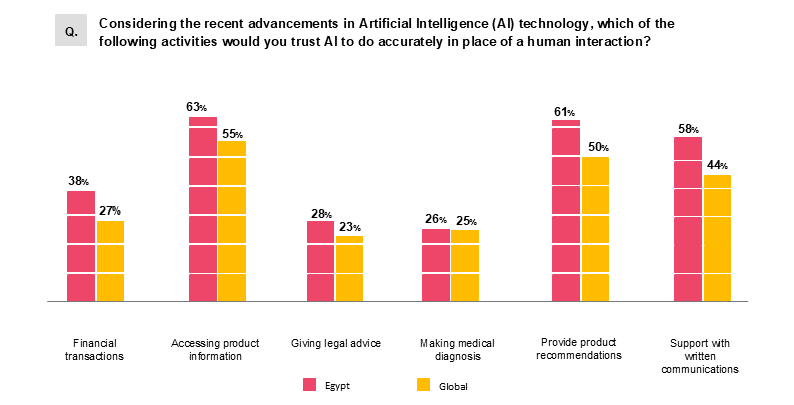

Emerging technologies

In Egypt, similar to what we have seen at the regional and global levels, more than half of the consumers surveyed are willing to trust AI for low-risk activities, such as accessing product information or receiving purchase recommendations. However, consumers expressed lower confidence in AI's ability to manage high-risk tasks, such as handling financial transactions (38%), giving legal advice (28%), or making medical diagnoses (26%). This highlights the need for greater awareness to help consumers better utilise AI to improve efficiency in these areas. This is also augmented by worry about cybersecurity risks and insufficient regulation of governance, as 79% of surveyed consumers were concerned about cyber threats when using AI.

Shopping behaviours

Notably, consumers surveyed in Egypt (46%), on par with their peers in the region have demonstrated a higher frequency of weekly online shopping via mobile phones compared to their global peers (34%). But despite the growth of online shopping, in-store purchases (46%) maintain their prominence. In fact, 44% of consumers surveyed in Egypt have highlighted real-time personalised offers as key drivers to encourage in-store shopping. The surveyed consumers in Egypt believe more accurate and detailed product description coupled with more detailed sizing information would help reduce online returns.

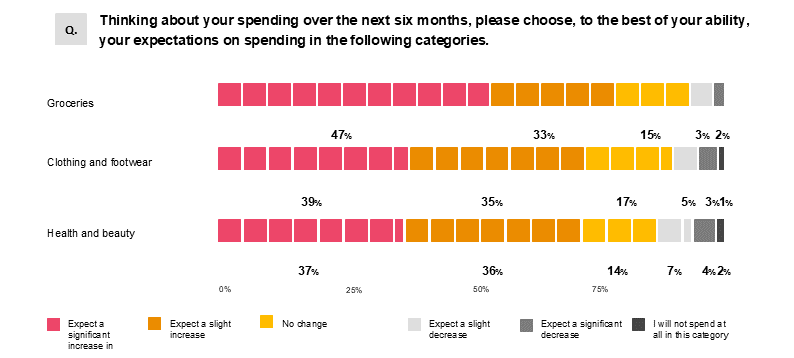

Consumers in Egypt anticipate an increase in spending over the next six months on groceries (80% vs. 62% globally), followed by clothing and footwear (74% vs 50% globally) and health & beauty (73% vs. 49% globally).

As Egypt grapples with rising prices, consumers are spending more on essential items, with a little over a third of their total spending going towards food and groceries, a recent NielsenIQ Egypt study has pointed out. Findings from our survey have also revealed that 62% of consumers in Egypt prioritise personal health when making food choices, with nearly 50% consider nutritional information as critical. For guidance on health and well-being, 56% consult physicians, followed by pharmacies and health experts (37%). In addition, there is a growing interest by consumers in integrating health tracking features into their lifestyle via products such as smart wearables.

Brand differentiators

Consumers surveyed in Egypt indicated that the key factors that could entice them away from their preferred brands are better value for money (32%) and higher quality (29%). In the wider region, financial benefits were most likely to drive consumers to switch brands, with 32% of consumers seeking better value for money. However, high quality innovative products, promotional offers, reputation as a trusted brand and positive reviews were also influential in driving choices of more than 20% of regional consumers. In the region, we also find an openness from consumers to consider purchasing ‘big ticket’ items without seeing the physical product ahead of time.

Digital and social media

Social media platforms have changed consumer behaviour in the region, enabling new brands to engage and attract consumers. Our regional findings have indicated that influencers and celebrities influence purchase decisions for 67% of consumers. In Egypt, over 80% of consumers agree that they have discovered brands through social media, with a significant 90% of those surveyed indicating that advertisements on social media influence purchasing decisions. Moreover, 60% of consumers consider advertisements on retailer websites and 50% consider email advertisements to influence purchasing decisions.

Over 80% of consumers in Saudi Arabia, the UAE, and 90% in Egypt actively seek reviews to validate companies before purchasing via social media. Additionally, over 60% of consumers are worried about their privacy and data sharing.

A future perspective

The Egyptian market, with its large and diverse population, is undergoing significant transformation as consumers become more discerning, cost-conscious, and tech-savvy. As consumer preferences continue to evolve, there is a notable shift toward supporting local businesses. This trend not only strengthens the local economy but also fosters a community-focused marketplace where quality and sustainability take precedence. Amid rising inflation and increasing prices, consumers are placing greater emphasis on essentials like groceries and health products, demanding better value from the brands they choose.

Additionally, sustainability is gaining traction, with more Egyptian consumers actively seeking eco-friendly products and sustainable brands. This shift presents a key opportunity for businesses to differentiate themselves by offering high-quality, value-driven, and sustainable goods. Local retailers are particularly well-positioned to thrive due to the higher import costs owing to the Egyptian pound devaluation, increasing the demand for locally sourced products.

Emerging technologies like AI offer great potential, but businesses must build consumer confidence. To stay competitive, retailers should embrace AI and leverage social media to enhance digital engagement. Creating seamless omnichannel experiences, with a focus on personalised services and in-store shopping enhancements, will be critical to driving customer loyalty and meeting the demands of this shifting landscape.

The path forward requires agility, innovation, and a deep understanding of the Egyptian consumer’s evolving mindset. Brands that can successfully navigate these challenges and focus on transparency, data protection, and trust will be well-positioned for long-term growth in Egypt's rapidly changing consumer landscape.