Introduction

The Saudi consumer landscape is increasingly defined by a young, dynamic, and empowered population, with an openness to innovation and keenness to embrace new opportunities, driving a uniquely Saudi consumer ethos.

With the Kingdom’s Vision 2030 reshaping its economy and society, steering growth beyond oil dependency, we find an increasing number of Saudi women entering the workforce, where they resonate as both professionals and key consumer audiences. In this truly transformative period for the Kingdom, we see high levels of optimism among business leaders, with 77% of Saudi CEOs confident in the Kingdom's economic outlook for the next year, well above the regional and global averages.

Underpinning this optimism is the rapid expansion of a diverse, tech-savvy, and environmentally conscious consumers, whose purchasing power and preferences increasingly define the Saudi consumer landscape. Insights from PwC Middle East’s Voice of the Consumer 2024 survey echo the sentiments of over 755 Saudi consumers, who have indicated the importance of trust, sustainability, and digital innovation. For them, data privacy remains a critical concern, and while in-store shopping is still popular, there is a growing demand for digital tools and AI-powered solutions, reflecting Saudi Arabia’s forward-looking consumer base.

These preferences reflect a broader societal shift towards a modern, diversified economy, positioning Saudi Arabia as a competitive and forward-looking market in the region.

Healthcare and aviation: KSA’s most trusted sectors

In Saudi Arabia, healthcare and aviation have emerged as the most trusted industries, each scoring 8 out of 10. The strong trust in healthcare stems from the Kingdom’s sweeping reforms and substantial investments in healthcare, bolstered by recent announcements of deals valued at US$13bn at the Global Health Exhibition in Riyadh. These initiatives underscore Saudi Arabia’s commitment to enhancing citizen well-being through an expanded and modernised healthcare infrastructure.

Similarly, the country’s aviation sector has seen unprecedented growth, with passenger numbers increasing by 15% over the first nine months of 2024. Projections indicate an annual growth rate of nearly 6% between 2024 and 2029, on the back of public and private sector investment. Aviation is a key pillar in Saudi Vision 2030, with ambitious long-term targets around passenger growth, fleet expansion, and cargo capacity, positioning it as a key contributor to Saudi Arabia’s economic diversification.

Findings of our survey have also indicated that when it comes to earning consumer trust, data protection stands as the top driver, cited by 86% of respondents, followed closely by fair treatment of employees (80%) and delivery of high-quality products/services, along with consistent customer service (80%). Across the Middle East, we see similar drivers of earning consumer trust, with a slightly stronger emphasis placed on corporate transparency in Environmental, Social, and Governance (ESG) practices (73% regionally vs. 70% in Saudi Arabia).

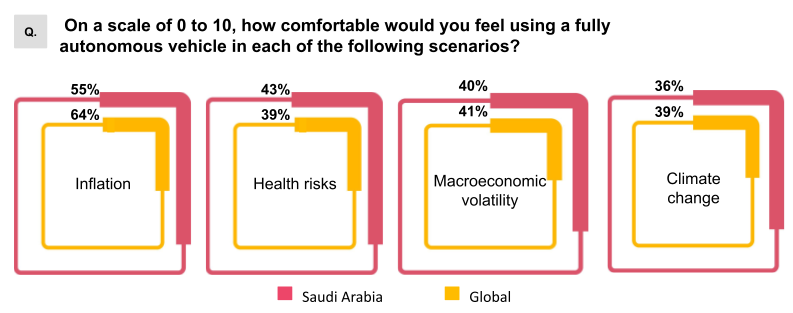

Inflation and health risks: Key concerns in the Kingdom

Inflation is a top concern for 36% of Saudi consumers surveyed. Similarly, business leaders in Saudi highlighted inflation as a critical issue, alongside other pressing challenges such as cyber risks, macroeconomic volatility, and a shortage of workers with key skills. These insights were revealed in the 28th Annual CEO Survey: KSA Findings.

However, despite higher inflation rates in the second half of 2024, compared to the first half, they remained lower than the global average, with non-oil growth in H1 2024 rising to 3.8% year-on-year, largely driven by the private sector. In fact, economic growth in Saudi Arabia is expected to outpace the global average in 2025 according to the latest International Monetary Fund study. Health risks, which were cited by 43% of respondents in our survey, were the second-biggest concern for the Kingdom’s consumers. This could be likely due to the high prevalence of chronic conditions, such as diabetes and obesity.

Climate and sustainability: Increasingly conscious consumers

Saudi Arabia’s sustainability journey under Vision 2030 has fostered a broad commitment to environmental stewardship, which also influences consumer behaviour. Our latest consumer survey reveals a shift in consumer preferences toward sustainable choices, with nearly 45% of respondents actively seeking more eco-friendly products. 18% of consumers indicated a willingness to pay 11-20% above the average price for products sourced locally, while a similar proportion would pay a premium for items made from recycled materials, underscoring a growing alignment between personal values and purchasing decisions.

This rising climate consciousness among Saudi consumers reflects the Kingdom’s proactive sustainability initiatives, such as the Circular Carbon Economy framework and the Saudi Green Initiative, which established ambitious goals for emissions reduction and ecosystem protection. In 2024, the introduction of a Green Financing Framework has further strengthened Saudi Arabia’s role as a regional sustainability leader, influencing eco-conscious consumers to value sustainable products and practices.

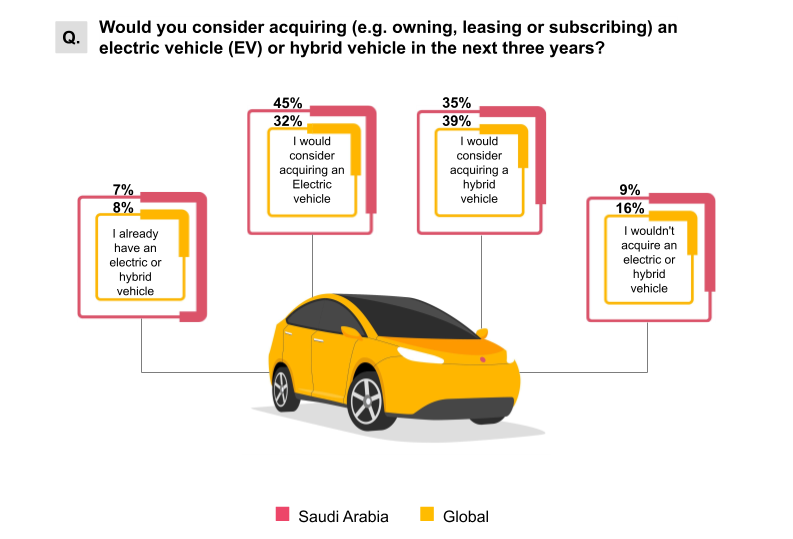

76% of Saudi consumers surveyed are willing to purchase a hybrid (35%) or electric vehicle (45%) within the next three years, reflecting regional trends. This shift aligns with the Kingdom’s strategy to reduce 50% of emissions in Riyadh by 2030, including a goal to make 30% of all vehicles in Riyadh, electric, as detailed in our KSA edition of the eMobility Outlook 2024. Saudi Arabia is also prioritising the development of a domestic EV manufacturing sector, which is expected to significantly boost in-country value and attract talent, technology, and foreign investment.

In terms of carbon and congestion reduction, 83% of Saudi consumers surveyed are open to using alternative transportation options, if local public transport infrastructure improves, while over two-thirds would support a car-free city centre.

Additionally, Saudi respondents express strong optimism in technology’s potential to ease road congestion, with 77% trusting drones for package delivery, a figure higher than the regional average (74%) and global average (58%).

Trust in AI - what do consumers value and fear?

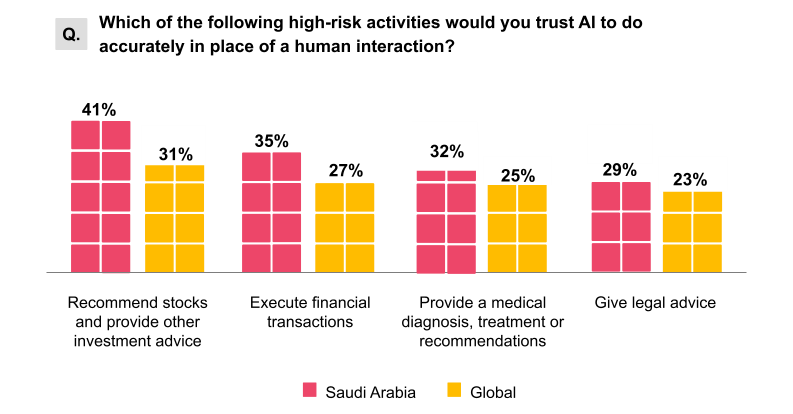

Saudi Arabia is harnessing artificial intelligence as a catalyst for economic transformation, aiming to boost productivity and drive GDP growth as the Kingdom shifts away from oil dependency. However, as indicated in our survey, trust in AI remains somewhat limited. While over half are comfortable using AI for low-risk activities like gathering product information and receiving personalised recommendations in areas such as nutrition and clothing, trust drops significantly for high-risk applications; only 29% would rely on AI for legal advice, and 32% for medical diagnoses.

Concerns around AI centre largely on the need for stronger regulation and governance, cited by 76% of Saudi respondents—a sentiment echoed more strongly across the region (81%) and globally (85%). Many Saudi consumers also worry that AI could increase their exposure to hacking (78%) or lead to job displacement (77%). Despite these apprehensions, consumer interest in AI-enabled products remains high, with 70% seeking AI features when purchasing electronics, followed by household appliances (60%) and food-ordering apps (54%). This underscores a market both interested in AI’s potential and mindful of its risks, emphasising the need for regulated, consumer-centred AI advancements.

Chatbots: Driving smarter, faster customer engagement

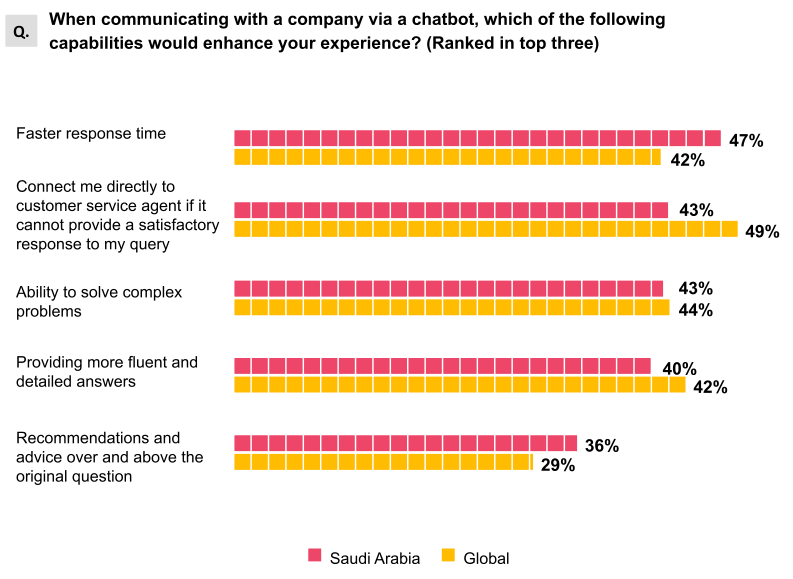

Respondents to our survey showed an appreciation for chatbots. Nearly half (47%) of the survey respondents in the Kingdom indicated that they value chatbots most for providing faster responses than human agents, while 43% appreciate chatbots that can seamlessly connect them to a human representative when needed, and an equal proportion value their capability to solve complex issues.

In-store shopping: An experience that needs to evolve

Despite the rise of e-commerce and shopping via smartphones, in-store shopping still retains value for 49% of the consumers surveyed, with nearly half visiting a physical retailer on a daily or weekly basis. When in-store, 40% seek technologies that elevate convenience, such as self-checkout and real-time personalised offers, while 38% prefer mobile and contactless payment options.

A growing trend shows consumers increasingly willing to make ‘big ticket’ purchases without physically seeing the product. Technology is a popular category for this type of ‘blind’ purchasing, favoured by 66% of regional consumers surveyed. Consumers surveyed were also open to purchasing luxury or designer items without seeing them, with 48% having done so — higher than the regional and global averages. While most consumers surveyed indicated that they were yet to buy a car without seeing it (82%), 44% expressed interest in doing so in the future, likely encouraged by VR technology, which allows them to customise and explore vehicles virtually.

Additionally, over 50% of Saudi consumers indicated they would be less likely to return products if provided with accurate, detailed product and size information, underscoring the importance of transparency for retailers.

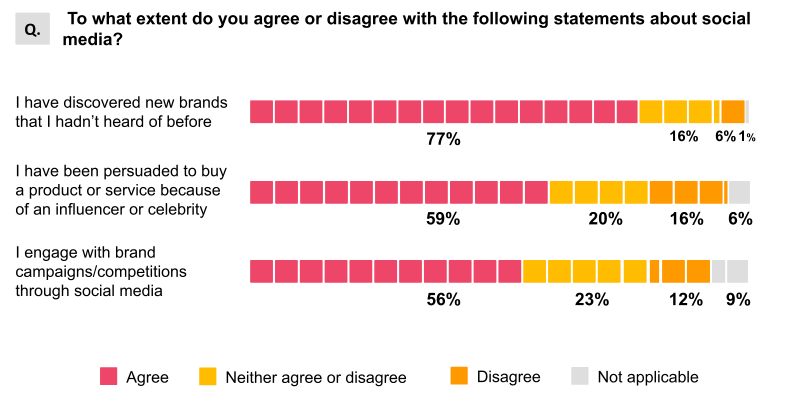

Social media: Digital discovery and influence remain critical

Even as social media plays a pivotal role in brand discovery for over three quarters (76%) of KSA consumers surveyed—compared to 78% regionally and 67% globally—many of the Kingdom’s consumers are reluctant to directly make purchases through these platforms, with 84% of respondents seeking out reviews on a company before purchasing from it through social media.

Nearly two-thirds (65%) of respondents expressed concerns about privacy and data sharing on social media, and more than half (57%) reported negative experiences when buying something on a social platform. The Saudi Personal Data Protection Law (PDPL) recently came into force to address the growing concern about how their data is collected, processed, stored, and shared. This takes the Kingdom one step closer to enhancing digital trust and security – another objective outlined in Vision 2030.

Despite growing concerns, social media continues to significantly influence purchasing decisions, with over 80% of Saudi consumers surveyed impacted by social media ads, compared to 72% globally. Advertising on retailer websites also plays a notable role, influencing over 60% of consumers.

Food: A spending set to continue rising

Nearly 70% of consumers surveyed expect their spending on groceries to rise over the next six months, which may be linked to food prices being a major driver of overall inflation. This is followed by clothing and footwear (64%), health and beauty (61%), travel, and electronic devices (both 56%). This trend echoes spending preferences across the region – with most consumers expecting their spend on groceries (70%), clothing and footwear to increase (65%), followed by health and beauty (63%), travel (61%) and electronic devices (59%).

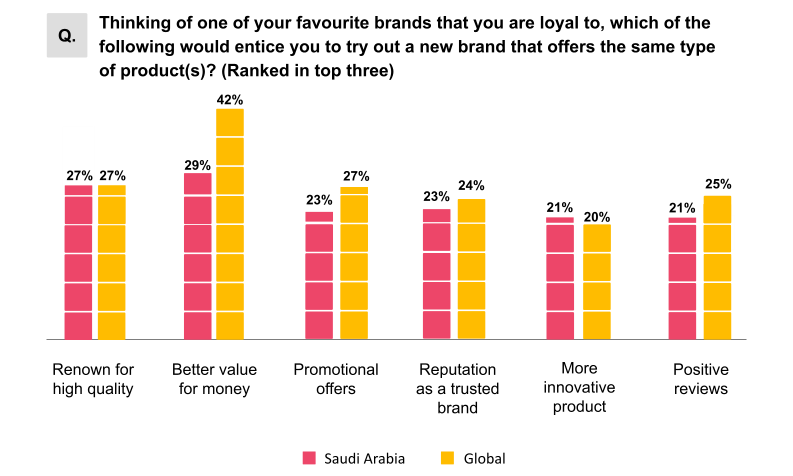

When it comes to factors that could entice consumers away from their favourite brands, better value for money (29%) and a reputation for high quality (27%) were most significant—which was also the case regionally and worldwide.

Consumer diets: Making healthier eating choices

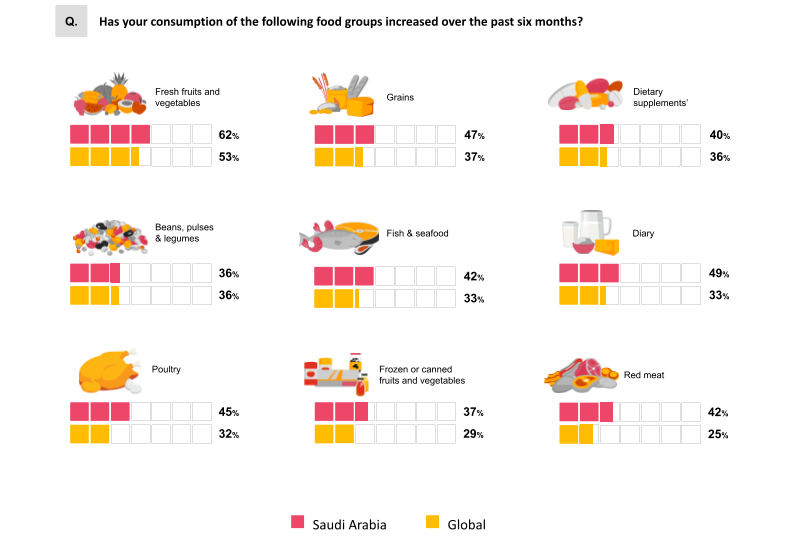

Findings from our latest consumer survey indicate that Saudi consumers are making mindful choices about what they eat.

When making food and dietary decisions, 62% of respondents primarily consider their personal health, while 48% look at nutritional information and 41% consider the price of a product. Similar to the Kingdom, easy access to nutritional information was the second-most important factor in the region, though cost mattered more globally.

When seeking guidance on health and well-being, the majority of consumers globally turn to healthcare professionals, valuing their expertise. Echoing similar sentiments, 50% of consumers surveyed in Saudi Arabia indicated that they would turn to physicians, and more than 30% would consult pharmacists.

In the past six months, 62% of Saudi consumers increased their consumption of fresh fruits and vegetables. Additionally, 14% of Saudi consumers planned to reduce red meat consumption in the next six months, which is lower than 19% of their peers regionally.

Trust at the heart of hospitality, leisure, and entertainment

Tourism spending in Saudi Arabia surged by 27.25% year-on-year in the three months ending in September, reaching SAR 25.05 billion ($6.68 billion). Data from the Saudi Central Bank (SAMA) further highlighted a 21.79% increase in spending by residents traveling abroad, totaling SAR 26.33 billion.

These trends align with Saudi Arabia’s Vision 2030, which prioritises the growth of the tourism, hospitality, and entertainment sectors as key drivers of economic diversification. Our survey revealed that 37.1% of consumers in Saudi expressed high trust (9–10) in the hospitality & leisure industry. Over the same period, 56.7% of respondents plan to increase their spending on travel, while 15.8% anticipate reducing their travel-related expenses.

Similarly, 34.8% of consumers in the Kingdom expressed high trust (9–10) in the entertainment & media industry. Looking ahead to the next six months, 56.4% of consumers expect to increase their spending on electronic devices, reflecting growing demand in entertainment and technology.

Key actions for retailers in Saudi Arabia

In the Kingdom’s swiftly evolving consumer landscape, retailers must navigate a complex interplay of demands and concerns. Saudi consumers, characterised by their tech-savviness and environmental consciousness, are seeking more from the brands they engage with. To thrive in a competitive, fast-growing market, retailers must adapt to these emerging expectations:

Align with the growing consumer demand for sustainability and digital innovation. Offering eco-friendly products, using renewable energy, and implementing sustainable practices like eco-friendly packaging will resonate with environmentally conscious consumers.

Invest in digital tools such as mobile payments and smarter chatbots can enhance customer engagement, appealing to the tech-savvy population. Ensuring robust data privacy and transparency will be crucial for building trust, while personalised services can motivate consumers to share their data.

Focus on health-conscious offerings by providing clear nutritional information and sustainability scores on food products to meet the rising awareness of health and wellness.

Enhance the in-store experience through self-checkout technologies and seamless integration to capitalise on the popularity of in-store shopping with digital tools. This will help retailers thrive in a hybrid shopping environment, ensuring they stay competitive and relevant in Saudi Arabia’s rapidly evolving market.