Welcome to our bespoke webpage on the latest VAT and Customs updates and developments in Qatar, analyzed and presented by our expert VAT specialists.

Qatar signed the GCC VAT Framework Agreement, mandating VAT implementation. This marks a significant shift for businesses, similar to KSA, UAE, Bahrain, and Oman, requiring meticulous preparation and adaptation.

Those that proactively prepare and adapt to the VAT regime stand to minimize disruptions and capitalize on opportunities for growth in Qatar's evolving economic landscape.

We have prepared a comprehensive document detailing VAT awareness and the necessary steps to take once VAT is announced which you can access easily here.

This is a modal window.

We have a specialised team with local expertise and worldwide experience. We also have industry specialists from working in the GCC region that can bring you real insights and best practice on-the-ground. How we can help you:

Over the past few years, Qatar is going through a tax transformation phase and VAT is an important part of this transformation.

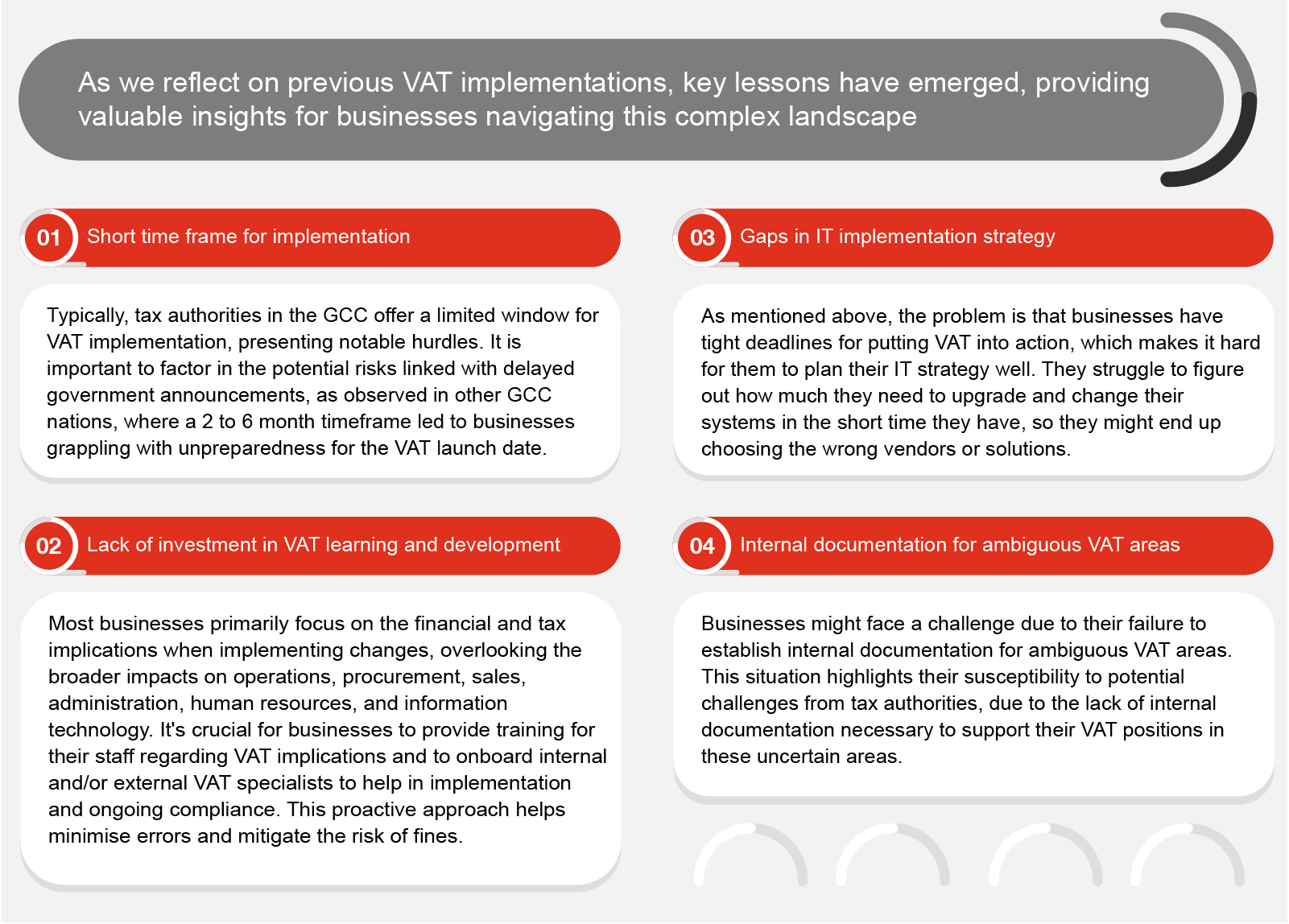

Sajid Khan - Qatar TLS LeaderBuilding on the lessons learned by the KSA, UAE, Bahrain and Oman, we have outlined the key lessons businesses in Qatar may wish to consider when creating a roadmap for VAT implementation.

"Taking a proactive approach to VAT preparation before announcements can minimize disruptions and optimize financial efficiency for upcoming tax changes."

Dima Maruf - Qatar Indirect Tax Partner

Under the Income Tax Law No. 24 of 2018 and its Executive Regulations (“Income Tax Law”), the GTA has the right to conduct tax audits and field inspections at taxpayers’ places of business and review their tax returns, activities, information systems and databases, accounting records, and financial information. The GTA also has the right to issue tax assessments on a presumptive basis in cases where taxpayers fail to file tax returns or submit supporting documents within the time limits prescribed under the Income Tax Law.

We are pleased to share the Quarter One 2024 edition of PwC’s GCC Indirect Tax Newsletter on the latest developments in the GCC.

We are pleased to share the Quarter Three 2023 edition of PwC’s GCC Indirect Tax Newsletter on the latest developments in the GCC.

We are pleased to share the Quarter Three 2023 edition of PwC’s GCC Indirect Tax Newsletter on the latest developments in the GCC.

Chadi Abou Chakra

Middle East Indirect Tax Network Leader, PwC Middle East

Tel: +966 11 211 0400 Ext: 1858