E-Invoicing: UAE’s digital transformation

The UAE’s e-invoicing framework, set to launch in phases starting July 2026, marks a pivotal shift in digital tax compliance. Built on the PEPPOL-based 5-corner Decentralised Continuous Transaction Control (DCTC) model, this system ensures invoices are securely transmitted, validated, and reported via Accredited Service Providers (ASPs) to the Federal Tax Authority. This new framework aims to streamline invoicing processes, reduce errors, and improve VAT reporting efficiency, creating a transparent and automated tax environment.

E-invoicing will enhance operational efficiency by automating invoice validation and reporting, ensuring compliance with UAE VAT standards, and reducing administrative costs. The real-time reporting mechanism will strengthen tax transparency and monitoring while minimizing manual delays. Companies that align early will not only improve compliance but also achieve significant cost savings and process improvements.

Businesses preparing for the transition must address key challenges, such as ensuring ERP systems are compatible with PEPPOL standards and managing cross-border compliance for export transactions. Readiness will depend on proper training of IT, Tax, and Finance teams to adapt to the new requirements. Companies can learn from Saudi Arabia’s experience, where early preparation reduced implementation challenges and ensured a smoother go-live phase.

To prepare for this transformation, businesses should assess their current systems for compatibility with e-invoicing standards, engage with Accredited Service Providers for seamless integration, and train their teams to navigate the new framework. Starting early will enable organizations to address potential hurdles and benefit from a well-executed transition.

E-invoicing represents more than regulatory compliance; it is a strategic opportunity to optimize financial operations and enhance decision-making. By embracing the change now, businesses can gain a competitive advantage in the UAE’s rapidly evolving digital economy.

For further insights on the UAE’s e-invoicing mandate, read our alert.

An overview of the current indirect taxes applicable in the GCC

UAE:

VAT standard rate of 5% (reduced VAT rate 0%).

Excise Tax rates: 100% for tobacco, tobacco products, electronic smoking devices and energy drinks; and 50% on carbonated and sweetened drinks.

KSA:

VAT standard rate of 15% (reduced VAT rate 0%).

Real Estate Transaction tax (RETT) applicable at 5% (effective 4 October 2020).

Excise Tax rates: 100% for tobacco products, electronic smoking devices and energy drinks; and 50% on soft drinks and sweetened drinks.

Bahrain:

VAT standard rate of 10% (reduced VAT rate 0%).

Excise Tax rates: 100% for tobacco (and related) products and energy drinks; and 50% on soft drinks.

Oman:

VAT standard rate of 5% (reduced VAT rate 0%).

Excise Tax rates: 100% on tobacco and related products, energy drinks and special purpose goods (pork & alcohol products), 50% on carbonated drinks.

Qatar

VAT is not yet introduced in Qatar.

Excise Tax rates: 100% for tobacco products and energy drinks; and 50% on carbonated drinks.

Kuwait

VAT and Excise Tax are not yet introduced in Kuwait.

The United Arab Emirates (UAE)

Value Added Tax

Amendments to the UAE Tax Procedures and VAT Laws

The UAE Ministry of Finance has announced the issuance of Federal Decree-Law No. 17 of 2024, which amends key provisions of Federal Decree-Law No. 28 of 2022 concerning tax procedures. Additionally, Federal Decree-Law No. 16 of 2024 introduces amendments to several provisions of Federal Decree-Law No. 8 of 2017 related to Value Added Tax (VAT).

These new Decree-Laws will take effect on 30 October 2024, bringing significant changes to the existing tax framework.

Introducing e-invoicing:

Federal Decree-Law No. 17 of 2024 on tax procedures introduces a definition for the “eInvoicing system” and grants the Minister of Finance the authority to issue the necessary decisions to implement the system, determine its effective dates, and specify the requirements and entities subject to it.

Federal Decree-Law No. 16 of 2024 on VAT introduces broader changes, expanding the definitions of “Tax Invoice” and “Tax Credit Note” to include electronic invoices. The major amendments are summarized as follows:

Amendments to the definitions of “Tax Invoice” and “Tax Credit Note” to encompass electronic tax invoices and electronic tax credit notes.

Introduction of three new defined terms within Article 1, being “e-Invoicing System”, “Electronic Invoice”, and “Electronic Tax Credit Note”.

Amendments to Articles 55, 65, and 70, for the purposes of incorporating provisions related to the new e-invoicing system.

Amendments to Clauses 4 and 5 of Article 76, to reflect: “Without prejudice to the provisions of the Tax Procedures Law, the Authority shall issue an Administrative Penalty Assessment to the Person and notify the Person of the same within 5 business days from the date of issuance in any of the following cases:

Failure by the Taxable Person to issue the Tax invoice or an alternative document when making any Supply within the legally prescribed period.

Failure by the Taxable Person to issue a Tax Credit Note or an alternative document within the legally prescribed period.

Other amendments:

In addition, the amendment to Federal Decree-Law No. 16 of 2024 on VAT covered the definition of Non-Resident in Article 1 as follows:

Previous wording: “Any person who does not own a Place of Establishment or Fixed Establishment in the State and usually does not reside in the State.”

New wording: “Any person who does not have a Place of Establishment or Fixed Establishment in the State and usually does not reside in the State.”

You may access the Ministry of Finance official announcement on the Decree-Laws changes here.

Amendment to the UAE VAT Executive Regulations

On 2 October 2024 the UAE Federal Tax Authority (FTA) published the amended version of the Executive Regulation of Federal Decree-Law No. 8 of 2017 on Value Added Tax (VAT). The amendments are implemented following Cabinet Decision No. 100 of 2024 and are effective from 15 November 2024 with some amendments have retrospective effect.

These amendments aim to enhance clarity, provide further details on key provisions and procedures, and align with earlier changes in the Decree-Law and other relevant tax legislation.

The key amendments (non-exhaustive) introduced to the UAE VAT Executive Regulations (ER), effective 15 November 2024, are summarised as follows:

1. Export of Goods and Export of Services

Article 30 of UAE VAT ER has provided more clarity on the expected documents that should be retained as evidence for the direct/indirect export, or customs suspension situation.

Article 31 of the UAE VAT ER had added a cumulative condition to Clause (1)(a) which effectively narrows the scope for the zero rate of export of services.

2. Exemption for fund management services

VAT exemption for services provided by fund managers independently for a consideration, to funds licensed by a competent authority in the UAE, including but not limited to, management of the fund’s operations, management of investments for or on behalf of the fund, monitoring and improvement of the fund’s performance.

3. Supplies with multiple components

The price of the different components of the supply is not separately identified or charged by the supplier and all components of the supply are supplied by a single supplier.

4. Real Estate

A supply of real estate including the lease, sale and any other forms of disposal that result in the transfer of ownership thereof from one person to another. In addition, any building that is used as a hotel, motel, bed and breakfast establishment, a hotel apartment or serviced apartment, hospital or the like is not classified as a residential building.

5. Input VAT recovery on Health Insurance services for dependents

Article 53(1)(c) of UAE VAT ER on ‘Non recoverable Input Tax’ has been amended to allow businesses to recover input VAT on health insurance, including enhanced health insurance for employees and their family members.

The key amendments (non-exhaustive) introduced to the UAE VAT Executive Regulations (ER) with retrospective effect, are summarised as follows:

1. Virtual assets - effective from 1 January 2018

VAT exemption for (1) transferring ownership of Virtual Assets, including cryptocurrencies, (2) converting Virtual Assets and (3) keeping and managing Virtual Assets and enabling control thereof (for an explicit fee).

2. Government supplies - effective from 1 January 2023

Transfers of ownership or the right of use of government buildings and real estate between government entities are not considered a supply.

The updated UAE VAT Executive Regulations is accessible here.

You may access PwC news alert through this link.

E-Invoicing

Upcoming e-invoicing (e-billing) mandate in the UAE

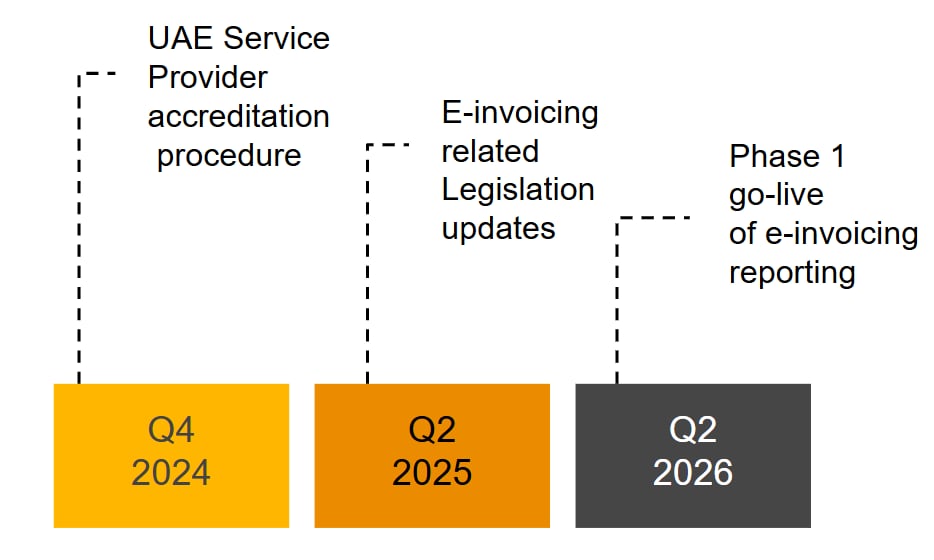

The UAE Ministry of Finance (MoF) have released a dedicated webpage on e-invoicing which provides further insights regarding e-invoicing implementation across the UAE and the scheduled dates for its roll out (in phases).

The webpage is accessible via this link.

The e-invoicing regime in UAE will operate based on the PEPPOL “5 corner” Decentralised model, with the MoF / Federal Tax Authority (FTA) placed in corner 5 to collect and store e-invoices.

Under the e-invoicing framework, it will be mandatory for taxpayers to engage commercially with an Accredited Service Provider (ASP) i.e. a technology vendor accredited by the UAE MoF. The direct connections to the UAE e-invoicing technology infrastructure will be provided to the ASP’s only and not to the taxpayers (unless they opt to become an ASP themselves, which may prove to be costly and impractical for general businesses).

Extract from the announcement regarding the expected timelines for e-invoicing implementation in the UAE is provided below:

For more information about e-invoicing, you may access PwC news alert through this link.

The Kingdom of Saudi Arabia (KSA)

Amnesty extension

Extension in Tax amnesty until 30 June 2025

On 29 December 2024, the Zakat, Tax and Customs Authority (ZATCA) by adopting the decision of the Minister of Finance, has announced further extension of the fines and financial penalties waiver initiative and made this available for taxpayers who wish to submit a voluntary disclosure through their returns and pay the taxes due.

The announcement, published in the official ZATCA website, can be accessed here.

The types of taxes included in this initiative are Excise Tax, Value Added Tax, Real Estate Transaction Tax, Withholding Tax and Corporate Income tax.

This initiative has been extended for an additional six-months period, commencing on 1 January 2025, and concluding on 30 June 2025. This extension follows the tax amnesty program introduced on 1 June 2022, and applies to tax obligations that must be fulfilled prior to the date of the extension.

ZATCA confirmed that the fines included under this initiative are the following:

Late registration

Late payment

Late filing

Amendment/ corrections of the VAT declarations

Other financial fines imposed under Article 45 of the VAT Law e.g., violations of the VAT field detection and E-invoicing.

It is important to note that the initiative does not cover penalties for tax evasion violations paid before the effective date.

A simplified guide has also been issued by ZATCA explaining the types of fines/penalties that will be covered with illustrative examples which can be accessed through the following links:

Value Added Tax

Guideline on VAT refund for the non-profit sector

On 31 October 2024, ZATCA issued a new guideline for VAT refunds for the non-profit sector. This guideline is available on the ZATCA website in Arabic language.

The guideline provides detailed information on the eligibility for the VAT refund and overview of refund processes for charitable associations and institutions in the Kingdom.

The guideline is accessible here.

Guideline for examination, assessment, correction and objection on ZATCA decisions

During November 2024, ZATCA issued a new guideline for examination, assessment, correction and objection on ZATCA decisions for VAT purposes.

This guideline clarifies the rights and obligations of taxable persons as well as ZATCA in relation to examination, assessment and correction of tax obligations.

Further detail is accessible here.

E-invoicing

As part of the Integration Phase of the e-invoicing, ZATCA has announced Wave 18 and Wave 19. Taxpayers with annual revenue exceeding 2 million SAR are required to integrate with the Fatoora platform by August 31, 2025. Similarly, taxpayers with annual revenue exceeding 1.75 million SAR must integrate to Fatoora platform by September 30, 2025.

Further details on KSA e-invoicing guidelines are accessible here.

Real Estate Transaction Tax

Approved Real Estate Transaction Tax Law

The KSA government, by adopting the Council of Ministers Decision No. 239, approved the issuance of the Real Estate Transaction Tax (RETT) Law through a Royal Decree No. M/8, which was published in the official Saudi Gazette on 11 October 2024. The RETT law will be effective 180 days after its publication in the official gazette.

ZATCA, following the aforementioned Royal Order, has also published the RETT Law on its official website.

The issuance of RETT law aims to :

Provide a legal framework to streamline the application of transaction tax on real estate disposals across the Kingdom.

Give additional exemptions from RETT and clarify some of the exemptions that were previously provided for in the RETT executive regulations.

Provide One Hijri year amnesty for taxpayers who had undocumented real estate transactions to comply with the RETT requirements under the law.

It is expected that the RETT Law will be followed by a Executive Regulations that would shed more lights on the application of the law.

Persons engaged in real estate transactions are advised to assess the impact of the RETT law on their transactions or businesses, and avail the benefit of the amnesty period being provided.

Customs

Fees Rules on Customs Services Provided at Customs Ports

On 6 September 2024, ZATCA Issues the Fees Rules on Customs Services Provided at Customs Ports.

ZATCA has revised its financial fee structure for customs services, effective October 2024. Changes include eliminating some charges and introducing a new methodology for calculating customs services fees. The aim is to enhance competitiveness, reduce import costs, and unify calculation methods.

In particular, the updates on customs services fees include:

The elimination of all fees for exports, including customs declaration processing fees, x-ray inspection, laboratory sample processing and other applicable export fees.

The introduction of a new structure to calculate the import fees, by charging 0.15% of the value of imported goods, including insurance and shipping, with a minimum amount of SAR 15 and a maximum of SAR 500. A special cap of SAR 130 will be applicable to exempt shipments.

The limitation of the fees for low value individual shipments via online stores (up to SAR 1,000) to SAR 15.

Please refer to the official announcement for further details.

Upgrading the Customs Tariff codes in Industrial Licensing

The Ministry of Industry and Mineral Resources (MIM) has announced the upgrade of customs tariff codes in the industrial license from the harmonized system of 10 digits to 12 digits, aiming to improve data accuracy and enhance integration with relevant authorities.

The ministry also urged industrial entities to review the proposed updates to their registered customs codes in the industrial license before the deadline of 31 January 2025.

Please refer to the official announcement for further details.

Definitive anti-dumping duties on imports of Sulfonated Naphthalene Formaldehyde

On 2 December 2024, The Saudi Official Gazette, Umm Al-Qura, announced Saudi Arabia's decision by The Saudi General Authority for Foreign Trade to impose definitive anti-dumping duties on imports of Sulfonated Naphthalene Formaldehyde from China and Russia.

The decision, effective for five years, aims to protect local industries from harm caused by unfair trade practices.

The final duties will be applied to the specified products under certain HS codes and enforced by the Zakat, Tax, and Customs Authority.

Please refer to the official announcement for further details.

Oman

Excise Tax

Digital Tax Stamp to extend to carbonated beverages, sweetened beverages, and energy drinks

The Oman Tax Authority (OTA) had previously implemented the Digital Tax Stamp system for excisable products, including cigarettes, shisha, and other tobacco products.

In July 2023, the OTA aimed to expand this system to encompass carbonated drinks, energy drinks, and sweetened beverages. However, this initiative was subsequently suspended.

In October 2024, the OTA decided to enforce the provisions for carbonated beverages, sweetened beverages, and energy drinks, effective from 1 February 2025.

Regional events in Q4 2024

The takeaway

Taxpayers are now, more than ever, required to keep up with the pace of indirect tax changes in the region and stay future ready.

For a deeper discussion on various aspects listed in the publication that are applicable to your business, please get in touch.

Download newsletter

GCC Indirect Tax News Roundup - Quarter Four 2024

Contact us

Chadi Abou Chakra

Middle East Indirect Tax Network Leader, PwC Middle East

Tel: +966 11 211 0400 Ext: 1858

Guido Lubbers LLM MBA

ITX Partner | TLS Middle East Consumer Markets leader, PwC Middle East

Tel: +966 54 110 0432

Gaurav Kapoor

Partner - Tax Reporting & Strategy Leader for Oman, PwC Middle East

Tel: +968 93891546

Carlos Garcia

Partner, Middle East Customs & International Trade, PwC Middle East

Tel: +971 56 682 0642