At a time of unprecedented turbulence for the industry, we examine in detail both the short and long-term consequences of COVID-19. Beyond the challenges, we also highlight the opportunities resulting from the fact that the sports industry is expected to grow faster in our region than anywhere else in the world over the next three to five years.

A key reason for this survey is to understand industry leaders’ perceptions of the growth, opportunities and threats faced by the sports market. Despite the unprecedented impact of the restrictions brought in to suppress the spread of COVID-19, the results in our region show cause for optimism. Our survey has identified three key enablers to accelerate change in this sector. These are digital transformation and the creation of digital assets, the growth of esports and ability of sports federations to capitalise on their popularity, and the transformational power of women’s sports within society.

Key Findings

The acceleration of change resulting from COVID-19

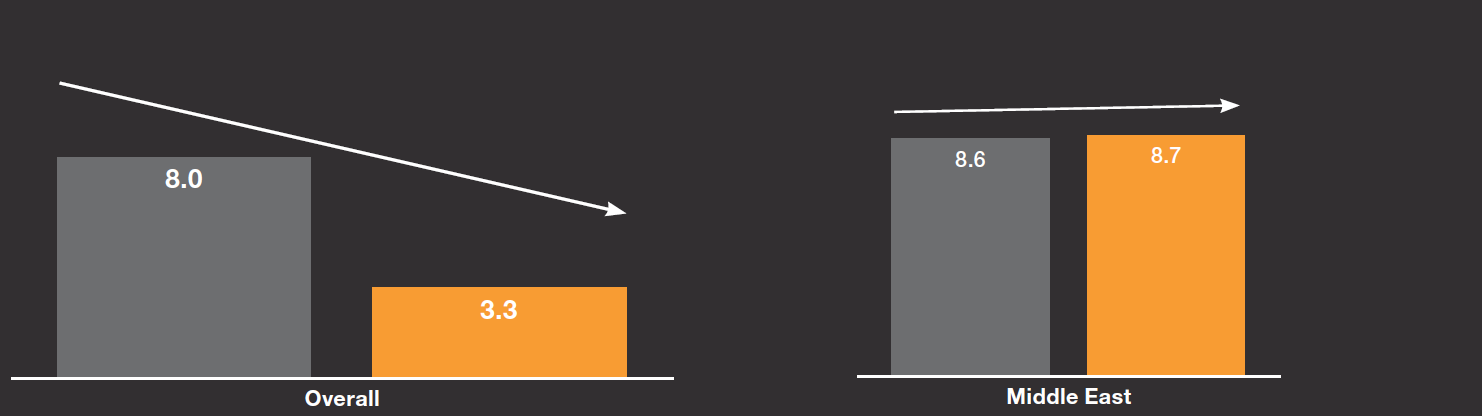

In stark contrast to the global market, for which respondents now expect the annual growth rate to slow to 3.3% over the next three to five years, respondents expect the Middle East to grow by 8.7% over the same period.

Market growth outlook by respondents' best known market

Percentage annual growth estimates over a 3-5 year period

The main differentiator for the Middle East is that regional governments are actively seeking to use sport as a way to diversify their economies away from natural resources and to build social cohesion. Gulf Cooperation Council (GCC) member states including Saudi Arabia and the United Arab Emirates (UAE) for example, have spent more than $65bn on sports development.

In the Middle East, respondents believe football and esports have the greatest potential for revenue growth:

What sports are winning?

Respondents who ranked their top two as answers "above average" and "very high"

Most sports leaders agree that the capacity of sport to engage audiences remains intact, and interest in live sports content is not expected to drop. Yet facing today’s dramatic challenges and tomorrow’s uncertainties, the sports industry urgently needs to ask itself what concrete initiatives should be prioritised to accelerate change.

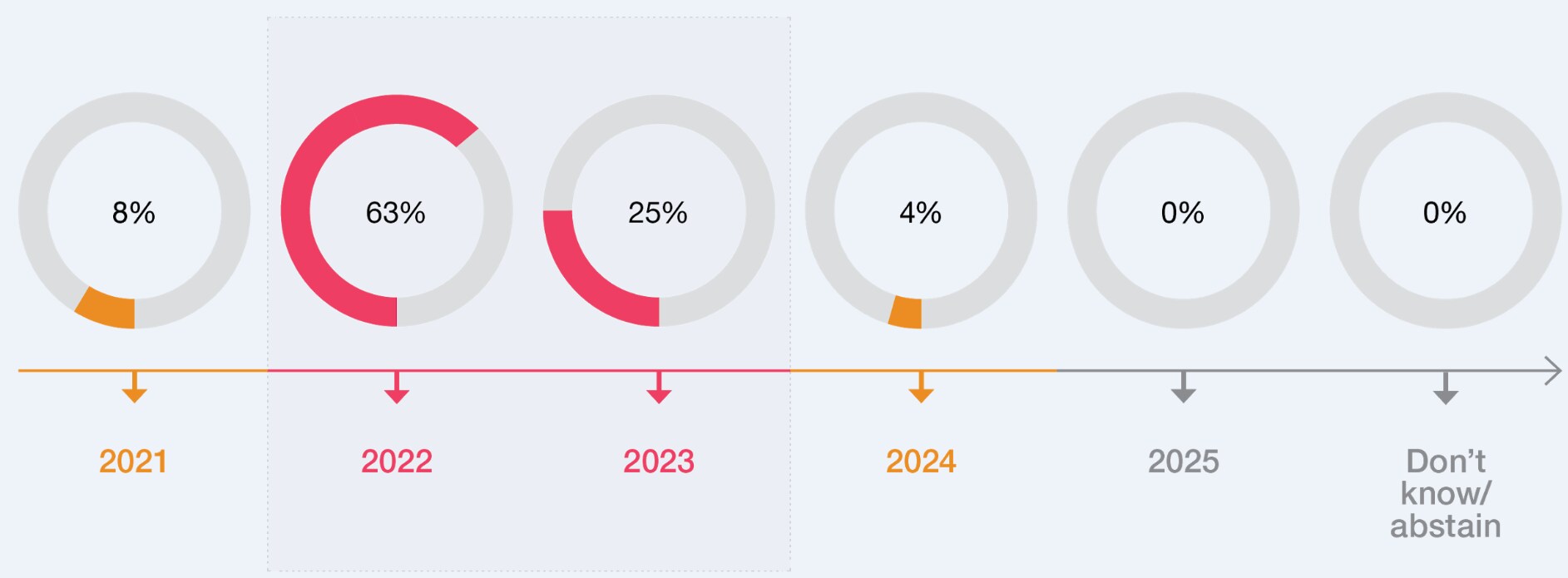

Some 63% of Middle East respondents expect the sports market overall to fully recover by 2022, which is far more optimistic than the global figure of 42%:

By when do you think the sports industry will have fully recovered to pre COVID-19 levels?

Percentage of respondents

Their positive outlook is bolstered by the expectation that public expenditure in the sector will continue. In addition, our survey respondents believe that the sports industry in the Middle East has responded well, as government-run sports bodies have put in place plans to adapt to the impact of the global pandemic.

Maximising the value of digital transformation and assets to build closer relationships with fans

Through necessity, sports organisations have carried out multiple experiments, giving rise to the first virtual stands, hybrid competitions, virtual player drafting, digital press conferences and summer tours.

Beyond media, the next laboratory phase is already focusing on stadiums and venues, where health and safety technology is poised to profoundly redefine the spectator experience.

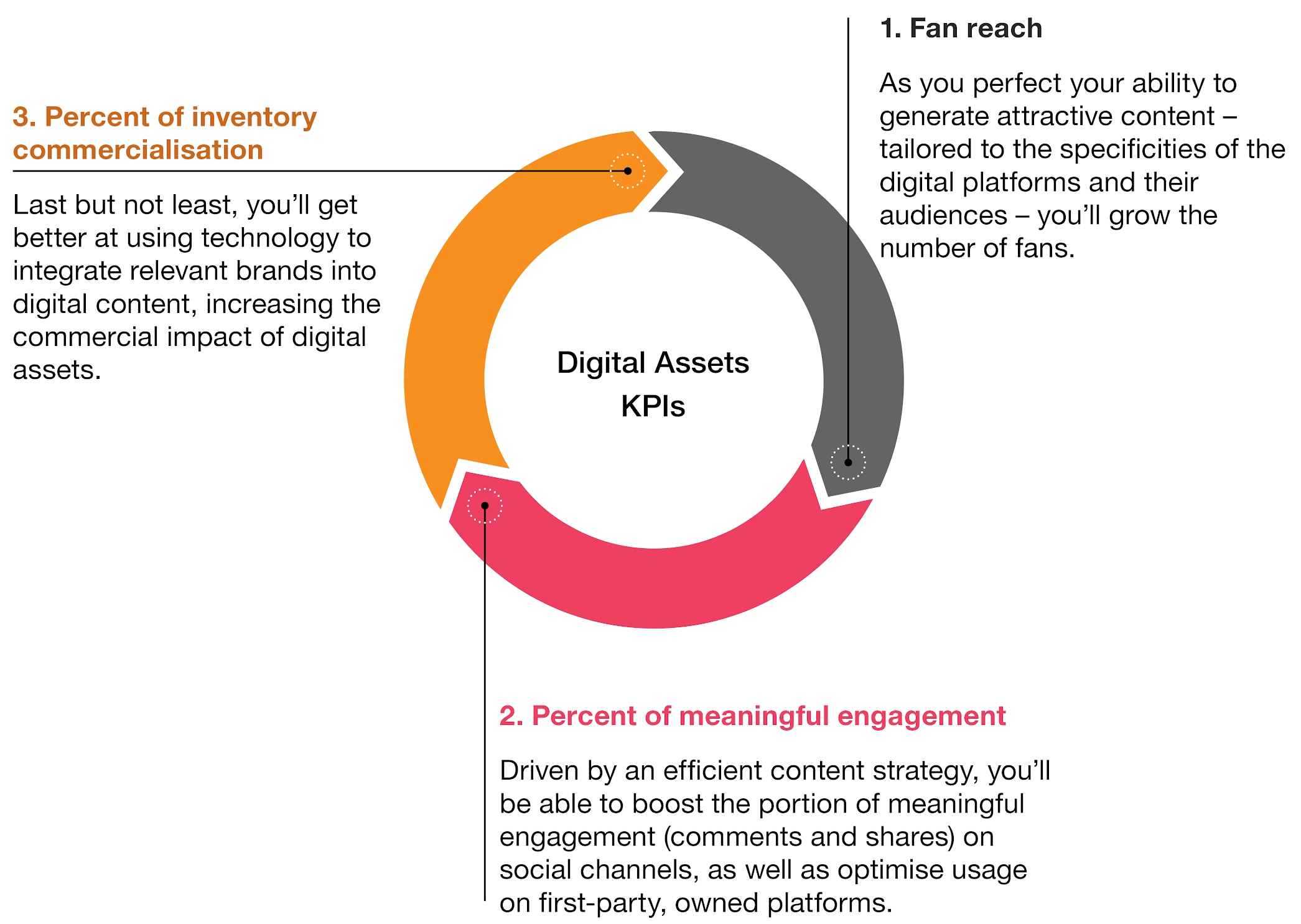

Digital assets owned by sports organisations are highly rated by our survey respondents as a way to unlock growth in both engagement and revenue, and making digital assets an integral part of the commercial strategy requires alignment and concerted progress across multiple dimensions within the organisation, including strategy, structure, leadership, performance and technology.

KPIs to track progress of commercialisation of digital assets

Capitalising on the growth of the esports industry

Esports is a natural fit for the Middle East, where the majority of the population is young and internet-savvy, and the climate, especially in GCC countries, is often too hot for outdoor sports. Saudi Arabia ranks among the top 20 countries for games revenue at $716 million, with the UAE generating $313 million and Egypt $287 million. Survey respondents ranked esports first equal with football in potential for revenue growth.

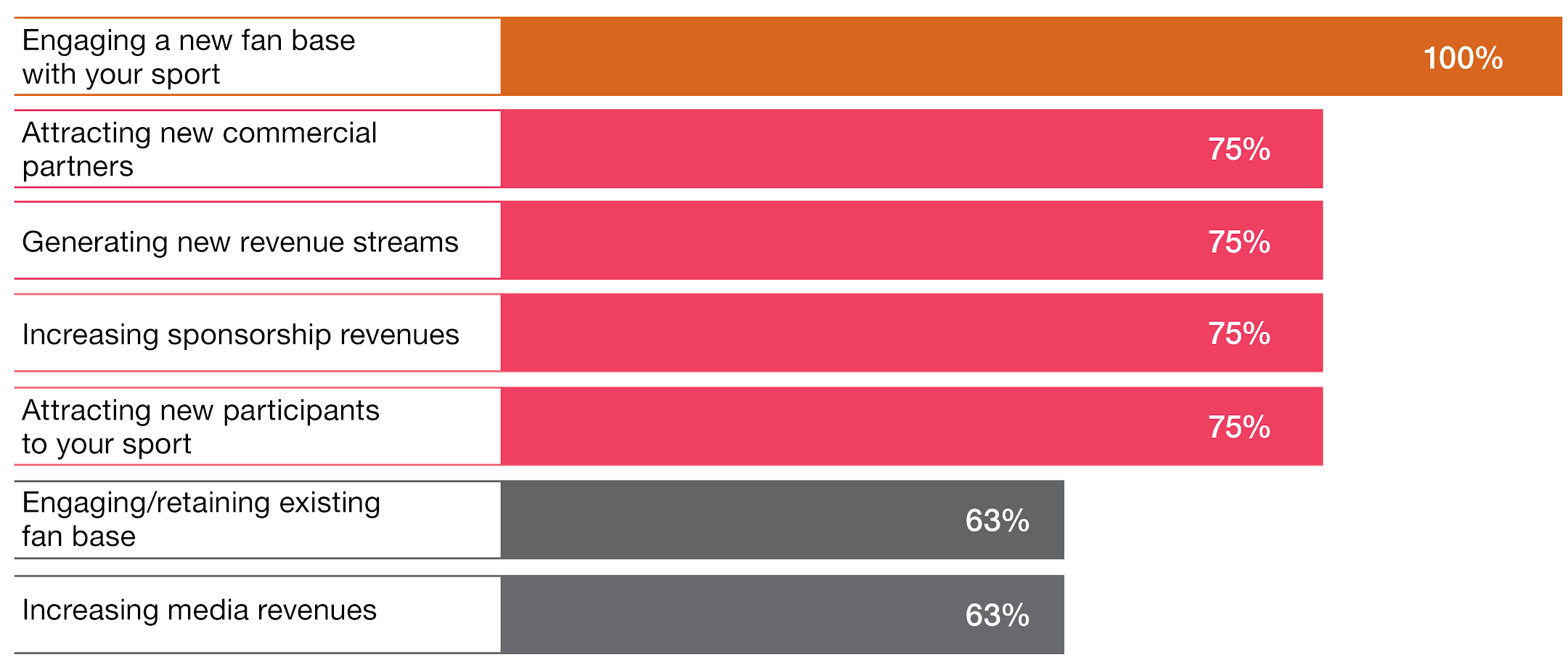

The staggering growth of esports means sports leaders are beginning to make it a strategic priority, and the level of engagement has accelerated significantly during the last two to three years. In 2018, for example, the Saudi Arabian Federation for Electronic and Intellectual Sports and Global eSport Resources joined forces to develop a Saudi esports industry. Our survey respondents also overwhelmingly recognise (Figure 7) that building an esports following opens up opportunities to attract new audiences, commercial partners and, ultimately, revenue streams. Formula One, for example, has acted on this already, offering an esports series where gamers can qualify for and compete in, and whose players include real-life F1 drivers.

Top esports benefits for rights owners

Respondents who ranked their top two as answers "above average" and "very high"

The transformational power of women’s sport in the region

In the Middle East, the opportunity presented by women’s sport goes far beyond an economic benefit for sports organisations. Enabling women to take part in sport is one of the major social reforms underway in several Middle Eastern countries, overturning cultural barriers that have excluded them in the past.

To meet social development objectives and improve women’s health and quality of life, we believe sports governing bodies should work with governments to establish plans to address the limited opportunities for women to take part in sport and exercise.

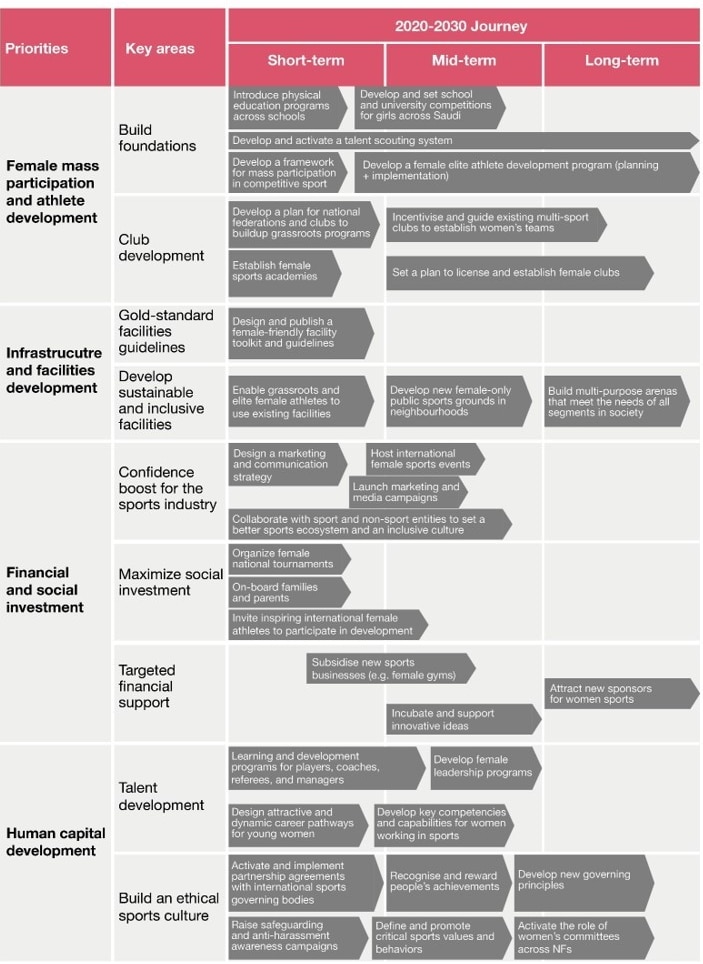

Major obstacles to progress remain, and our focus group identified in particular a lack of planning and collaboration between stakeholders, including sports governing bodies and policymakers, which is holding back making sports facilities accessible to women and establishing active physical education programs for girls in schools. To overcome these challenges, our focus group agreed on the following priorities and high-level roadmap for the next decade:

Women’s Sports Roadmap 2020-2030

Key Takeaways

COVID-19 has presented tremendous challenges to the sports sector internationally, and revenues from live spectator events will continue to struggle until vaccines have been delivered at scale across the world. However, events of 2020 have also amplified the transformation of the industry, as virtual entertainment, digital fan engagement and digitalised physical activity all extended their reach.

In the Middle East, where governments are investing in sport as a way to diversify their economies and promote social change, the challenge for the major sports governing bodies is to harmoniously integrate both global trends and regional developments in order to nurture and solidify the developing sports ecosystem.

The good news is that the region’s sports industry is expected to recover and grow at a faster pace than in the rest of the world. To capitalise on this, sports organisations should focus on developing mass participation, particularly women’s sport, to create a strong foundation of fans and players. Investing in their digital capabilities to increase fan engagement, and capitalising on the opportunity of esports, will also empower sporting federations and clubs to capture future growth.