{{item.title}}

{{item.text}}

{{item.text}}

21/02/22

It’s often said that people are at the heart of any organisation. In our previous blog, we explored the wider environmental, social and governance (ESG) agenda. We discussed its relevance to tax and how governments are leveraging the “carrot and stick” approach, utilising green incentives or taxes to encourage greener practices and investments to tackle the “E” element in ESG. For the second part of this series, we will take a closer look at tax considerations in relation to the social aspects of an organisation and the people it impacts within and outside the business, from employees to suppliers, customers, regulatory authorities and the broader communities they operate in.

In Malaysia’s Budget 2022, tax made up 51.6% (2021: 54.1%) of the estimated revenue. This will enable the government to fund essential social initiatives such as improving access to healthcare services and stimulus packages, crucial in supporting the livelihoods of Malaysians affected by COVID-19 and the slowdown in economic activity. To date, Malaysia has implemented 8 stimulus and assistance packages totalling RM530 billion1 benefiting approximately 20 million people and 2.4 million businesses. In October 2021, Malaysia also revised the 2021 fiscal deficit and statutory debt to 6.5% and 65% of GDP respectively to support economic recovery efforts, Budget 2022 measures and to meet the objectives of the 12th Malaysia Plan.

With the increase in country expenditure due to the pandemic, we note that the increased scrutiny on how much taxpayers are channeling into the overall tax system has resulted in the question of whether they are paying their “fair share”. For instance, what are companies doing to support their employees, supply chain and the communities they are located in? How are their employees treated and remunerated? These questions come into the picture when we consider ESG and the shift from profit maximisation to value optimisation as explored in our first blog. Increasing investor demands are after all prompting companies to make decisions based on the benefits derived for all their stakeholders and not merely on profits to satisfy their shareholders.

The concept of “fair tax” together with good social practices have become top priority with stakeholders. The scrutiny and moral obligation around fair wages, upholding labour standards across supply chains, and giving back to communities where businesses are located means that stakeholders want to know the value that organisations are creating, especially with people whose lives they impact.

Therefore, organisations are increasingly considering disclosures to demonstrate value created. For instance, transparent public reporting on an organisation’s total tax contributions (TTC), remuneration or people-related policies. From a tax perspective, information such as employee and employer's contributions, direct and indirect taxes paid and tax incentives/grants utilised and their alignment with the organisation’s wider ESG objectives will be compared to the size of their operations, business activity in the respective countries and overall financial results to assess whether they are contributing their “fair share”.

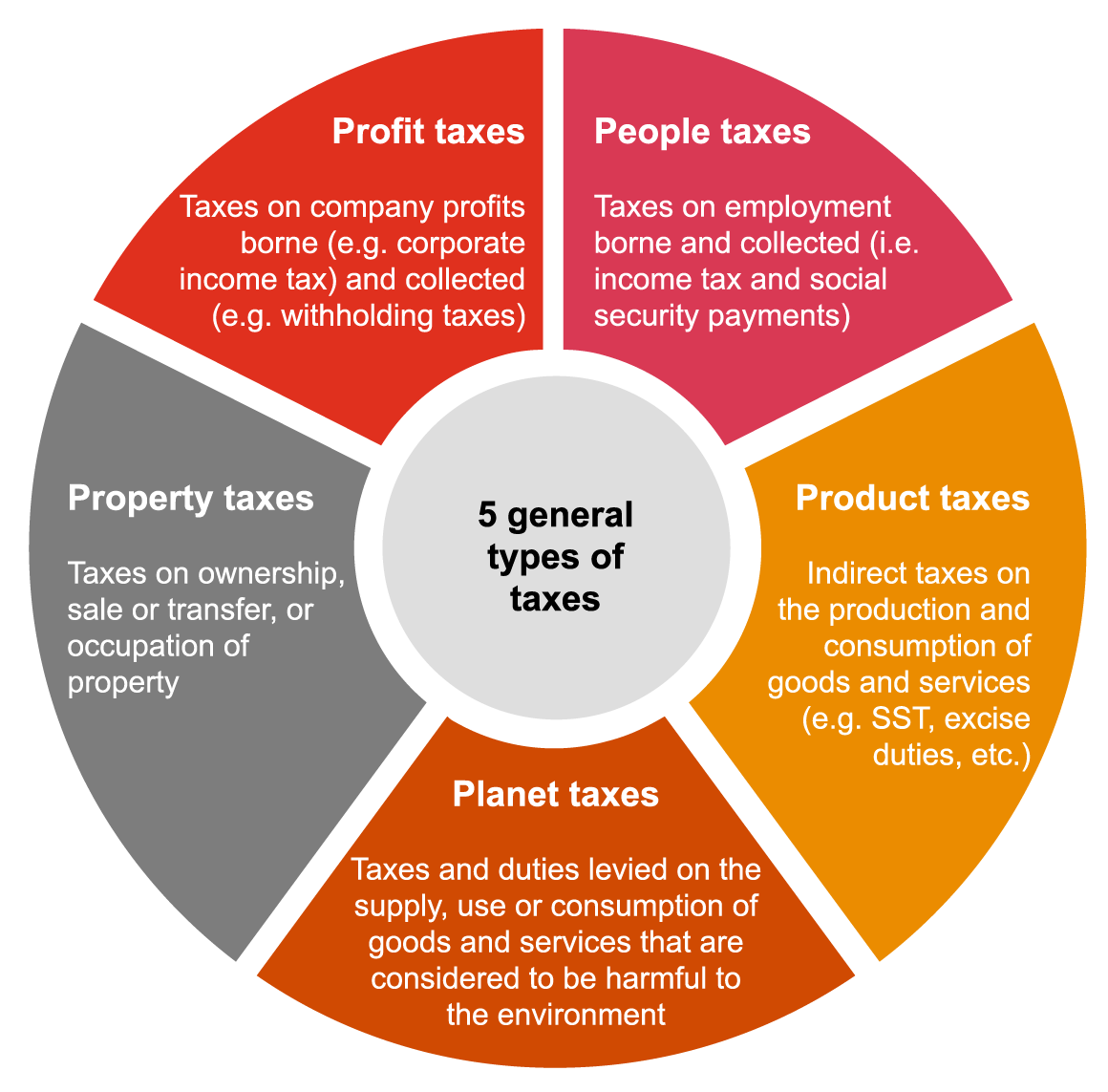

In 2020, the World Economic Forum International Business Council (IBC) developed an ESG reporting framework that includes reporting of taxes borne by an organisation as a core metric. This has been supported by the “100 group”2, who disclose TTC (illustrated in diagram below) as part of their annual reporting.

TTC comprises of both:

taxes borne (i.e. cost to the company and are reflected in their financial results, e.g. corporate taxes), and

taxes collected (i.e. generated by a company’s operations and not a tax liability of the company, e.g. employee income tax deducted monthly).

Each component is disclosed separately and has to be organised in a manner easily understood by the public. Hence, accurate and timely data has to be readily available. Companies with global/regional footprints have found TTC reporting time-consuming and challenging due to local reporting requirements, multiple data sources and Enterprise Resource Planning (ERP) systems that may not be configured to capture the necessary data. Therefore, most companies that disclose TTC should plan ahead (e.g. leveraging tools, data profile, etc) to ensure that data can be extracted to support this reporting exercise.

Alongside TTC, regular stakeholder engagement and cooperative compliance to get clarity on their approach to tax and risk policy statements, as prescribed by Global Reporting Initiative [GRI] 2073 are helpful in providing details on an organisation’s sustainable value creation.

The emergence of ESG considerations is an opportunity for organisations to demonstrate their contributions and impact in the countries and communities they operate in, through greater transparency facilitated by the disclosure of substantiated data beyond mere compliance. This transformation of tax reporting also supports other regulatory requirements. Therefore, ensuring that robust systems are in place to seamlessly extract accurate and relevant data for tax sustainability reports will be key to addressing the tax element in the “S” in ESG.

As a start, it is important for businesses to:

Understand your company’s tax position with an ESG focus not only from the shareholder’s perspective, but that of investors, employees and the tax authorities.

Keep abreast of the latest metrics and requirements for your company's tax disclosures.

Concurrently, be ready to engage across the entire business to align tax strategy with the broader corporate strategy. As business decisions have tax impacts, which become increasingly visible with the disclosures required in ESG reporting, considering tax impacts early will help you understand and develop your tax narrative for TTC reporting.

Assess what is currently available (e.g. accuracy, accessibility, etc) and potential risks that may need to be addressed, and

Explore tools to support this process, particularly if this is a yearly project to help manage time and costs needed to prepare comprehensive reports.

A carefully considered approach and clearly articulated tax strategy will help you build trust and align your journey with that of your wider stakeholders.

Get in touch if you would like to delve deeper into any of the aspects covered in this blog.

1 Source : Fiscal outlook 2022 tabled to Parliament on 29 October 2021

2 The “100 Group” represents the views of Finance directors of FTSE 100 and several large UK private companies. The group comprises a main committee and 3 sub-committees that cover Stakeholder Communications and Reporting, Tax and Pensions.

3 GRI 207 on tax disclosures (with effect from 1 January 2021) provides structure to tax sustainability reporting as the first global standard for comprehensive tax disclosures at management and country-by-country level.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}