The growing sustainability-related products and services offered by financial institutions offers companies new financing opportunities. PwC’s Sustainable Finance masterclass provides a practical approach to understanding the sustainable finance landscape and process of obtaining financing, ensuring that companies have the key insights needed to access sustainable finance. In addition, PwC will leverage our network to invite industry practitioners to share their experience and knowledge, giving companies the opportunity to speak directly to financiers and peers who have undergone the sustainable financing process.

This course has been designed for participants to:

- Understand how sustainable finance can be leveraged to meet company goals

- Gain an awareness of sustainable finance instruments available in Singapore

- Become familiar with the process of obtaining sustainable financing

Course details

This course has been developed by industry practitioners, bringing together a wealth of practical and applicable knowledge to maximise and integrate strategic environmental, social and governance (ESG) business value. The course delivery team sits in PwC’s Asia Pacific Centre for Sustainability Excellence, ensuring that all course content is relevant for businesses and up to date with industry best practices and emerging standards. The course also leverages PwC’s expertise in sustainability services ranging from developing ESG strategies to adhering to a host of reporting standards.

Module 1 – Introduction to sustainable finance

Context setting of sustainable finance as the mobilisation of finance to integrate environmental, social and governance (ESG) criteria into business or investment decisions, leading to sustainable growth and the transition to a low carbon economy.

Topics include:

- Definitions of sustainability and value for business

- Global and local trends in sustainable finance

- Overview of the local sustainable finance ecosystem

- Relevance of sustainable finance to businesses

Module 2 – Sustainable finance instruments

Establishing an understanding of sustainable finance instruments as predominantly debt instruments that channel funds to finance projects and programmes with positive environmental and social benefits.

Topics include:

- Different types of sustainable finance instruments for small and medium enterprises (SMEs)

- Debt instruments (Loans, bonds)

- Impact investing

Module 3 – Accessing Sustainable Finance

Providing a comprehensive walkthrough of how companies can decide upon different types of sustainable financing, the process of securing financing and what companies need to do to prepare for financing, with the inclusion of case studies and best practice examples.

Topics include:

- Selecting suitable instruments

- Preparing to access sustainable financing

- Process for securing financing

- Positioning the company

- Best practices and case studies

Module 4 – Sharing by peers and industry players

Sharing by enterprises and industry players on sustainable financing. Peers will be asked to share their experiences and learnings while industry representatives from financiers and government agencies will share advice.

Speakers include:

- Financiers

- Expert consultants and advisors

- Chief Sustainability Officers / Sustainability Champions

- Enterprises that have secured sustainable financing

Course duration: 10 hours in total, over two consecutive days

Learning modalities: In-person sessions

2025 course dates to be confirmed

| Date | Time | Format |

| To be confirmed | - | - |

Programme fees and registration

| Learning modalities | In-person sessions |

| Duration | 10 hours in total, over 2 consecutive days |

| Programme fees | Full price - SGD $1,000* Enterprise Singapore subsidised price - SGD $300* *Fee stated is per participant and excludes prevailing GST, which will be applied on the full price |

| Class size | 25-35 pax |

Enterprise Singapore subsidy conditions:

- Subsidised course fee of S$300 (not inclusive of GST) per participant is only applicable to nominees from local companies1 and trade associations (TACs).2

- Each eligible entity will be supported for up to a maximum of 3 participants for each type of ESP Sustainability Course.3

- Each individual will only be supported once for each type of ESP Sustainability Course.3

- The company or TAC is liable to make full payment for the course fees if it or its participants are found to be ineligible or fail to complete the course.

- Course completion includes:

- Participant’s attendance of the entire course

- Obtaining Certificate of Attendance (CoA)

- Submission of post-course feedback form

1 Business entities registered and operating in Singapore. This excludes: (a) non-profit organisations and charities (registered as public companies limited by guarantee); and (b) foreign companies operating in Singapore (registered as branch or representative offices).

2 TACs will need to fulfil the following criteria: a) registered with Registry of Societies (ROS) or Accounting & Corporate Regulatory Authority (ACRA); and b) defined as a non-profit organisation.

3 There are currently three types of ESP Sustainability Courses: Foundational, Decarbonisation, and Sustainable Financing. Please refer to the ESP website here for the list of courses under each course type.

Subsidy Process

To receive this subsidy, please submit the following documents to sg_esg_upskilling@pwc.com after you have registered using the link at the bottom of this page:

- Completed Company Nomination Declaration Form (Download here)

- Verification documents:

- Local Companies :

- Company’s most recent ACRA Bizfile profile (Accessed from 2022 onwards)

- Trade Associations

- Company’s most recent ACRA Bizfile profile (Accessed from 2022 onwards)

- If ACRA Bizfile profile is not available, please provide a screenshot of the organisation’s registration with the Registry of Societies (ROS)

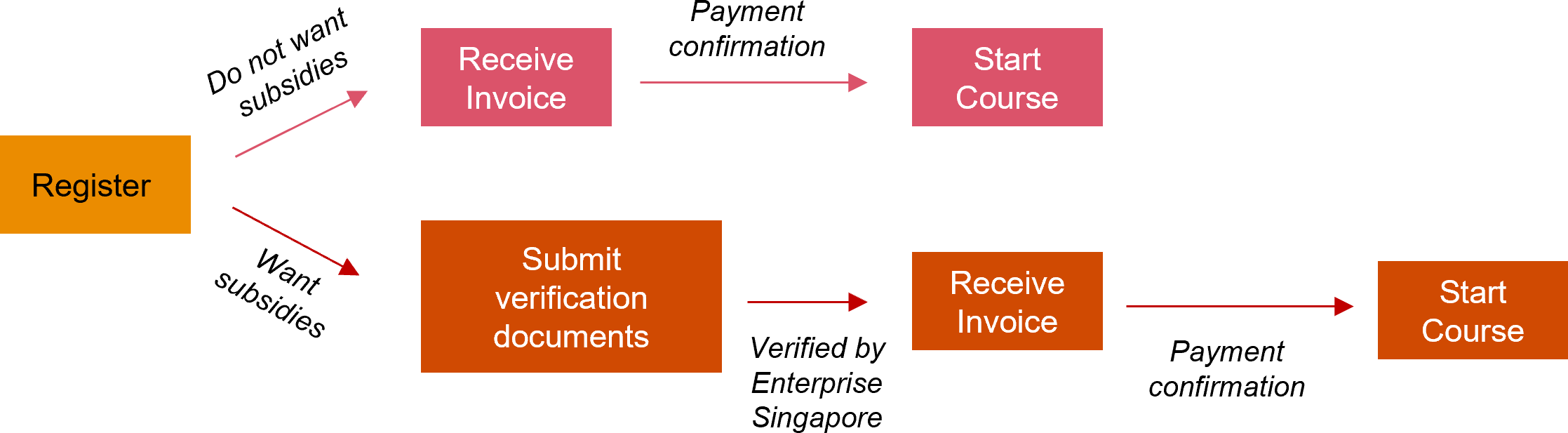

Application process

About the Enterprise Sustainability Programme - Sustainability Courses

The Enterprise Sustainability Programme (ESP) supports Singapore businesses to build capabilities in sustainability and capture new opportunities in the green economy. As part of the initiatives under the ESP, Enterprise Singapore has partnered industry players to conduct a series of ESP Sustainability Courses to help businesses build awareness and knowledge in sustainability.

There are currently three types of ESP Sustainability Courses: Foundational, Decarbonisation, and Sustainable Financing.

Please refer to the ESP website here for more information.

Foundational

The ESP Foundational Course aims to equip business leaders with basic awareness and knowledge of sustainability, and serves as a foundation for businesses seeking to build capabilities for the green economy and develop a plan for sustainability efforts. Participants are provided access to tools and resources to assess the current sustainability readiness and performance of their businesses.

PwC’s ESG Essentials for SMEs is part of the ESP Foundational Course series.

Decarbonisation

The ESP Decarbonisation Course aims to equip business leaders with key knowledge to embark on decarbonisation, including principles of carbon accounting and disclosures, setting of decarbonisation targets, and means of decarbonisation. Participants can access tools and frameworks to learn the basics of carbon accounting, and identify decarbonisation pathways for their businesses.

ESG Masterclass Series: Carbon Management is part of the ESP Decarbonisation Course series.

Sustainable Financing

The ESP Sustainable Financing Masterclass aims to build knowledge of sustainable finance amongst business leaders by providing a background to sustainable finance, an overview of sustainable finance instruments, and practical knowledge on how businesses can access sustainable finance for their sustainability efforts.

ESG Masterclass Series: Sustainable Finance is part of the ESP Sustainable Financing Masterclass series.