{{item.title}}

{{item.text}}

{{item.text}}

Over the past three years, there have been many developments affecting Indonesia’s mining industry. The COVID-19 pandemic, global energy crisis, geopolitical instability from the Russia-Ukraine conflict, supply disruption and commodity price volatility have resulted in an unpredictable macroeconomic situation. The industry is also being impacted by the global energy transition which affects not only fossil fuels such as coal, but also causes increased demand for critical minerals essential to the energy transition. The new laws and regulations issued by the Government in the last few years have also continued to significantly affect Indonesia’s mining industry, and in some instances, create more uncertainty for mining companies operating in Indonesia.

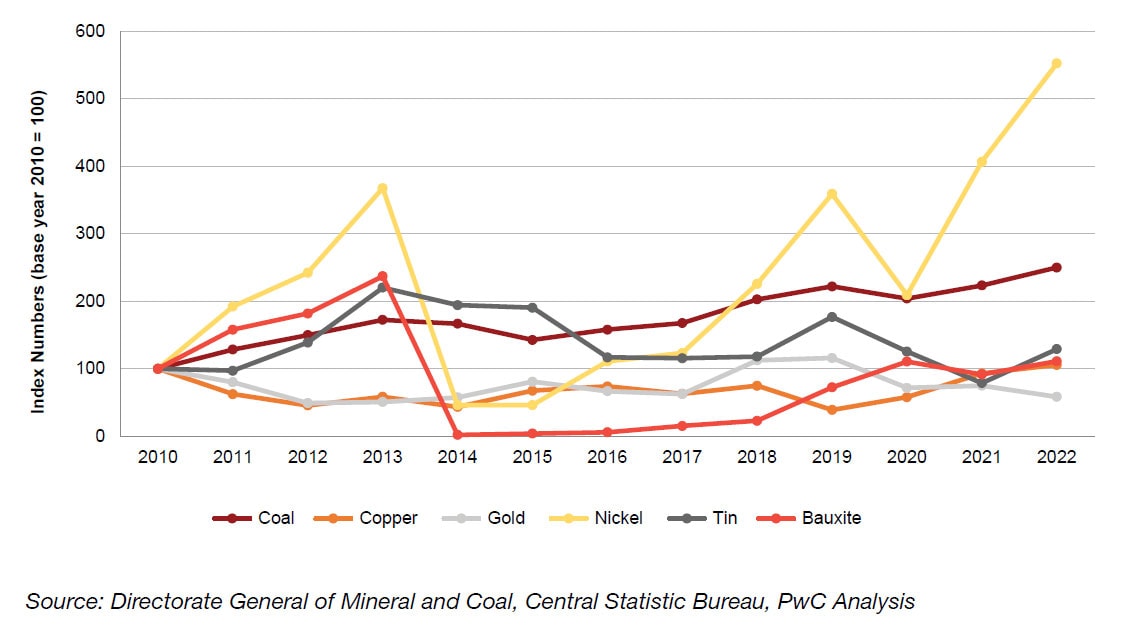

The coal production of Indonesia has shown steady growth over the last decade. Indonesia consistently recorded coal production increases, except for the years 2014-2015 when coal production decreased due to the decline in coal price and the attempt by the Government of Indonesia (“the Government”) to limit coal production increases, and in 2020 due to the decline of global and domestic demand for coal during the onset of the COVID-19 pandemic, which drove the decision of coal producers to cut production and reduce investment. Despite the declining production, the 2020 coal production of 561 million tonnes was still above the target of 550 million tonnes.

The production of nickel and bauxite has also continued to increase after the relaxation of the ban on exports of nickel ore and washed bauxite by the Government at the beginning of 2017. Another factor contributing to the increase has been the production from the new nickel smelters that have been coming online since 2017 together with higher global nickel prices driven by increased demand from the EV industry.

In 2020, nickel production fell due to the pandemic, but then recovered strongly in 2021 and 2022, supported by increasing demand and the waning impact of the pandemic. Meanwhile, the production of bauxite increased by 21% in 2022, ahead of the ban on exports of washed bauxite imposed by the Government in June 2023.

The race to net zero is changing what it means to be a miner. Demand for critical minerals is surging and operating environments are getting more challenging. The market for mining materials is reconfiguring in fundamental ways. The energy transition and the race to reach net-zero emissions are creating a surge in demand for ‘critical minerals’. These are the commodities needed to generate low-emission energy — elements such as lithium, nickel, cobalt and graphite for energy storage; copper and aluminium for energy transmission; and silicon, uranium and rare-earth elements for solar, wind and nuclear energy generation.

In Indonesia, the ESG landscape has been gradually evolving since the inception of the International Paris Accord Agreements in 2016. The Government’s commitment to adopt ESG measures in order to advance national efforts to achieve its updated sustainability target of net zero emissions by 2060 is apparent in a number of initiatives: the establishment of a coherent roadmap (i.e. the Sustainable Finance Roadmap Phase II (2021-2025) guidebook) issued by the Financial Services Authority of Indonesia (Otoritas Jasa Keuangan or “OJK”); the creation of the 2021-2040 National Electricity General Plan (Rencana Umum Ketenagalistrikan Nasional or “RUKN”); and the issuance of a standard for “investor-grade” ESG reporting amongst publicly listed companies.

{{item.text}}

{{item.text}}