In recent years, we have witnessed a rapid transformation in the macroeconomic landscape, with sustainability taking centre-stage. However, this shift in focus presents a challenge, as many countries still heavily rely on fossil fuels for their energy needs and daily necessities, including petrochemical products. Recognising the need to balance sustainability with energy and petrochemical product demand, the investment climate for oil and gas has become even more crucial. In response, the Indonesian government has implemented alternative solutions, such as the establishment of a carbon credit market to promote emission offsetting. Additionally, there is a growing emphasis on carbon capture & storage (CCS) as a prominent solution, given Indonesia’s immense potential in this area. These initiatives align with the government’s broader focus on energy transition, aiming to strike a balance between energy demand and economic growth, and the country’s commitment to achieving net-zero emissions by 2060.

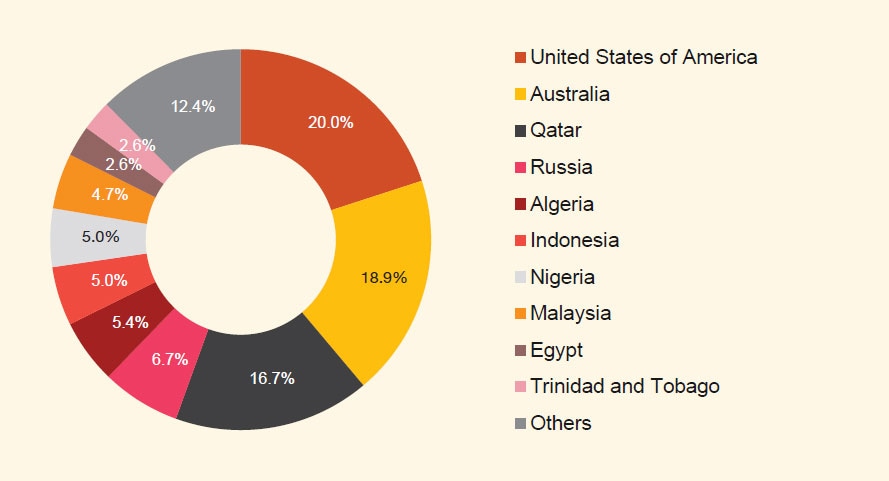

World's Top LNG Exporters 2023

Source: Global Energy Monitor (GEM), 2023

Indonesia’s relevance in seaborne LNG is critical to maintain its reserves and production level. Indonesia managed to maintain its position as the sixth largest exporter of LNG in 2023, with a capacity of 23.3 million tonnes per annum (MMTPA), behind the US, Australia, Qatar, Russia and Algeria.

Energy transition in Indonesia

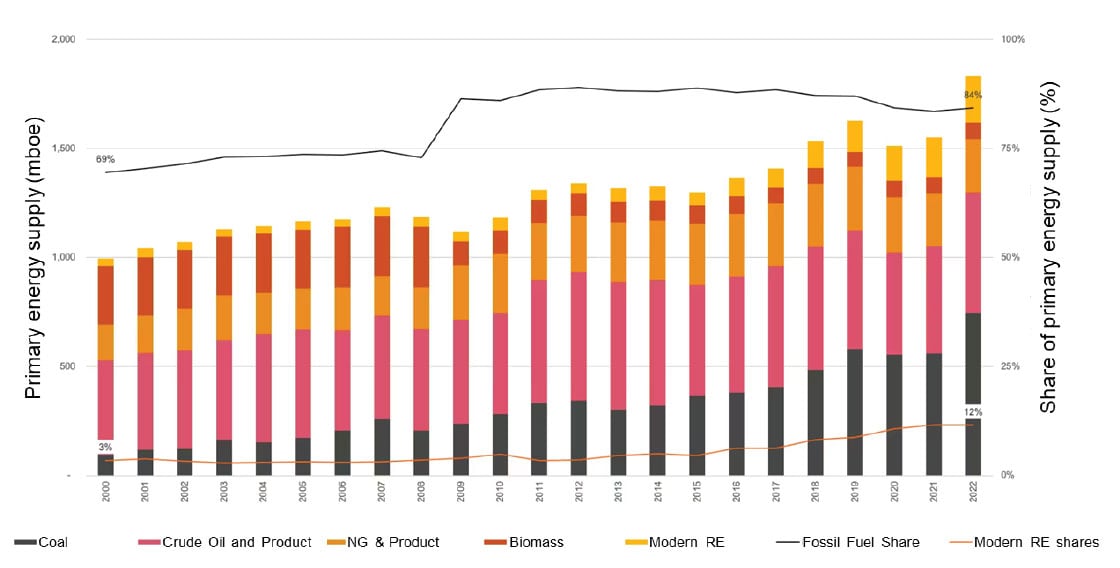

Indonesia has demonstrated strong and consistent economic growth over this century, with GDP at constant 2010 prices increasing from IDR 4,122 trillion in 2000 to IDR 11,710 trillion in 2022, supported by primary energy-supply expansion of 836 MBOE. 78% (652 MBOE) of this expansion was from coal, reflecting natural-resource endowment and a national policy stance favouring domestic-resource exploitation for economic development and job creation. This strong and consistent growth has resulted in a more than tenfold increase of per capita GDP over the same period from ca. USD 770 (IDR 6.5 million) to ca. USD 4,788 (IDR 71 million). However, this also indicates how much further Indonesia has to go in its ambition to become a developed economy.

Source: PwC, “The Energy Transition,” PwC, accessed 2024

Oil and Gas in Indonesia: Investment, Taxation and Regulatory Guide 2024

Indonesian Oil & Gas Concessions and Major Infrastructure Map

Related content

Oil and Gas in Indonesia: Investment and Taxation Guide 2023

The 12th edition of the guide focuses on updating readers on the latest tax, regulatory and commercial changes since our previous edition, with a brief update on the energy transition in Indonesia.

Oil and Gas in Indonesia: Investment and Taxation Guide 2020

The 11th edition outlines the latest tax and regulatory changes that have occurred in the oil and gas industry over recent years.

Oil and Gas in Indonesia: Investment and Taxation Guide 2019

The 10th edition outlines the latest tax and regulatory changes that have occurred in the oil and gas industry over recent years, including our views on recent regulatory developments surrounding the new “Gross Split” PSCs, introduced in 2017.