Assurance Publications

January 2026

In brief: PSAK 413 and PSAK 414 - impairment of sharia financial assets

Effective from 1 January 2027, PSAK 413 and PSAK 414 introduce a unified expected-loss impairment model for sharia financial assets, together with key disclosure requirements.

November 2025

Accounting Technical Alert - PSAK 119: Reduced disclosures for eligible subsidiaries without public accountability

On 27 August 2025, DSAK-IAI issued PSAK 119, which refers to IFRS 19 Subsidiaries without Public Accountability: Disclosures. IFRS 19 was published by the IASB on May 2024. This standard is a voluntary accounting standard designed to reduce disclosure requirements stipulated in other PSAKs. It is intended for subsidiaries without public accountability where the parent entity prepares consolidated financial statements that are publicly available and comply with Indonesian Financial Accounting Standards (SAK), International Financial Reporting Standards (IFRS), or other IFRS Accounting Standards.

October 2025

PT Indonesia Tbk and subsidiaries - Illustrative SFAS consolidated financial statements

This publication presents the sample annual consolidated financial statements of a fictional listed company, PT Indonesia Tbk (“PT Indonesia Tbk”). It illustrates the financial reporting requirements that would apply to such a company under Indonesian Financial Accounting Standards effective as at 1 January 2025.

August 2025

IFRS and Indonesian GAAP (IFAS) - similarities and differences

This publication provides a summary of the key differences between the Indonesian Financial Accounting Standards (IFAS) and the International Financial Reporting Standards (IFRS Accounting Standards) that are required for annual reporting periods beginning on 1 January 2025.

August 2025

A practical guide to the new and revised Indonesian Financial Standards for 2025

Indonesian Financial Accounting Standards (IFAS) are being updated, with new revisions set to take effect in 2025. This guide provides a summary of the expected impacts on processes, systems, and business operations, along with key considerations for understanding and implementing these changes in reporting requirements.

July 2025

Accounting Technical Alert - PSAK 118: Redefining financial performance reporting

On 28 May 2025, DSAK-IAI issued PSAK 118: Presentation and Disclosure in Financial Statements, which will replace PSAK 201. This alert aims to guide financial reporters in understanding the significant changes introduced by PSAK 118, addressing challenges in application to the existing system, compliance with contracts and compensation, and its influence on Indonesian regulatory reporting standards.

January 2025

Transparency Report 2024

Our 2024 Transparency Report serves as a testament to our commitment to open and honest communication in building trust, by providing clear and comprehensive insights into our policies, systems, and processes for ensuring quality. This report sets out the actions we have taken to create a culture in our Assurance practice that delivers consistently high-quality work.

December 2024

PT Indonesia Tbk and Subsidiaries - Illustrative SFAS consolidated financial statements

This publication provides an illustrative set of consolidated financial statements for a listed company, prepared in accordance with the 2024 Indonesian Financial Accounting Standards (“IFAS”) as issued by the Indonesian Financial Accounting Standards Board (“the Board”) and best practices in the market.

September 2024

IFRS and Indonesian GAAP (IFAS) Similarities and Differences

This publication provides a summary of the key differences between the Indonesian Financial Accounting Standards (IFAS) and the International Financial Reporting Standards (IFRS Accounting Standards) that are required for annual reporting periods beginning on 1 January 2024.

July 2024

A Practical Guide to the New and Revised Indonesian Financial Standards for 2024

February 2024

PT Indonesia - Illustrative PSAK consolidated financial statements

This publication presents the sample annual financial report of a fictional non-listed company, PT Indonesia. It illustrates the financial reporting requirements that would apply to such a company under Indonesian Financial Accounting Standards effective as at 1 January 2023.

February 2024

PT Indonesia Tbk and Subsdiaries - Illustrative PSAK consolidated financial statements

This publication presents the sample annual financial report of a fictional listed company, PT Indonesia. It illustrates the financial reporting requirements that would apply to such a company under Indonesian Financial Accounting Standards effective as at 1 January 2023.

January 2024

Transparency Report 2023

Welcome to PwC Indonesia 2023 Transparency Report which serves as a testament to our commitment to open and honest communication in building trust, by providing clear and comprehensive insights into our policies, systems and processes for ensuring quality. The report also includes the results of key quality monitoring programmes, reviews performed and the way we foster a culture of quality at every level of the firm.

November 2023

IFRS and Indonesian GAAP (IFAS) Similarities and Differences

This publication provides a summary of the key differences between the Indonesian Financial Accounting Standards (IFAS) and the International Financial Reporting Standards (IFRS Accounting Standards) that are required for annual reporting periods beginning on 1 January 2023.

November 2023

PSAK Pocket Guide 2023

disclosure requirements under those standards.

September 2023

A Practical Guide to the New and Revised Indonesian Financial Standards for 2023

December 2022

Transparency Report 2022: A conversation on transparency, quality and value

This report is PwC Indonesia's second transparency report in which we share what we’re doing and how we plan to build on the trust and confidence that our clients already have in our assurance services.

December 2022

PT Indonesia - Illustrative PSAK consolidated financial statements

October 2022

PSAK Pocket Guide 2022

September 2022

IFRS and Indonesian GAAP (IFAS) Similarities and Differences 2022

September 2022

A Practical Guide to the New and Revised Indonesian Financial Standards for 2022

This publication is a practical guide to the new, revised and amended Indonesian Financial Accounting Standards (“IFAS”), which come into effect in 2022. It contains an overview of the changes in reporting requirements, which may then be useful for the entities’ future reporting periods by gaining sufficient familiarity with those standards first.

June 2022

Guidance on the carbon tax under the Harmonisation of Tax Regulation Law

This practical guide is designed to help financial reporters in understanding and

implementing the carbon tax scheme in Indonesia under the HPP Law, including the financial reporting implication.

December 2021

PT Indonesia Tbk dan entitas anak 2021/ PT Indonesia Tbk and subsidiaries 2021

This publication provides an illustrative set of consolidated financial statements, prepared in accordance with Indonesian Financial Accounting Standards (“IFAS”) as issued by Indonesian Financial Accounting Standards Board (“the Board”) and best practices in the market, for a listed company.

December 2021

Guidance on the Supplier Financing Arrangements

November 2021

Transparency Report 2021: A conversation on transparency, quality and value

This report is PwC Indonesia's second transparency report in which we share what we’re doing and how we plan to build on the trust and confidence that our clients already have in our assurance services.

August 2021

A Practical Guide to the New and Revised Indonesian Financial Standards for 2021

This publication is a practical guide to the new, revised and amended Indonesian Financial Accounting Standards (“IFAS”), which come into effect in 2021. It contains an overview of the changes in reporting requirements, which may then be useful for the entities’ future reporting periods by gaining sufficient familiarity with those standards first.

December 2020

PSAK Pocket Guide 2020

November 2020

IFRS and Indonesian GAAP (IFAS) Similarities and Differences

November 2020

A Practical Guide to the New and Revised Indonesian Financial Standards for 2020

This publication is a practical guide to the new, revised and amended Indonesian Financial Accounting Standards (“IFAS”), which come into effect in 2020. We have listed the most important changes in reporting requirements, helping companies understand what should be applied now and what changes will apply to future reporting periods.

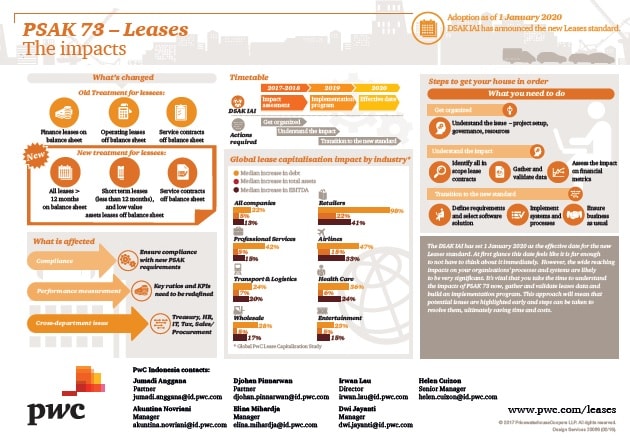

This year marks the important milestone for IFAS reporters since the three major accounting standards (PSAK 71, ‘Financial Instruments’, PSAK 72, ‘Revenue from Contracts with Customers’ and PSAK 73, ‘Leases’) have become effective as of 1 January 2020.

November 2020

State of Readiness - PSAK 71-73 Implementation

Starting January 1, 2020, three new accounting standards for “Financial instruments” (PSAK 71), “Revenue from contracts with customers” (PSAK 72) and “Leases” (PSAK 73), known as the “Big 3 Standards”, are required to be applied by companies reporting under Indonesian financial accounting standards.

August 2020

Indonesia CFO Survey 2020: Robotic Process Automation for Finance Function in Indonesia

Our first Robotic Process Automation survey to 54 CFOs in Indonesia on how finance functions are leveraging robotic process automation to digitise their day to day activities.

June 2020

Accounting Technical Alert - June 2020

On 31 March 2020, the government issued Perpu 1/2020 (“the Regulation”), which articulated its policy on maintaining the stability of state finances and the financial system in light of the Covid-19 pandemic and other threats that might endanger the national economy.

November 2019 (Rev.2020)

Guidance on the New Big-3 Standards: Real Estate Sector (Rev.2020)

This publication reflects the implementation developments and provides guidance on the application of the new standards (PSAK 71, PSAK 72 and PSAK 73) specifically for the real estate industry, including updates on land right issued in November 2020.

November 2019

Guidance on the New Leases Standard: Banking & Capital Markets Sector

This publication reflects the implementation developments and provides guidance on the application of the new leasing standard (PSAK 73) specific for the Banking & Capital Markets sector.

November 2019

Guidance on the New Big-3 Standards: Transportation and Logistics Sector

This publication reflects the implementation developments and provides guidance on the application of the new standards (PSAK 71, PSAK 72 and PSAK 73) specific to the transportation and logistics industry.

November 2019

Guidance on the New Big-3 Standards: Telecommunications Sector

This publication reflects the implementation developments and provides guidance on the application of the new standards (PSAK 71, PSAK 72 and PSAK 73) specific to the telecommunications industry.

November 2019

Guidance on the New Big-3 Standards: Technology Sector

This publication reflects the implementation developments and provides guidance on the application of the new standards (PSAK 71, PSAK 72 and PSAK 73) specific to the technology industry.

September 2019

Guidance on the New Big-3 Standards: Retail and Consumer Sector

This publication reflects the implementation developments and provides guidance on the application of the new standards (PSAK 71, PSAK 72 and PSAK 73) specifically for the retail and consumer industry.

June 2019

A Practical Guide to the New and Revised Indonesian Financial Accounting Standards for 2019

This publication is a practical guide to the new, revised and amended Indonesian Financial Accounting Standards ("IFAS") which come to effect in 2019.

April 2019

PSAK 73 - Leases : A new era for lease accounting

In 2017 the Indonesian Financial Accounting Standards Board (DSAK-IAI) issued PSAK 73, ‘Leases’, and thereby started a new era of lease accounting for lessees. Whereas, under the previous guidance in PSAK 30, Leases, a lessee had to make a distinction between a finance lease (on balance sheet) and an operating lease (off balance sheet), the new model requires the lessee to recognise almost all lease contracts on the balance sheet; the only optional exemptions are for certain short-term leases and leases of low-value assets. For lessees that have entered into contracts classified as operating leases under PSAK 30, this could have a huge impact on the financial statements. This publication summarises the significant changes that PSAK 73 requires.

April 2019

PSAK 72 - Revenue from contracts with customers: A comprehensive look at the new revenue model

On 26 July 2017, the DSAK-IAI issued PSAK 72, a new standard for revenue recognition. PSAK 72 is adapted from IFRS 15 Revenue from Contracts with Customers. Almost all entities will be affected to some extent by the significant increase in required disclosures, but the changes extend beyond disclosures, and the effect on entities will vary depending on industry and current accounting practices. Entities will need to consider changes that might be necessary to information technology systems, processes, and internal controls to capture new data and address changes in financial reporting. This edition of In depth summarises the new revenue recognition model.

April 2019

PSAK 71 - Financial Instruments: Understanding the basics

The new standards for revenue and leases are not the only new standards to worry about for 2020—there is PSAK 71, Financial Instruments, to consider as well. Contrary to widespread belief, PSAK 71 affects more than just financial institutions. Any entity could incur significant changes to its financial reporting as the result of this standard, especially those with long-term loans, equity investments, or any non-vanilla financial assets. It might even be the case for those only holding short-term receivables. It all depends. This publication summarises the more significant changes that PSAK 71 introduces (other than hedging), explains the new requirements and provides our observations on their practical implications.

April 2019

IFRS/ IFAS News - April 2019

In this latest issue of IFRS/IFAS News, we report on the latest updates in IFRS 17 implementation proposed by the IASB in its February 2019 meeting; the new definition of a business, which promises to impact the pharmaceutical and life sciences industry in particular; and additional guidance on assessing whether contract manufacturing arrangements may contain an embedded lease. Please contact our accounting advisory specialists to discuss further.

January 2019

PT Indonesia Tbk dan Entitas anak 2018/ PT Indonesia Tbk and Subsidiaries 2018

This publication provides an illustrative set of consolidated financial statements, prepared in accordance with Indonesian Financial Accounting Standards (“IFAS”) and best practices in the market for a listed company. SFAS 1, “Presentation of Financial Statements”, prescribes the basis for the presentation of general purpose financial statements to ensure compatibility both with the financial statements of previous periods and the financial statements of other entities. The standards also set out the requirements for the presentation of financial statements, financial reporting structure, and the minimum content for the financial statements. The financial report of PT Indonesia Tbk and subsidiaries contains a complete set of financial statements. These consolidated financial statements include the disclosures required by the IFAS applicable in 2018. The example disclosures in these illustrative consolidated financial statements should not be considered to be the only acceptable form of presentation. The form and content of the reporting entity’s financial statements are the responsibility of the entity’s management. Other forms of presentation which are equally acceptable may be preferred and adopted, provided they include the specific disclosures prescribed by the IFAS and the Indonesian Financial Services Authority (“OJK”)."

October 2018

PSAK Pocket Guide 2018

This pocket guide provides a summary of the recognition, measurement and presentation requirements of Indonesian financial accounting standards (PSAK) applicable for financial statements for periods beginning on or after 1 January 2018, unless otherwise indicated. It does not address in detail the disclosure requirements under those standards.

The information in this guide is arranged in five sections:

- Accounting rules and principles

- Balance sheet and related notes

- Consolidated and separate financial statements

- Other subjects

- Industry-specific topics.

June 2018

IFRS and Indonesian GAAP (IFAS) Similarities and Differences 2018

This publication provides a summary of the key differences between the Indonesian Financial Accounting Standards (IFAS or PSAK) and the International Financial Reporting Standards (IFRS) that are required for annual reporting periods beginning on 1 January 2018.

May 2018

IFRS/ IFAS News - May 2018

In this issue, we discuss the impact of IFRS 9, 15, 16 and 17 to your business and how the amendment to IAS 1 affects you.

May 2018

A Practical Guide to the New and Revised Indonesian Financial Accounting Standards for 2018

This publication is a practical guide to the revised Indonesian Financial Accounting Standards (“IFAS”) and new interpretation which comes into effect in 2018. In order to further align IFAS with global standards, the Indonesian Financial Accounting Standards Board (“DSAK-IAI”) has amended several existing standards, containing amendments and annual improvement projects and introduces new Standards & Interpretations.

March 2018

IFRS/IFAS News - March 2018

In this issue, we discuss amendments to IFRS 19, impairment of intercompany loans in separate financial statements, and issuance of ISAK 34.

February 2018

IFRS News - February 2018

In this issue, we will discuss about amendments to IFRS 9 and IFRS IC decision on interest and penalties related to income taxes. However, we would like to draw your attention the fact that these publications should be used together with the standards and interpretations and are not to be considered as the only reference in understanding the standards and interpretations. While every effort has been made to ensure accuracy, this publication is not comprehensive and information may have been omitted which may be relevant to a particular user.

December 2017

PT Indonesia Tbk dan entitas anak 2017/ PT Indonesia Tbk and subsidiaries 2017

This publication provides an illustrative set of consolidated financial statements, prepared in accordance with Indonesian Financial Accounting Standards (“IFAS”) and best practices in the market for a listed company. SFAS 1, “Presentation of Financial Statements”, prescribes the basis for the presentation of general purpose financial statements to ensure compatibility both with the financial statements of previous periods and the financial statements of other entities. The standards also set out the requirements for the presentation of financial statements, financial reporting structure, and the minimum content for the financial statements. The financial report of PT Indonesia Tbk and subsidiaries contains a complete set of financial statements. These consolidated financial statements include the disclosures required by the IFAS applicable in 2017. The example disclosures in these illustrative consolidated financial statements should not be considered to be the only acceptable form of presentation. The form and content of the reporting entity’s financial statements are the responsibility of the entity’s management. Other forms of presentation which are equally acceptable may be preferred and adopted, provided they include the specific disclosures prescribed by the IFAS and the Indonesian Financial Services Authority (“OJK”).

December 2017

IFRS and Indonesian GAAP (IFAS) Similarities and Differences

This publication provides a summary of the key differences between the Indonesian Financial Accounting Standards (“IFAS” or “PSAK”) and the International Financial Reporting Standards (“IFRS”) that are required for annual reporting periods beginning on 1 January 2017.

December 2017

PSAK Pocket Guide 2017

This pocket guide provides a summary of the recognition, measurement and presentation requirements of Indonesia’s financial accounting standards (“PSAK”) applicable for financial statements beginning on or after 1 January 2017, unless otherwise indicated. It does not address in detail the disclosure requirements under those standards.

The information in this guide is arranged in below sections:

- Accounting rules and principles.

- Balance sheet and related notes.

- Consolidated and separate financial statements.

- Other subjects.

- Industry-specific topics

December 2017

A Practical Guide to the New and Revised Indonesian Financial Accounting Standards for 2017

We have published a practical guide to applying the new standards and interpretations that have come into effect in 2017. The Board has published a number of new standards, interpretations, and amendments to existing requirements arising from the 2016 annual improvements project.

December 2017

Series of Publications on PSAK 72 "Revenue from contracts with customers"

This publication series provides a brief discussion of the Five-Step Model introduced by PSAK 72 and other significant changes that may affect the accounting policies adopted for reporting under PSAK. This series also creates awareness of the new standards, how they affect your business, and serves as a preliminary guidance to assess the impact of the standards on your business.

PSAK 72 Placemat - A Summary of Key Changes and Impacts

December 2017

Series of Publications on PSAK 73 "Leases"

This publication series outlines the difference between the previous and the new standards on leasing and, at the same time, creates an awareness of the impact of the new standard on current lease accounting.This series also creates your awareness of the new standards, how they affect your business, and serves as a preliminary guidance to assess the impact of the standards on your business.

September 2017

Transparency Report: A Conversation on Transparency, Quality, and Value

This report is PwC Indonesia’s first transparency report for our Assurance practice in which we share what we’re doing and how we plan to build on the trust and confidence our clients already have in our assurance services.

March 2017

Key Findings from the Global State of Information Security Survey™ 2017: Indonesian Insights

Cybersecurity incidents are daily news, with ongoing reports of escalating impacts and costs. There is a distinct shift in how organisations are now viewing cybersecurity, with forward-thinking organisations understanding that an investment in cybersecurity and privacy solutions can facilitate business growth and foster innovation.

March 2017

Staying the Course Toward True North: Navigating Disruption

Our survey based on 70 interviews conducted globally found that "Prepared" and "Adaptive" are the key traits that enable Agile Internal Audit Functions to effectively lead in disruptive environment.

Contact us