The industry in perspective

In recent years, Indonesia's mining sector has navigated a landscape shaped by geopolitical dynamics, the global shift towards sustainable energy, and regulatory changes like the Amendment to the Mining Law and the Job Creation Law. These developments have introduced challenges, yet the sector's appeal to investors remains strong due to Indonesia's significant geological potential, especially for critical minerals essential to the energy transition. There is an opportunity for Indonesia to attract more investment in both exploration and critical minerals development to boost the sector's economic contribution.

Coal and Minerals

Coal and Mineral Prices

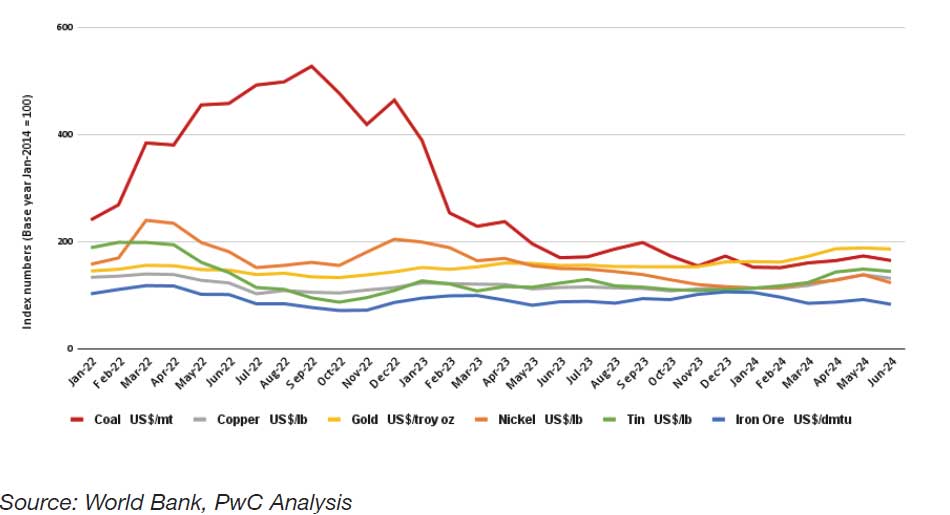

Since their peak in 2022, the price increases caused by the Russia-Ukraine conflict have mostly dissipated. The Middle East conflict, a slowing global economy, and changing global trends further reduced the average prices of coal and most minerals in 2023. By mid-2024, prices for coal, nickel, and iron continued to decline, while copper, gold, and tin experienced a rise.

Indonesian Production of Coal and Minerals

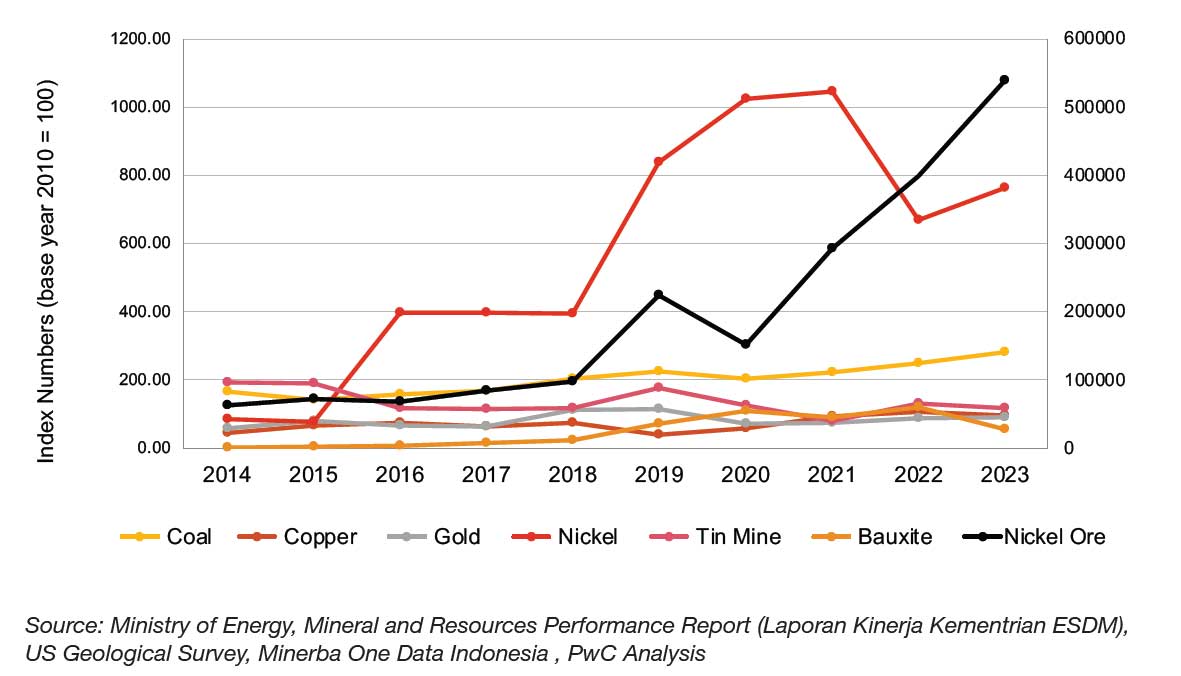

Over the past decade, Indonesian coal production has generally increased, except during 2014-2015 due to falling coal prices and government-imposed production limits, and in 2020 due to reduced demand from the COVID-19 pandemic. Despite these declines, production targets were often exceeded, with 2023 seeing a remarkable 771 million tonnes produced. In 2024, production reached over 830 million tonnes, driven by strong export demand. For non-coal minerals, Indonesia's gold production, primarily from the Grasberg mine, is largely exported. Tin production has fluctuated due to government restrictions and environmental issues, but saw a significant rise in 2024 due to increased demand for clean energy technologies. Copper production has been influenced by the Grasberg mine's transition to underground mining, with a new smelter in Gresik boosting domestic processing capacity. Nickel production has surged since 2017, driven by new smelters and demand from the EV industry, despite a price drop in 2023. Bauxite production, however, has declined significantly due to export bans imposed in 2023 and 2024.

Historical Indonesian coal and mineral production trends are presented in the diagram below (indexed to the base year 2010 = 100)

The energy transition in Indonesia

Energy transition drives the demand for critical minerals

Critical minerals significantly influence the global energy transition, as clean energy technologies require many critical mineral resources, including silica, lithium, and nickel. The growth of aggregate critical mineral demand is driven for the most part by clean energy technologies such as low-carbon power generation, electricity networks, EVs, battery storage and hydrogen. Demand is expected to at least double (under normal projections) or quadruple (under more ambitious projections) in the next 20 years (2020-2040). It is projected that this demand growth will mostly be driven by EVs, battery storage, and low-carbon power generation. In particular, the production of EVs and battery storage for power generation will be the main contributors to increased demand for three key minerals over the next two decades: lithium, nickel, and graphite. EVs are already the primary driver of the demand growth for these minerals, accounting for half of the total existing demand. Meanwhile, the large-scale capacity addition of low-carbon power generation, particularly wind power, hydrogen fuel cells and PVs, pushes growing demand for silicon, neodymium, copper, nickel, zinc, cadmium, etc. Demand for these minerals, due to the continuing expansion of low-carbon power generation, is expected to double by 2040. Aside from these critical minerals, other commodities including titanium, tellurium, cobalt, and rare-earth elements (REEs), will also play a vital role in supporting the clean energy transition.

Sustainable Mining for Critical Minerals: A New Way of Full Decarbonisation

The Government of Indonesia is now aiming to develop more critical mineral smelting facilities, which require more substantial local and international investment to achieve. The goal is to process all mining products domestically, rather than exporting the raw materials. Interestingly, while Indonesia moves towards the energy transition by securing critical minerals and their refined outputs, Indonesia still relies on coal-dominated power generation for processing. This presents a setback in Indonesia’s energy transition efforts. A coal power plant is indeed currently a favourable option as it provides stable and reliable electricity with no significant land requirements and low upfront investment. In addition, coal is also produced locally, and therefore generates more income for Indonesia’s economy, while domestic renewable energy manufacturers are still limited, and imported products are still preferred.