{{item.title}}

{{item.text}}

{{item.text}}

Japanese financial institutions are looking to accelerate the growth of their overseas market operations. Till now, Japanese financial institutions have expanded overseas by growing their network of branches.

Understandably, in this model, operations were designed to meet the unique needs of each branch. However, a rise in the cost of doing business overseas and a lack of capacity to cover a rapidly expanding business has made it difficult to ignore inherent inefficiency of this model. Furthermore with the increasing regulatory burden on their operations, financial institutions are finding it hard to gain an edge against their global competition with an operating model that is based on the optimum use of branches. In these circumstances, financial institutions are turning their attention towards functions that are conducted separately in each region. It is by concentrating such functions in the form of a global shared service centre or optimized central IT centre that financial institutions will realize comprehensive improvements in productivity, quality, customer service and cost effectiveness.

With a global network of 136 countries, PwC Consulting LLC(PwC) supports our clients, from roadmap development to implementation. PwC can do this because we have the expertise: experts who are well versed in the operations of financial institutions, global shared services, and financial regulation.

The target operating model will vary depending on the current state, culture and strategy of the financial institution. While financial institutions can expect significant benefits from concentrating not only their traditional corporate functions, but also their back-up support functions, the path to those benefits is challenging. Financial institutions will need to overcome cross-border business model development issues, and navigate the complex landscape of international financial regualation. In order to achieve a truly revolutionary operating model that goes beyond a simple geographic migration, any institution-wide initiative to consentrate operations must be backed by strong leadership, indeed, leadership that stems from an endorsement by top management- right from the very start.

Main issues for initial studies

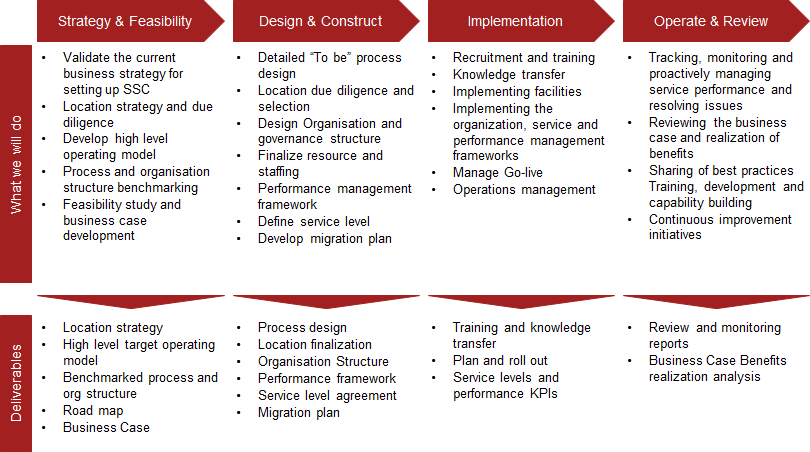

PwC supports our clients from concept development to measuring the effectiveness and improvement through a post-implementation review. Unlike system or BPO vendors, we provide our proposals and recommendations from a neutral stance, supporting our clients’ decision making with a deep understanding of, and professional expertise pertaining to, regulatory compliance and the taxation policies of each country.

Example of Project Approach

A European/US bank decided to concentrate their business unit management and finance functions to its existing shared service centre that was already running their global operations. Through an analysis that determined which operations would be concentrated, PwC found that targeting the HQ and global branches would reduce the headcount by almost 40%. In addition, PwC also made significant contributions in the areas of business improvement by supporting the development of the banks’ migration planning, migration work, and post-migration operation optimization.

A global bank had a system whereby each branch administered its own KYC(Know Your Customer)operations. Unfortunately, this led to inconsistencies in the decision-processes and standards between branches. Moreover, due to an increase in regulatory scrutiny surrounding KYC compliance, and the impact that this could have on their business, the bank urgently needed to improve its KYC system. PwC supported the development of concept behind their KYC operations and developed the end state operating model based on an evaluation of the cost and human resources; research that yielded competitor performance benchmarks and a the third-party evaluation of the current operations.