{{item.title}}

{{item.text}}

{{item.text}}

Amid a slowdown in long-term economic growth in the Japanese domestic market, the accelerating trend for the development of global business platform leveraging M&A in a short period of time can also be seen among the Japanese financial institutions targeting fast-growing Asian markets and other large-scale markets including the US financial market. On the other hand, it is not always easy to unlock the potential of acquired local companies for group-wide synergy maximization in the face of various barriers, such as differences in competitive environments and business models of each country, country-specific financial regulations and taxation system, together with gap in languages and cultures. With our global network of experts specializing in the financial industry in 136 countries, PwC Consulting LLC (PwC) is capable of providing assistance for our clients with supports from the initial stage of M&A strategy development to the full-scale post-closing business integration followed by transformation.

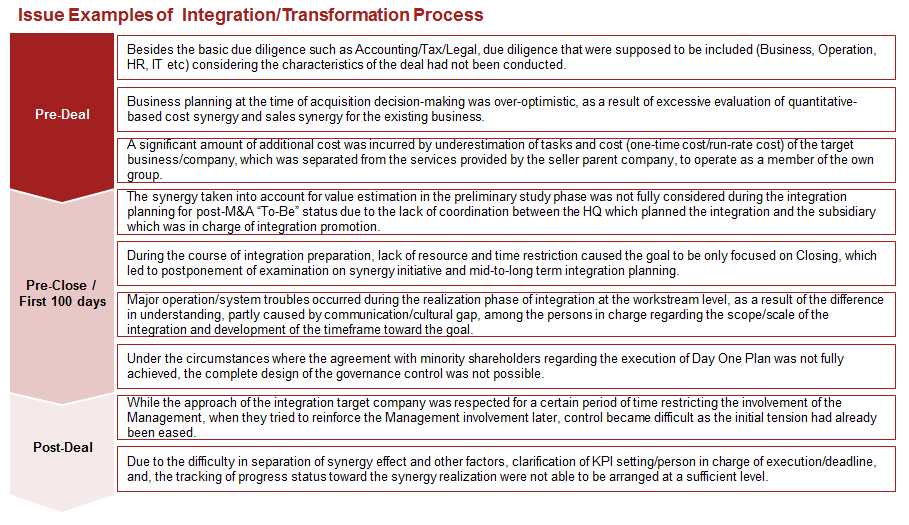

While M&A has become widely known as one of the most important strategies, there are only a limited number of Japanese financial instiutitons that have actually succeeded in post-merger integrations along with the consequent full-scale transformation of organization/process/systems that are indispensable for the realization of the initial purpose of M&A planning.

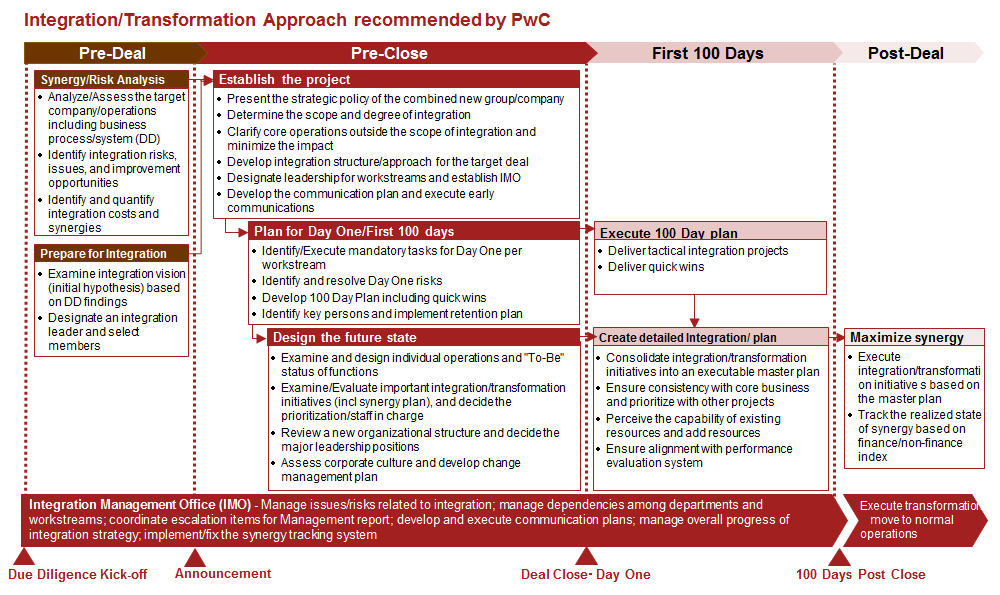

Through the findings from synergy/risk analysis focused on business model/operation process/system, PwC assists our clients to acquire the value expected at the time of M&A planning in a short period of time and to promote the transformation for the strategy realization with the development of integration planning from the pre-close phase and regular tracking of synergy initiatives.

By leveraging tools/templates developed based on PwC's past integration/transformation experiences, we provide support for early-establishment of Integration Management Office(IMO)/ Workstreams, strict overall progress/risk management, visualization of synergy effects, as well as creation of explicit knowledge/organizational knowledge regarding integration.

We provided assistance for a major Japanese bank which has made a foreign bank into its full subsidiary for the business integration. More specifically, we helped this client to design the new bank’s integration business model for the management of integrated business/operation to solve the issues for achievement of the goal by providing the supports of PwC members specializing in Finance/Accounting, HR, Risk Management, System, and Business Administration of the local office.

{{item.text}}

{{item.text}}