{{item.title}}

{{item.text}}

{{item.text}}

In the ‘Global Restructuring Trends’ series, we bring a local view to global challenges and their implications for business leaders, restructuring practitioners and lenders alike. In this video, Satoru Uzawa, a partner of PwC Advisory LLC’s business restructuring practice, gives an overview of the current state of the automobile manufacturing market in Japan.

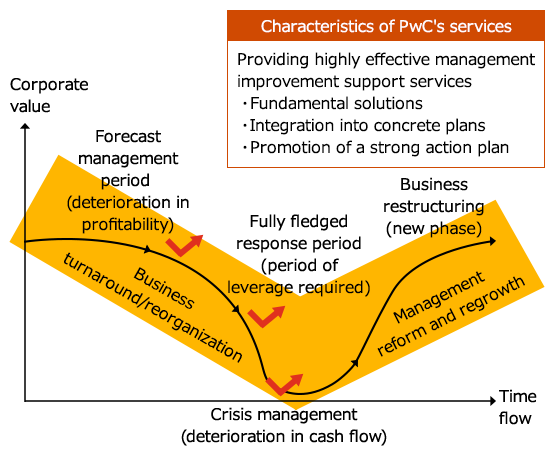

Against a backdrop of intensifying global competition and an increasingly complex and uncertain business environment, there are cases in which companies are unable to appropriately respond to changes and risks, resulting in sluggish business performance or shortage of funds. To avoid such circumstances, companies need to identify the essential challenges they face and take appropriate steps at the right time. However, due to an insufficiency of resources and know-how (due to shortfall of experience), it is also a fact that companies in the midst of struggling alone are not able to take the required actions quickly enough, leading to unsatisfactory results.

Since 1999 (when our focus on business turnaround projects began), PwC has provided support to many companies in the frontline of this arena. The types, sizes, and challenges of the companies that we have supported so far are wide-ranging, which enables us to provide services backed by our experience in the various phases of management reforms that companies face. Professionals with a wealth of experience and expertise provide appropriate support to companies in the transition and regrowth phases of their business, as well as companies facing deteriorating business conditions, excessive obligations and financial difficulties.

Based on the PwC network’s knowledge and experience, consisting of nearly 364,000 people in 136 countries around the world, we can advise on overseas business plan development, performance improvement of existing overseas businesses, and simplification and M&A of overseas businesses.

For many companies, the development of overseas markets is the cornerstone of their growth strategy, and acquisitions of overseas companies and the establishment of JVs with local players are becoming more common. On the other hand, many companies struggle to manage their overseas operations due to differences in culture and business practices. In recent years, there have been cases where massive losses incurred by overseas subsidiaries led to a management crisis, affecting the entire group. Often, the reason behind such losses is weakness in the governance and management of overseas subsidiaries. Due to major changes in the political, economic, and technological fields around the world, uncertainty surrounding businesses is increasing and reconsideration of the governance and management of overseas subsidiaries is more vital than ever before.

Since our business turnaround practice began, PwC has been involved in the turnaround and reorganization of many large Japanese companies. Through this wealth of experience, we are familiar with what happens next and what kinds of preparation and response will be required in the various phases of business turnaround projects.

Against the backdrop of intensifying global competition and changes in the domestic and international economic environment, it has become difficult even for large companies to continue stable management. In particular, in the case of reorganizing a business through a business selection and concentration strategy to achieve sustainable growth, gaining the consent of various stakeholders is critical. However, it is not easy to promote consensus-building amid the presence of complex interests among stakeholders.

PwC supports the turnaround and reorganization of large companies by leveraging our years of experience and know-how based on our extensive business credentials.

The global economy is changing dramatically, and the domestic market will inevitably shrink in the future. In order to cope with the needs of their global business partners, medium-sized companies / SMEs need to expand their overseas operations, as well as seek to expand into new business areas so as to respond to the shrinking domestic market. However, many companies cannot foresee future turnaround and regrowth strategies due to a shortfall of human resources, a lack of know-how and business succession issues.

PwC provides a wide range of services to medium-sized companies and SMEs, including support for overseas expansion, streamlining domestic operations and consideration of new businesses, along with providing human resources and know-how, as necessary.

The purpose of business reorganization and restructuring is to achieve an optimal portfolio of management resources tailored to each stage of the company’s lifecycle to improve profitability and enhance corporate value. It should be considered an important management strategy, not only when an improvement in the company’s financial position is urgently required, but also when pursuing corporate growth.

In addition, real estate properties, which always need to be carefully considered during business reorganization / restructuring projects, are also sources of corporate value. Especially during the turnaround phase, the value of collaterals and/or the realizable value tend to be highlighted. Going forward, real estate strategies that lead to increased corporate value will be required.

PwC professionals with advanced expertise provide one-stop support for M&As, from the formulation of reorganization schemes through to advisory and negotiation support for sellers and buyers and to due diligence. In real estate-related services, we provide a wide range of support, from strategies for effective utilization of real estate and the appraisal of properties to transaction support for disposals and acquisitions.

{{item.text}}

{{item.text}}

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC