{{item.title}}

{{item.text}}

{{item.text}}

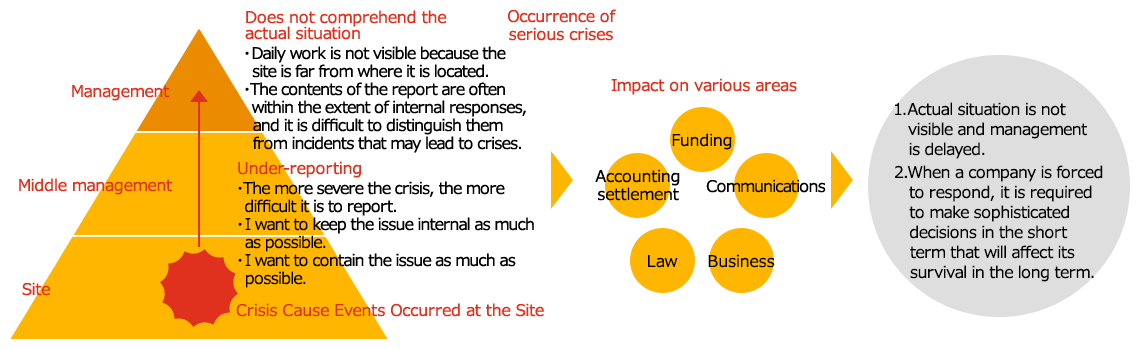

Recently, we have encountered sudden crises caused by accounting frauds, recalls, violations of laws and regulations, and so on. Several of these incidents have occurred at listed companies, which are strengthening internal compliance and internal controls, and crisis management has become an important management issue.

The difficulty of responding to a crisis lies in its nature.

The company lost social credibility due to recall concealment, etc., and became in a critical situation in terms of cash flow. PwC provided crisis response support, including a detailed analysis of cash flow.

The company found that a recall related to safety parts had occurred, resulting in a large loss and financial burden. PwC provided crisis response support, including cash flow management and stabilizing financial transactions.

Although the company made a large-scale investment prior to the Lehman Shock, demand declined sharply thereafter, and it became difficult to secure funds to repay loans. PwC prepared a structural transformation plan based on a close examination of the client’s cash flow and assisted with crisis response.

The company experienced a variety of risk events, and in addition, the impact of the Lehman Shock and other factors caused financial performance to deteriorate, leaving the company in a critical situation. PwC provided crisis response support, including the development of a restructuring plan.

The company was facing a critical situation after being prohibited from operating due to a violation of laws and regulations. PwC supported the client’s crisis response by operating its crisis management steering committee.

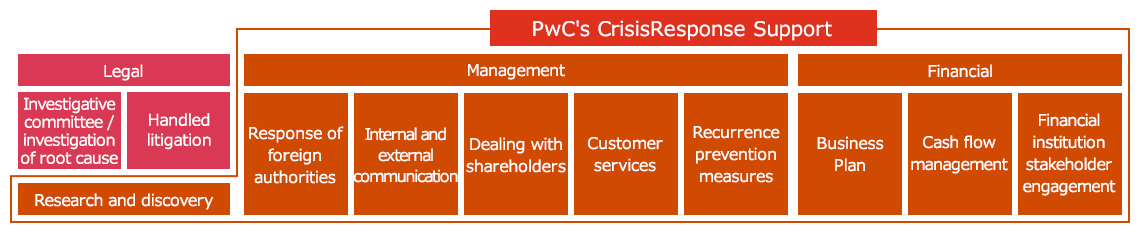

In the event of a crisis, there is a sudden increase in non-daily operations related to management, financial, and legal matters. PwC works with legal counsel and other specialists in specific areas to provide comprehensive support for efforts to manage the crisis and return to business as usual.

Efforts to avoid and prevent crises are of paramount importance. We identify potential risks and assess the potential impact through risk scenario and controls analysis. We also help our clients prepare for crises through simulation and training, the development and enhancement of, crisis management playbooks,, the assessment and enhancement of existing crisis management programs, and the improvement of compliance measures and internal controls.

In the event of a crisis, critical stakeholders need to respond promptly and appropriately.

We provide critical support to our clients, including internal and external communications (media, regulators and other stakeholders) necessary for effective crisis response, investigation of the root causes, operation of crisis management steering committees, formulation of measures to prevent recurrence, enhance business continuity plans, risk assessment, impact analysis and mitigation, formulation of crisis response plans and playbooks, and financing and equity reinforcement.

After the crisis, it is essential to restore trust with critical stakeholders such as employees, shareholders, regulators and the public, and to restore the value of the business.

We provide consistent support, from consideration of KPIs and restoration of business value to implementing and monitoring the effectiveness of enhanced controls.

{{item.text}}

{{item.text}}

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Masato Yamagami

Partner, PricewaterhouseCoopers Japan LLC

Partner, PwC Risk Advisory LLC