{{item.title}}

{{item.text}}

{{item.text}}

Due diligence (DD) is an important task in determining whether or not to carry out an M&A and is a valuable opportunity for direct contact with management and business personnel of the target company prior to the acquisition.

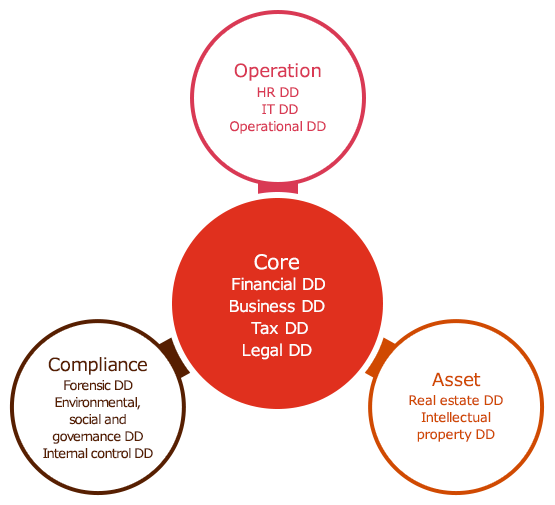

The core areas of due diligence are financial DD to analyze financial risks and to understand historical normalalized profitability, tax DD to validate potential tax liabilities, legal DD to validate potential risks related to legal rights and obligations, and pending cases, and business DD to assess market growth and to analyze business probability.

Depending on the characteristics of a project, due diligences are performed by professionals in various areas to identify issues in an acquiring company's personnel management system and organizational deployment systems, ITDD to measure issues in the information system and the value of IT assets, and operational DDs to identify operational inefficiencies and improvement points.

PwC provides a comprehensive one-stop service that organically combines bespoke due diligence services from the perspective of maximizing business value after M&A.

{{item.text}}

{{item.text}}

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Chief Executive Officer and President, PwC Advisory LLC

Director, PwC Advisory LLC

Senior Manager, PwC Advisory LLC