{{item.title}}

{{item.text}}

{{item.text}}

We support our clients for necessary tasks and matters to be considered from the pre-deal phase throughout the deal execution phase in the situation that they are a seller or a buyer, and sometimes a party who are proceeding with the group reorganization. Examples of our support are project management, including creation and update of a project work-plans, DD process control, consideration of transaction structures, development of business plan with some scenarios, discussion on negotiation strategies and definitive agreements, and preparation of internal explanation and discussion materials. Our service scope has a flexibility depending on size and characteristics of a transaction and our client's team structure. Not only providing comprehensive support, we also provide selected supports needed to complete the transaction by co-working with the client project team.

Unlike acquisitions of stocks that can acquire an entire independent business operation, acquisitions through assignment of business have following risks, such as lack of headquarters functions and management operations, lack of assets and contracts that negatively effect on business operations, and insufficient resources in back office operations. Those risks could cause additional costs and deterioration in performance. In particular, when the target business is located in overseas, it is often difficult to obtain sufficient information to take the necessary measures before the acquisition.

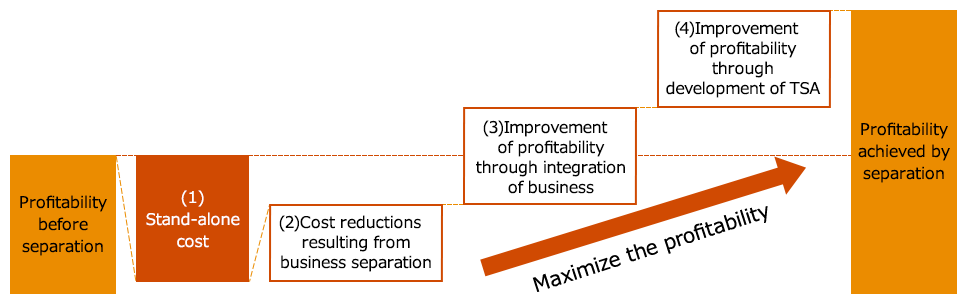

Divestitures tend to be challenging projects because of the complexity of businesses, a number of stakeholders, and the need to consider employees. At the same time, maximization of business value can be achieved by planning operational improvements as well as cost reduction suited for the business scale in the process of projecting a stand-alone business after separation.

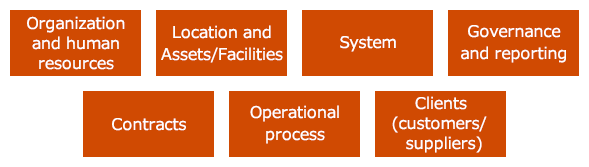

In considering acquisitions through assignment of business, it is important to comprehensively identify the operating costs (stand-alone costs) of a single business resulting from the separation (carve-out) as well as what functions to be and not to be transferred from the seller in order to coordinate functions to be provided by the seller (TSA) in light of the company's circumstance and its post-acquisition objectives.

In considering separating business as a seller, it is important to properly understand the stand-alone cost that arises when the target business becomes a single business in order to determine the sale value. In addition, well-experienced players will strive to maximize the value of sales by improving the profitability of the target business by optimizing the cost structure as a stand-alone business, liquidating the business in advance through the integration of the target businesses, and reducing buyer-side risk factors through the preliminary development of TSA.

{{item.text}}

{{item.text}}

Partner, PwC Advisory LLC

Partner, PwC Advisory LLC

Director, PwC Advisory LLC