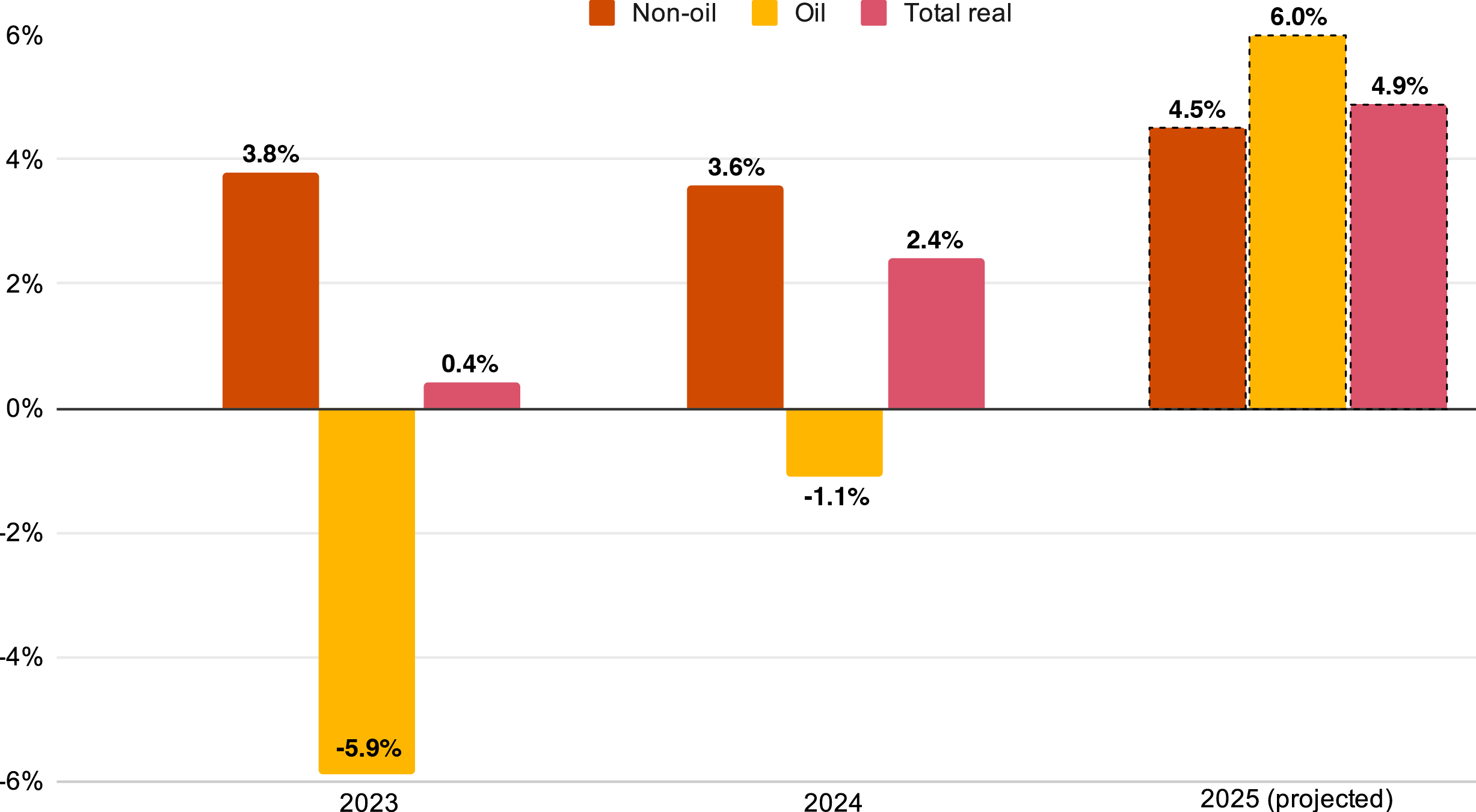

Looking at the overall picture in 2024 the global economy demonstrated moderate growth, with notable regional disparities. The US economy exceeded expectations, expanding by 2.8% in the third quarter (Q3), primarily driven by strong consumer spending and exports, which rose by 3.5% and 7.5% respectively. In contrast, China's growth is expected to slow to 4.8% in 2024, weighed down by ongoing challenges in the real estate sector and subdued domestic demand.1 Meanwhile, after a year of concerted monetary tightening, inflation appears to be easing, with global rates expected to decline from 6.7% in 2023 to 5.8% in 2024, offering a glimmer of stability amid uneven economic conditions.2 Within the GCC, continued investments in economic diversification, particularly across the tourism, real estate and manufacturing sectors, drove non-oil sector growth in 2024. These gains helped offset the impact of OPEC+ oil production cuts, which significantly affected hydrocarbon output. As a result, non-oil GDP growth averaged 3.7%, outpacing the overall economic growth rate of 1.8%.3 These suggest that diversification efforts have been effective, as countries such as Saudi Arabia, one of the hardest hit by production cuts, saw its non-oil sector expand at a healthy pace of 3.5% despite modest overall GDP growth of just 1.5%. In 2025, the GCC is expected to remain economically resilient and effectively navigate the anticipated challenges of declining oil revenues and geopolitical fragmentation through five key themes which will define the year ahead:

1. Time for prudence

The region faces the challenge of declining oil revenues as global demand weakens, particularly in China. OPEC+ has delayed the phasing out of production cuts from the end of 2024, into 2025. Brent crude oil prices are expected to average around US$70 per barrel in 2025 - a sharp drop of nearly 30% from the highs of 2022 and more than 10% below the 2024 average.4,5

The weaker outlook for oil has made fiscal consolidation a top priority for oil-exporting GCC economies. Budget figures for 2025 reveal that all GCC countries are anticipating reduced revenues from 2024, driven by lower oil prices.6

Saudi Arabia’s 2025 budget will see a 1.5% decrease in expenditure, primarily through reductions in capital spending.7 Deeper cuts are expected in Kuwait, with its 2024/2025 budget figures 6.6% below the previous cycle.8,9 The UAE, in contrast, aims to maintain expenditure at 2024 levels, reflecting a steady approach. Meanwhile, Qatar has reported a 4.6% increase in spending, relying on local and international debt markets to finance the deficit.10

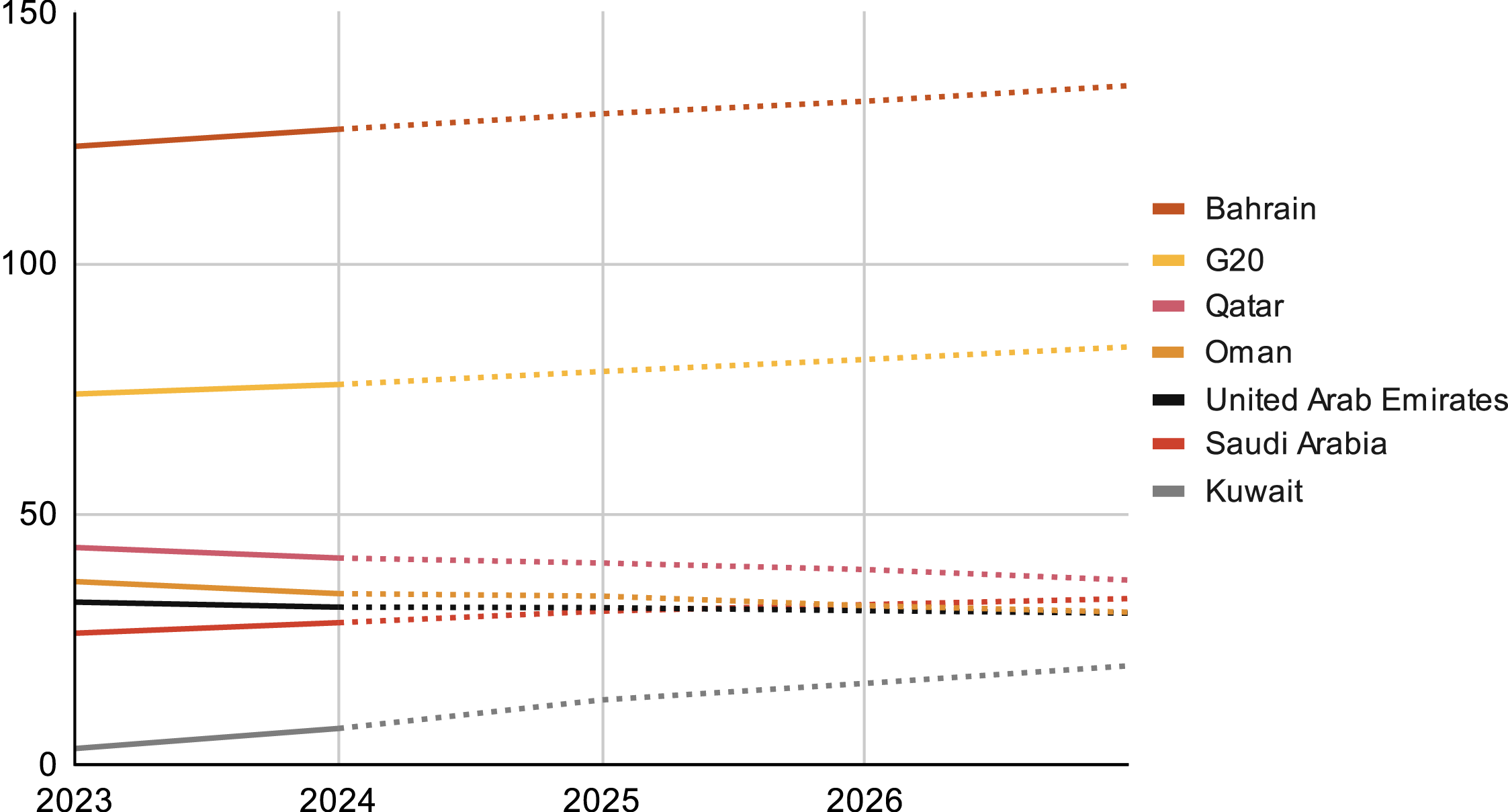

To absorb lower oil prices while sustaining investments in economic diversification, GCC countries are increasingly turning to international debt markets to bridge budget deficits. In 2024, GCC debt issuance reached US$120 Bn. By 2025, the region's outstanding debt is expected to approach US$1 Tn.11,12

Saudi Arabia’s foreign debt is anticipated to rise by 35% in 2025 compared to 2022 levels, and within the first week of 2025, the government successfully completed a US$12 Bn bond issue. Meanwhile, the UAE, despite maintaining a budget surplus, plans to leverage its fiscal position to continue its borrowing at 2024 levels into 2025 to support ongoing investments. This strategic use of debt underscores the region's commitment to balancing fiscal pressures with long-term economic goals.

Figure 1: General Government Gross Debt (% of GDP)

Source: IMF,13 figures for 2025 onwards are projections

Most GCC countries enjoy considerable fiscal headroom for additional borrowing. Debt-to-GDP ratios are low in comparison to the G20 economies, while sovereign credit ratings remain in positive to neutral territory.

The region heads into 2025 with its highest average sovereign credit rating since 2017, bolstered by the strong credit ratings across the GCC countries.14 Saudi Arabia was upgraded by Moody's to "A1” from "Aa3," while Oman was upgraded to 'BBB-' from 'BB+ by S&P.15,16 Improved ratings, coupled with a more accommodative monetary policy, are anticipated to reduce the cost of borrowing in 2025, making debt an increasingly attractive tool for financing spending and investment initiatives.

2. Achieving tax harmony

Corporate income tax reforms that will be introduced across the region are an opportunity to align with the OECD’s Pillar 2 framework. These reforms reflect a commitment to tax transparency but also strengthens the revenue diversification agenda by institutionalising a stable and sustainable income stream for governments.

Specifically, these aim to address profit shifting and tax base erosion by ensuring multinational enterprises (MNEs) pay a minimum tax rate of 15%, regardless of their operating location. The UAE will introduce a Domestic Minimum Top-up Tax (DMTT) of 15% on large MNEs, building on the existing 9% corporate tax rate that was introduced in 2023. Bahrain will implement a similar DMTT from January 1, 2025, while Kuwait plans to introduce a 15% corporate income tax on multinational businesses starting in 2025.17

Although oil revenues are anticipated to decline, non-oil revenues are set to benefit from continued growth in the non-oil sector, projected to expand by 4.2% in 2025, up from 1.8% in 2024, driven by sectors such as tourism, trade, real estate and manufacturing.18

Purchasing Managers’ Indices (PMI) readings suggest strong momentum in non-oil sectors going into 2025. The UAE’s PMI rose to 55.4 in December, while Saudi Arabia’s stood at 58.4; both well above the 50-point threshold that indicates economic expansion.19,20 These positive indicators continue to bolster the region’s appeal to global investors who are drawn to diversification-related reforms and investments. The UAE is expected to solidify its position as a global leader in FDI relative to the size of its economy in 2025.21

Figure 2: GCC Real Oil and Non-Oil GDP Growth (% change, y-o-y)

Source: IMF,22 figures from 2025 are projections

3. Building bridges

The global economy is increasingly shaped by escalating geoeconomic fragmentation. Domestic industries and supply chain resilience are prioritised over global integration, with strategic sectors particularly electric vehicles, semiconductors and critical minerals, at the forefront of protectionist measures. Countries are taking assertive measures to secure their economic and security interests, such as China restricting exports of key rare earth elements critical for high-tech manufacturing, in response to trade barriers imposed by the US and Europe.23

As geopolitical fragmentation intensifies into 2025, trade tensions between major trading blocs - the US, Europe, and China - are expected to escalate, exacerbated by the resurgence of "America first" policies under a Trump administration. While the immediate impact may be limited, the uncertainty of this new reality - along with the reshaping of international commerce and its effects on global economic growth in 2026-2027 - will create challenges for 2025.

Amid this fragmentation, the GCC is adopting a more strategic, multipolar approach to diplomacy by diversifying alliances. Saudi Arabia and the UAE have joined BRICs in 2024 as an observer and member respectively, reflecting the region’s intent to expand its influence beyond traditional partners. The GCC is also leveraging its strategic location and role as a global energy leader to deepen economic ties with emerging economies. For example, over 70% of the GCC’s oil and gas exports now flow to Asia, with China alone accounting for 20%, while imports from Asia have also surged, reflecting the mutual strengthening of economic ties.24

The GCC is actively pursuing free trade agreements (FTAs) with the aim of unlocking new markets and attracting investments, positioning the region as a model of trade openness in an increasingly fragmented world. In October 2024, the region concluded a long-awaited FTA with New Zealand after over a decade of negotiations.25 The region is in the final stages of negotiating a free trade agreement with the UK, which is projected to increase bilateral trade by 16%.26 Additionally, both the GCC and China agreed to accelerate FTA negotiations moving into 2025.27 Discussions are also underway with the EU and Japan, amongst other partners.28,29

Figure 3: Total Import and Export Value of Goods relative to GDP (% of GDP)

Source: World Bank,30 UN Comtrade Database31

4. Urban evolution

Historically, GCC cities faced challenges related to infrastructure and climate that shaped perceptions of the region as less accommodating for expats. However, major GCC cities are undergoing transformative changes as it positions itself as a global hub for high-skilled talent, driven by an evolving economy that demands advanced digital, technical and analytical expertise to support its future-focused ambitions.

Investments in urban planning and infrastructure are transforming GCC cities into more livable and sustainable environments, improving quality of life for citizens and residents alike. Saudi Arabia plans to invest US$1.28 Bn in new housing projects in 2025. The long-awaited $22 Bn Riyadh Metro, which began operations in December, is set for a full launch in January 2025. Doha Metro’s expansion, expected to be completed in 2025, will improve connectivity to key urban and suburban areas.

Similarly, the UAE is advancing livability through Dubai’s Urban Master Plan 2024, featuring a Dhs3.7 Bn road expansion and the Dubai Walk Master Plan, which aims to create 3,300 kilometers of pedestrian pathways by 2040. 2025 will also see the opening of King Salman Park in Riyadh, the world's largest urban park, spanning 16.6 square kilometers. These initiatives aim to redefine urban living in the region.

The IMD’s World Talent Ranking highlights this progress, ranking Saudi Arabia as the 32nd most preferred destination for global talent, up from 36th - a significant milestone in its talent attraction strategy.32 Innovative initiatives such as granting citizenship to exceptional talents in science, medicine and innovation, alongside the Premium Residency Program, further enhance talent attraction and retention within the Kingdom.33

Urban developments are further supported by significant investments in tourism, enhancing the region’s appeal to expat professionals and tourists. Saudi Arabia’s Sindalah Island resort, launched in late 2024, targets high-net-worth travelers and is projected to contribute SAR10 Bn annually to tourism revenues from 2025. Hosting the 2025 World Heritage Forum will spotlight the Kingdom’s historical and cultural sites, and underscore its commitment to preserving heritage while promoting sustainable tourism and global cultural exchange.

The launch of Riyadh Air in 2025, with a capacity of 25 million passengers in its first year and direct flights to over 100 destinations, will significantly improve connectivity for international visitors and professionals. In preparation for the Riyadh Expo 2030 and the 2034 FIFA World Cup, Saudi Arabia is making substantial investments in key cities like Riyadh, Jeddah and Dammam, focusing on expanding infrastructure, upgrading transportation networks and developing world-class stadiums and hospitality facilities.

These developments not only demonstrate the Kingdom’s readiness to host large-scale global events but also make it a more attractive destination for high-skilled talent seeking opportunities in a rapidly evolving economy.

5. AI infrastructure boom

With its advanced ICT infrastructure, abundant capital and appetite for advanced technology adoption, the GCC has positioned itself as a global leader in AI adoption and innovation.34 2025 is expected to see greater focus on AI infrastructure investments, partnerships with global AI and tech giants, and the establishment of robust data security and privacy frameworks to support sustainable AI growth.

The growth in demand for cloud-based services and AI-powered edge computing solutions, coupled with data localisation requirements, mean that investments in scalable and advanced infrastructure will gain increasing significance. Saudi Arabia’s Project Transcendence, announced in late-2024, represents a US$100 Bn commitment to accelerate infrastructure investment to foster the development of the Kingdom’s AI ecosystem.35 MGX, an investment vehicle founded by Abu Dhabi-based G42 and Mubadala, aims to develop physical infrastructure to support AI adoption and innovation, such as data centers and semiconductor manufacturing.36 A 100MW, AI-optimised data centre is under construction in Ajman, UAE, which will be the largest of its kind in the region.37

Global partnerships will remain a key pillar of the GCC’s AI agenda in 2025. Several groundbreaking partnerships have been announced, including between Saudi Arabia’s Public Investment Fund (PIF) and Alphabet, Google’s parent company, to develop an advanced AI hub in the kingdom in line with Project Transcendence.38 In April 2024, Microsoft announced a US$1.5 Bn investment in G42, which will see the establishment of two AI research centers in the country.39 The newly established Hub71+ AI, an AI incubator, has garnered support from Amazon Web Services, Google, Nvidia, and Hewlett Packard Enterprise, facilitating infrastructure support, talent access, and R&D opportunities.40 Qatar’s Ooredoo announced it would become a NVIDIA Cloud Partner, adopting its accelerated computing platform across data centres in Qatar, Kuwait and Oman.41

These developments will be enabled by increasingly sophisticated data and cybersecurity regulatory frameworks. Personal data protection legislation came into effect in Saudi Arabia as well as a framework for the ethical use of AI, balancing innovation with privacy and transparency. Cybersecurity frameworks in the region have been strengthened to protect critical infrastructure, as well as mitigate the cybersecurity threats such as ransomware. GCC countries have also tightened regulations requiring sensitive data to be stored locally, especially for government and financial sectors.

Further regulatory developments are expected in 2025, as governments enhance the robustness of frameworks governing generative AI and algorithmic accountability to mitigate misinformation, and improve compliance with IP laws. The use of AI in specific domains (e.g. AI in credit scoring and fraud detection in banks) will be more closely scrutinised to ensure that they yield equitable and effective outcomes that can be explained.

The GCC in 2025

Despite fiscal challenges and heightened geoeconomic fragmentation, the GCC’s adaptability, global alliances and financial firepower means that it is well-positioned to navigate the complexities that 2025 will bring.

Continued investments in the non-oil sectors, adoption of global tax frameworks, advancements in AI and urban development highlight the region’s commitment to building a globally-competitive, future-ready economy.

To find out more, keep an eye out for our upcoming Middle East Economy Watch where we examine the latest economic developments across the region, as well as our Economy Matters blogs and Economy Bites podcast series

Authors:

- Jing Teow

- Sajeda Khwaja

- Noa Sreden